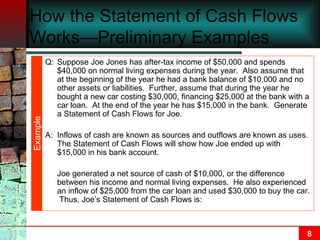

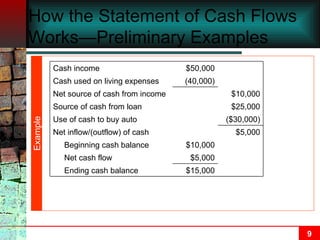

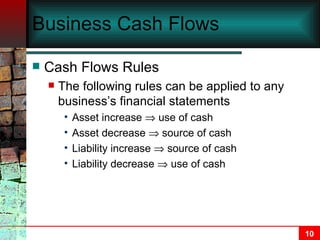

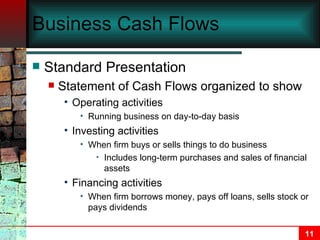

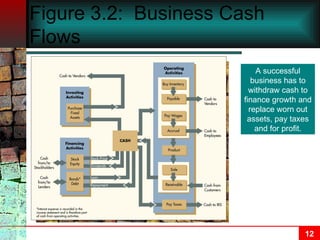

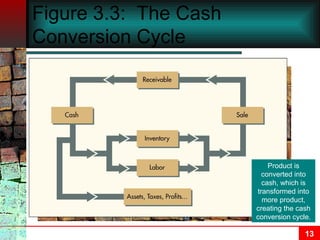

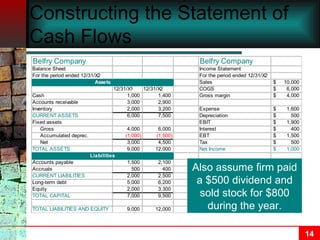

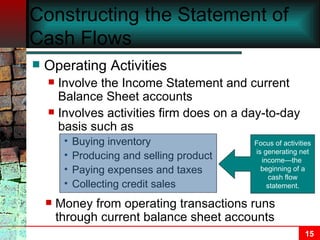

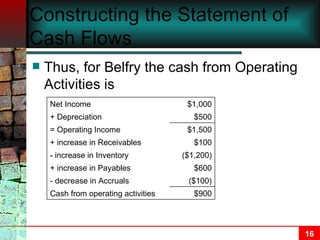

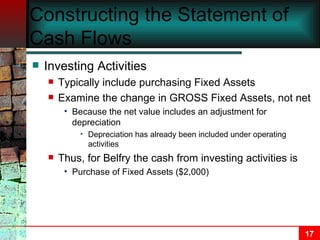

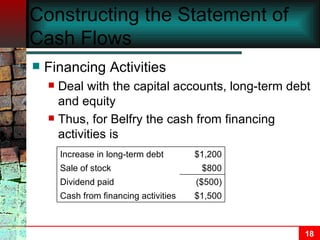

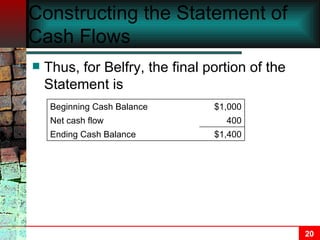

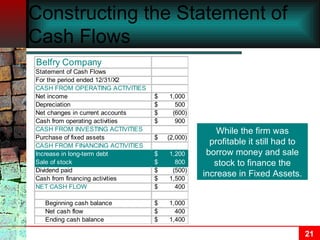

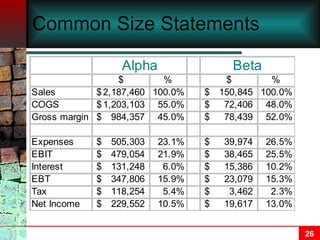

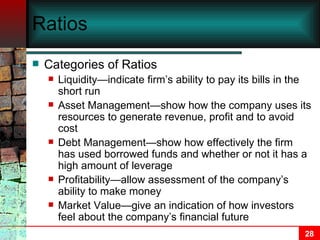

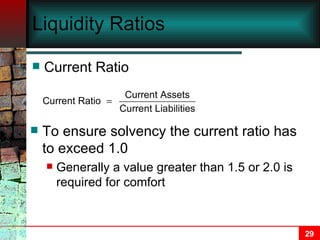

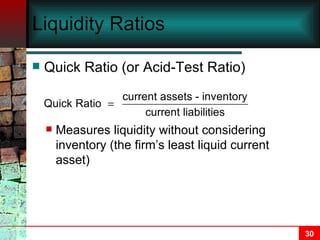

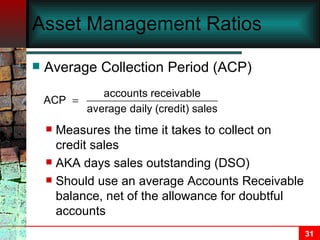

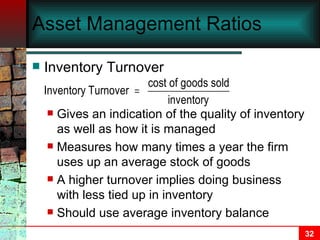

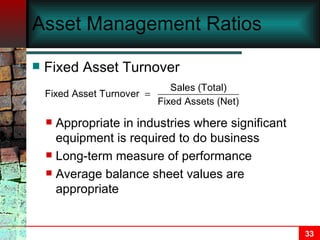

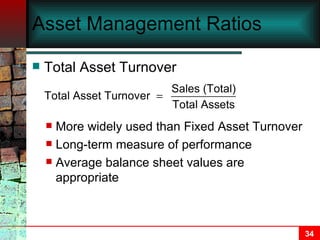

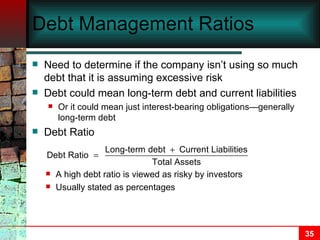

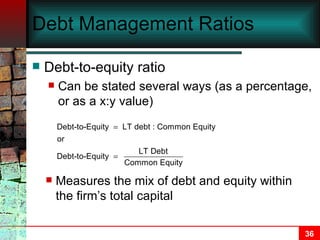

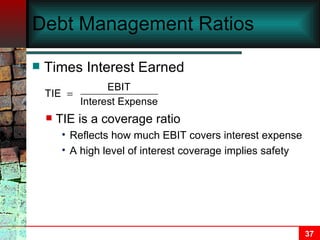

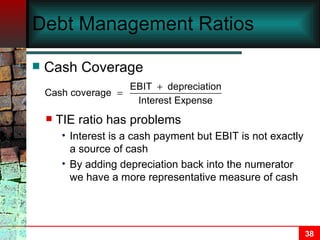

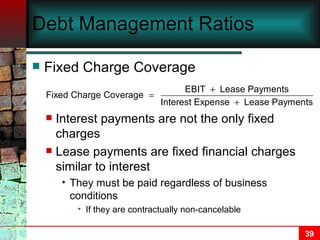

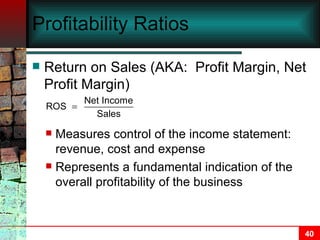

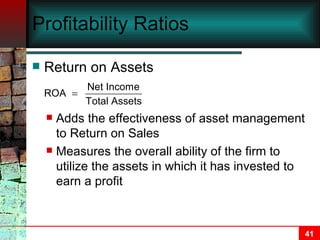

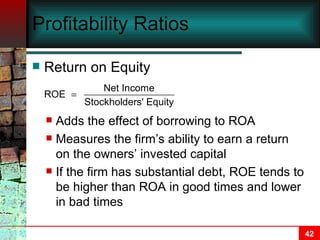

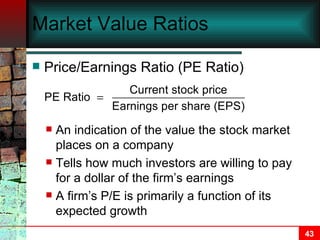

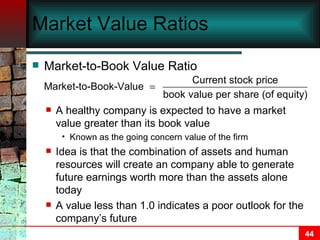

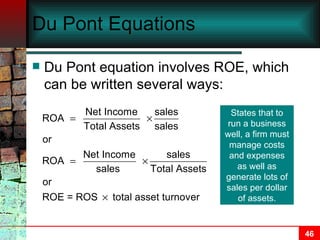

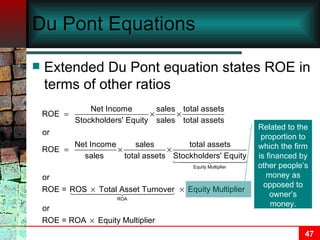

This document discusses the statement of cash flows and financial analysis. It provides examples of constructing a statement of cash flows for an individual and a business. It explains the three sections of the statement of cash flows - operating, investing, and financing activities. It also discusses various types of ratios used in financial analysis, including liquidity, asset management, debt management, and profitability ratios.