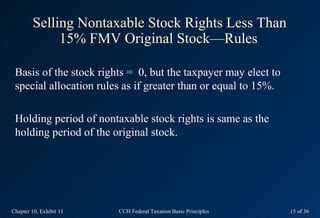

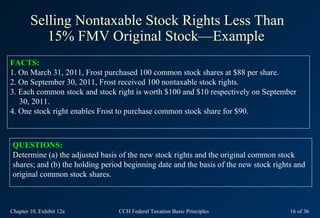

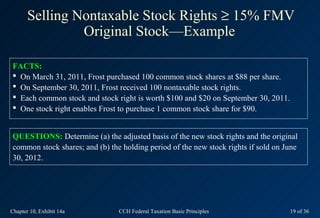

(a) The adjusted basis of the original common stock shares remains $8,800 (100 shares x $88 per share). The basis of the new stock rights is $0 since they are worth less than 15% of the original stock's FMV.

(b) The holding period of the original common stock shares remains March 31, 2011. The holding period of the new stock rights includes the holding period of the original shares, which is March 31, 2011.

![Lump-Sum Purchases of Several Properties

General Rule. Allocate total cost according to the relative fair market

value of each property.

Example

FACTS: A buyer pays a seller a lump-sum amount of $800,000 for land tracts A, B,

and C valued at $200,000, $300,000, and $500,000 respectively. ($1,000,000 is the total

value of the three tracts.)

QUESTION: What is the buyer’s basis in the three tracts?

SOLUTION:

A: $160,000 ($800,000 x [$200,000 ÷ $1,000,000])

B: $240,000 ($800,000 x [$300,000 ÷ $1,000,000])

C: $400,000 ($800,000 x [$500,000 ÷ $1,000,000])

Chapter 10, Exhibit 5 CCH Federal Taxation Basic Principles 9 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-9-320.jpg)

![Selling Identical, Nontaxable Stock Dividends—Example

FACTS:

1. 1,000 shares of common stock are purchased for $12,000 on March 31, 2011.

2. On September 30, 2011, the shareholder receives a 20% nontaxable common stock dividend.

3. On June 30, 2012, the 200 new dividend shares are sold for $30 per share.

QUESTION: Determine the tax treatment for the receipt and sale of the stock dividends.

SOLUTION:

September 30, 2011, receipt: The stock dividends are not taxable.

June 30, 2012, sale results is a $4,000 long term capital gain.

Amount realized = 200 shares x $30 = $6,000

Adjusted basis = 200 shares x $10 = $2,000

**Basis per share = [$12,000 ÷ (1,000 old shares + 200 new shares)] = $10

Chapter 10, Exhibit 9 CCH Federal Taxation Basic Principles 13 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-13-320.jpg)

![Selling Nontaxable Stock Rights Less Than

15% FMV Original Stock—Example

SOLUTION to (a):

Adjusted basis of new stock rights: $0, since their value is < 15% FMV of common stock

[100 stock rights x $10 FMV per share] < [15% x (100 common stock shares x $100 FMV

per share)];

Adjusted basis of original common stock shares: $8,800 (i.e., no change).

SOLUTION to (b):

Holding period of the stock rights and original common stock shares begins on the day

following March 31, 2011.

Chapter 10, Exhibit 12b CCH Federal Taxation Basic Principles 17 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-17-320.jpg)

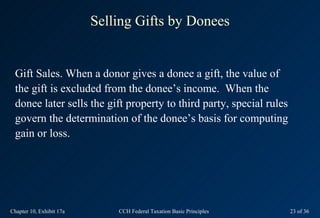

![Selling Gifts by Donees

Donee's Adjusted Basis (AB) Donee's Holding Period (HP)

“Gain” basis Same as donor's AB. Same as donor's HP.

“Loss” basis Lesser of: If donor's basis is used,

Donor's basis or HP = donor's HP.

FMV at gift date (but use GAIN If FMV is used,

basis for depreciation.). HP begins on gift date.

“No gain or loss” For depreciation, use GAIN basis. Same HP for GAIN basis.

basis

Gift tax rule. When a donee assumes a donor's basis, the basis includes:

[Gift tax paid by donor x (FMV at gift date - Donor's basis at gift date)]

taxable amount of the gift

Chapter 10, Exhibit 17b CCH Federal Taxation Basic Principles 24 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-24-320.jpg)

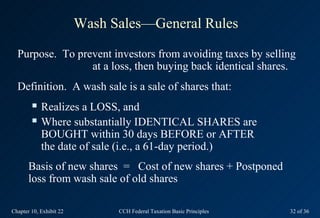

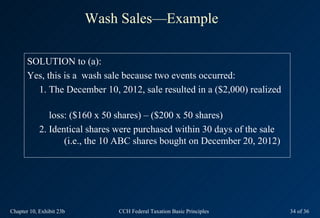

![Wash Sales—Example

SOLUTION to (b):

Loss postponed: ($400); Loss recognized: ($1,600)

Only that portion of loss attributable to the wash sale is postponed as

shown below:

Portion attributable to wash sale: ($400) postponed loss

[10 shares/50 shares x (2,000) = (400)]

Portion NOT attributable to wash sale: ($1,600) recognized loss

[40 shares/50 shares x (2,000) = (1,600)]

Chapter 10, Exhibit 23c CCH Federal Taxation Basic Principles 35 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-35-320.jpg)

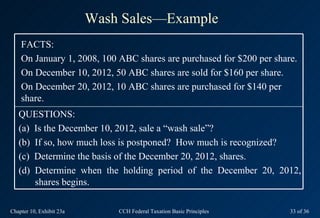

![Wash Sales—Example

SOLUTION to (c):

Basis of December 20, 2012, shares: $1,800

$1,400 [10 shares bought on December 20, 2012 x $140 cost per share]

+ 400 [Postponed loss on December 10, 2012 wash sale, computed

= $1,800 at (b)]

SOLUTION to (d):

Beginning holding period of the December 20, 2012 shares: the day

following January 1, 2008 (i.e., the holding period “tacks on” to the

holding period of the original shares)

Chapter 10, Exhibit 23d CCH Federal Taxation Basic Principles 36 of 36](https://image.slidesharecdn.com/2013cchbasicprinciplesch10-120911125319-phpapp02/85/2013-cch-basic-principles-ch10-36-320.jpg)