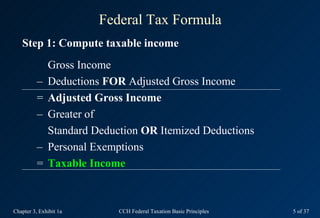

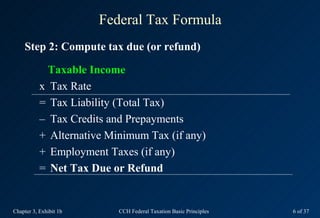

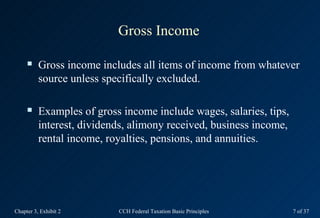

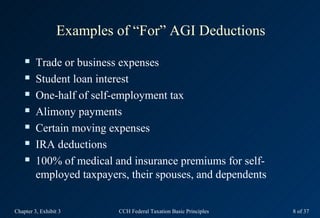

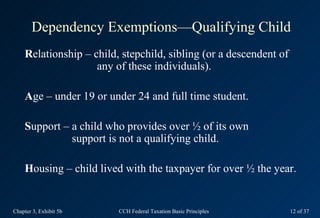

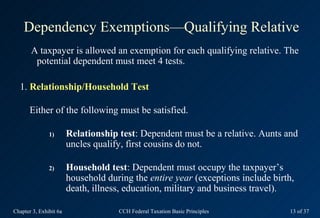

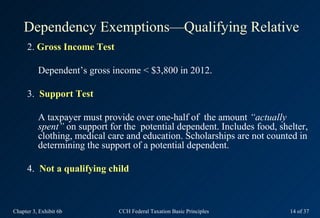

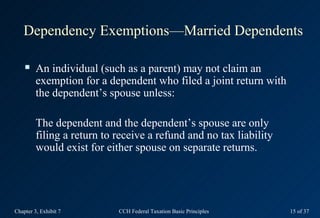

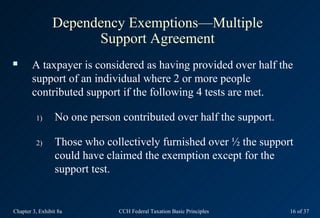

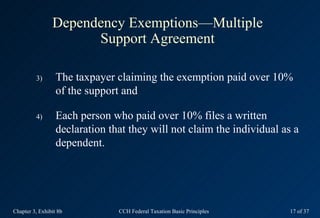

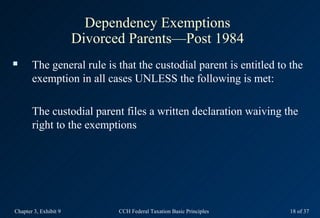

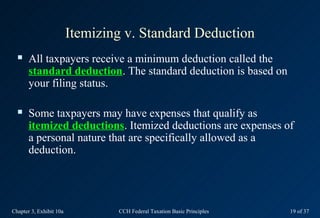

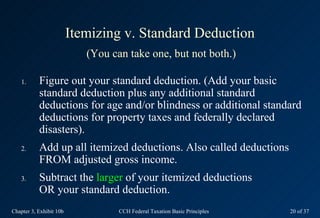

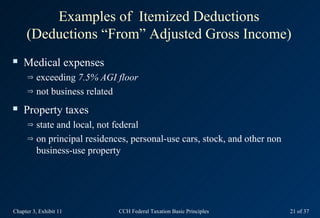

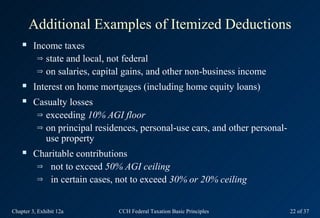

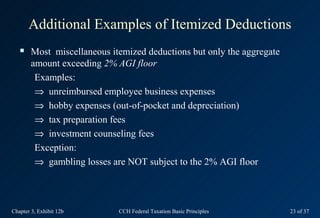

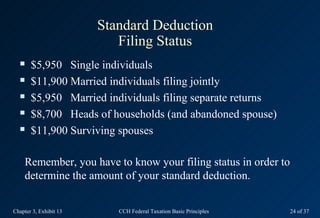

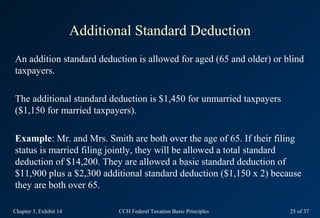

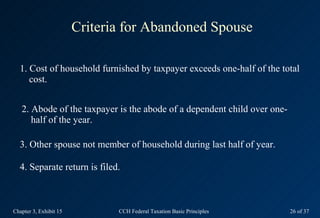

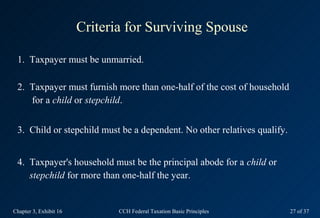

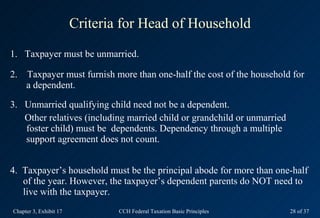

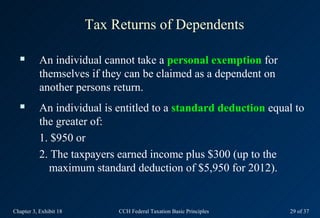

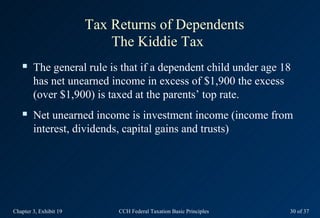

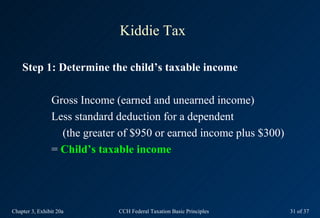

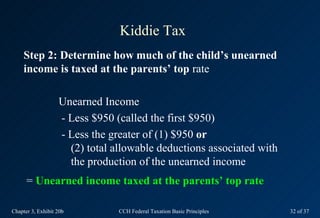

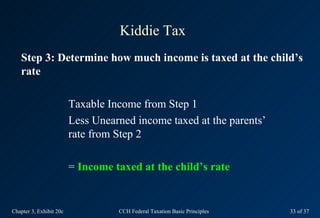

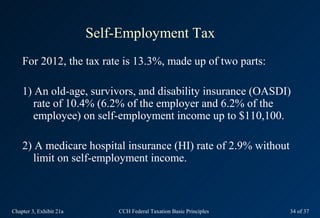

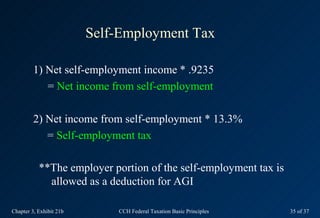

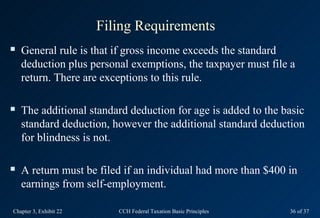

This document provides an overview of Chapter 3 and its exhibits on individual taxation. It includes 15 exhibits that cover topics such as the federal tax formula, definitions of gross income and adjusted gross income, personal and dependency exemptions, standard deductions, itemized deductions, filing status requirements, tax rates and schedules, self-employment taxes, and special rules for dependents. The exhibits provide definitions, examples, and criteria for key concepts in individual income taxation.