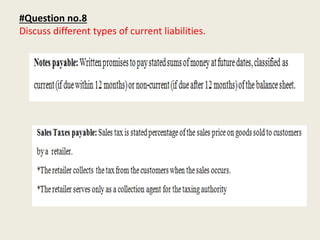

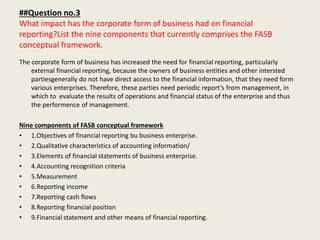

This document summarizes an intermediate accounting presentation discussing various accounting concepts and questions. It discusses the impact of corporate form of business on financial reporting and the nine components that comprise the FASB conceptual framework. It also addresses questions about organizing costs, capitalizing costs such as copyrights and franchises, the conceptual framework of financial accounting, and the major objectives and qualitative characteristics of financial reporting as specified by FASB.