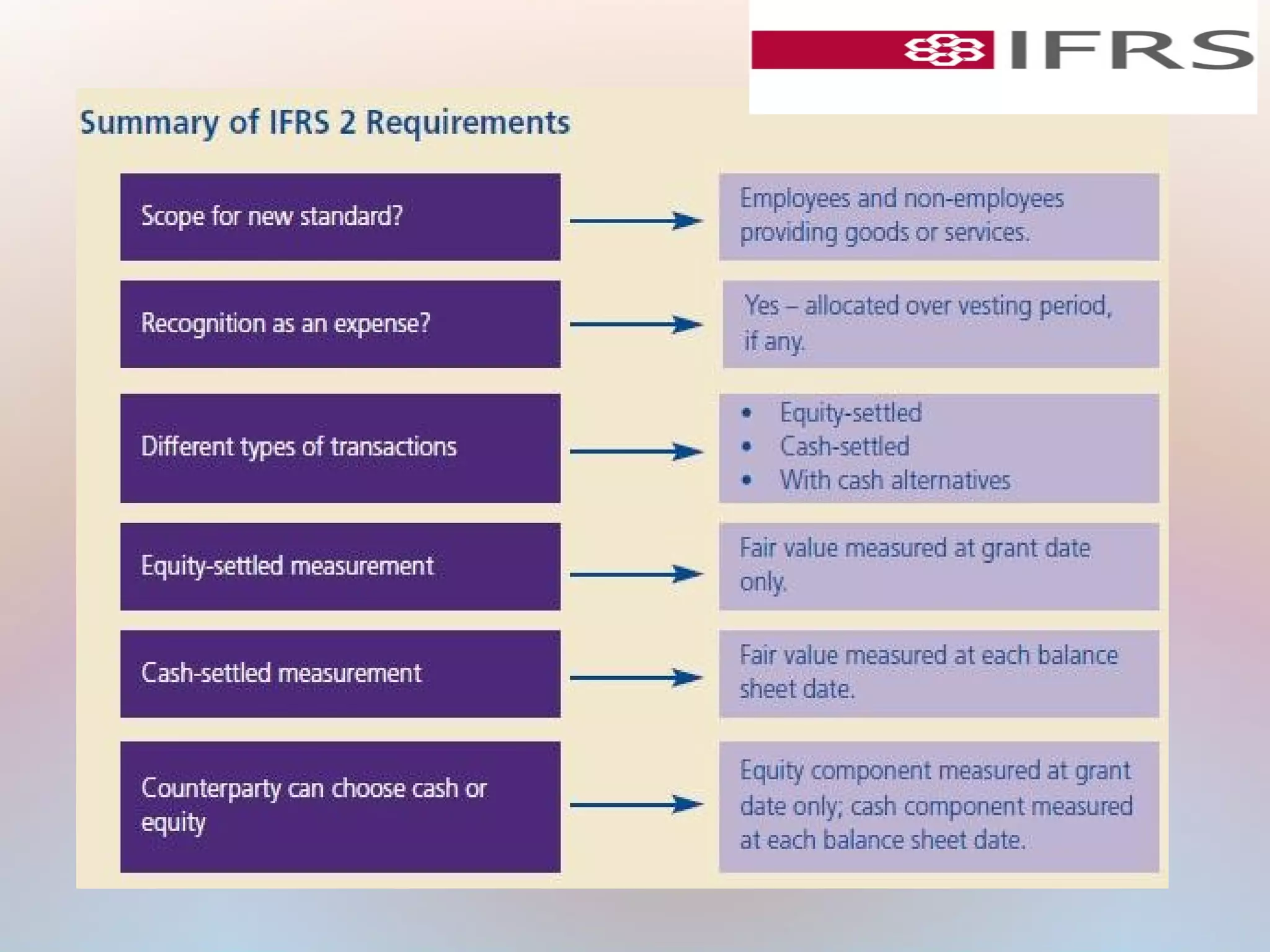

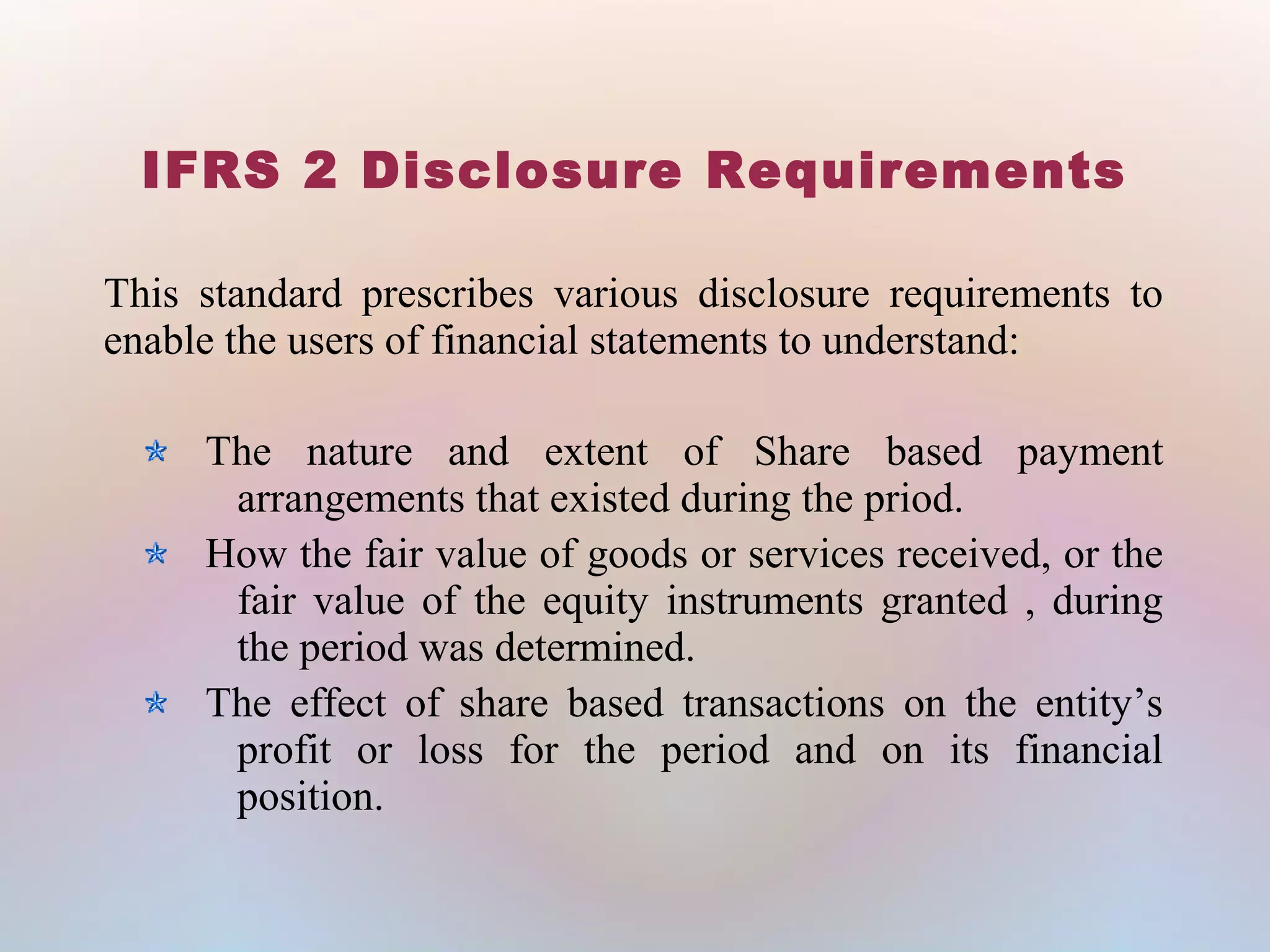

This presentation introduces International Financial Reporting Standard 2 (IFRS-2) which provides guidance on accounting for share-based payment transactions. IFRS-2 requires companies to recognize share-based payments as an expense in their financial statements and measure them at the fair value of the goods or services received. It sets out measurement principles for equity-settled, cash-settled, and cash alternative share-based payment transactions. IFRS-2 also prescribes disclosure requirements to help users understand the nature, timing, and extent of share-based payment arrangements.