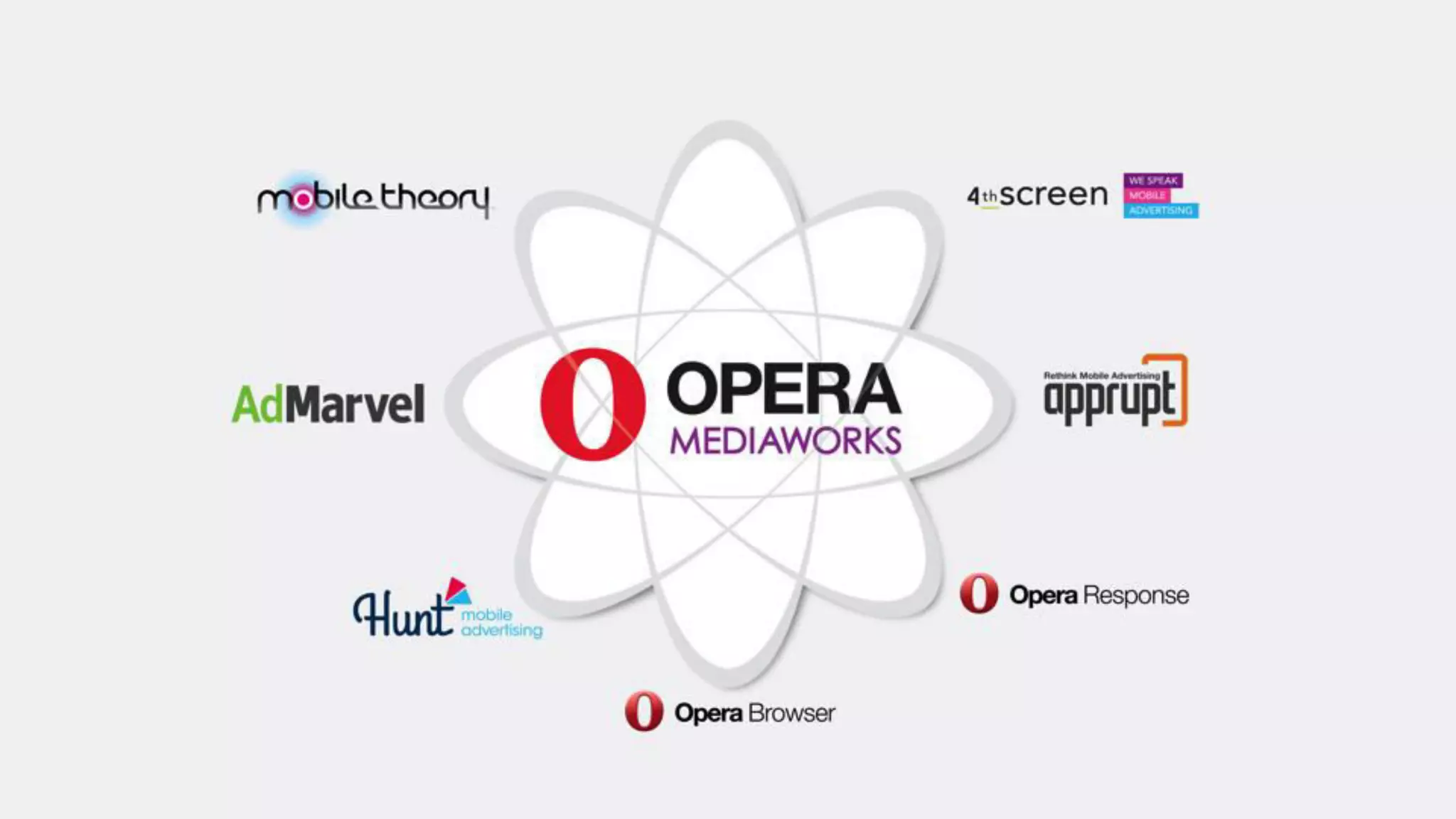

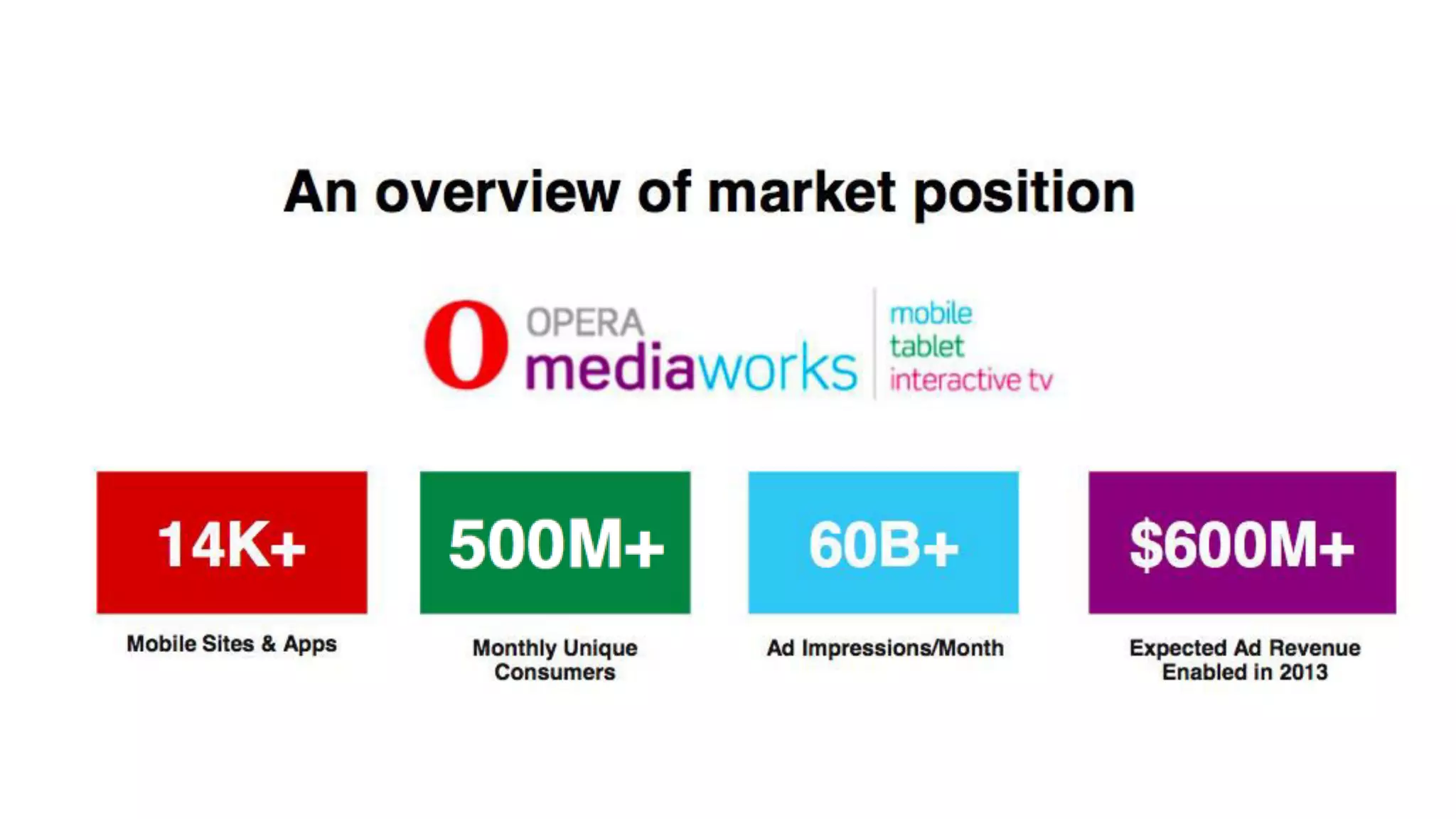

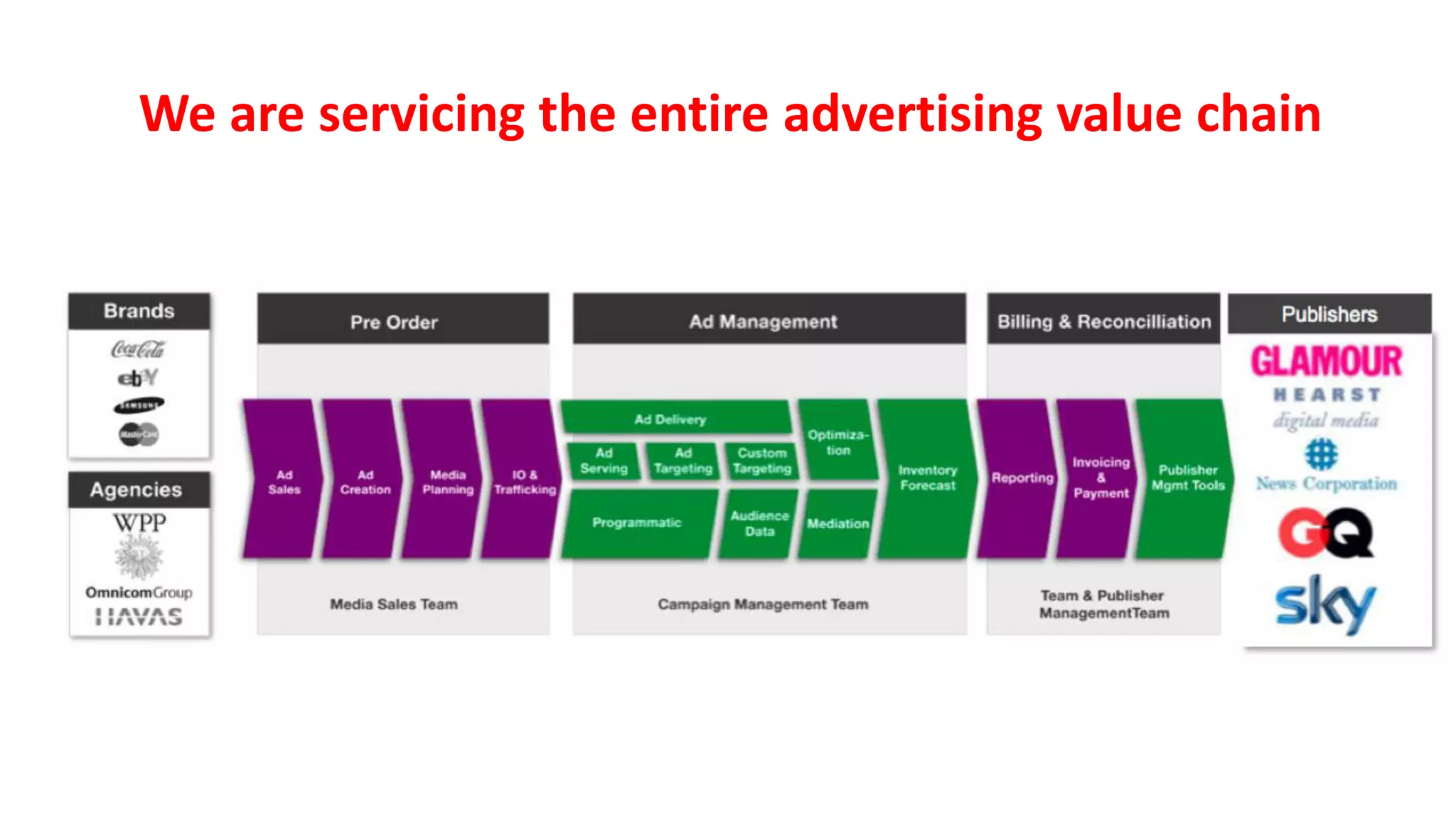

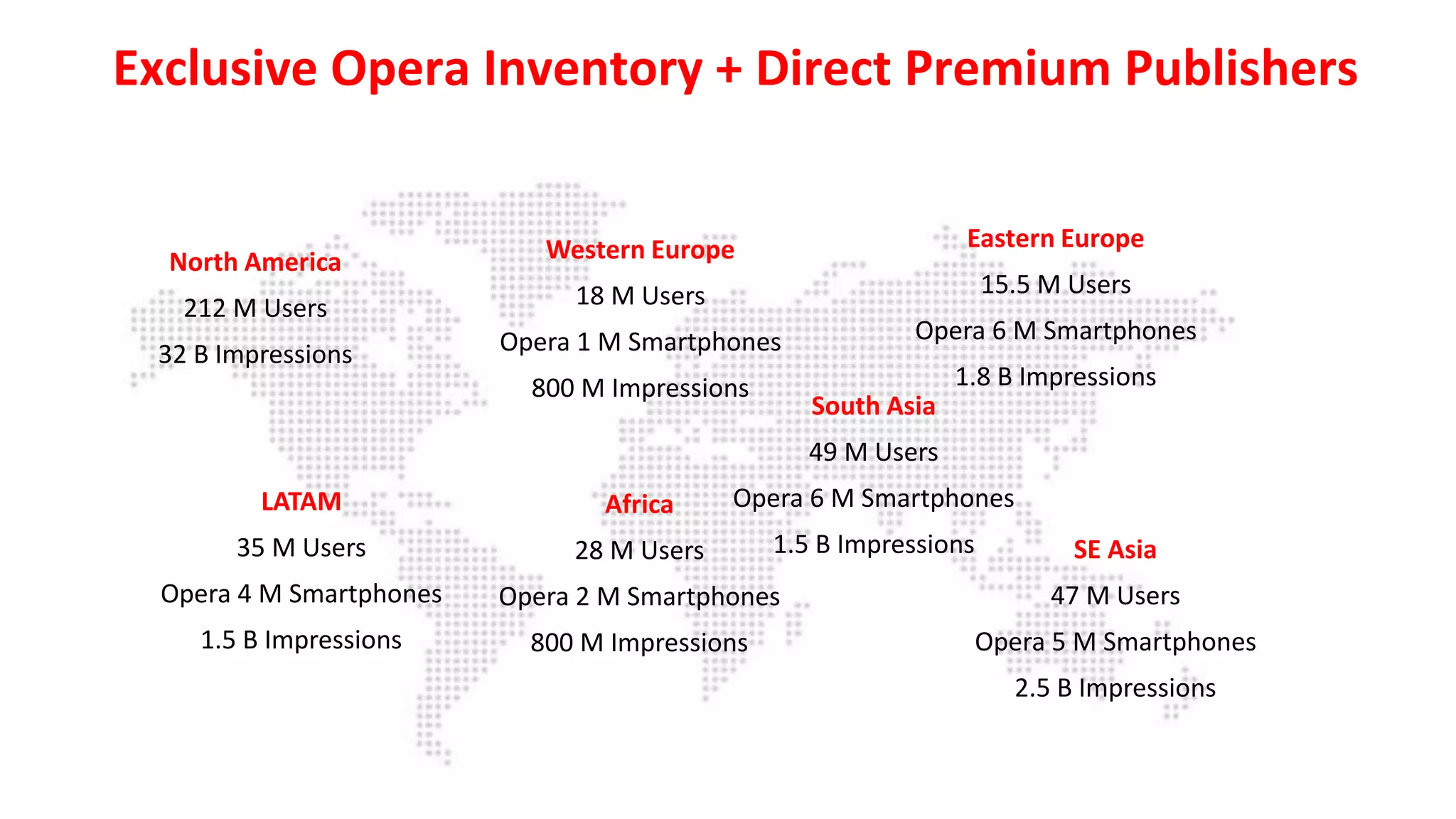

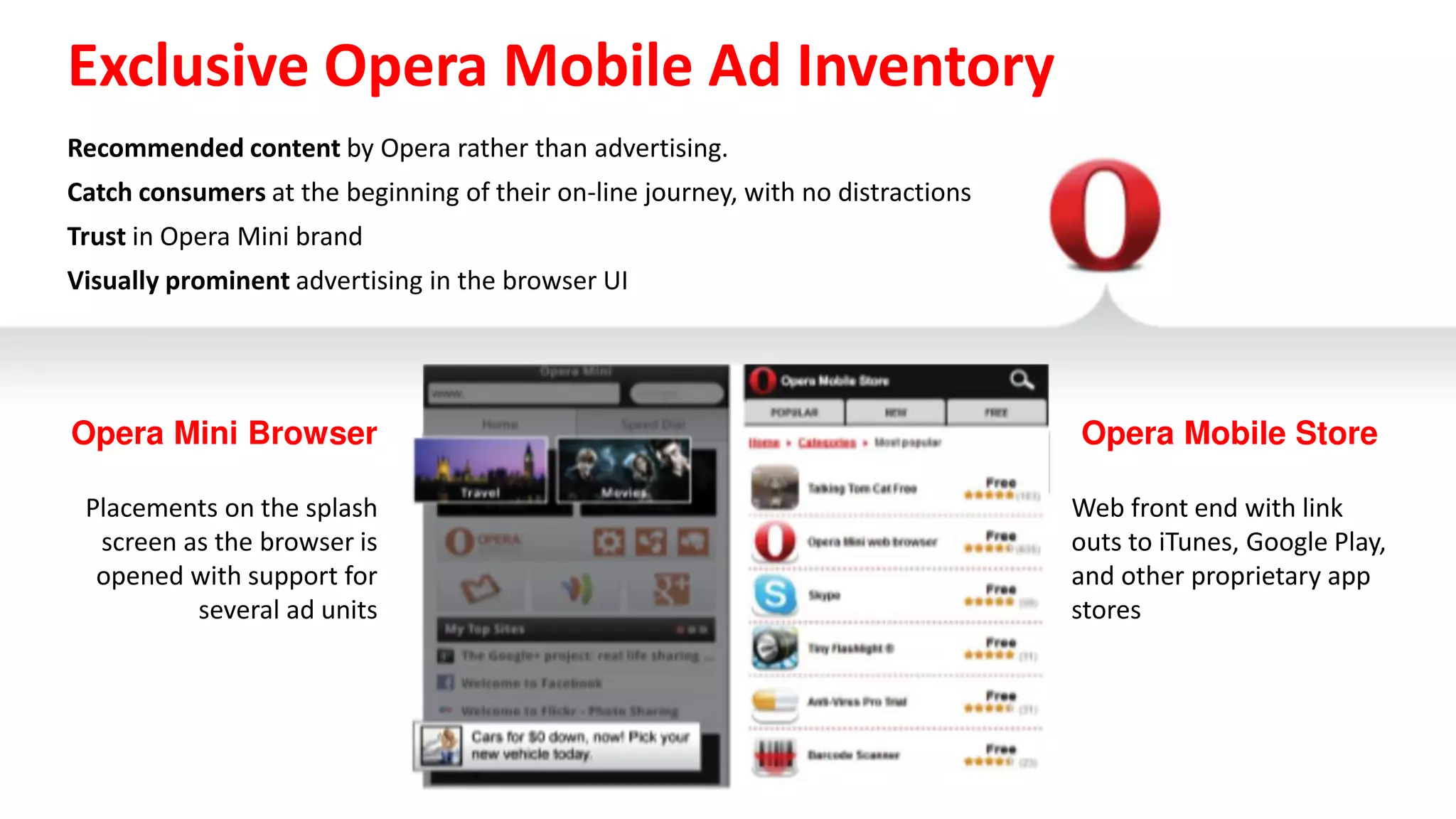

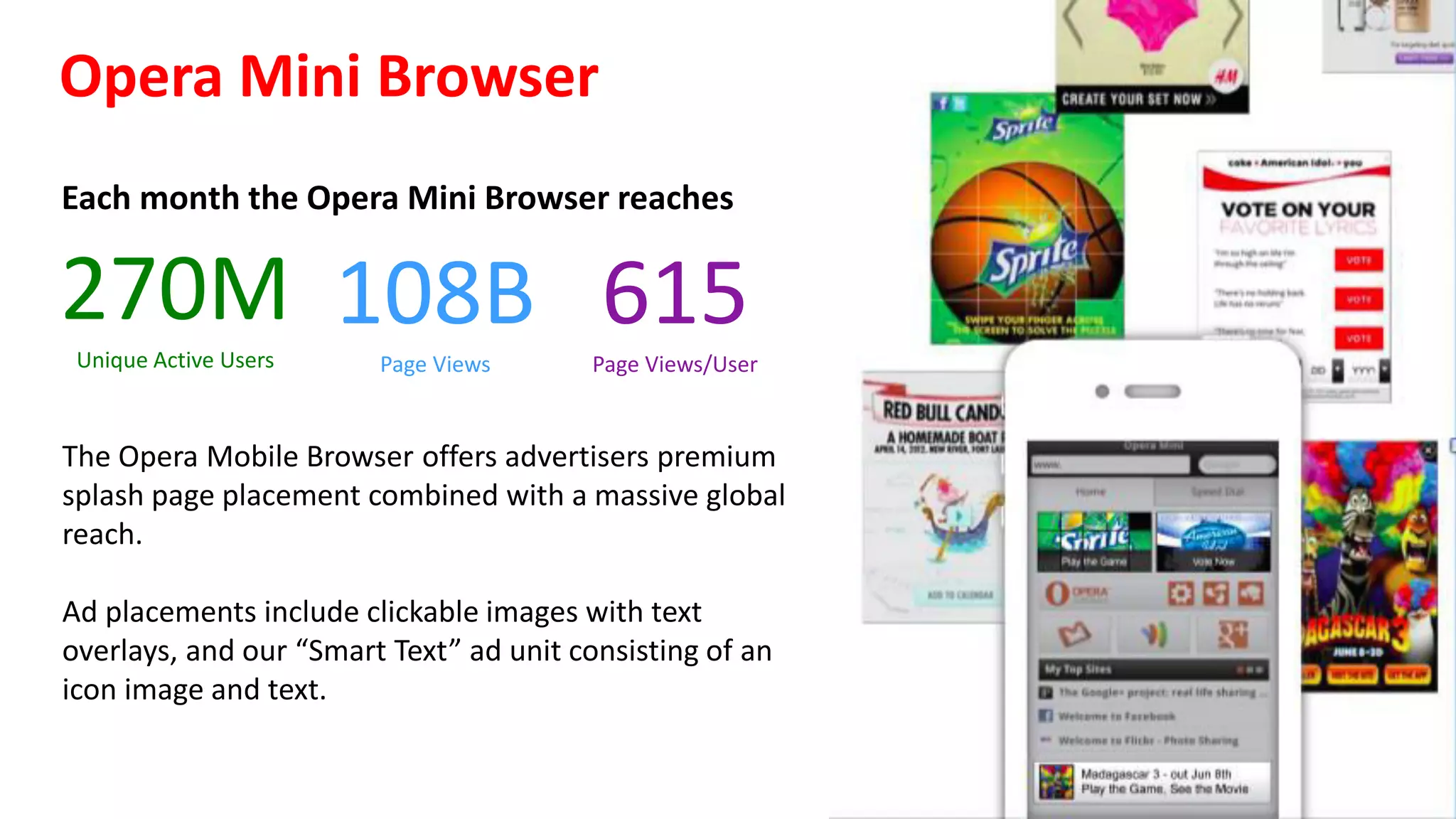

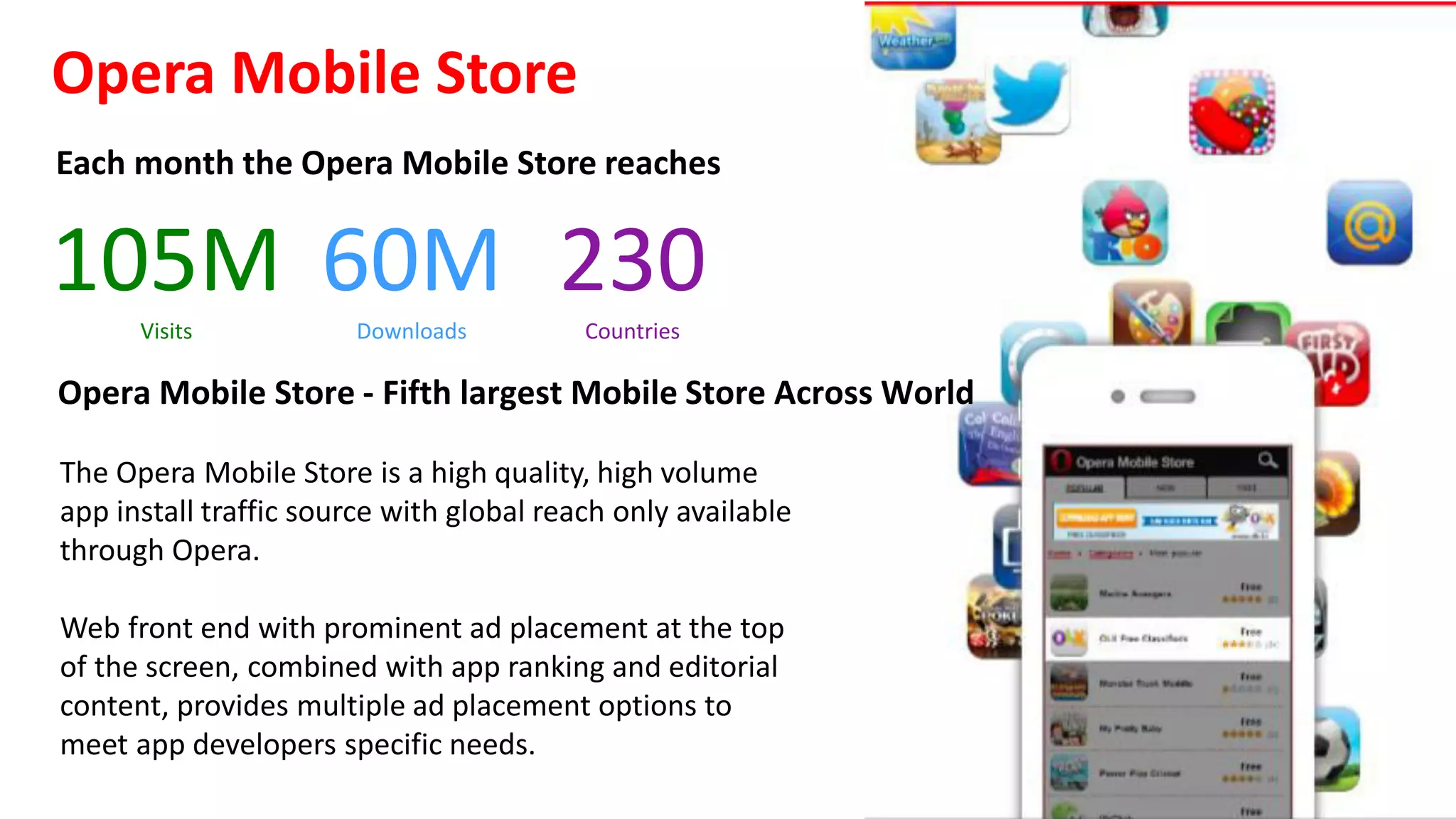

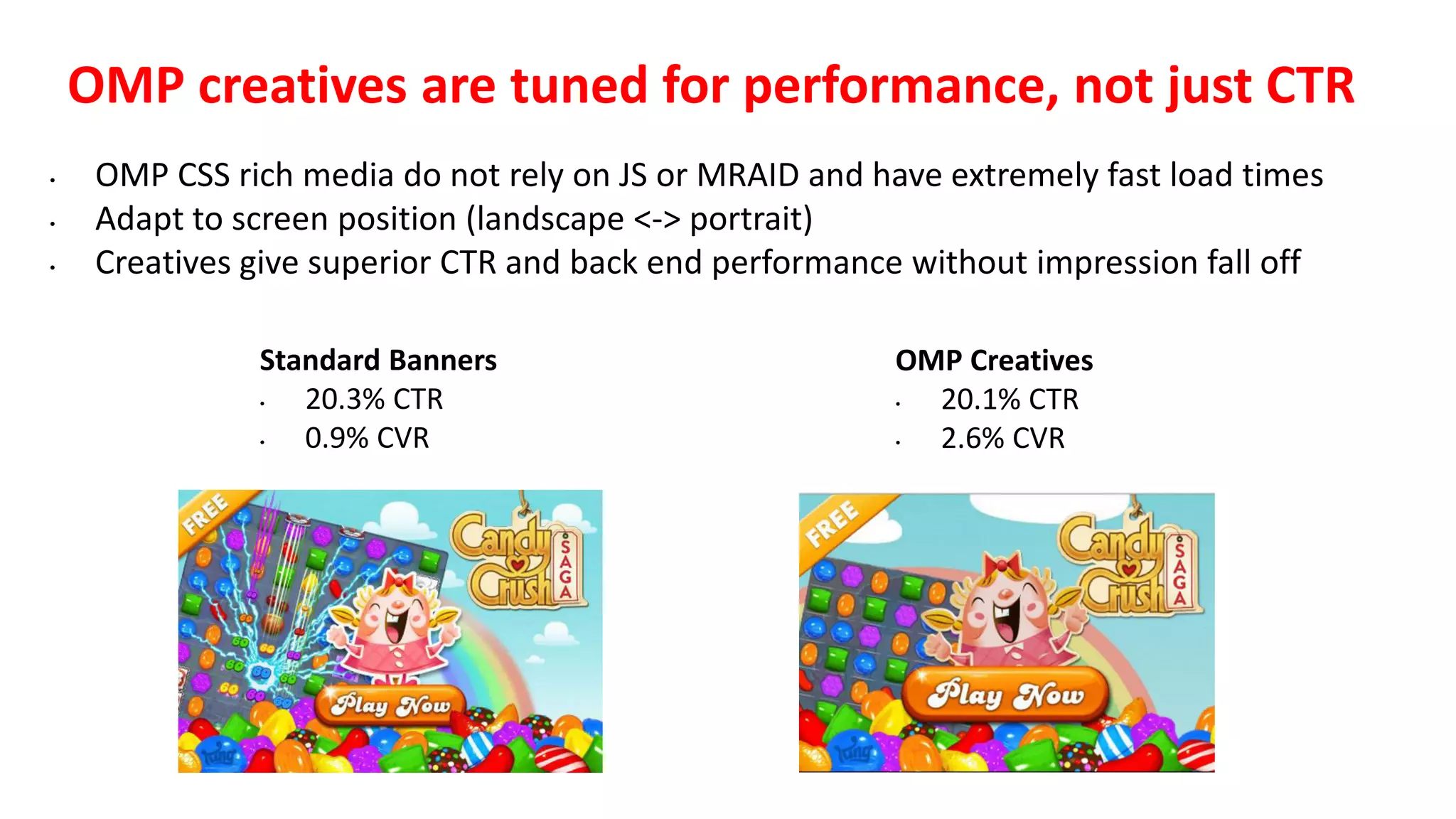

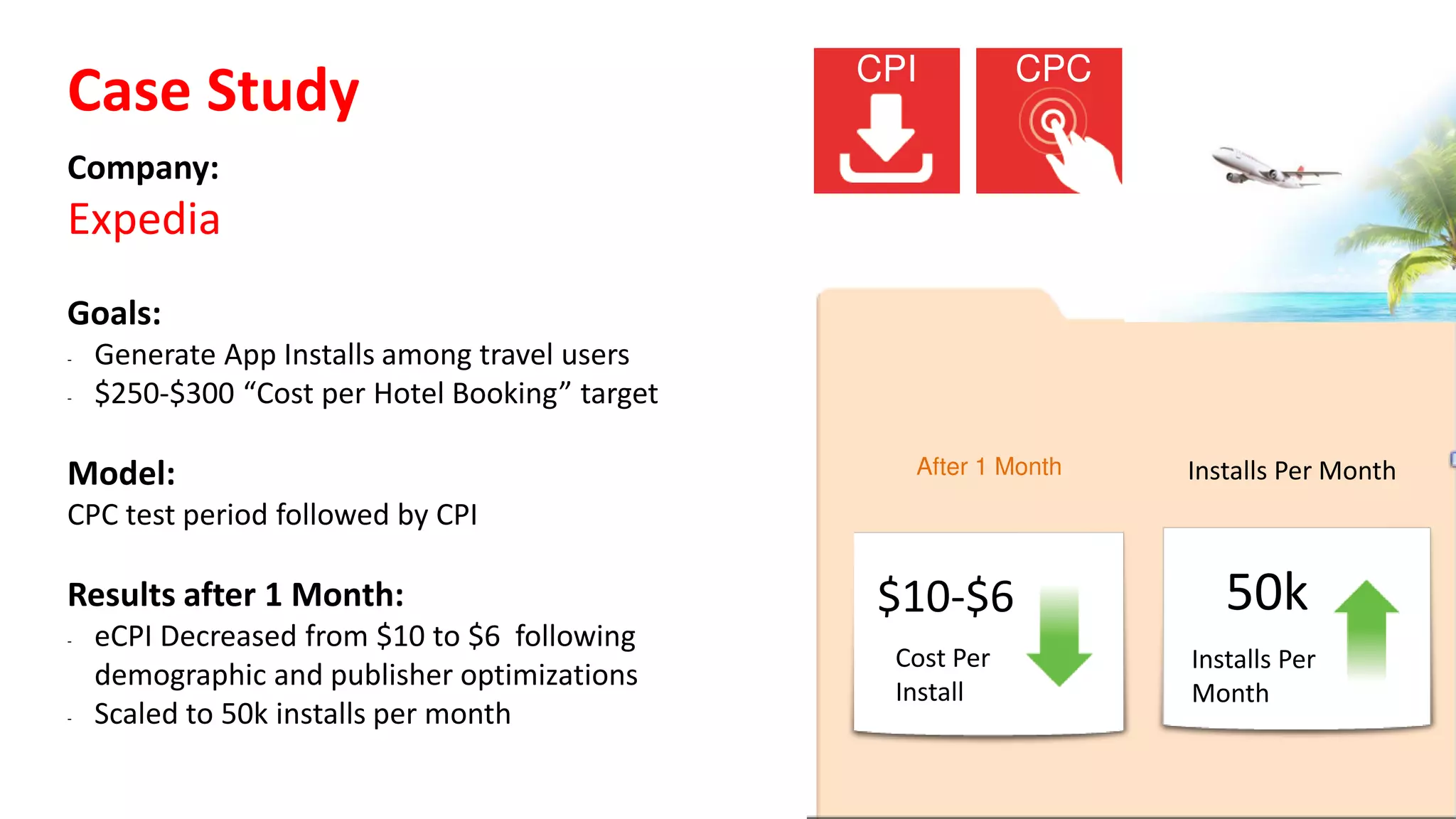

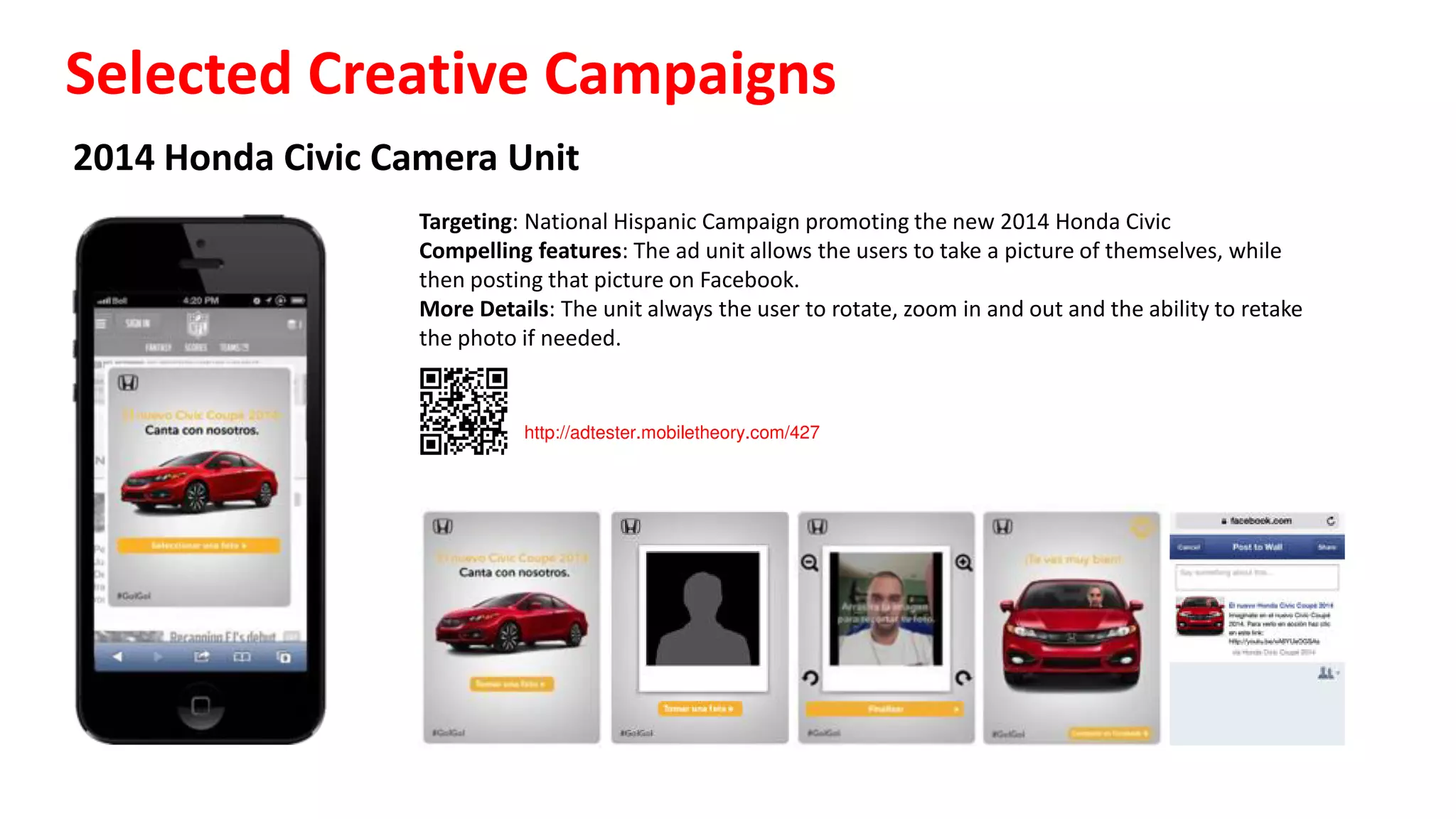

The document describes an advertising network called Opera Mediaworks that provides mobile advertising inventory and services across various regions. It details the large user base and impressions across Opera's mobile browser and store properties. Examples are also given of campaign case studies demonstrating increased installs, optimized costs per installation, and improved key performance metrics for advertisers.