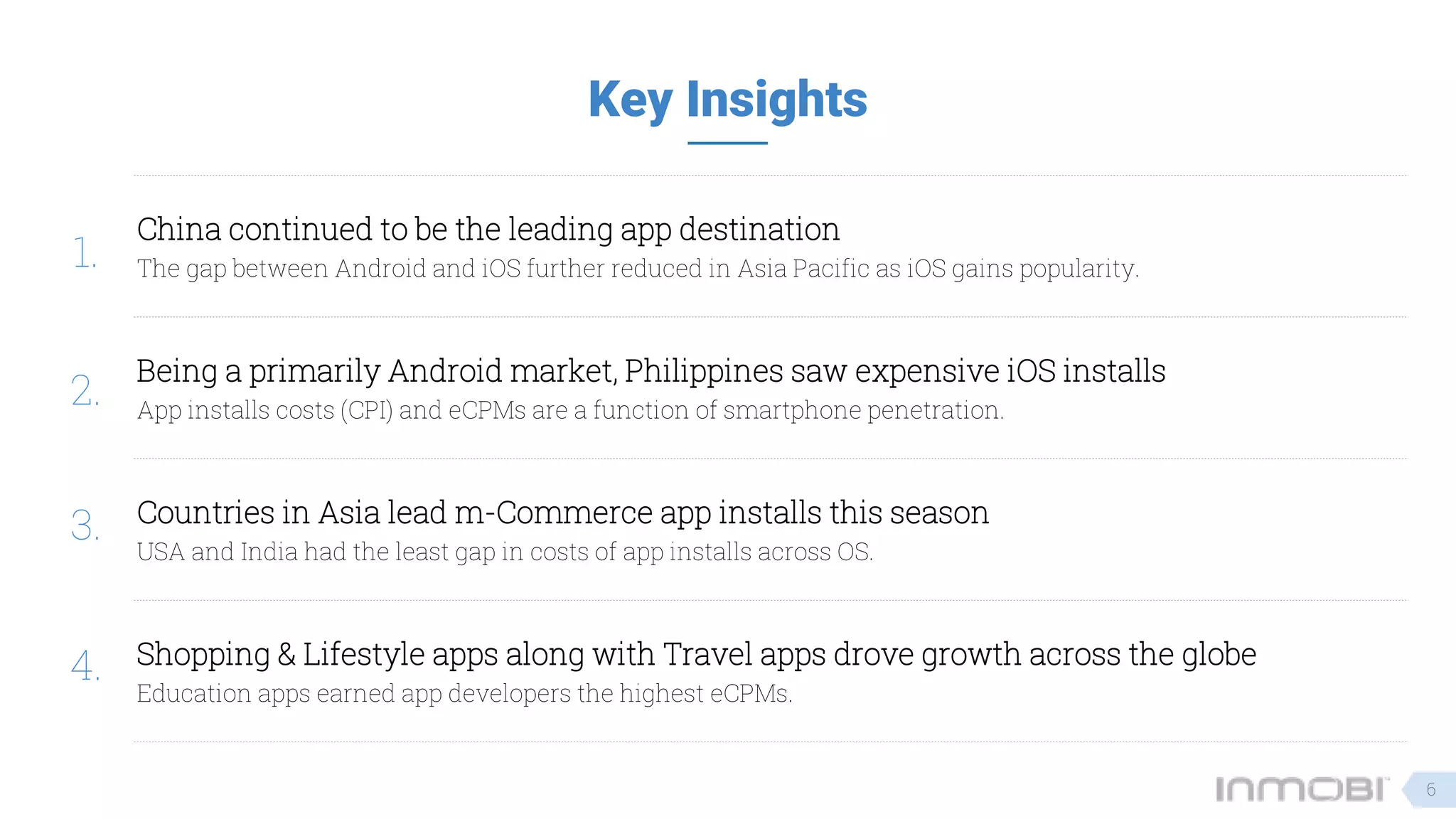

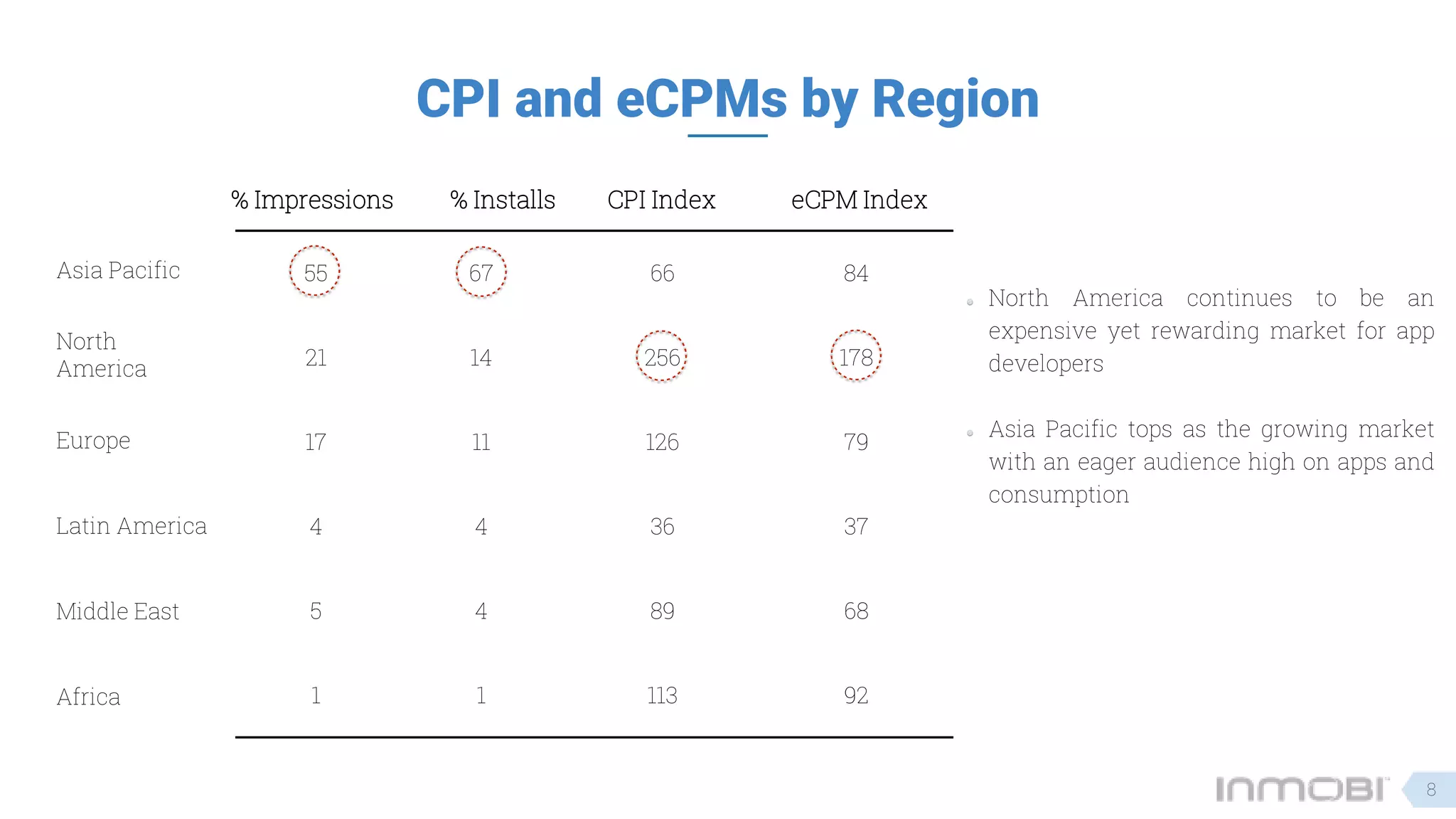

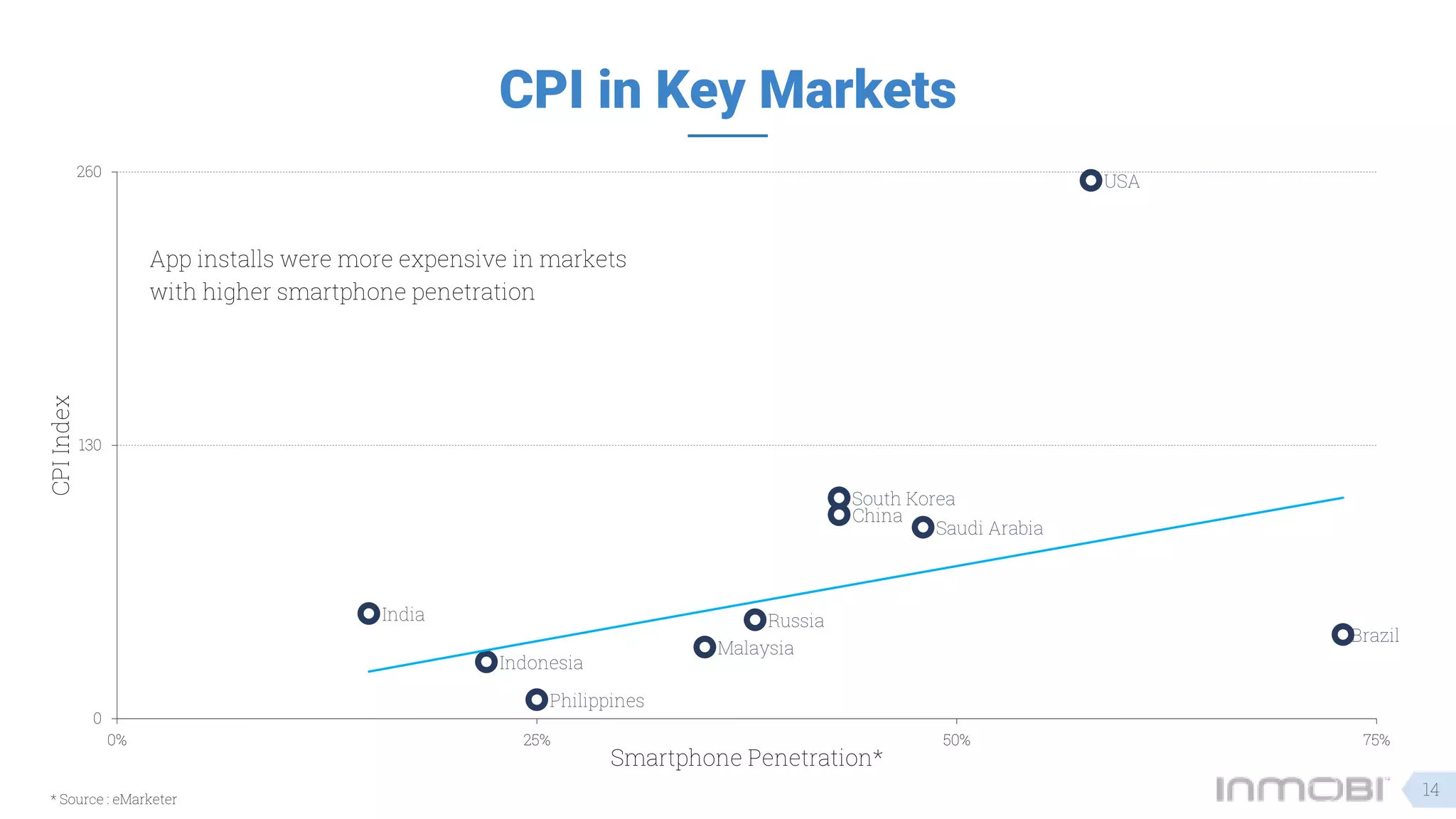

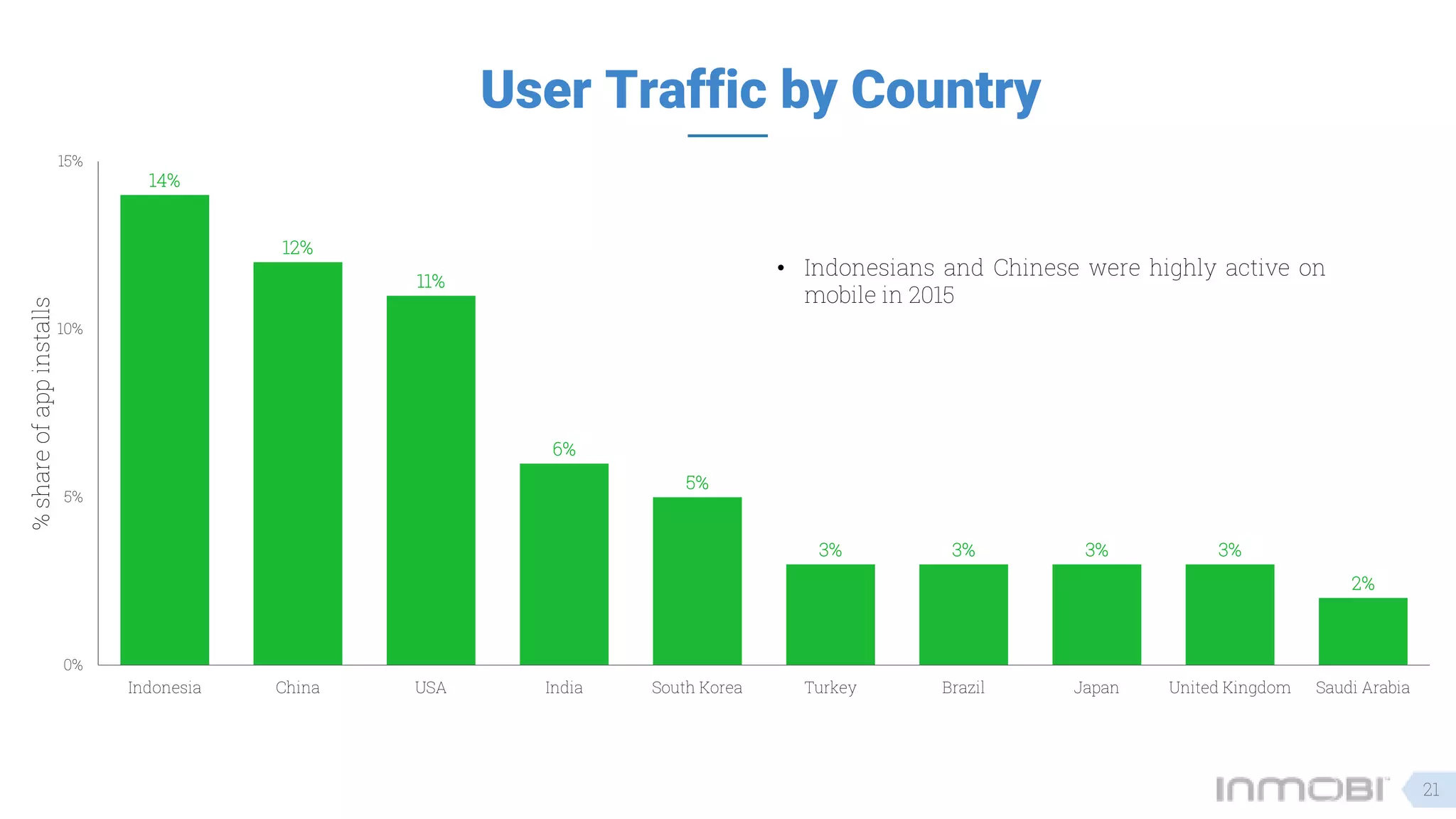

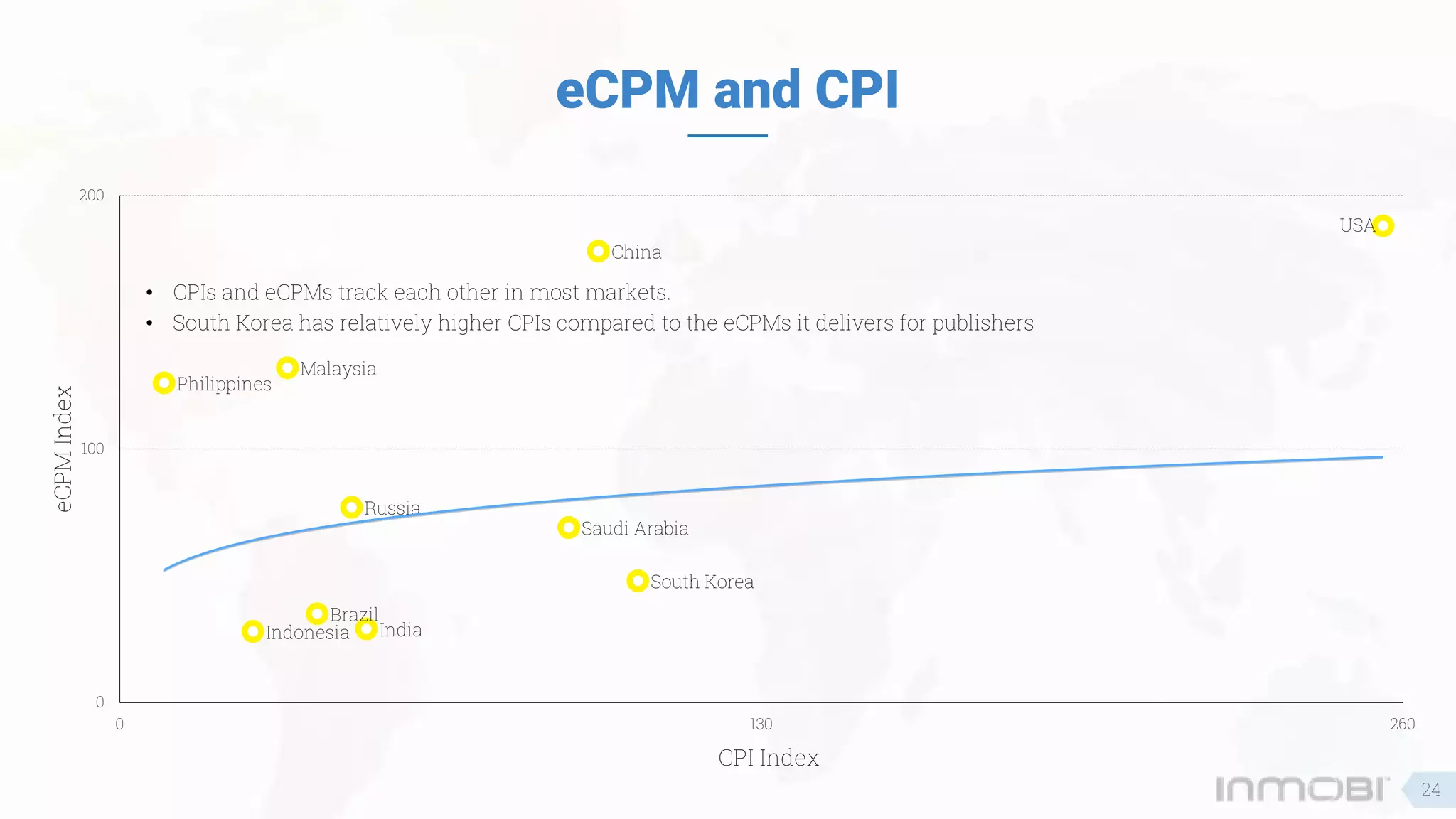

InMobi's report from February 2016 analyzes global app downloads and monetization trends, noting China as the leading app destination and highlighting the increased gap between Android and iOS in the Asia Pacific. It indicates that app install costs (CPI) and effective cost per mile (eCPM) vary significantly by region and OS, with high smartphone penetration correlating to higher costs. Key findings reveal that shopping, lifestyle, and travel apps are driving growth, while education apps yield the highest eCPMs for developers.