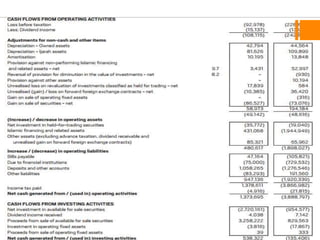

This document summarizes the key requirements of IAS 1 regarding the presentation of financial statements. It outlines the general purpose and components of financial statements, including statements of financial position, comprehensive income, changes in equity, and cash flows. It describes the general features that financial statements must adhere to, such as fair presentation, going concern basis, accrual accounting, materiality and offsetting. It provides details on the minimum line items that must be presented in each financial statement and notes. In the end, it gives examples of how Burj Bank implemented IAS 1 in its own financial statements.