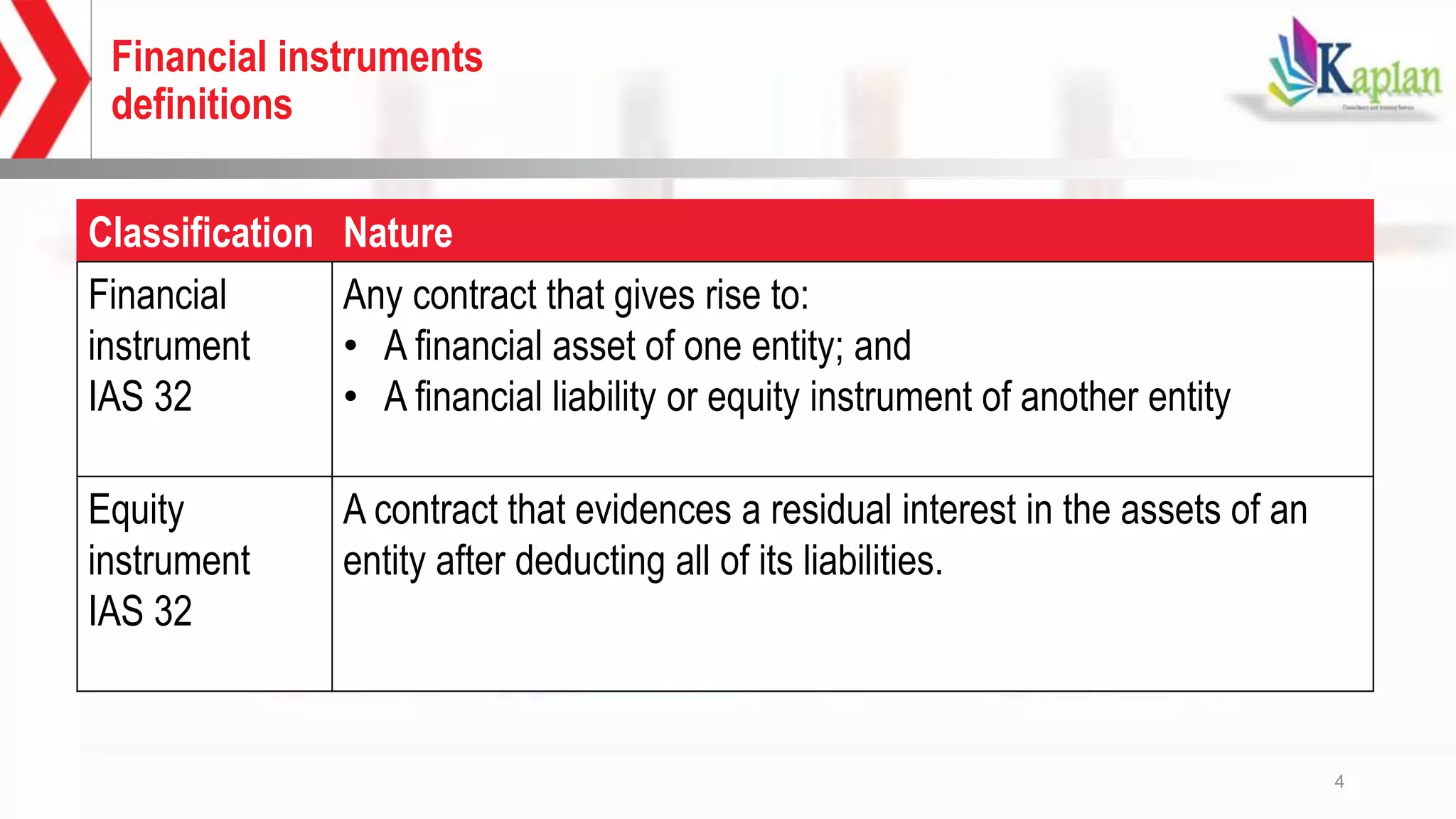

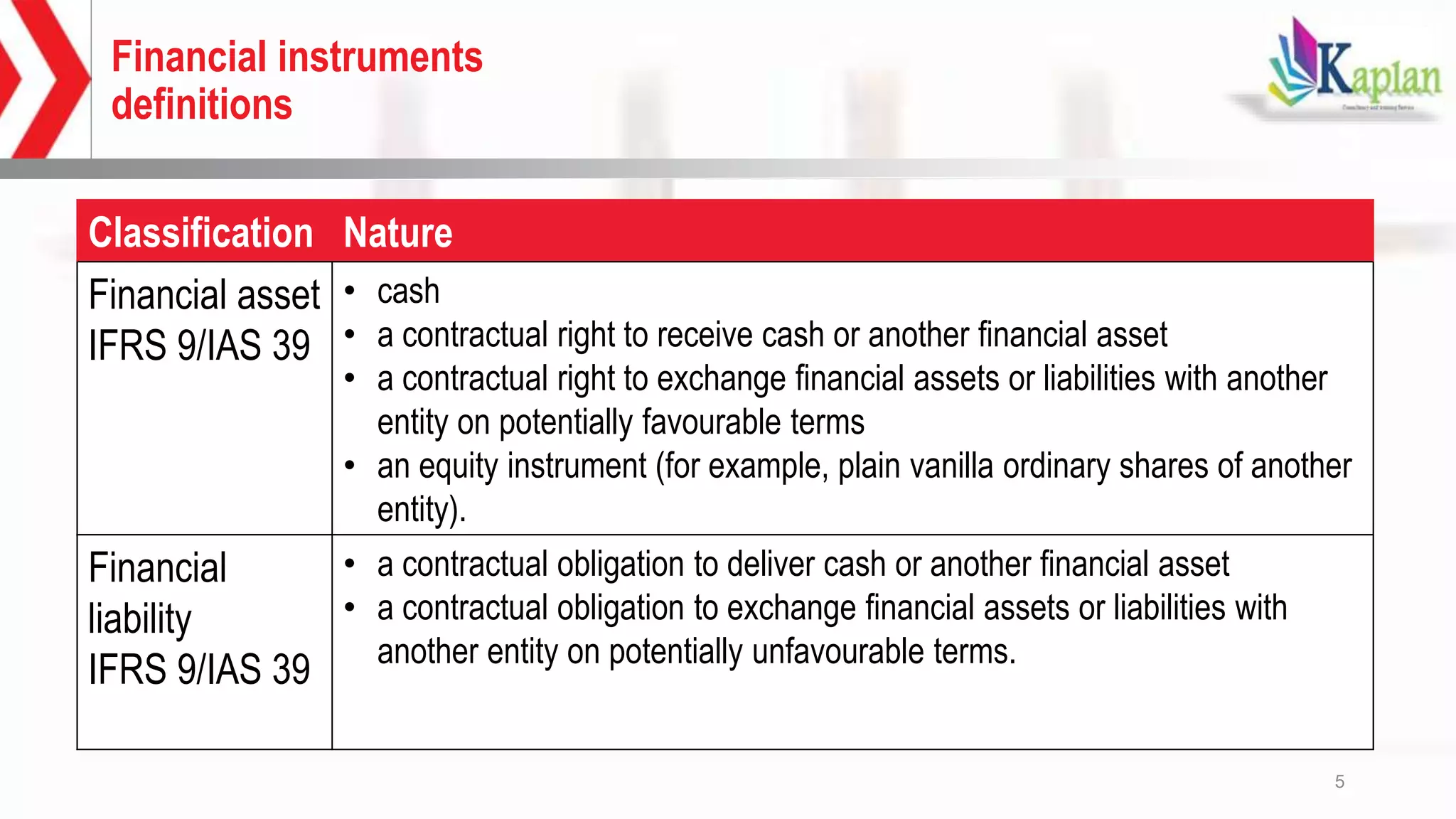

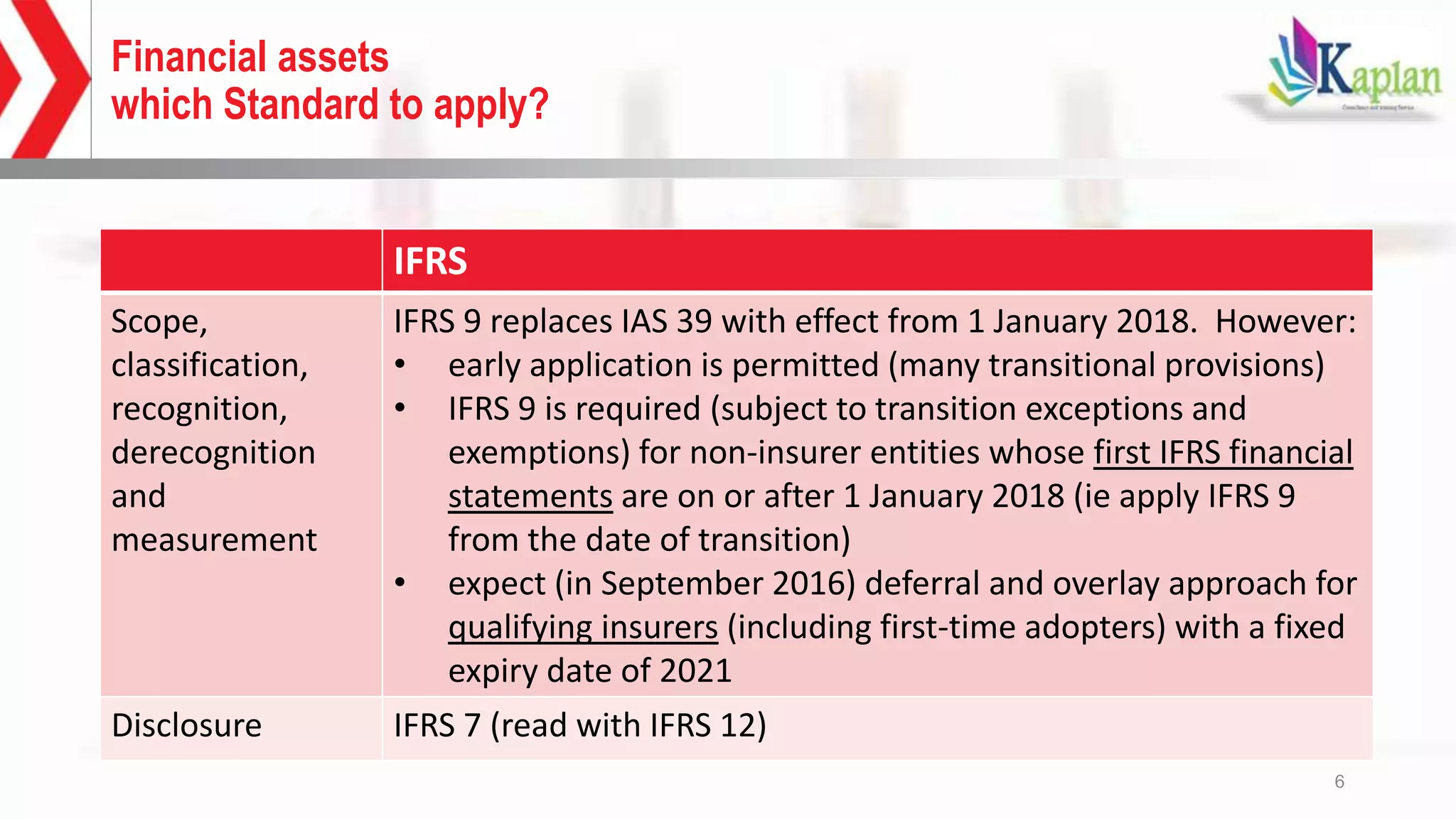

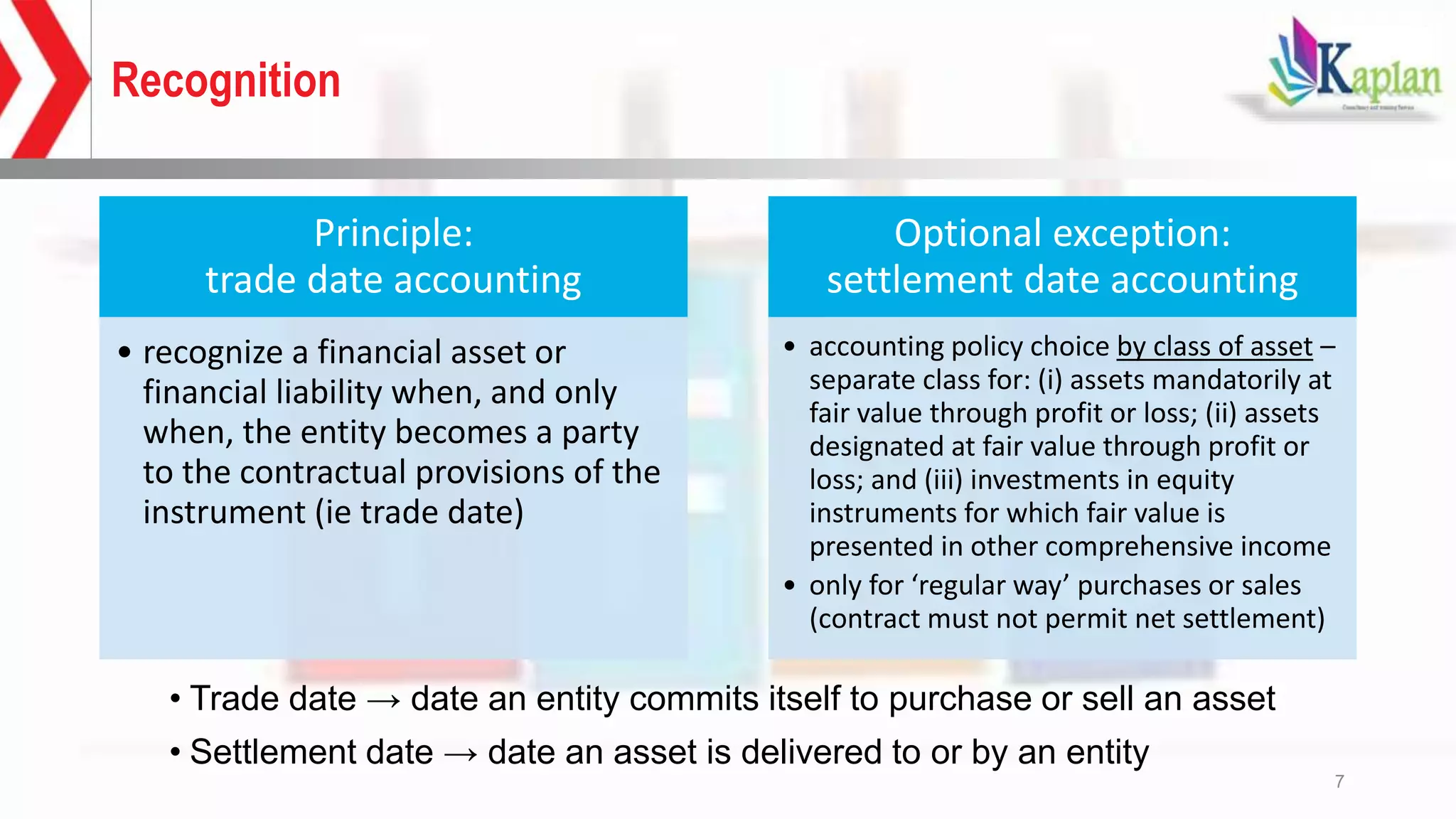

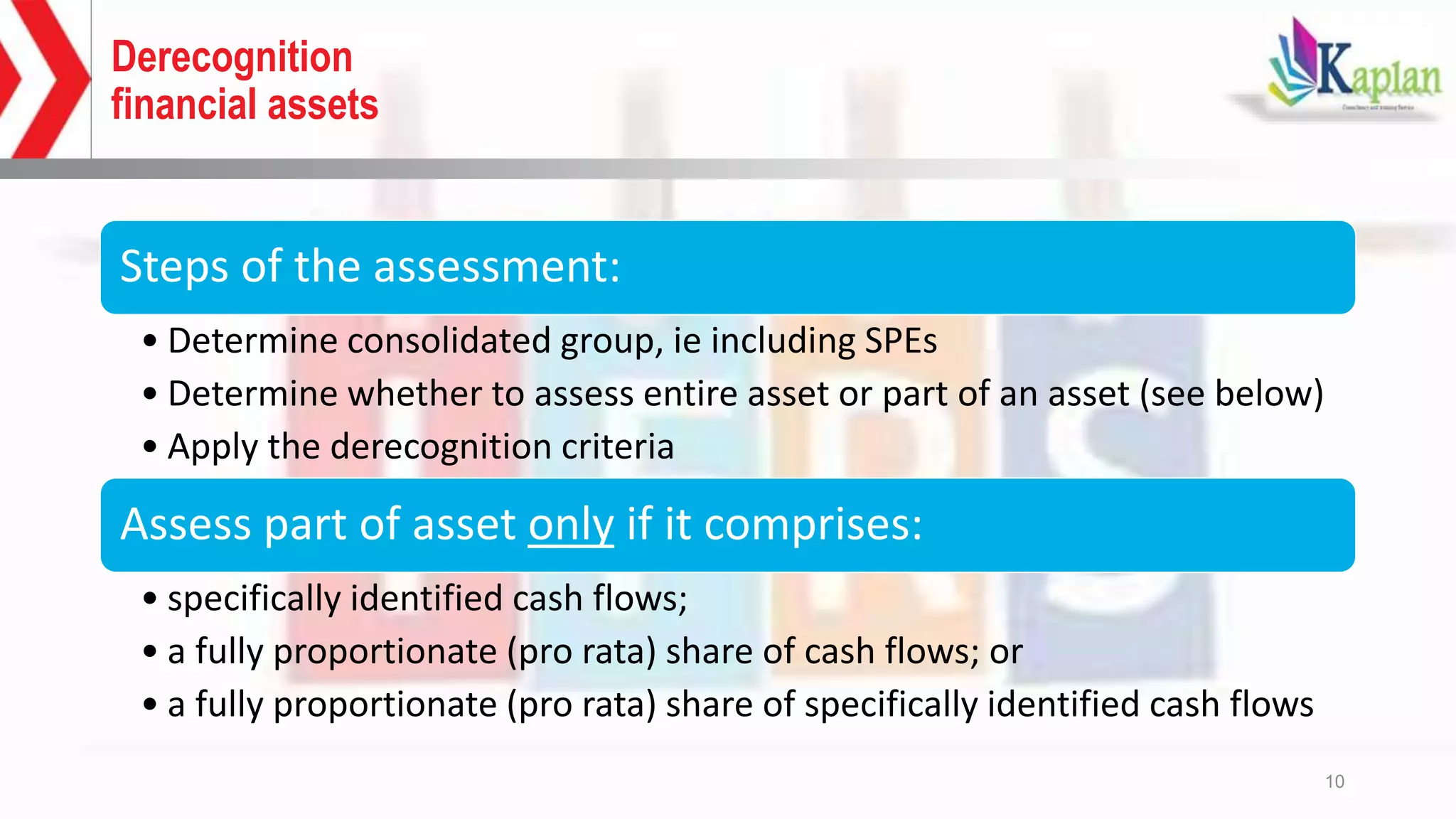

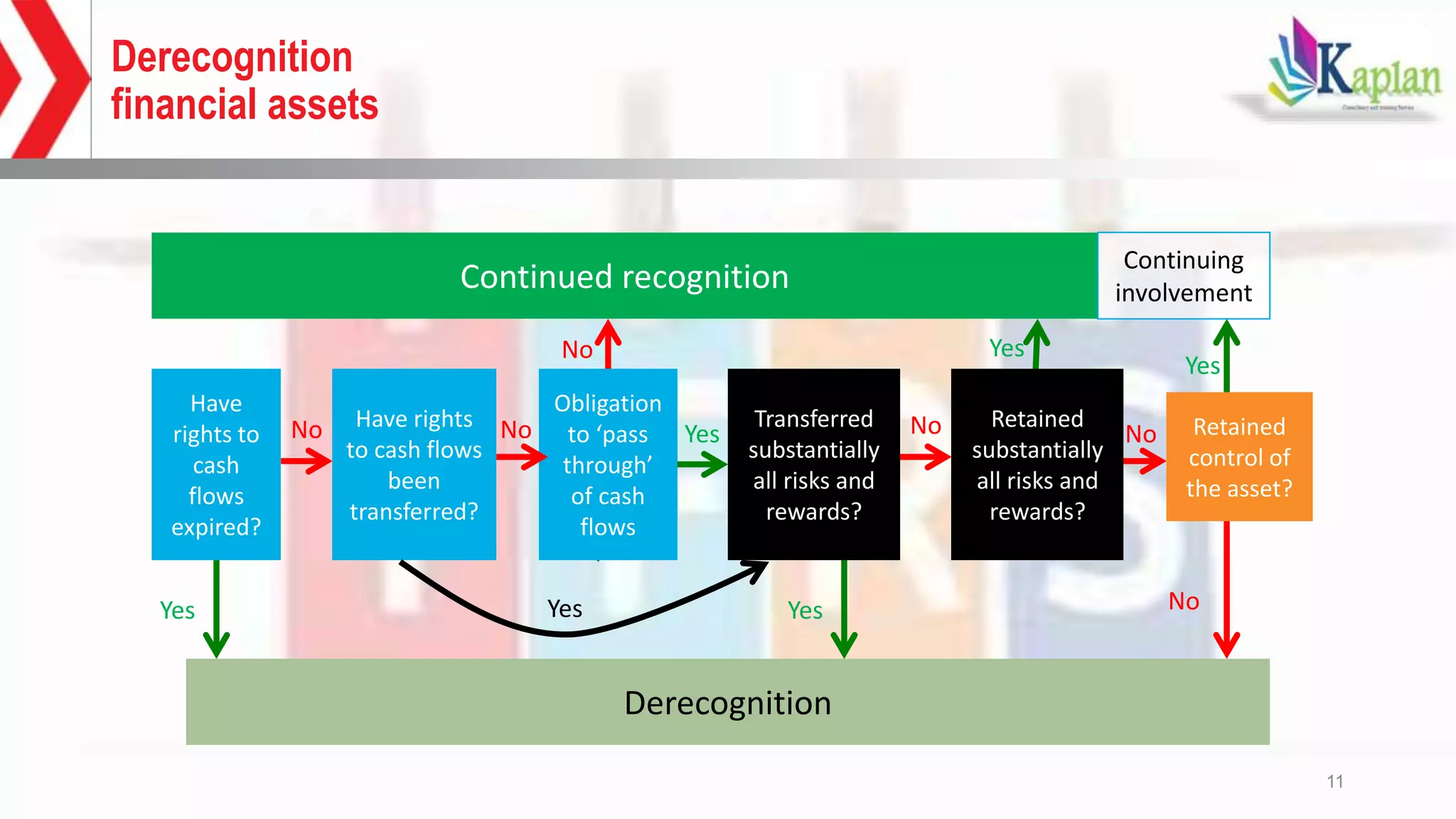

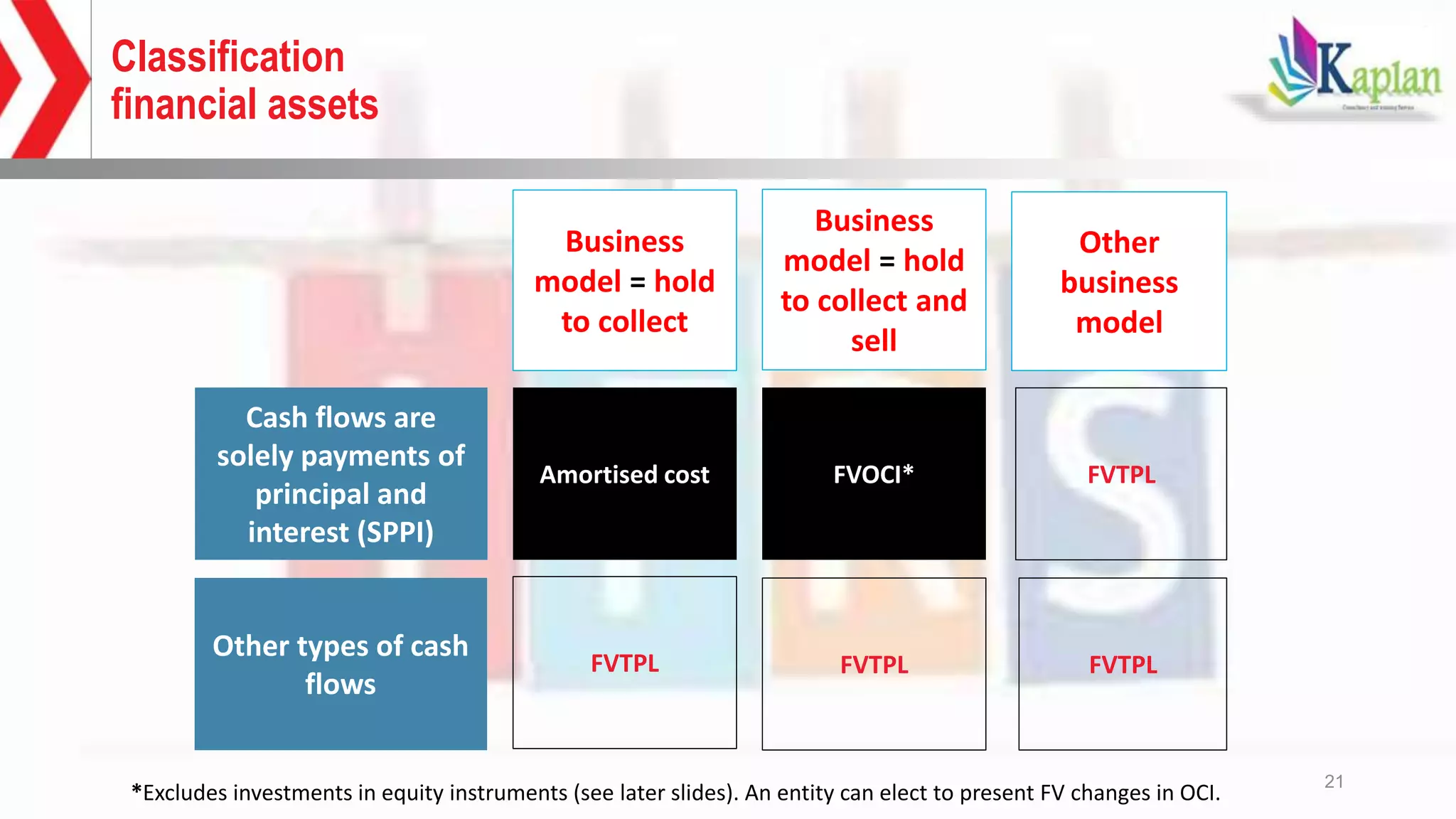

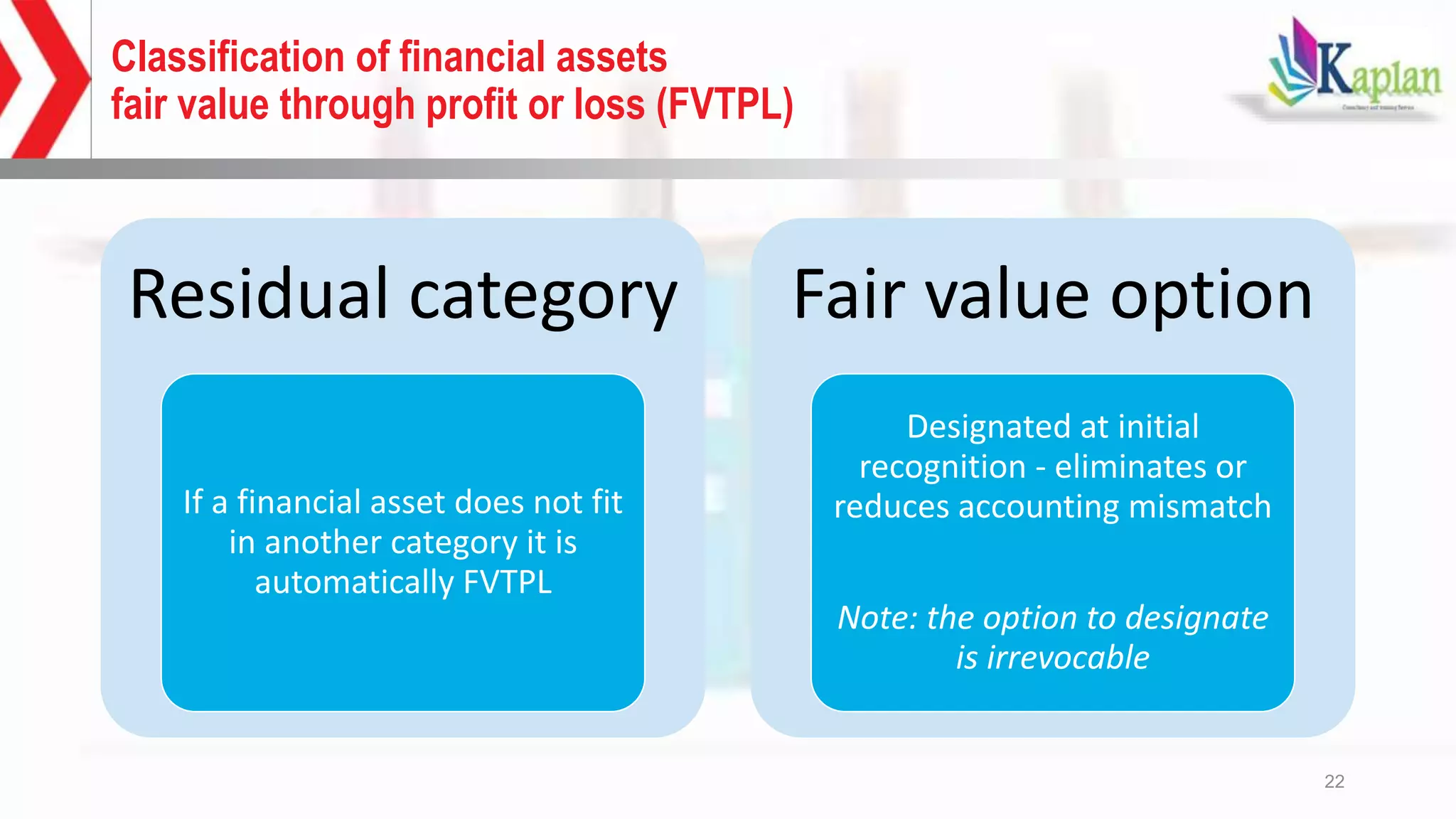

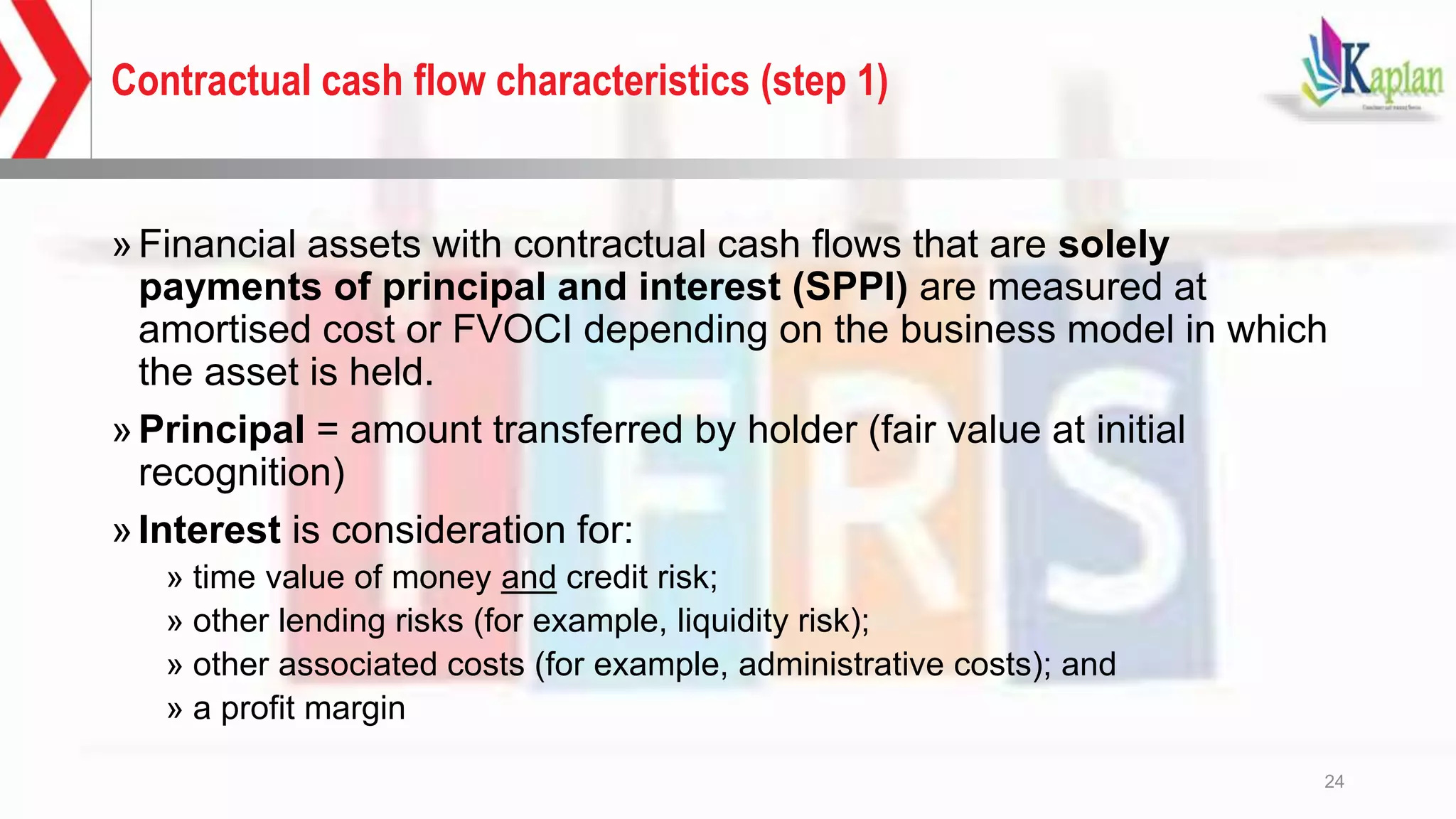

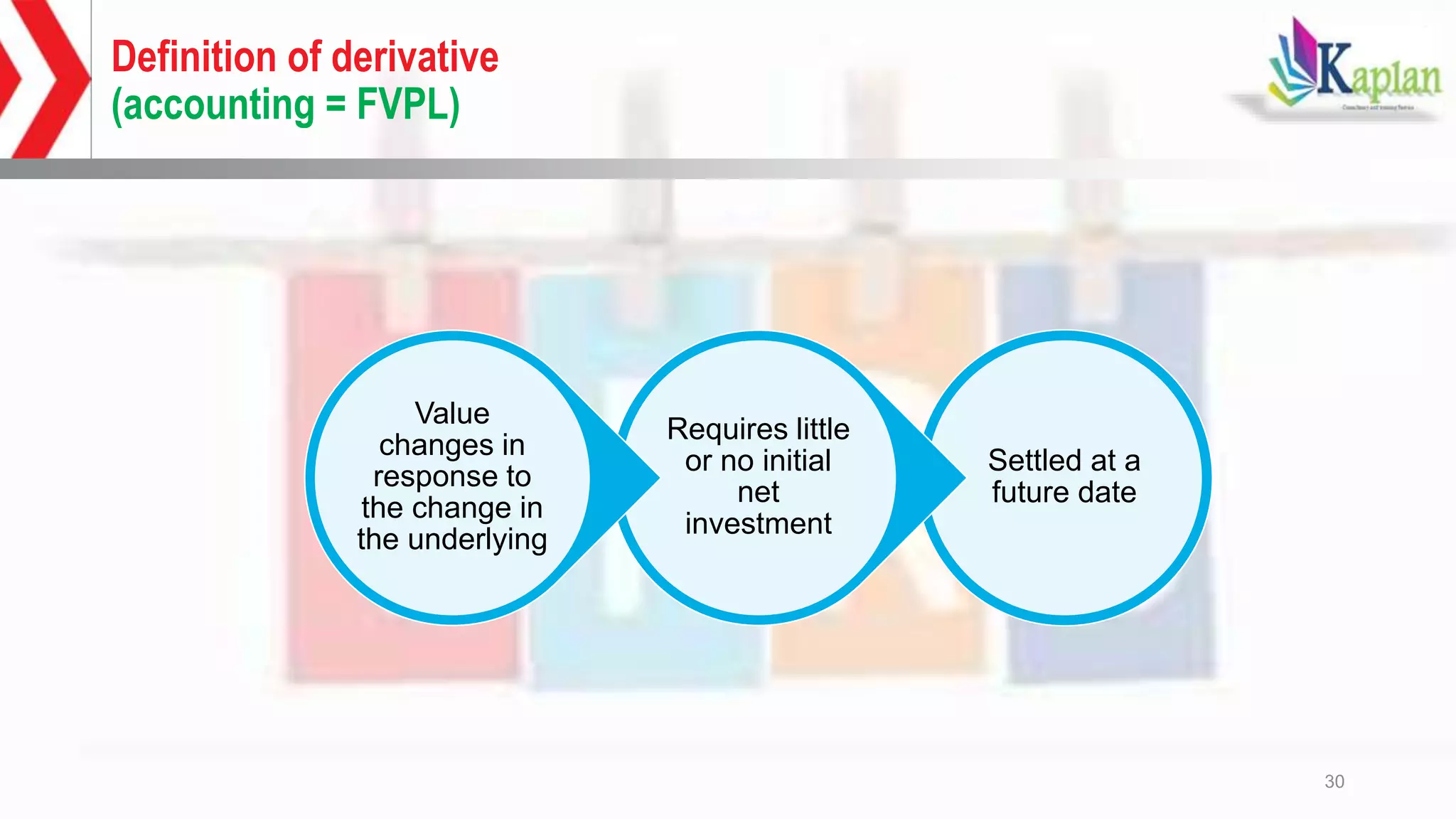

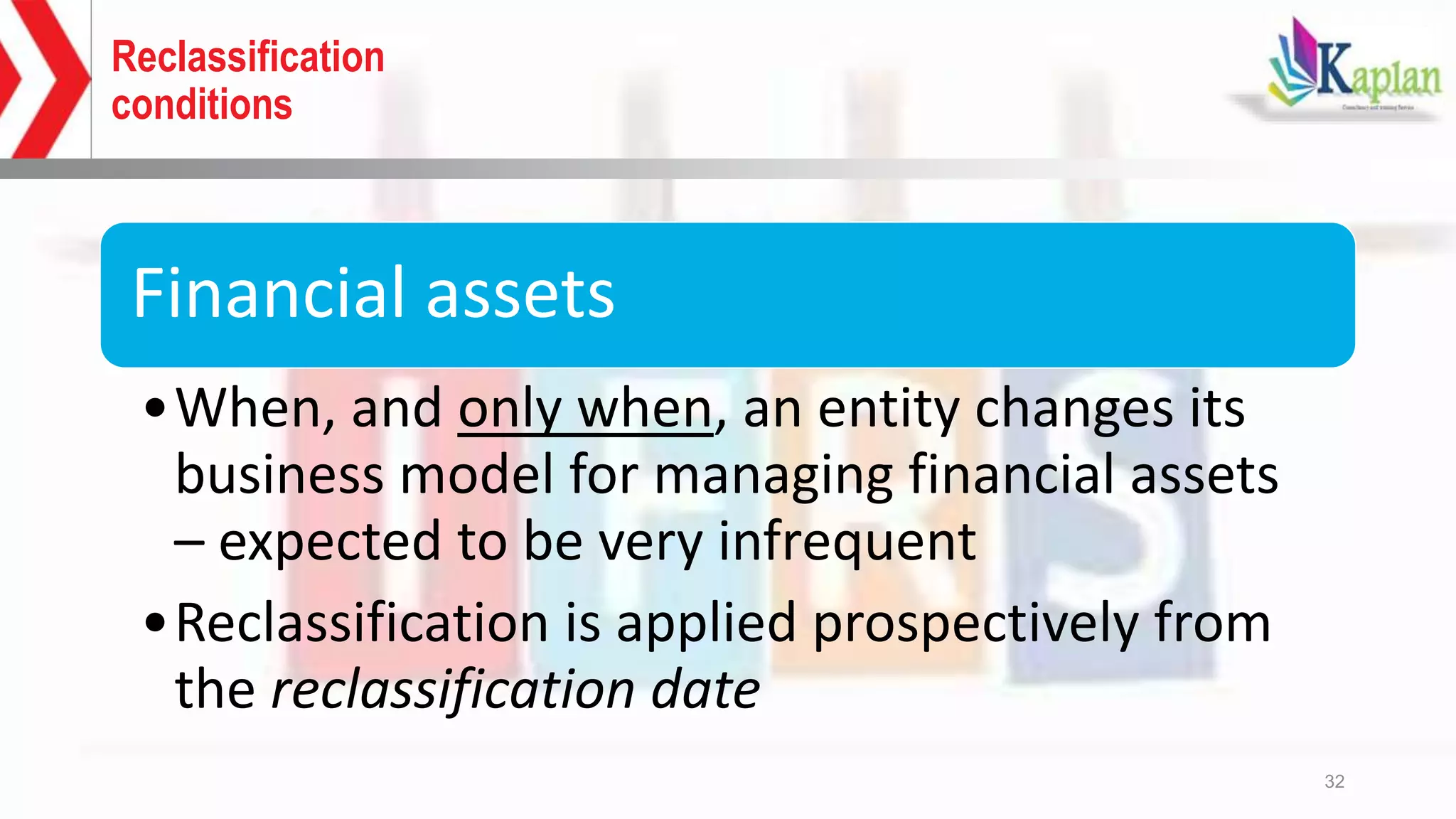

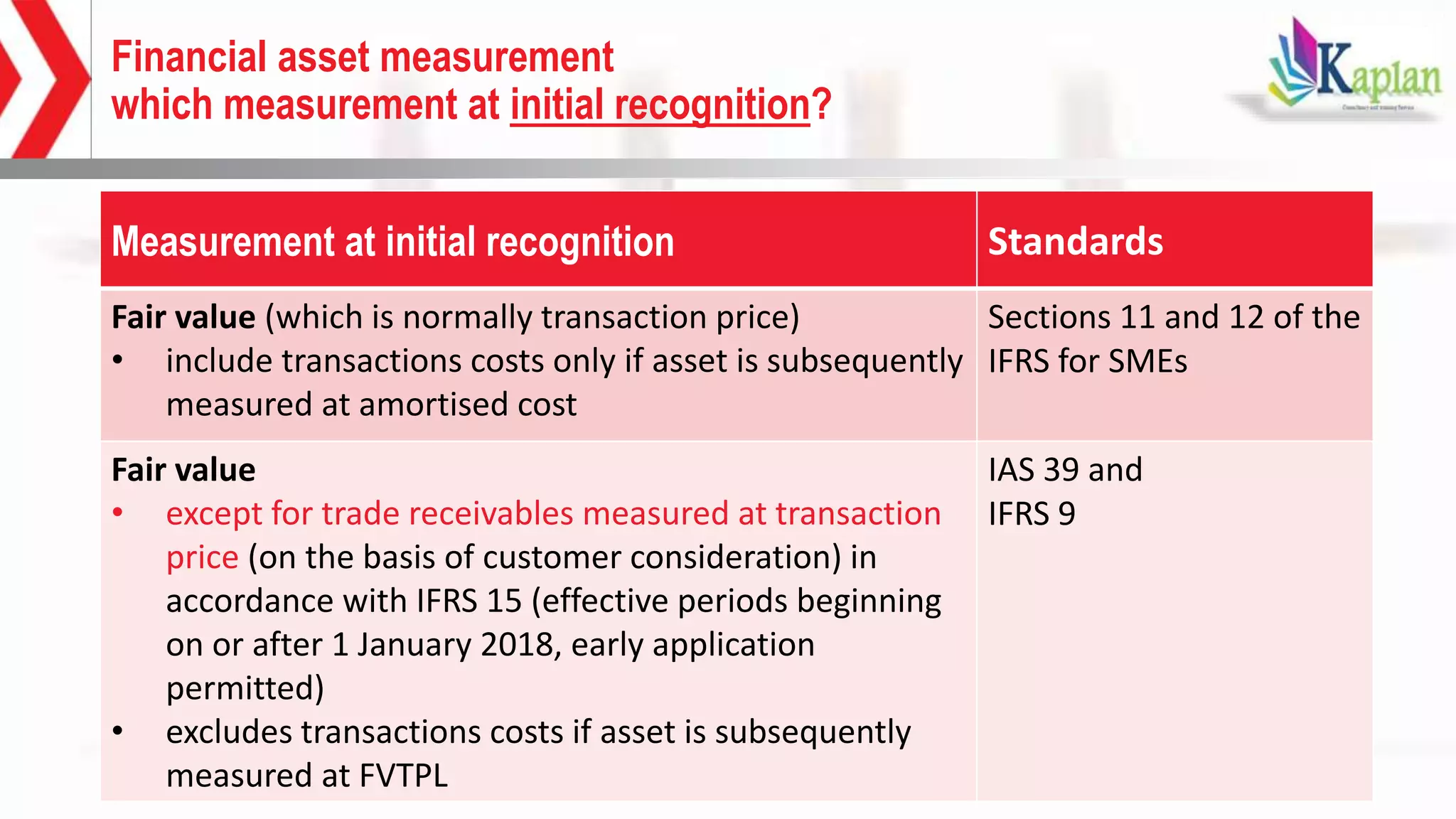

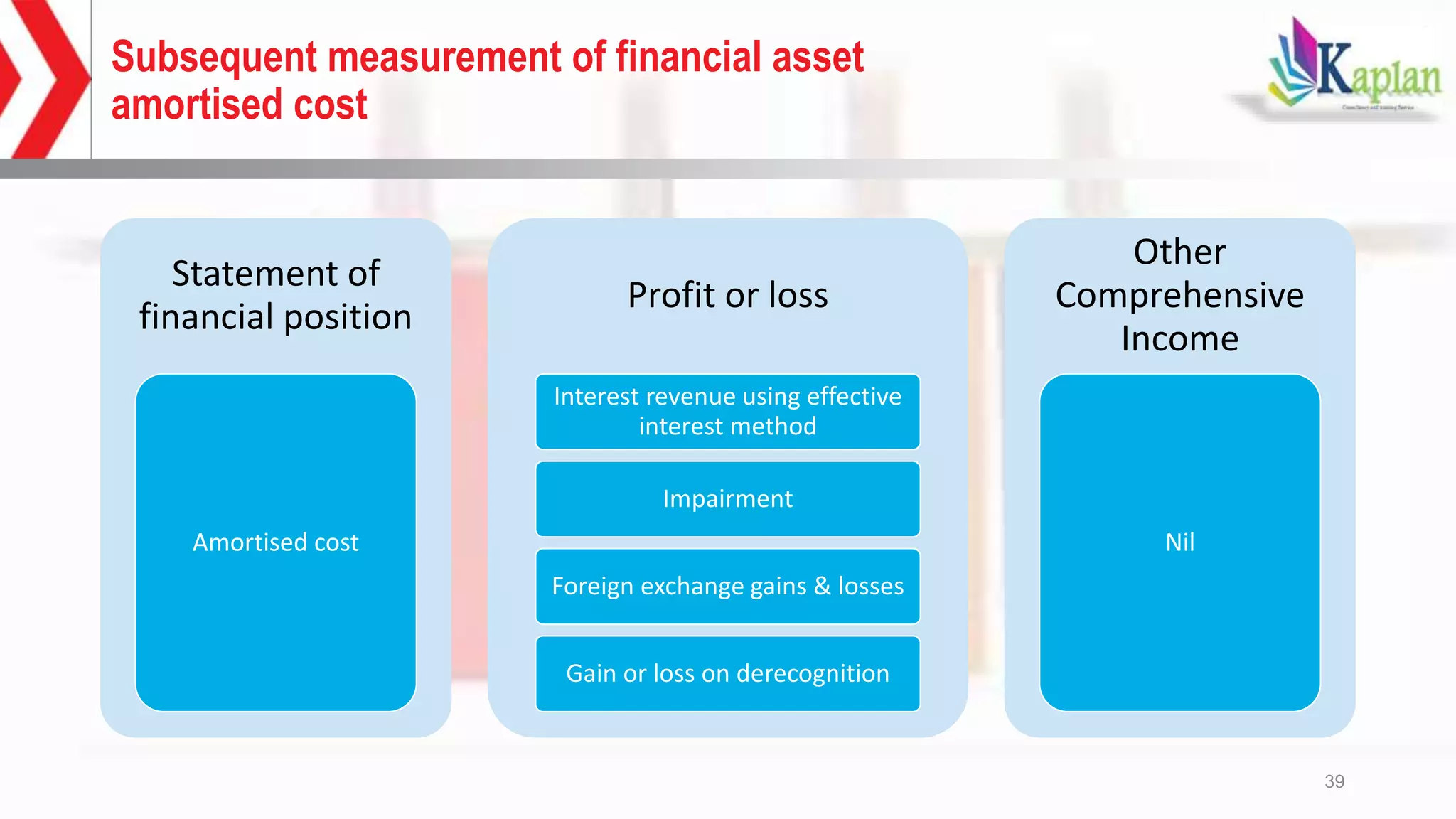

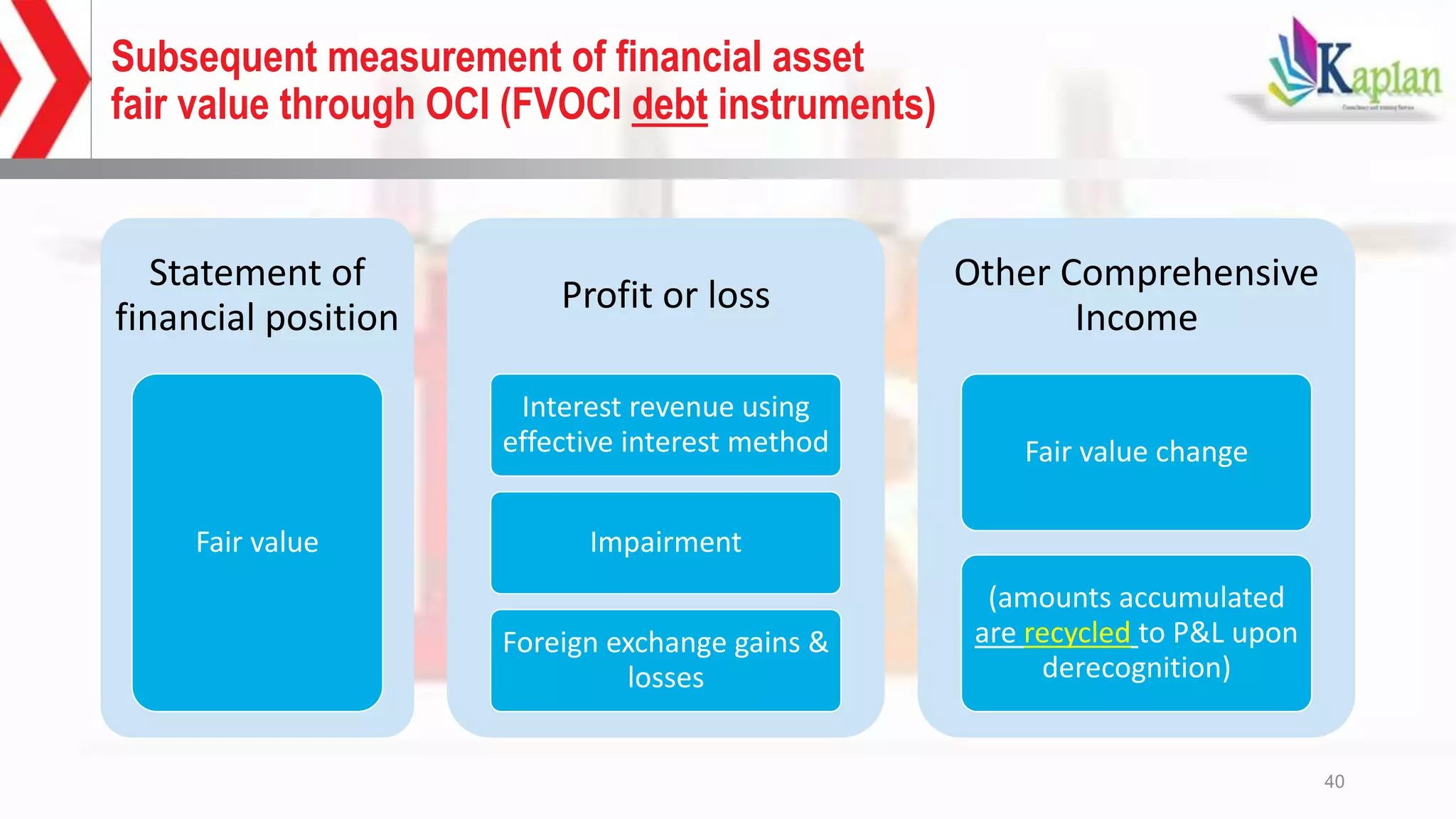

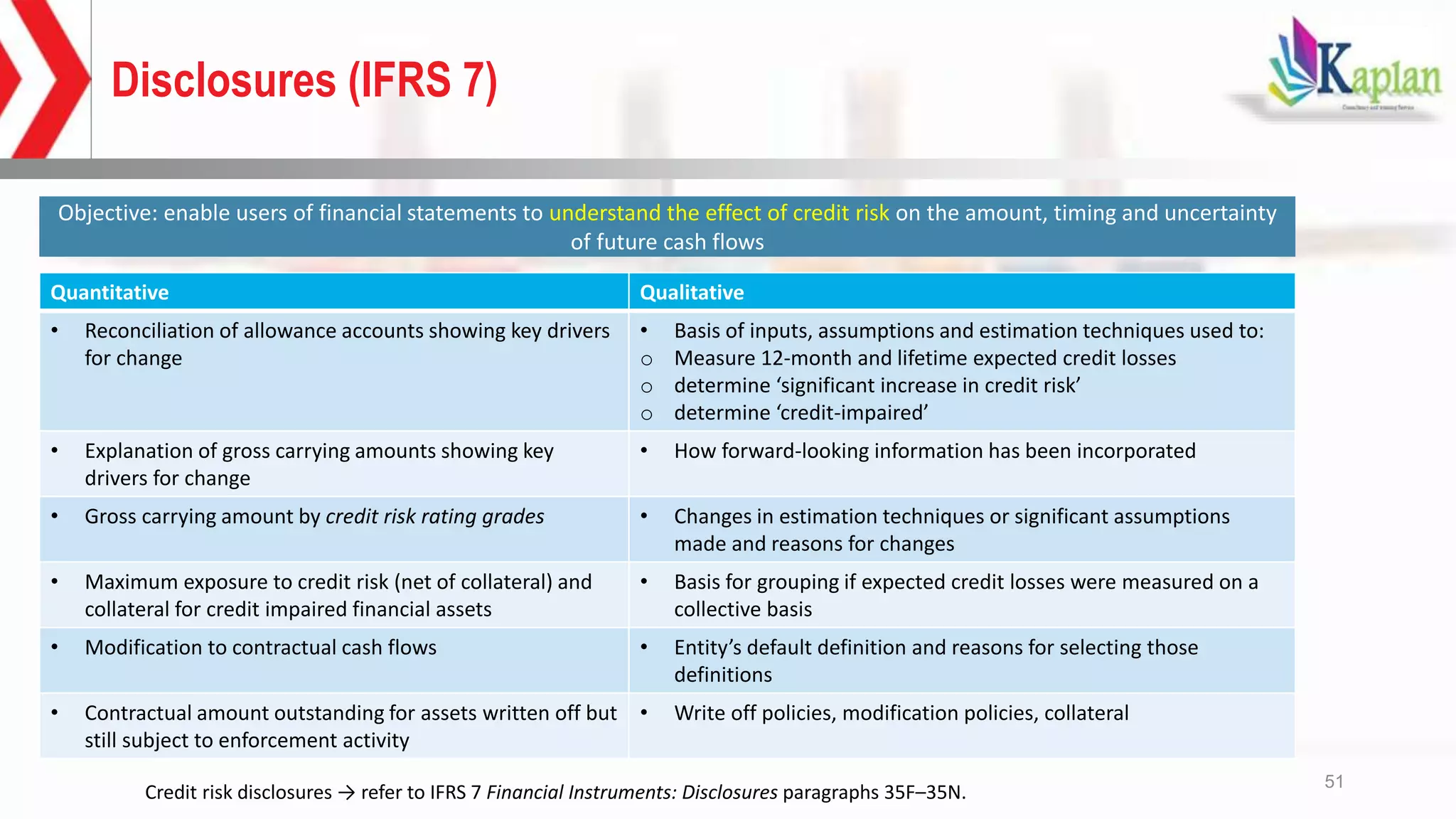

This document provides an overview of accounting for financial instruments under IFRS 9. It discusses key aspects such as classifying financial instruments, recognizing and derecognizing financial assets, and impairment of financial assets. The document defines various financial instruments and outlines their classification and measurement. It describes the criteria for classifying financial assets as amortized cost, fair value through other comprehensive income, or fair value through profit or loss depending on contractual cash flow characteristics and business models. The derecognition principles for financial assets and continuing involvement are also summarized.