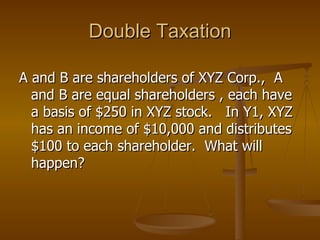

Double taxation occurs when both a corporation and its shareholders are taxed on the same income. Corporations pay tax on their income, and shareholders also pay tax when they receive dividends from the corporation. This can be avoided by using a pass-through entity like a partnership or S corporation, where the income "flows through" to the shareholders without double taxation. Alternatively, a C corporation can retain earnings and treat distributions as deductible payments to avoid double taxation.