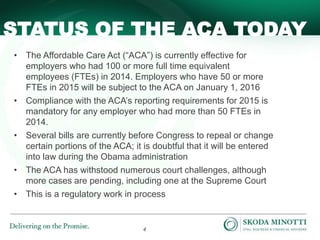

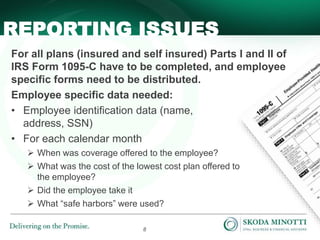

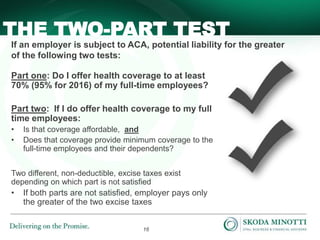

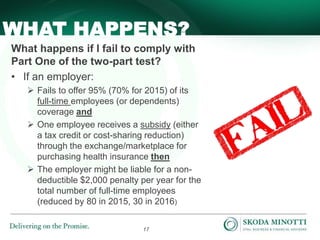

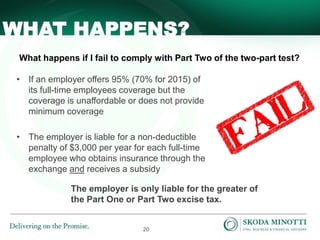

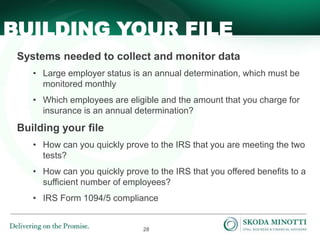

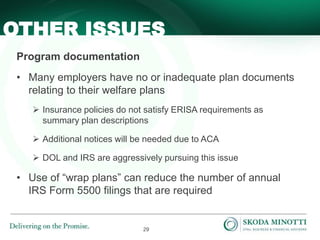

The document provides an update on the Affordable Care Act (ACA), highlighting compliance requirements for employers with 50 or more full-time equivalent employees, mandatory IRS reporting, and potential penalties for non-compliance. It discusses the employer mandate to provide affordable health coverage and details about excise taxes that may arise if coverage is inadequate. Additionally, it outlines strategies for managing workforce levels to avoid ACA obligations and key definitions relevant to compliance.