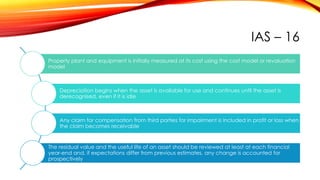

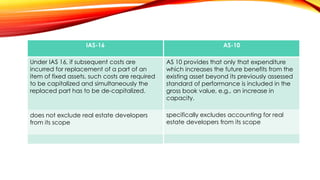

The document compares Indian Accounting Standards and International Financial Reporting Standards regarding the accounting treatment of fixed assets. Some key differences include:

- Under IAS 16, subsequent replacement costs of parts must be capitalized, whereas AS 10 only requires capitalization if it increases future benefits.

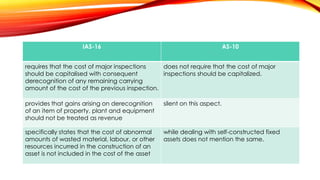

- IAS 16 requires capitalization of major inspection costs, whereas AS 10 does not.

- IAS 16 does not allow gains on derecognition of assets to be treated as revenue, but AS 10 is silent on this.

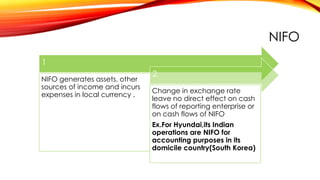

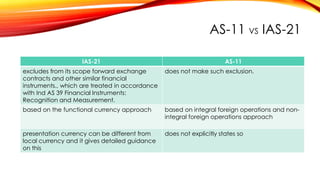

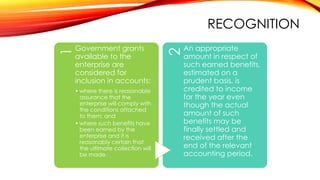

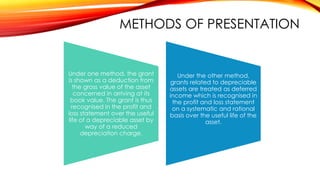

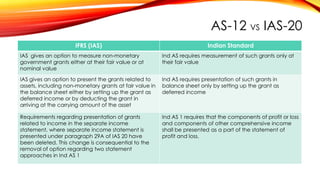

The document also discusses the accounting for government grants, foreign currency transactions, and integral versus non-integral foreign operations.