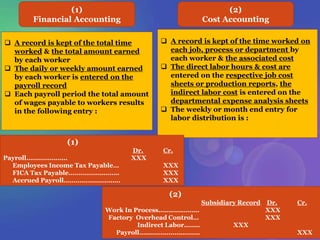

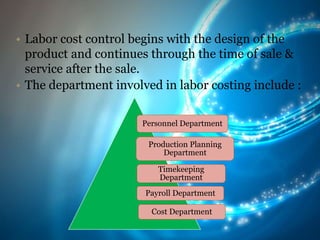

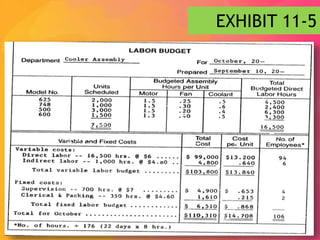

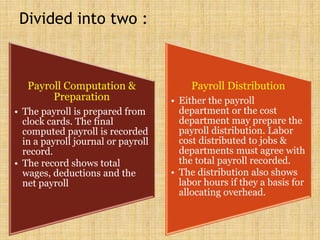

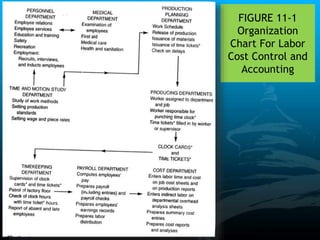

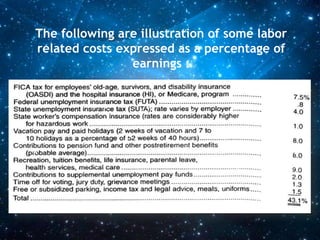

This document discusses labor cost accounting and control. It describes the organizational structure including personnel, production planning, timekeeping, payroll, and cost departments. It explains their roles in labor costing such as recruiting employees, scheduling work, tracking employee time and costs, paying employees, and recording direct and indirect labor costs. The appendix discusses accounting for personnel related costs including benefits, taxes, and insurance that make up total labor compensation costs.