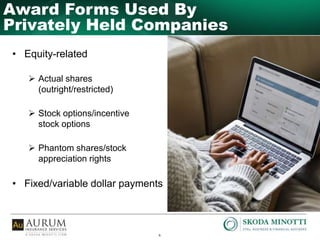

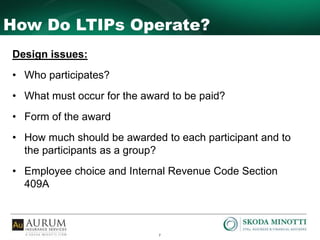

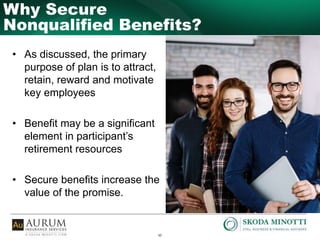

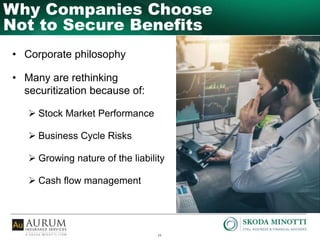

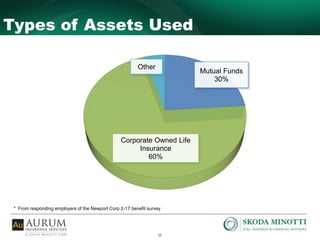

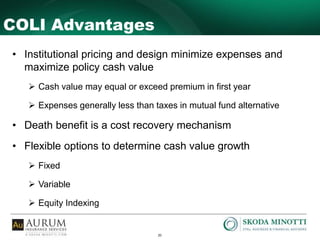

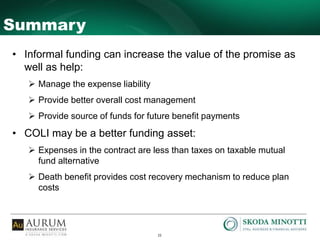

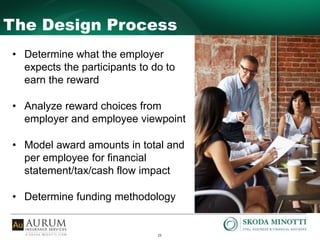

This document discusses non-qualified deferred compensation programs (LTIPs) for private companies. LTIPs are used to reward and retain current employees, attract new employees by focusing on long-term results, and supplement tax-qualified retirement programs. LTIPs can take the form of equity shares, stock options, phantom shares or fixed/variable payments. Employers must consider who participates, what triggers payment, the payment form, amounts, and compliance with IRS rules. Benefits are unsecured and subject to employer credit risk, so some employers informally fund LTIPs using assets like corporate-owned life insurance, which provides tax advantages over mutual funds. The design process involves determining performance requirements, analyzing reward structures, and funding