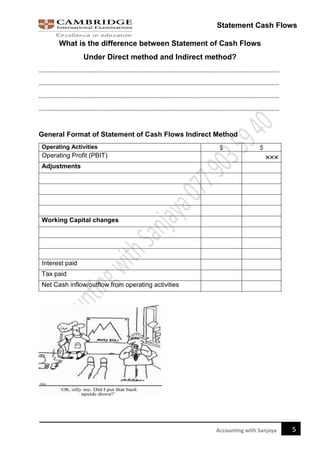

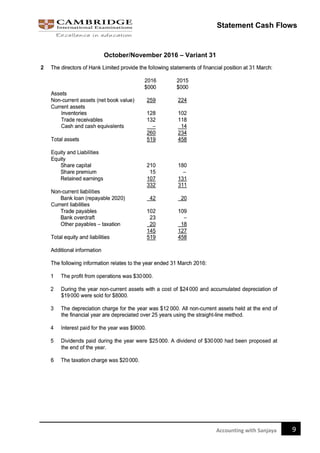

The document discusses the statement of cash flows, highlighting its importance for short-term business survival and detailing how it differs from income statements and statements of financial position. It covers types of cash movements, regulatory requirements under international accounting standards, and the distinction between direct and indirect methods of presenting cash flows. Additionally, it includes examples, test questions, and emphasizes the historical nature of cash flow statements and their limitations in representing non-cash transactions.