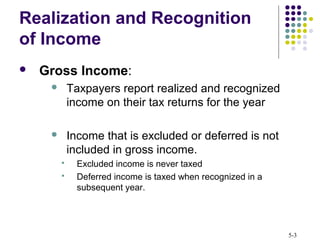

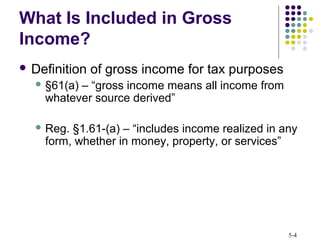

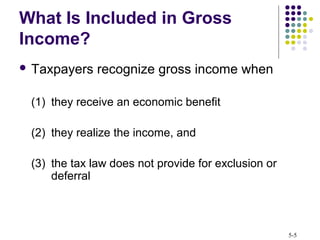

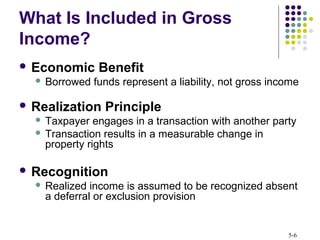

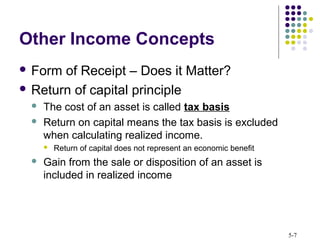

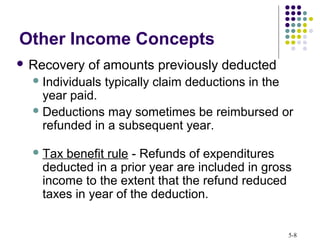

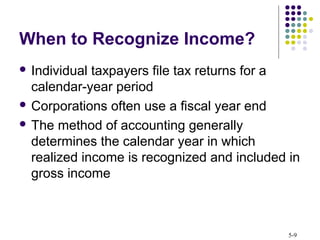

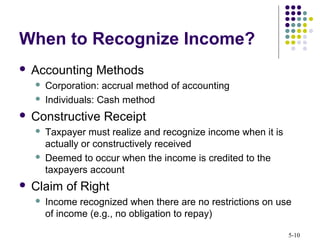

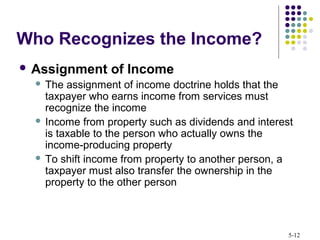

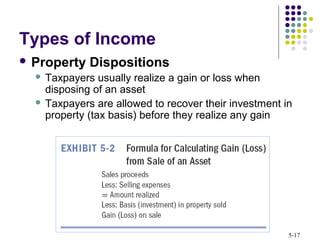

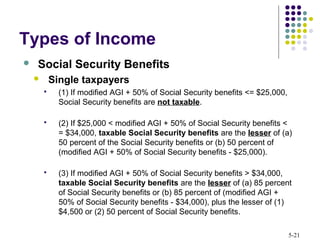

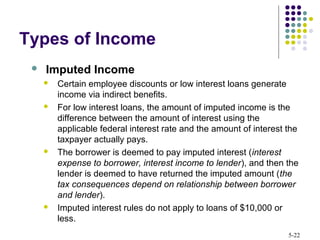

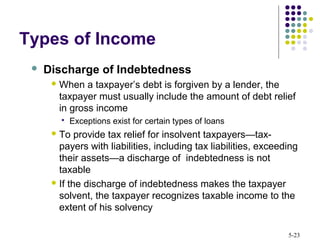

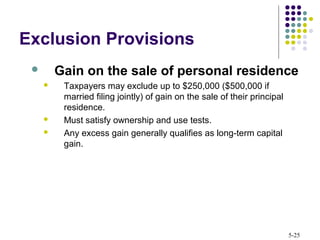

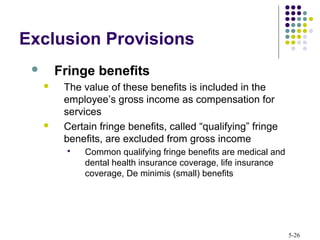

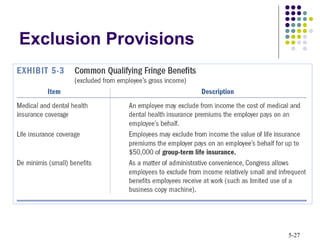

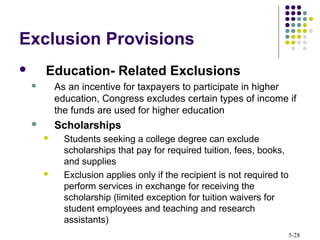

This document discusses the concepts of gross income and exclusions under US tax law. It defines gross income as all realized income from any source, unless specifically excluded or deferred. Realization, recognition and the tax benefit rule are explained. Various types of income including income from services, property, annuities, and flow-through entities are described. The document also outlines many exclusion provisions that allow taxpayers to exclude certain types of income from gross income, such as municipal bond interest, capital gains on primary residences, qualified fringe benefits, scholarships and more. Deferral provisions are also briefly mentioned.