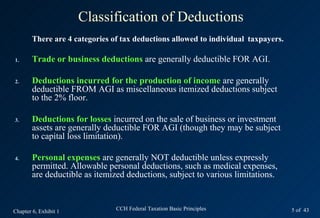

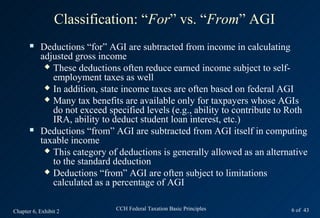

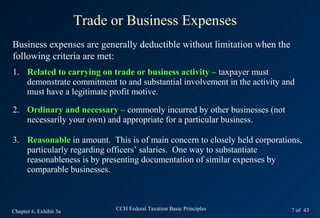

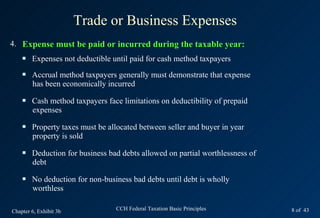

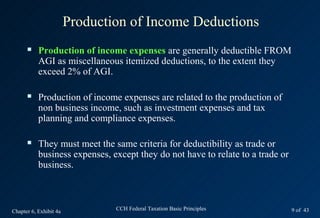

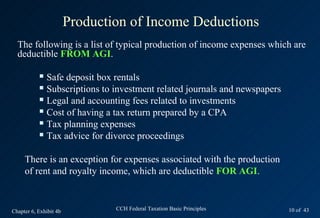

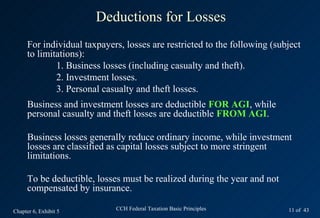

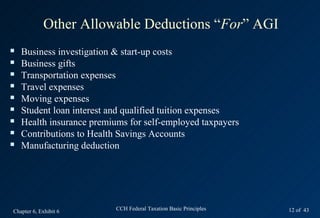

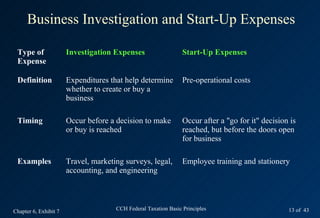

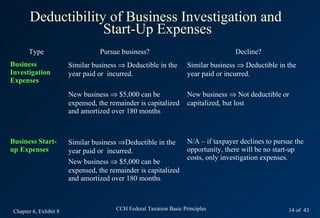

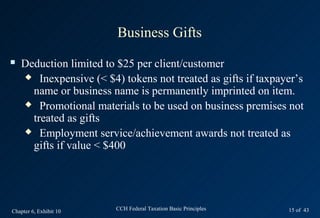

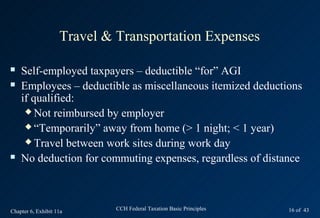

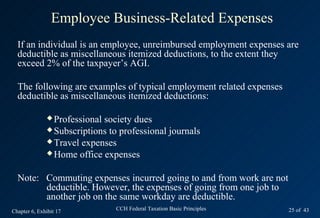

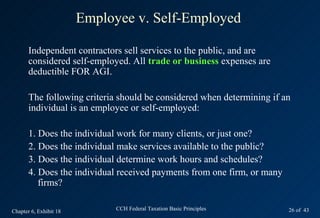

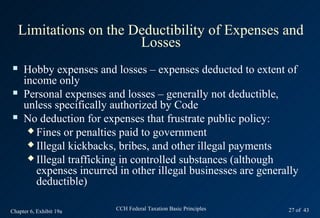

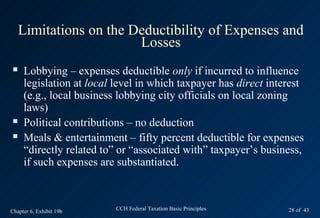

This document discusses various types of deductions allowed for individuals, including trade or business deductions, deductions for producing income, and deductions for losses. It provides examples of expenses that fall under each category and whether they are deductible "above the line" or "below the line" on a tax return. The document also examines business investigation and start-up expenses in more detail, outlining how they are treated depending on whether the business is similar or new.