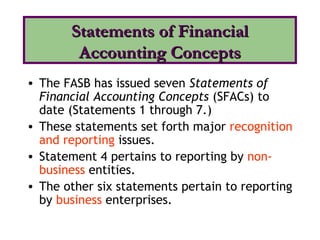

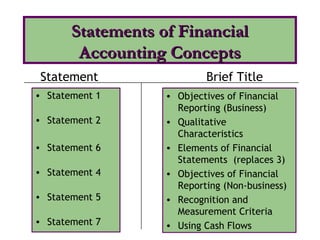

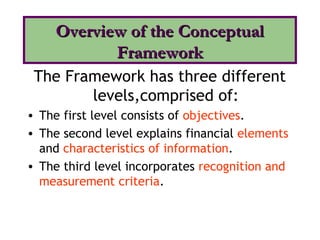

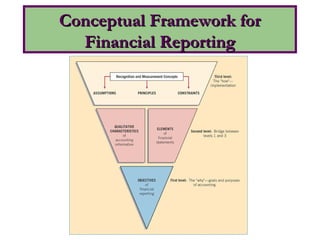

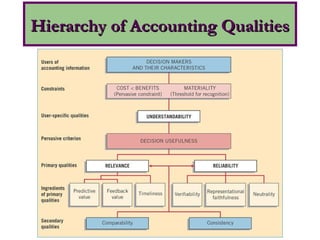

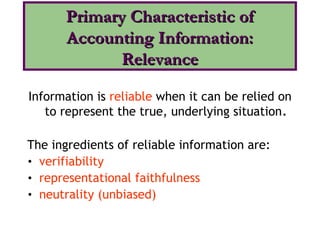

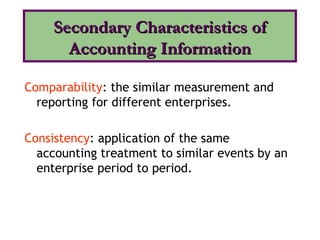

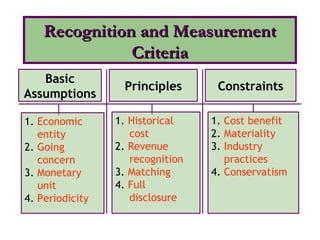

The document provides an overview of the conceptual framework for financial reporting established by the Financial Accounting Standards Board (FASB). It describes the objectives of the framework to establish standards and solve emerging problems. The framework consists of objectives, elements, and criteria. The objectives are to provide useful information to investors and creditors for decision making. The elements are assets, liabilities, equity, income and expenses. The qualitative characteristics are relevance, reliability, comparability and consistency.