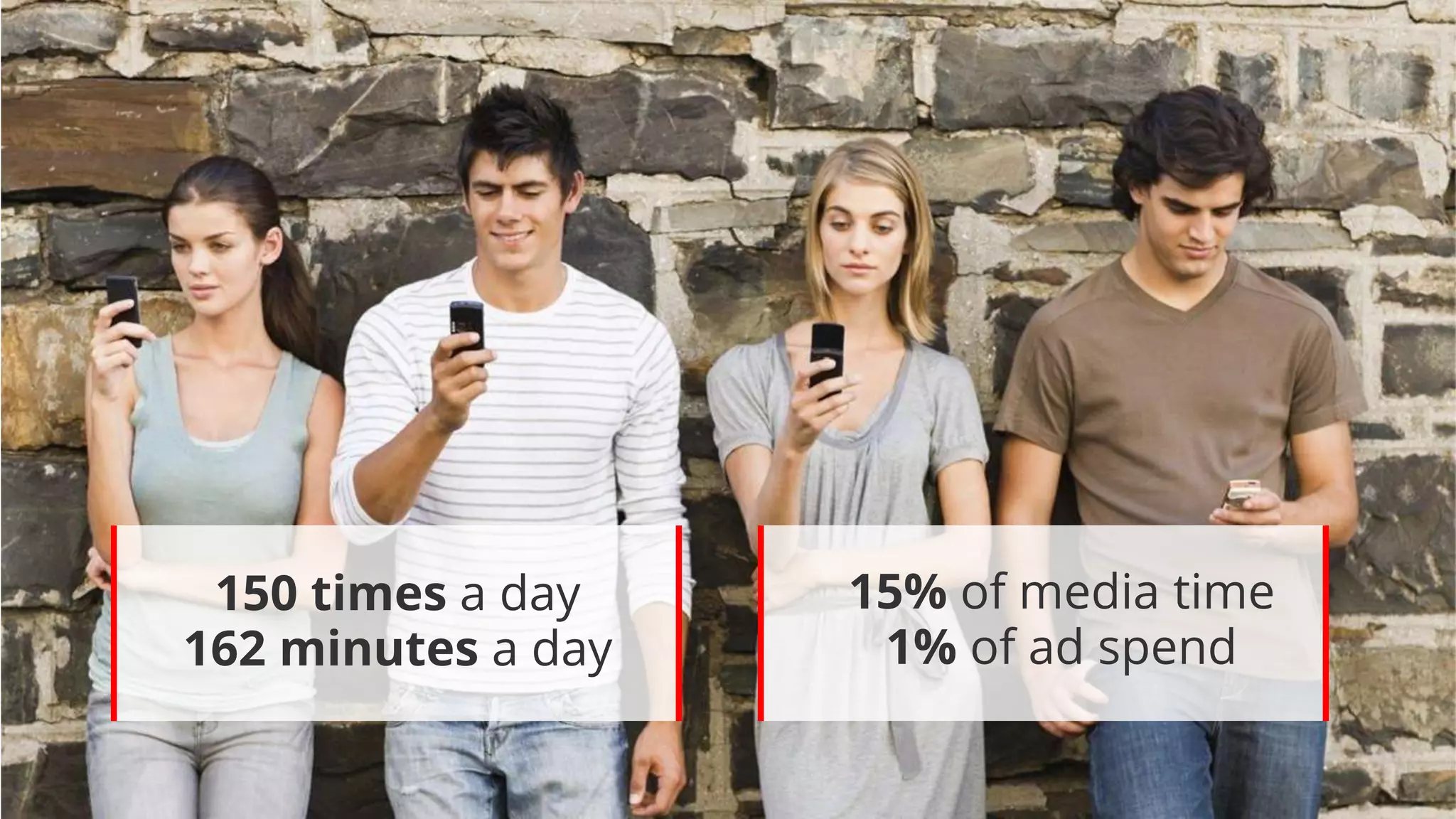

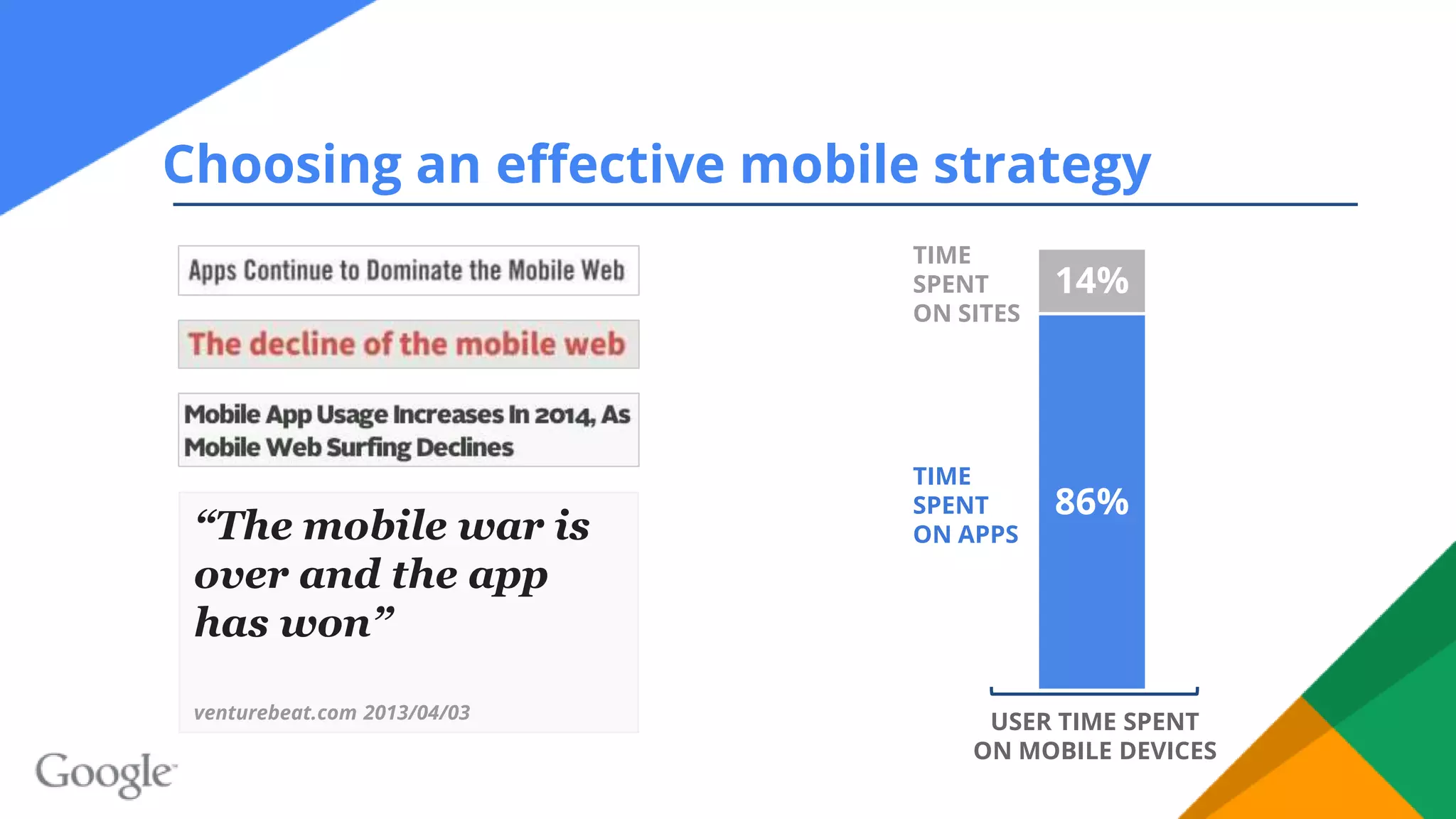

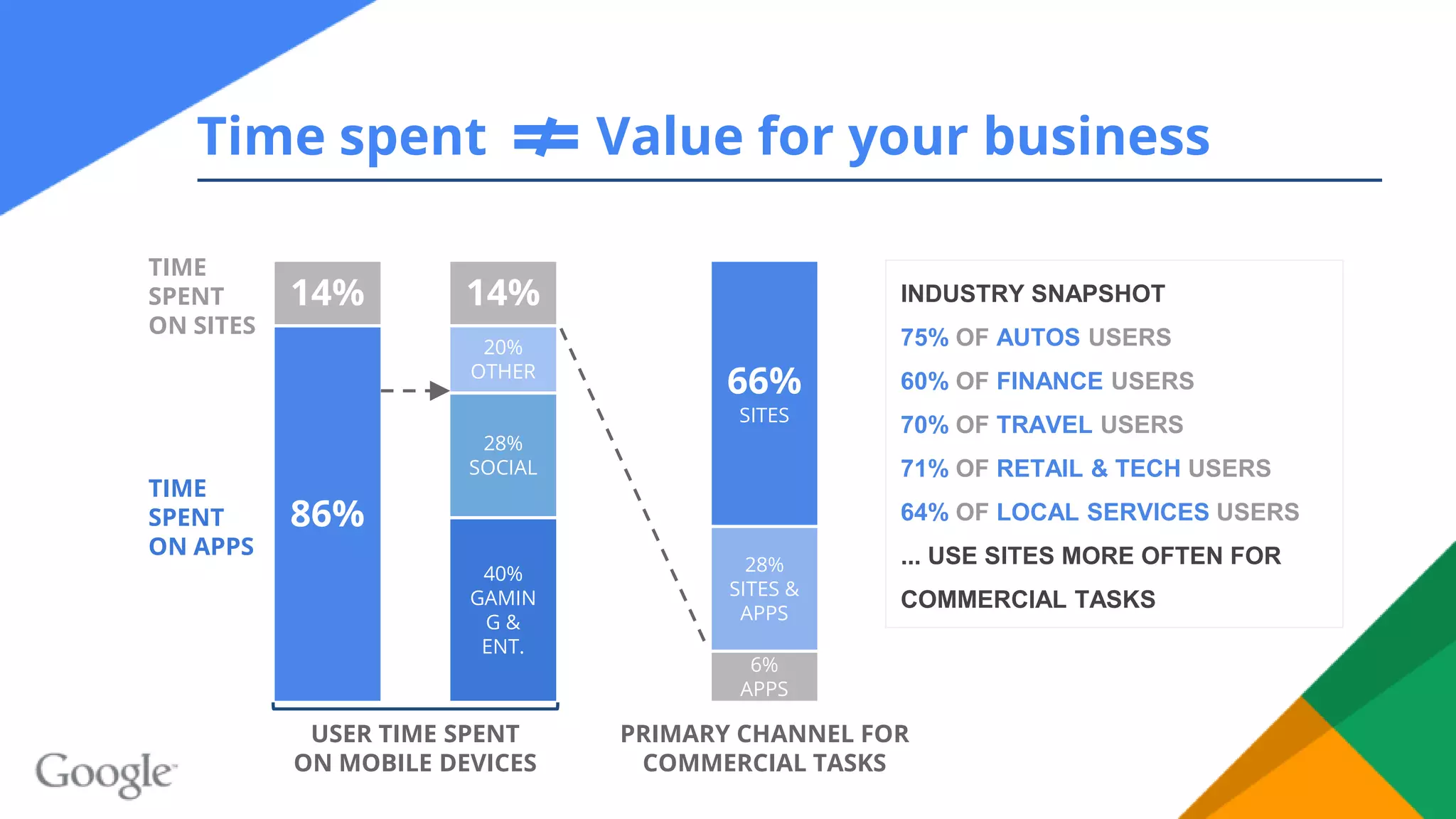

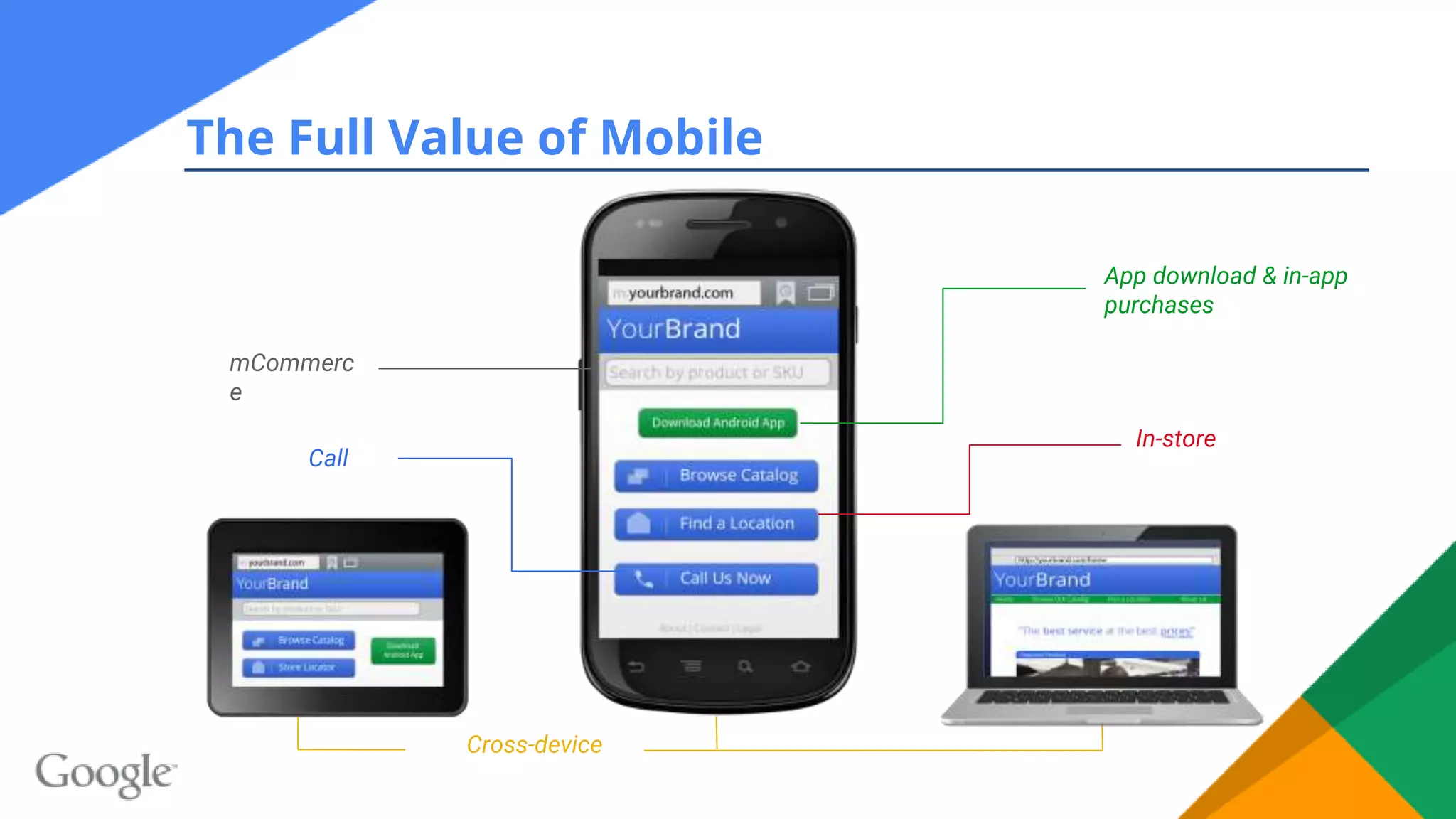

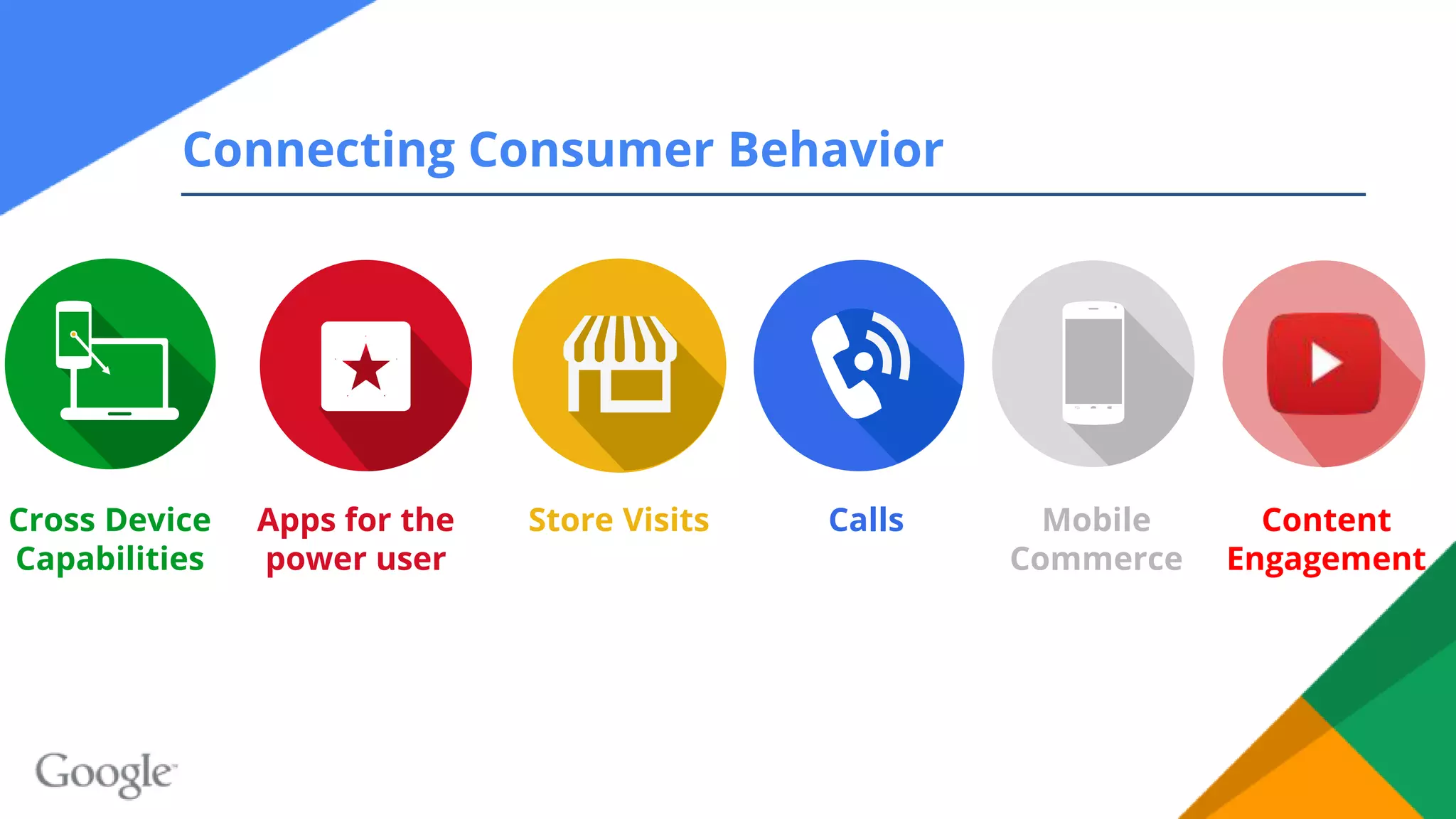

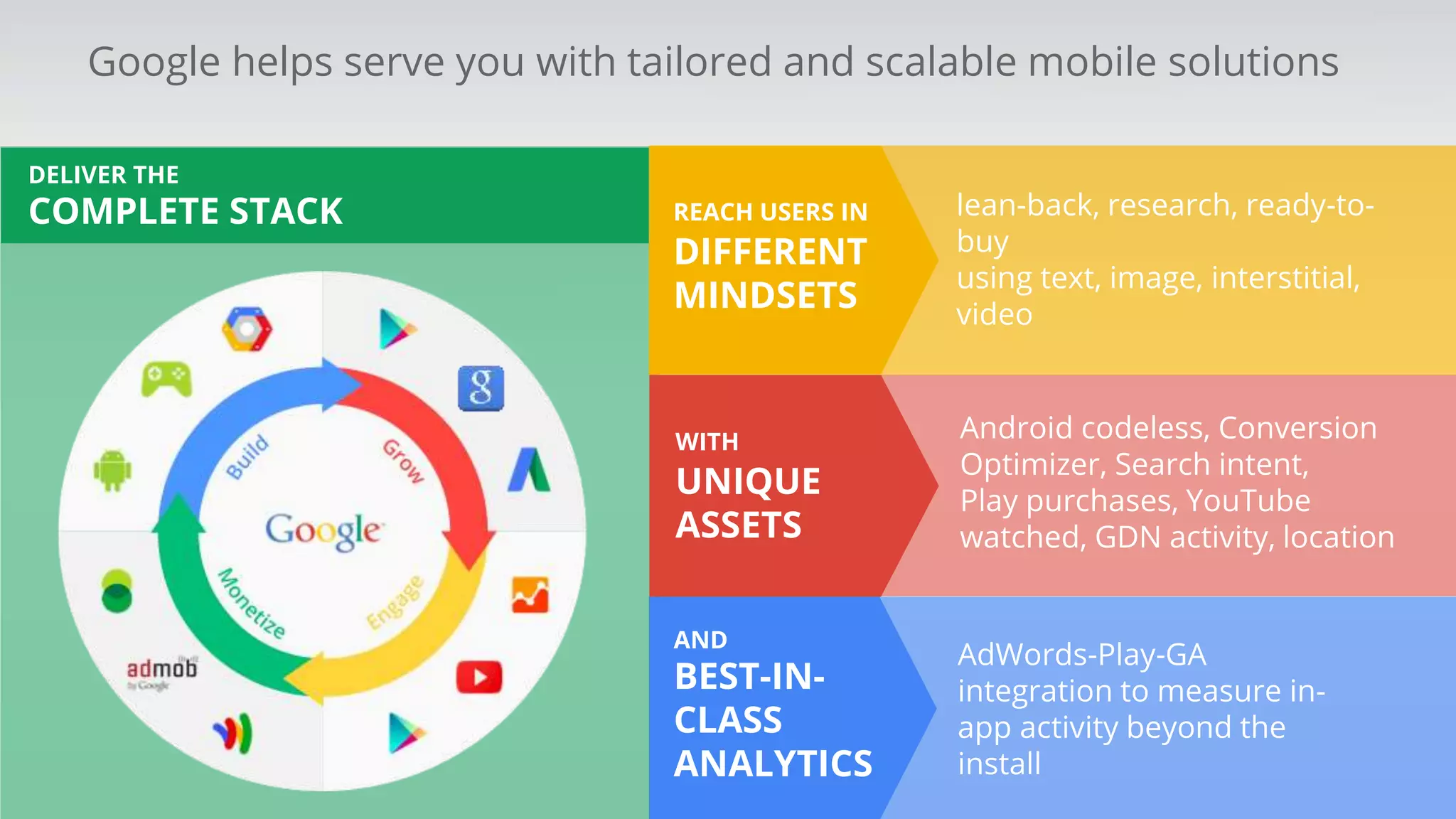

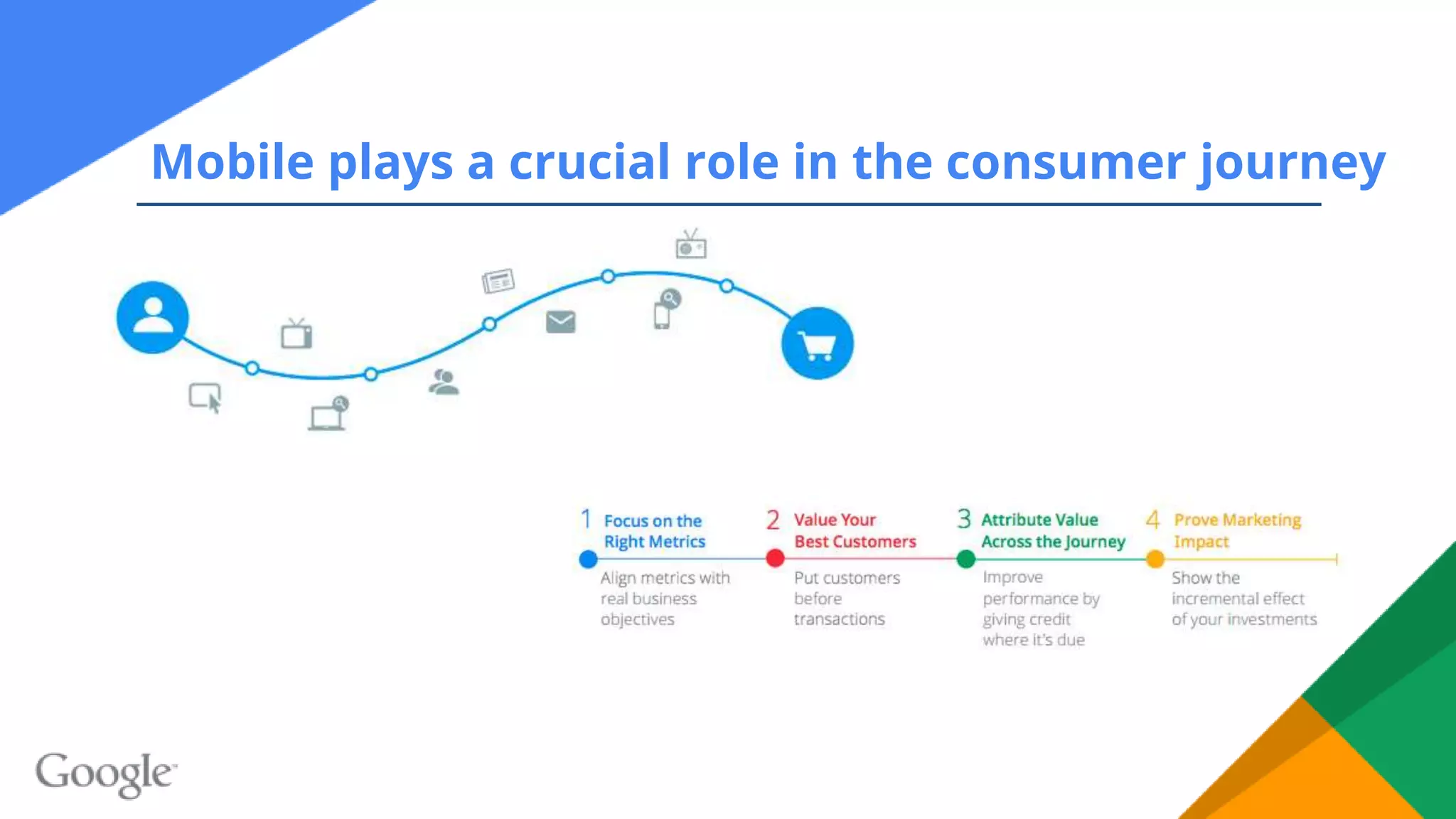

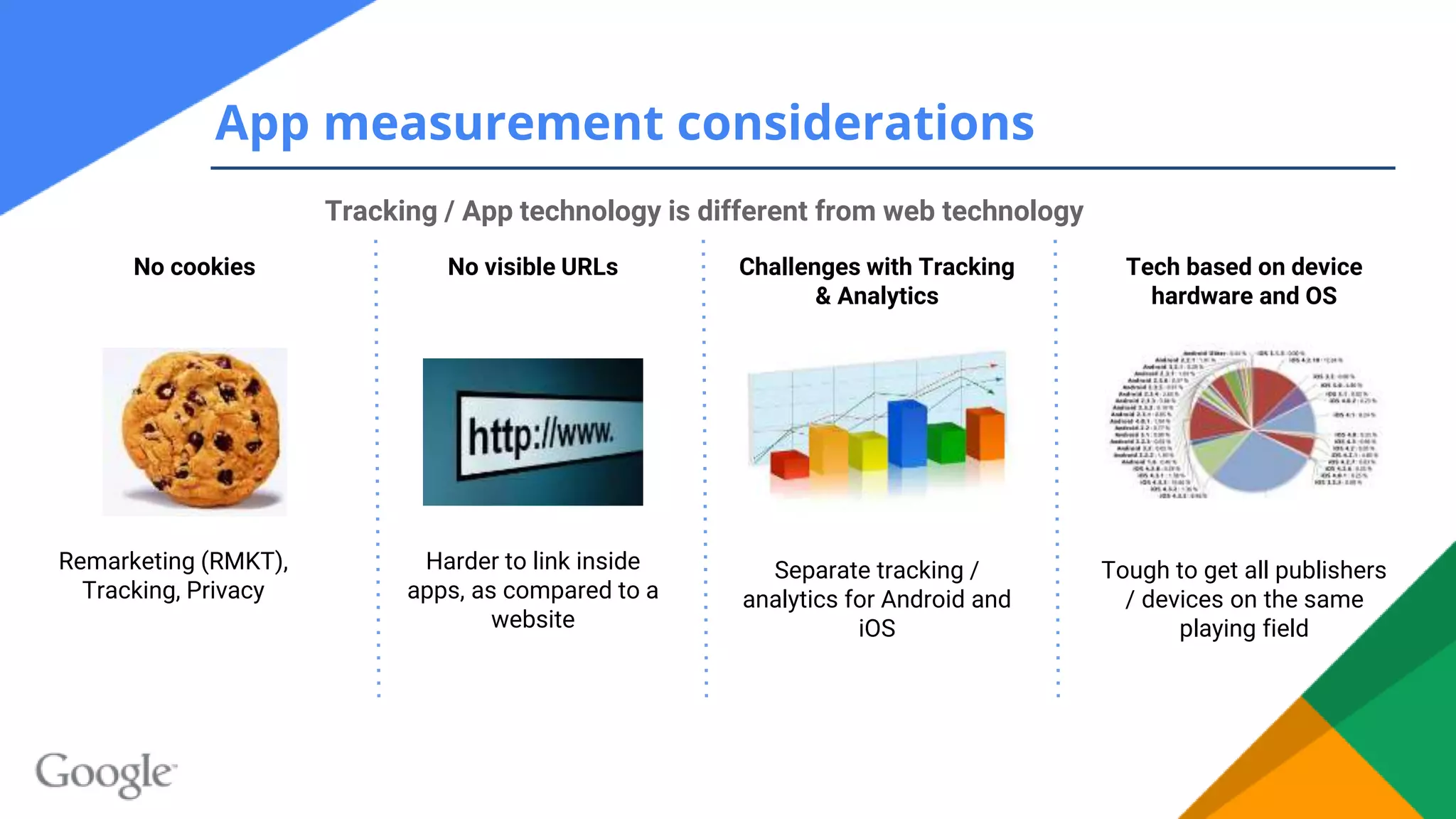

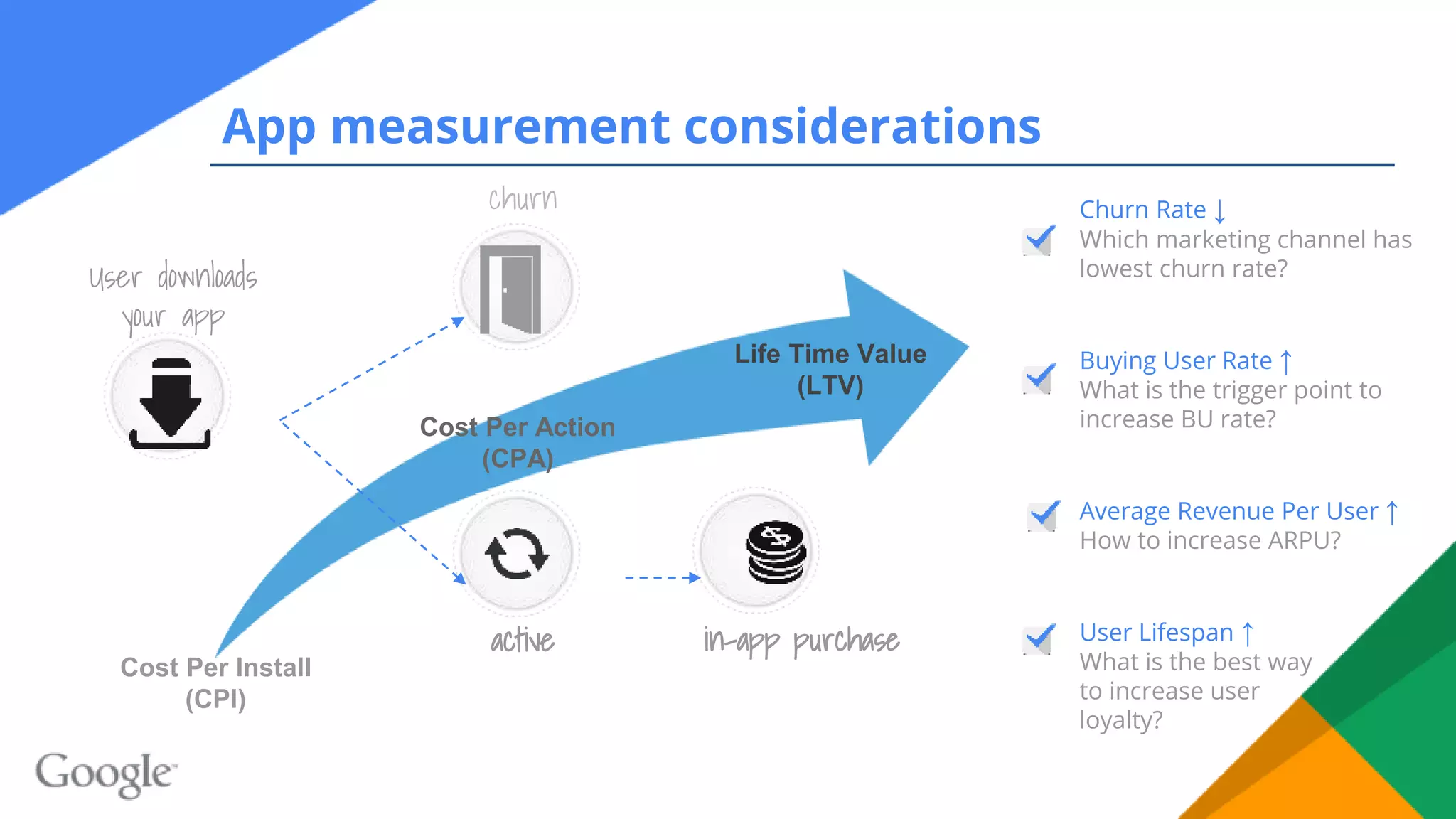

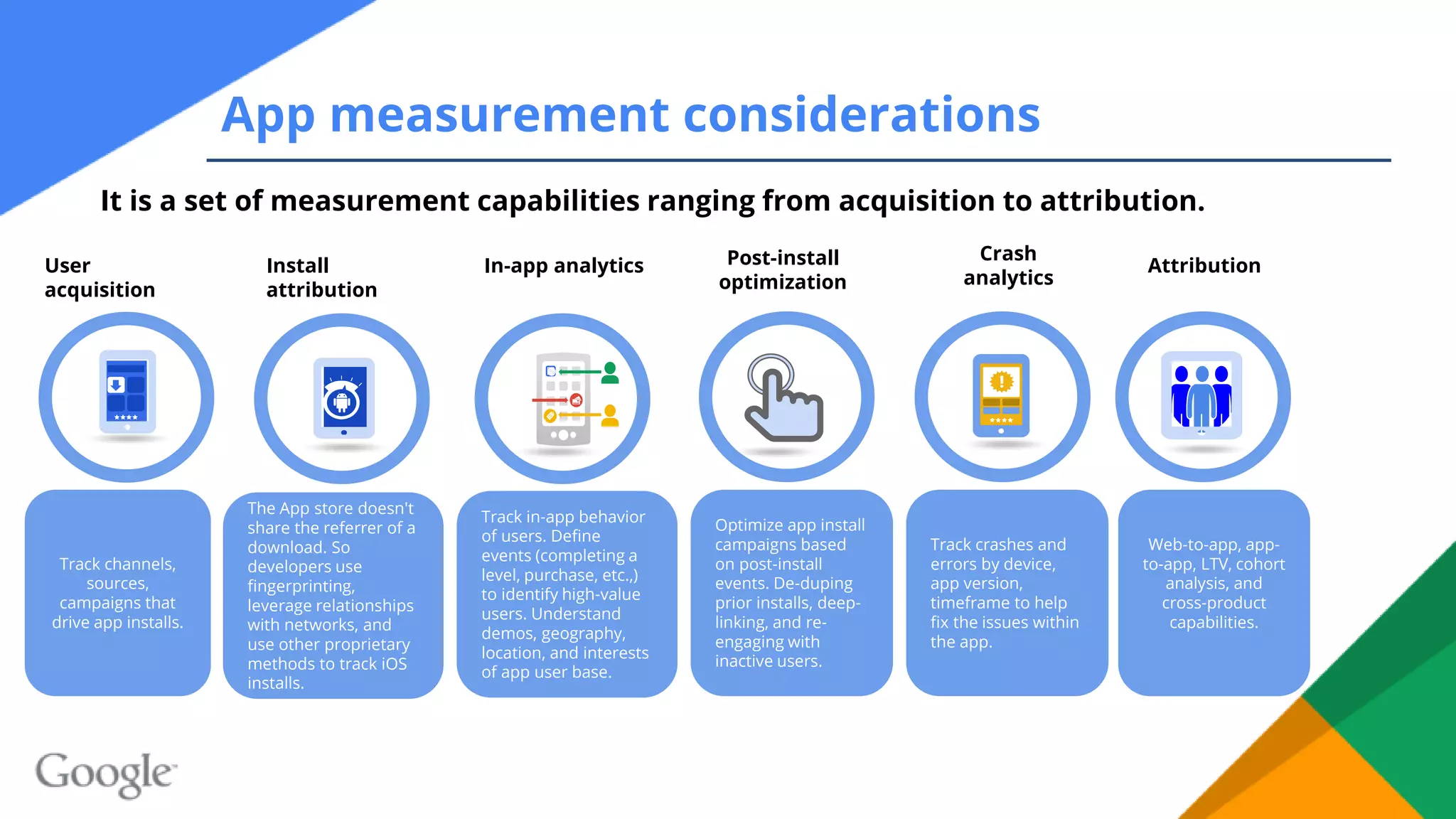

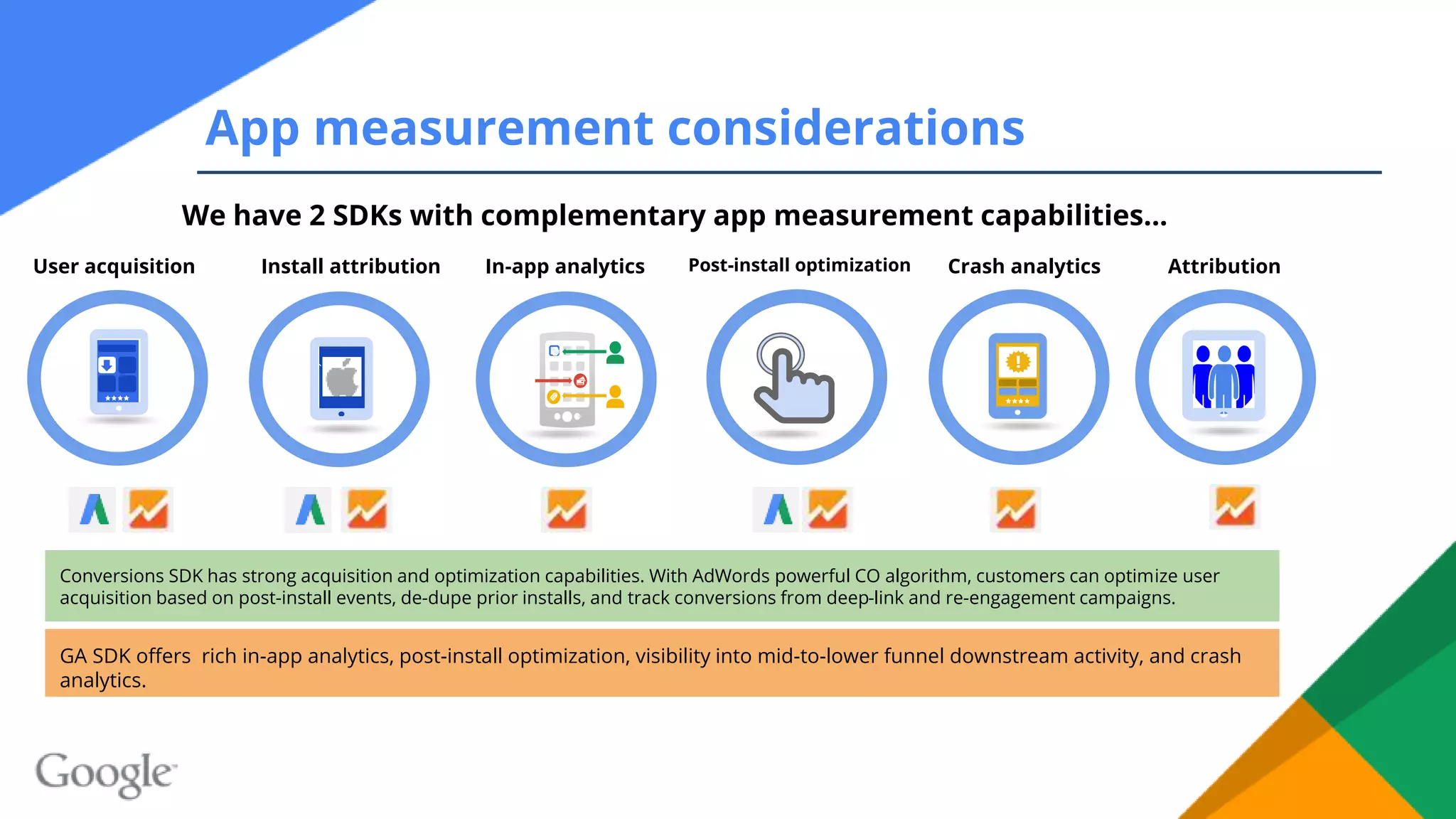

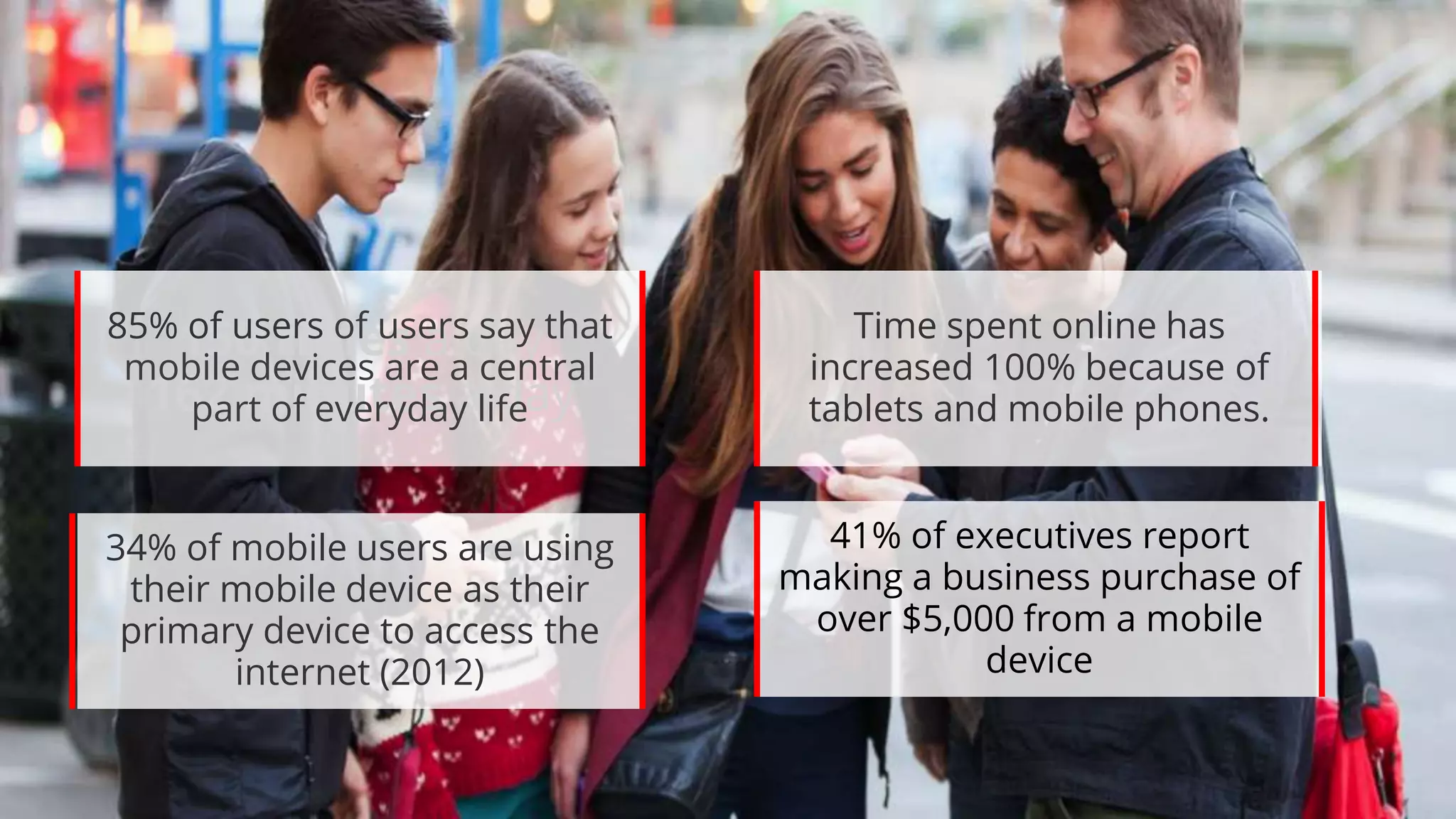

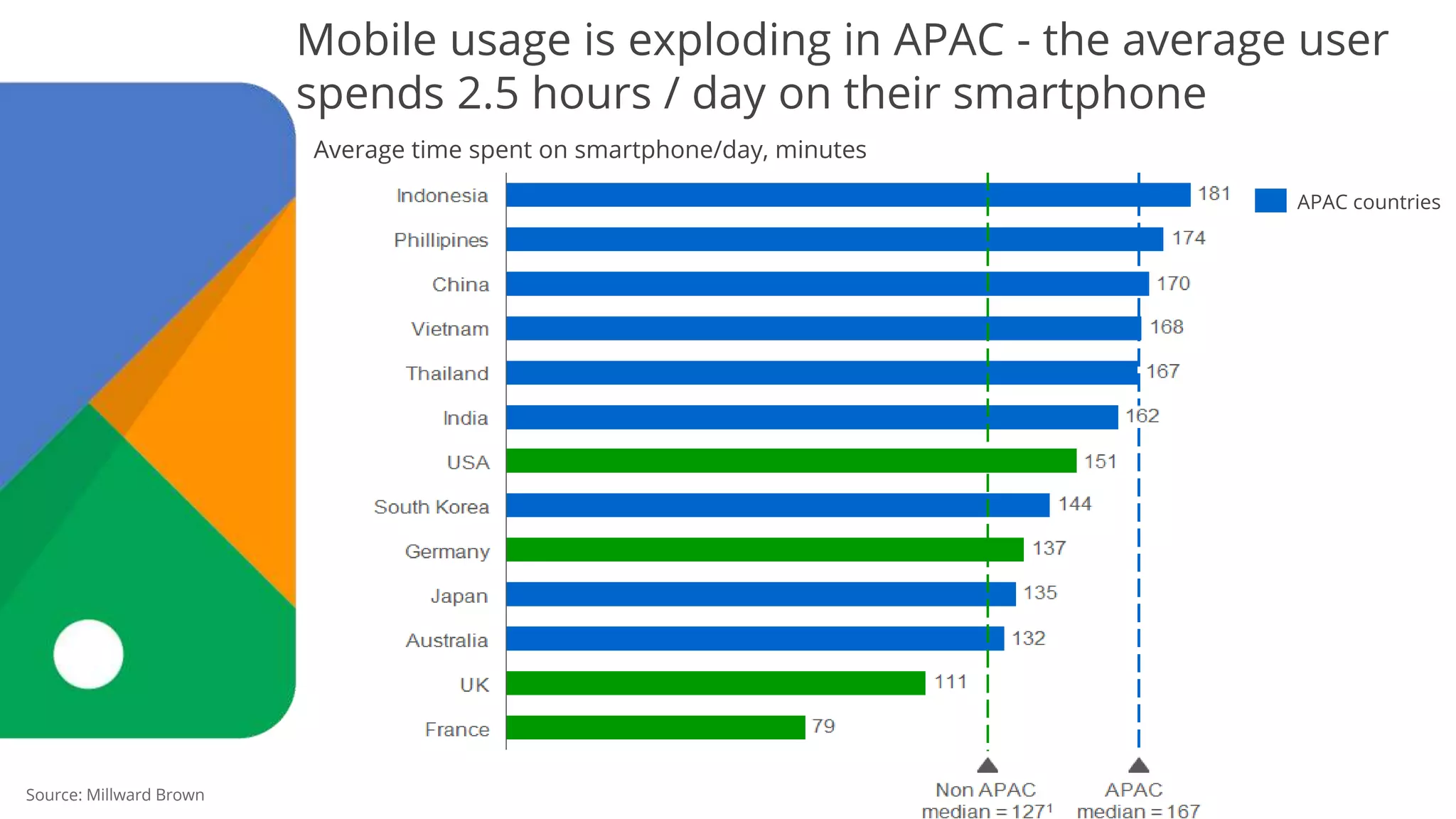

Mobile usage is increasing dramatically, with people spending significant time and money on their mobile devices. Whether a mobile site or app is better depends on factors like a company's goals and customers' needs. Google offers solutions like AdWords, Play, and Analytics to help businesses reach users across platforms, devices, and stages of the consumer journey, and measure mobile marketing effectiveness through install attribution, in-app analytics, post-install optimization, and crash reporting. Proper measurement is important for mobile as tracking technology differs from the web.

![77%

of consumers

use a

smartphone

today - up from

[44%] a year ago

of consumers have

researched a product or

service on their phone

of consumers say they’ve

used a smartphone to

research a purchase

completed on a computer

of consumers say they’ve used

a smartphone to research a

purchase completed offline

of consumers say

they’ve completed a

purchase

on a smartphone

56%

46% 40%

38%

Mobile is a part of our everyday lives](https://image.slidesharecdn.com/1mobileleadershipprogram-mobilemarketmobileassetswhygooglemobilemeasurement-150925023506-lva1-app6891/75/1-mobile-leadership-program-mobile-market-mobile-assets-why-google-mobile-measurement-7-2048.jpg)