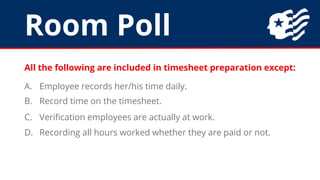

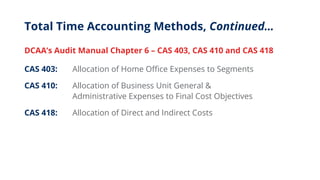

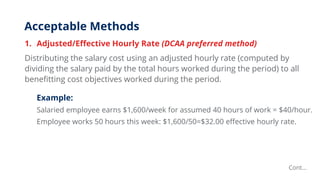

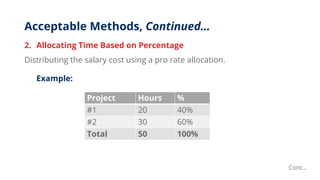

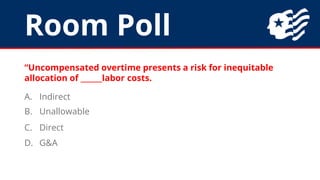

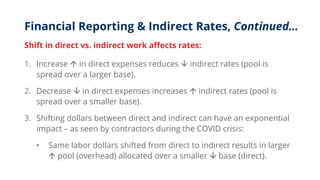

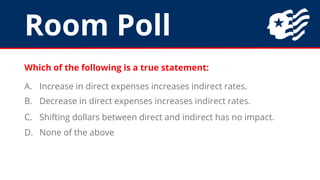

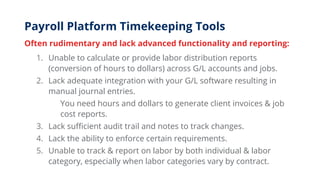

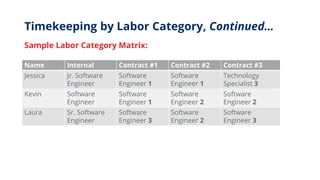

Left Brain Professionals is a specialized accounting firm for government contractors, focusing on timekeeping, labor distribution, and compliance. The document outlines the components of effective timekeeping systems, labor distribution methods, and the impact of labor costs on financial reporting and indirect rates. It emphasizes the importance of accurate time tracking for financial analysis and compliance with government regulations.