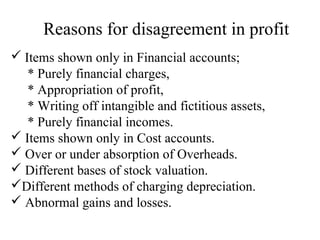

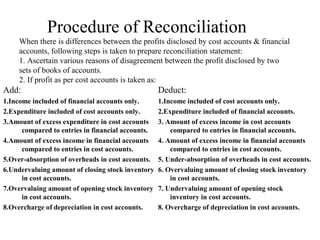

This document discusses reconciliation between cost and financial accounts. It defines reconciliation as identifying reasons for differences in profits reported by cost versus financial accounts. Key points include definitions of cost and financial accounting, reasons for discrepancies like treatment of overhead absorption or depreciation, and methods of reconciliation like preparing a reconciliation statement or memorandum reconciliation account. The procedure of reconciliation involves determining reasons for disagreement and adjusting the base profit reported by one set of accounts to match the other set.