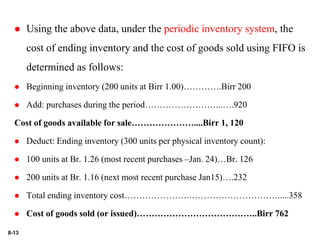

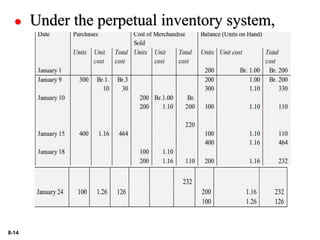

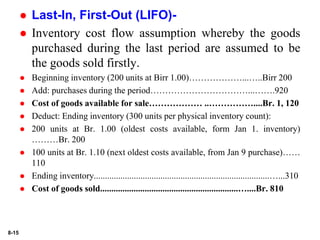

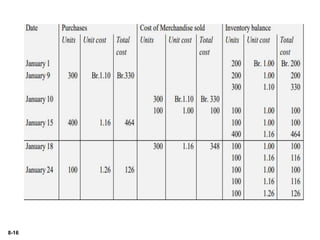

1. The document discusses various methods for classifying, valuing, and estimating inventory. It covers perpetual and periodic inventory systems.

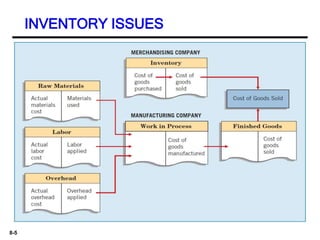

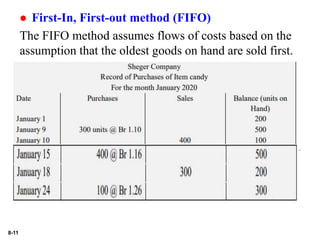

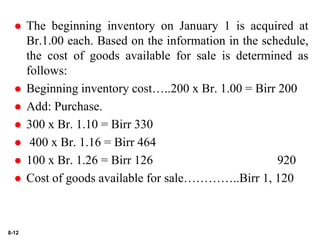

2. Major inventory classifications include raw materials, work in progress, and finished goods for manufacturers. Common inventory valuation methods are FIFO, LIFO, and weighted average.

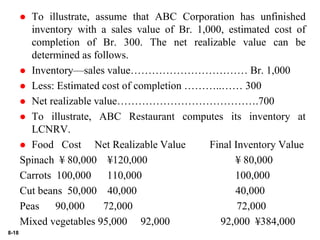

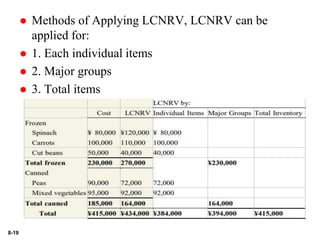

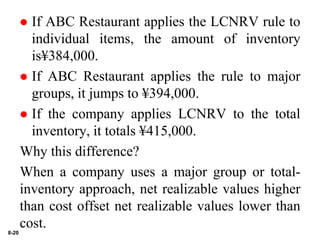

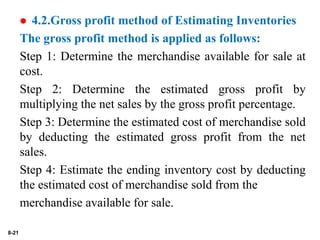

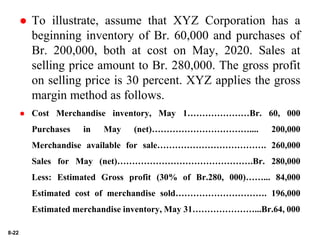

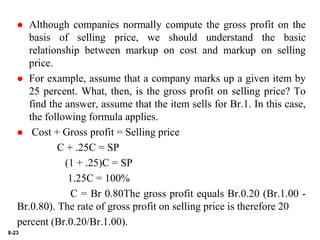

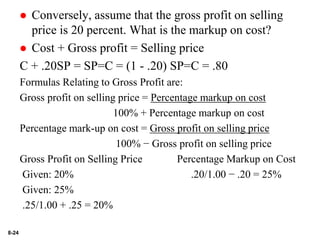

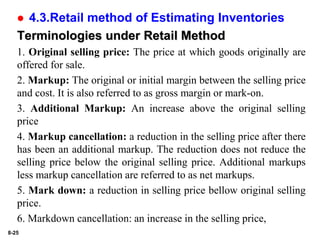

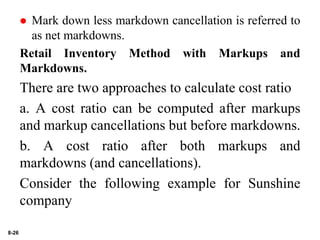

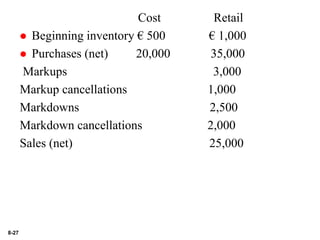

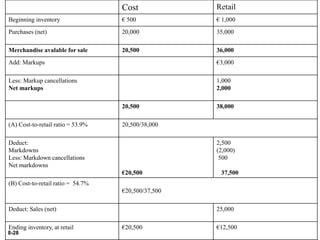

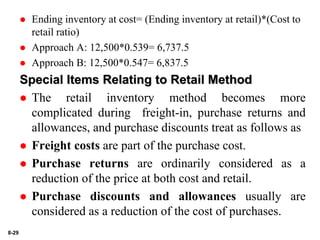

3. Inventories must be valued at the lower of cost or net realizable value. The gross profit and retail methods can be used to estimate ending inventory balances.