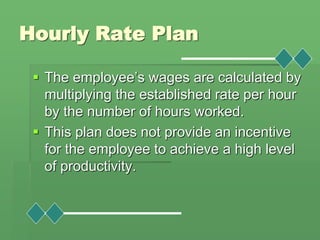

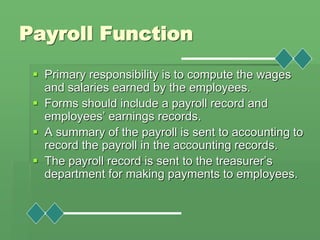

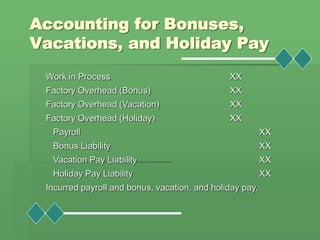

This document discusses accounting for labor costs. It covers topics such as direct and indirect labor costs, hourly and piece-rate payment plans, payroll procedures, recording of labor time and costs, and accounting entries. Payroll costs are initially recorded through journal entries that allocate wages to accounts like work in process, overhead, and liabilities for taxes. Labor costs then flow from time records to job cost and overhead ledgers to the general ledger.