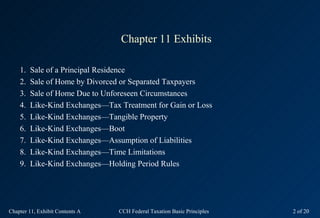

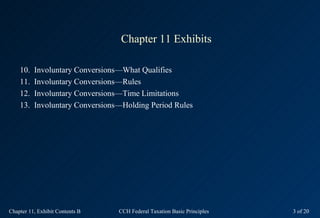

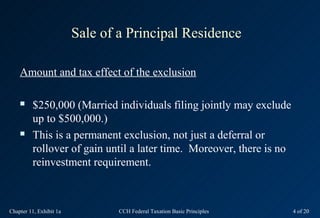

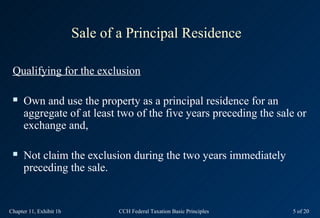

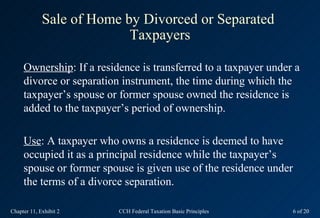

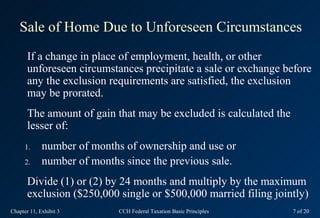

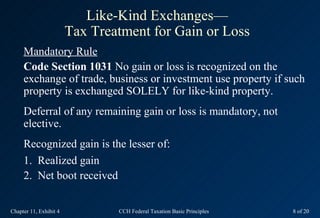

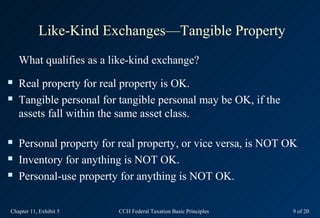

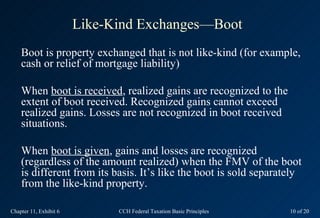

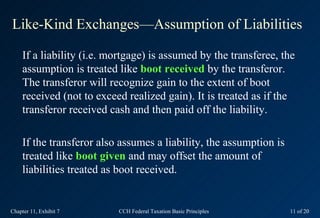

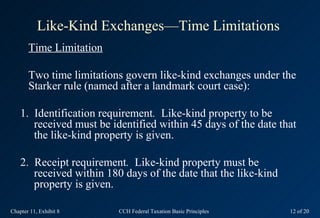

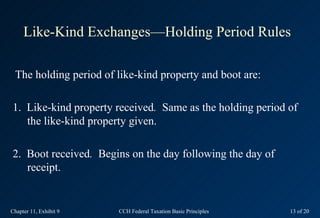

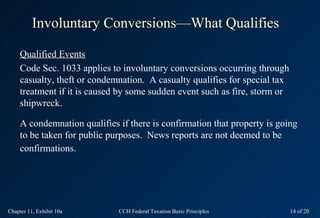

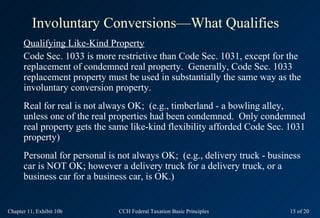

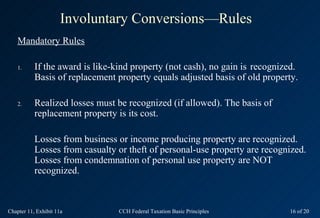

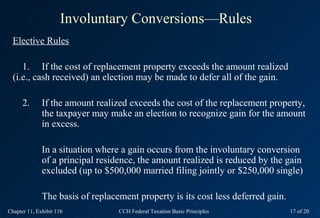

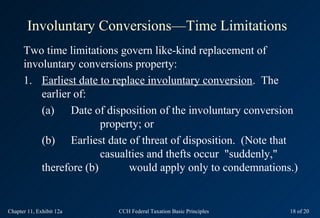

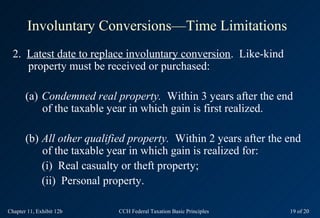

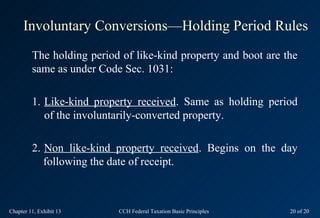

This document contains 13 exhibits that summarize key provisions related to nonrecognition of gains and losses from property transactions under sections 1031, 1033, and 121 of the Internal Revenue Code. The exhibits cover topics such as like-kind exchanges, involuntary conversions, and the sale of a principal residence. Each exhibit provides an overview of the relevant rules, qualifications, time limitations, and tax treatment for these various property transactions.