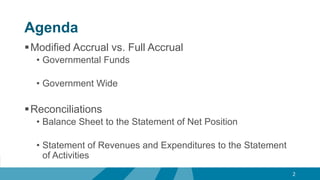

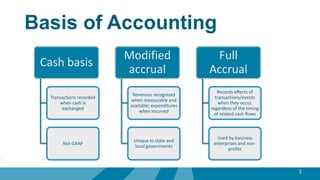

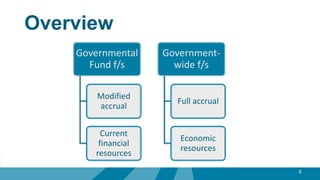

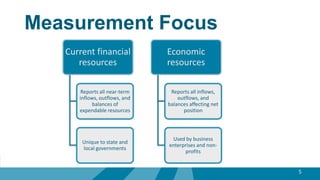

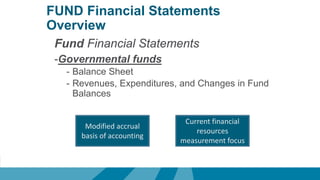

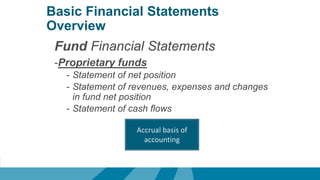

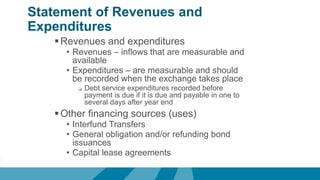

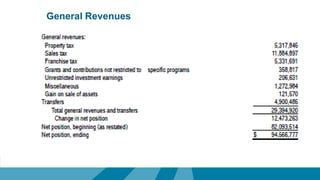

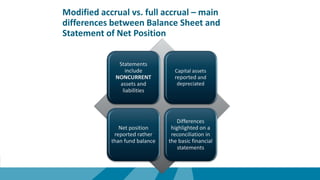

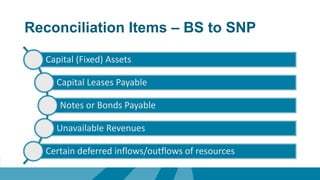

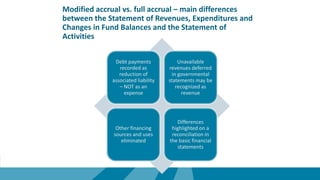

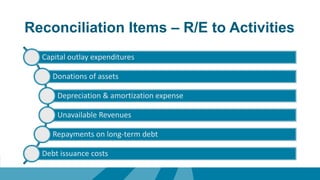

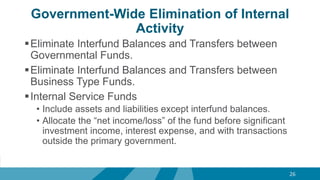

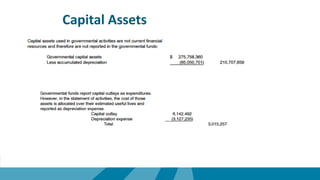

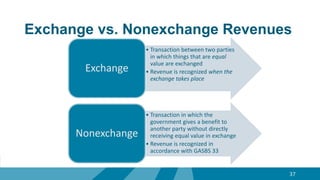

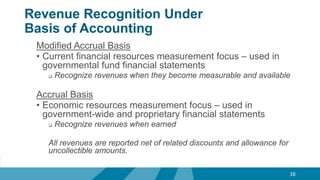

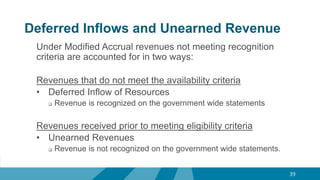

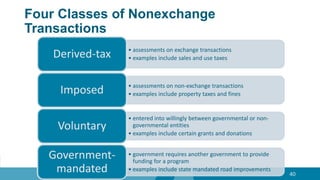

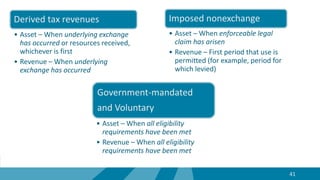

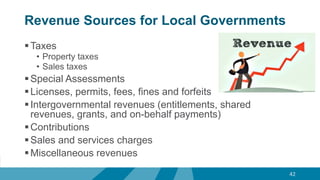

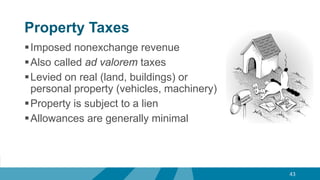

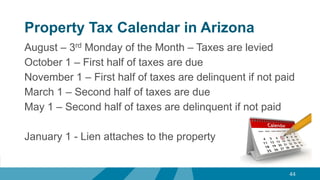

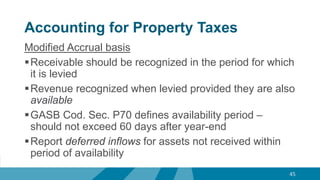

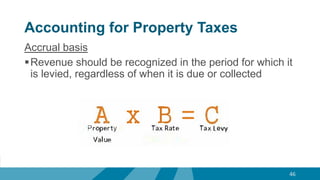

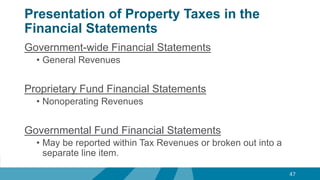

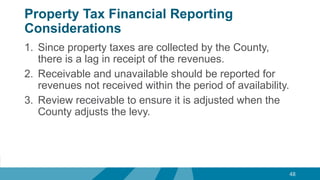

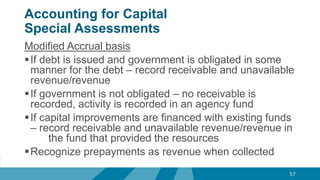

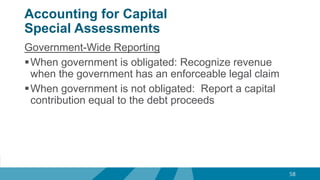

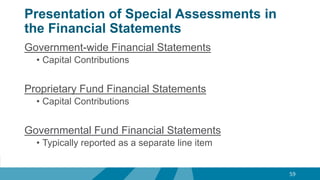

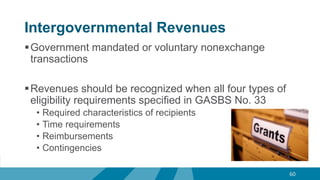

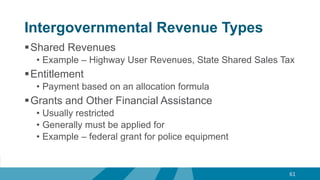

The document provides a comprehensive overview of governmental accounting, focusing on the differences between modified and full accrual accounting methods. It discusses the financial statement presentation for various funds, revenue recognition, and the types of transactions involved, including exchange and nonexchange revenues. Additionally, it covers accounting measures for specific revenue sources like property taxes, sales taxes, and intergovernmental revenues, emphasizing the recognition criteria under different accounting bases.