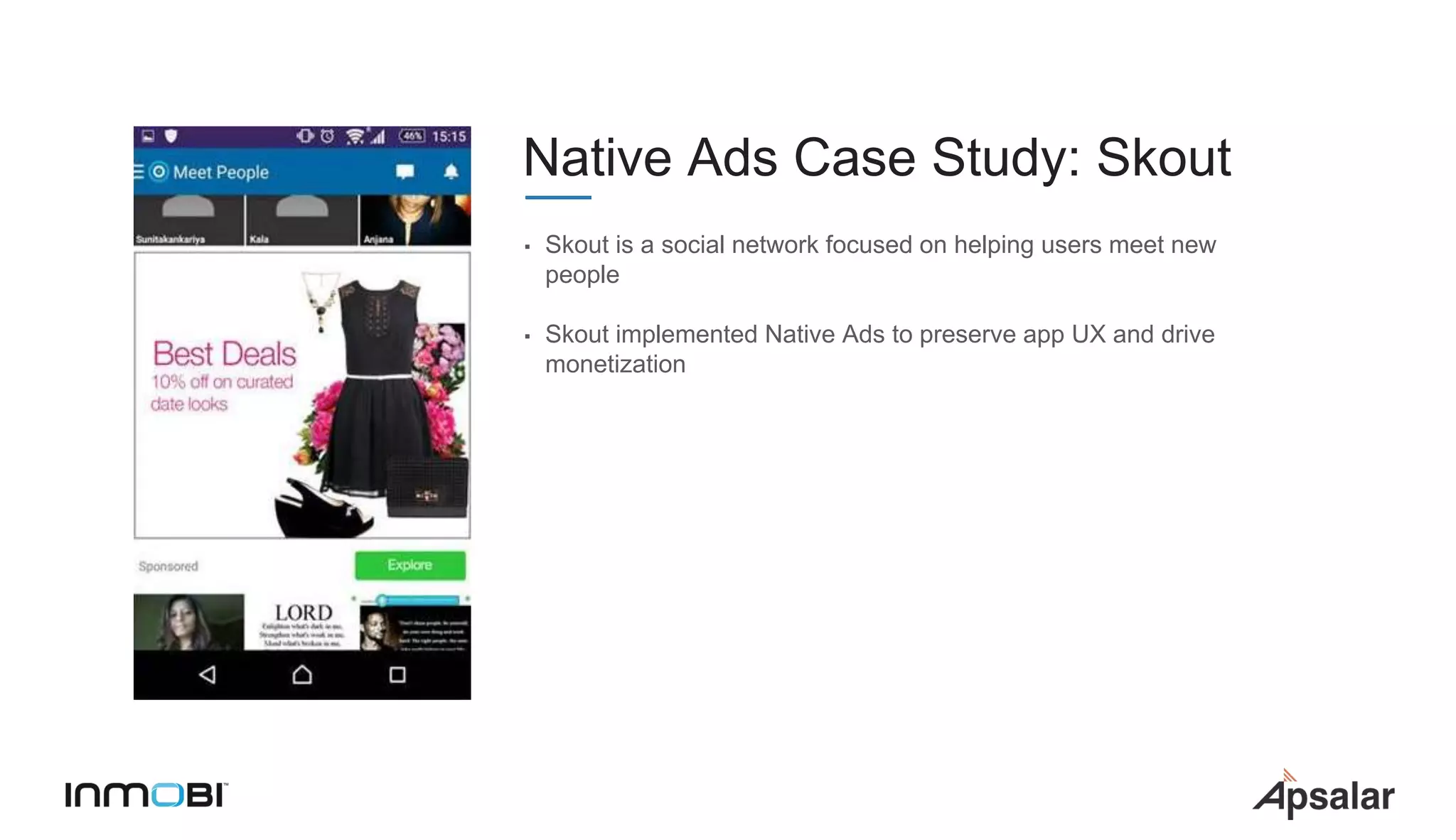

The document outlines strategies for maximizing return on investment (ROI) through mobile app advertising and monetization, highlighting six key areas: testing ad formats, exploring monetization models, measuring user lifetime value (LTV), KPI-based targeting, richer lookalike targeting, and app cross-marketing. It features case studies from companies like Skout, Apex Designs, Zomato, and Dropbox, demonstrating practical applications of these strategies. The emphasis is on leveraging user data and insights to drive more efficient user acquisition and retention.