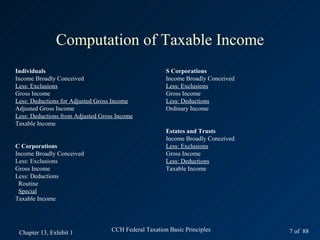

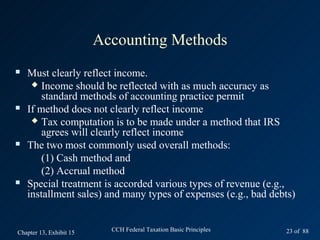

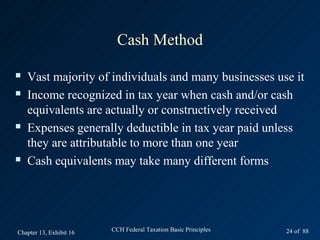

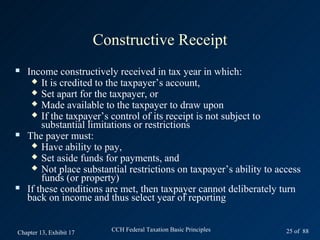

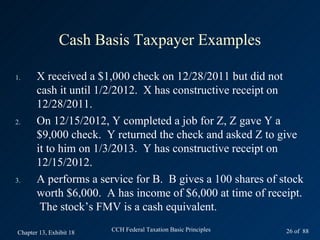

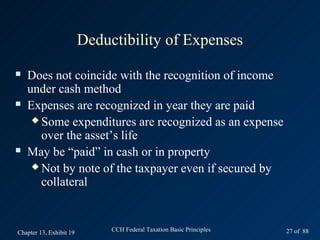

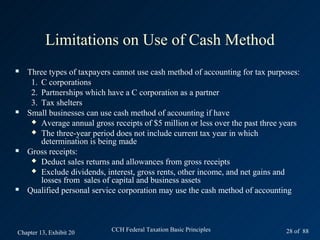

This document provides an overview of tax accounting methods and concepts. It discusses the cash method of accounting, which recognizes income when cash is received and expenses when paid. The document provides examples of constructive receipt, where a taxpayer has income even if not yet received in cash. It also briefly mentions the accrual method and hybrid accounting methods. The document appears to be an introductory chapter on tax accounting from a textbook.

![Alternative Method

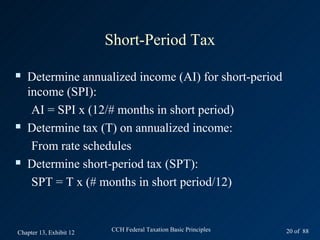

Annualization may result in inequities to taxpayer

An exception to general rule may result in less tax:

Determine taxable income for the 12-month period beginning on

the first day of the short period

Determine the tax on the taxable income for this 12-month

period

Alternative short-period tax ASPT) =

Tax on 12-month period × [ Taxable income for short

period/Taxable income for 12-month period]

Short-period tax computed in Step 3 cannot be less than it would

have been if it had been computed on short-period taxable income

without placing it on an annualized basis

Chapter 13, Exhibit 13 CCH Federal Taxation Basic Principles 21 of 88](https://image.slidesharecdn.com/2013cchbasicprinciplesch13-120911125327-phpapp01/85/2013-cch-basic-principles-ch13-21-320.jpg)

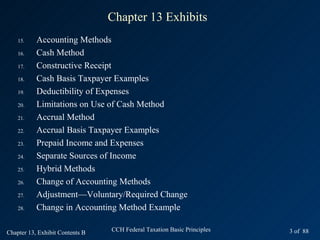

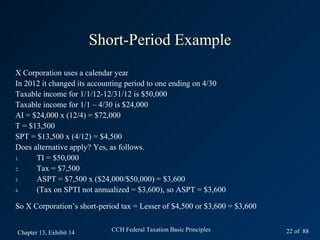

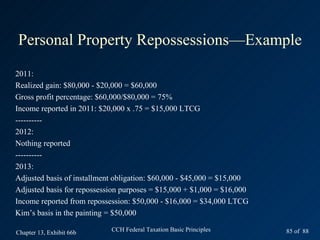

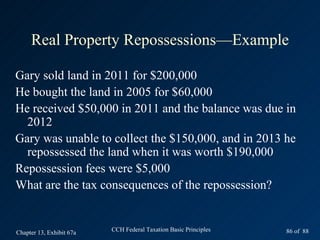

![Real Property Repossessions—Example

2011:

Realized gain: $200,000 - $60,000 = $140,000

Gross profit percentage: $140,000/$200,000 = 70%

Income reported in 2011: $50,000 x .70 = $35,000 LTCG

----------

2012:

Nothing reported

----------

2013:

Adjusted basis of installment obligation: $150,000 - $105,000 = $45,000

(1) Excess of payments received – gain reported in previous years: $50,000 - $35,000 =

$15,000

(2) Gain not yet reported: $150,000 x .7 = $105,000

Income reported from repossession: lesser of [(1) or (2)] – repossession fees

= lesser of $15,000 or ($105,000 - $5,000) = $15,000 LTCG

Gary’s basis in the painting = $45,000 + $5,000 + $15,000 = $65,000

Chapter 13, Exhibit 67b CCH Federal Taxation Basic Principles 87 of 88](https://image.slidesharecdn.com/2013cchbasicprinciplesch13-120911125327-phpapp01/85/2013-cch-basic-principles-ch13-87-320.jpg)