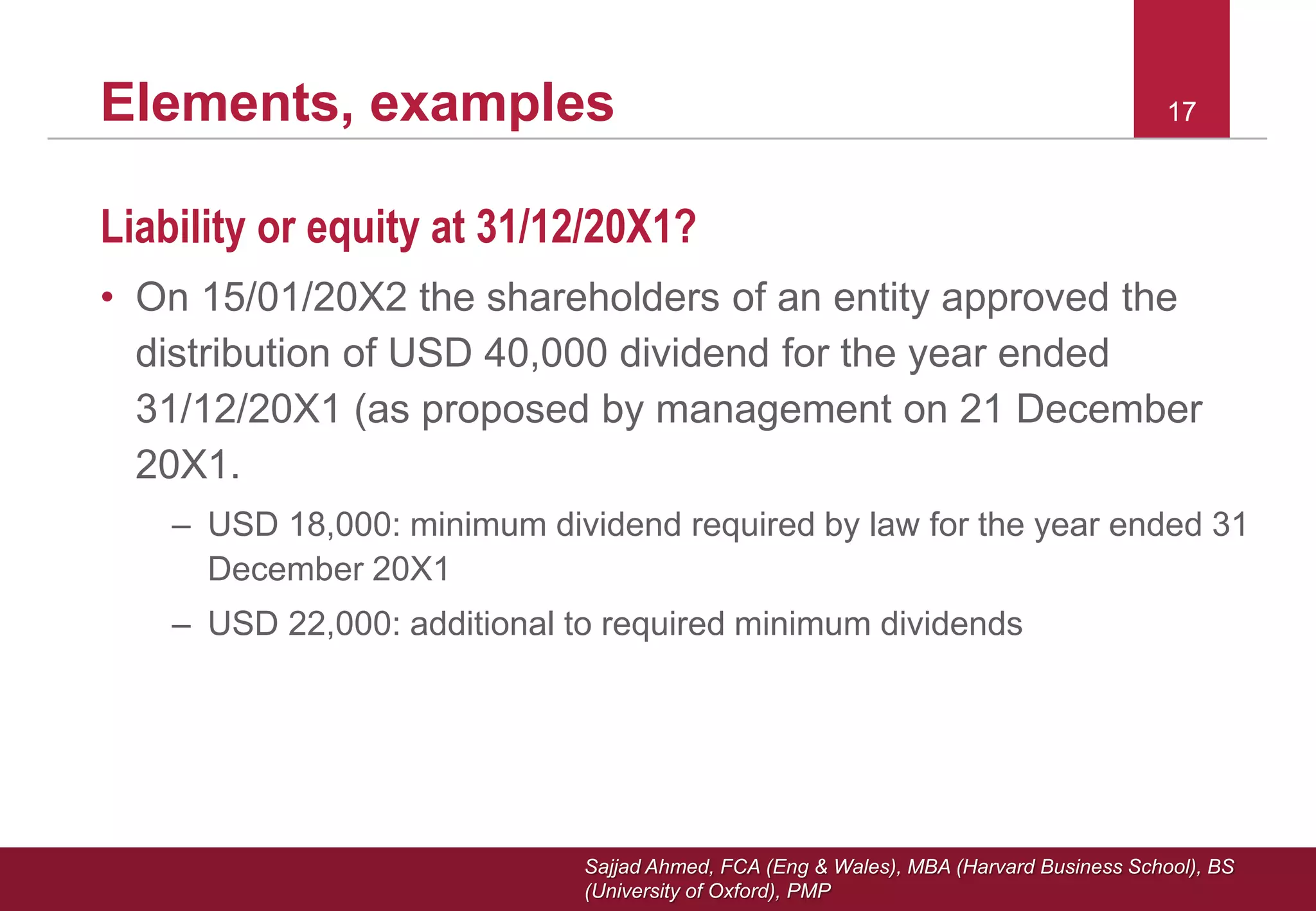

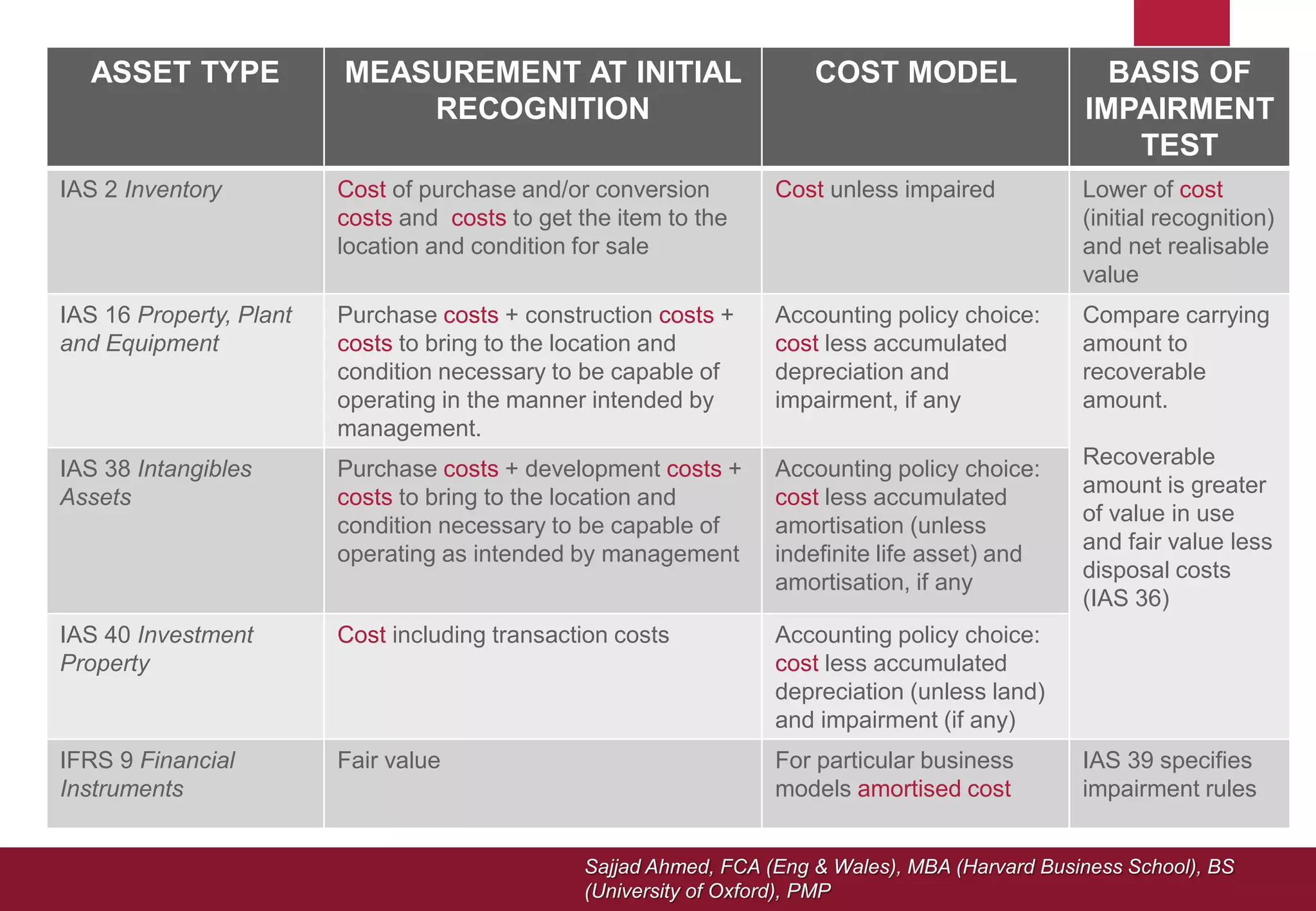

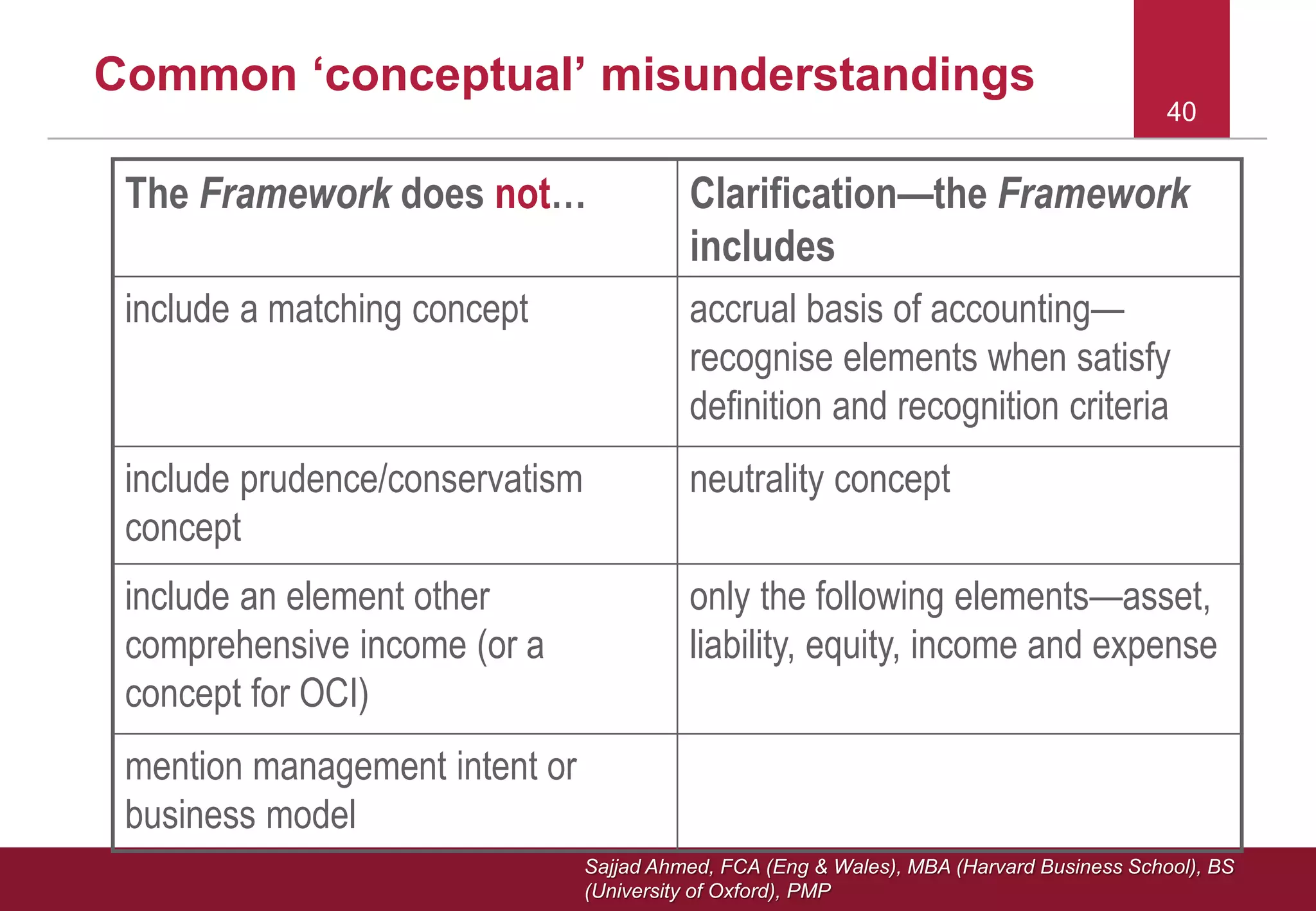

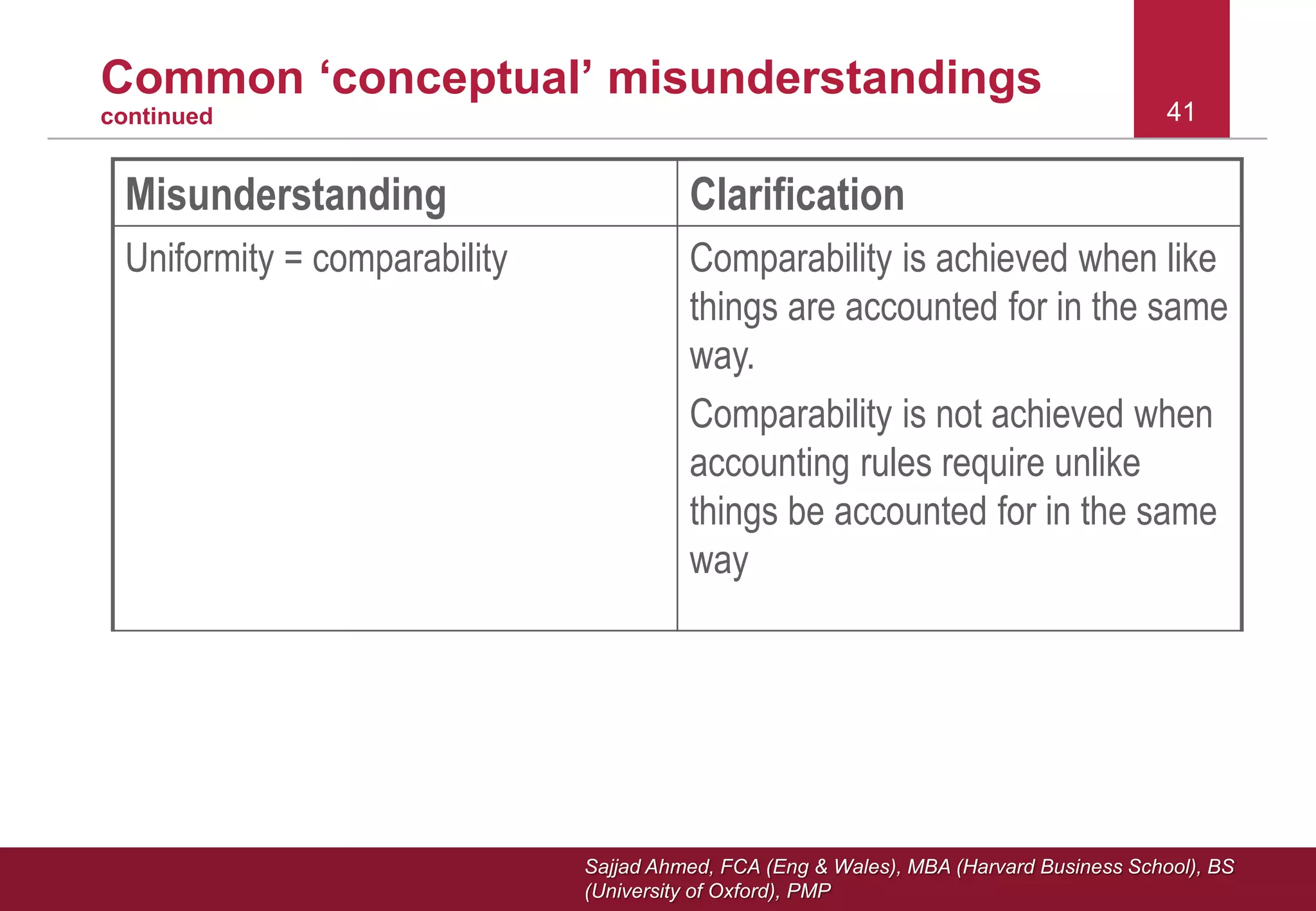

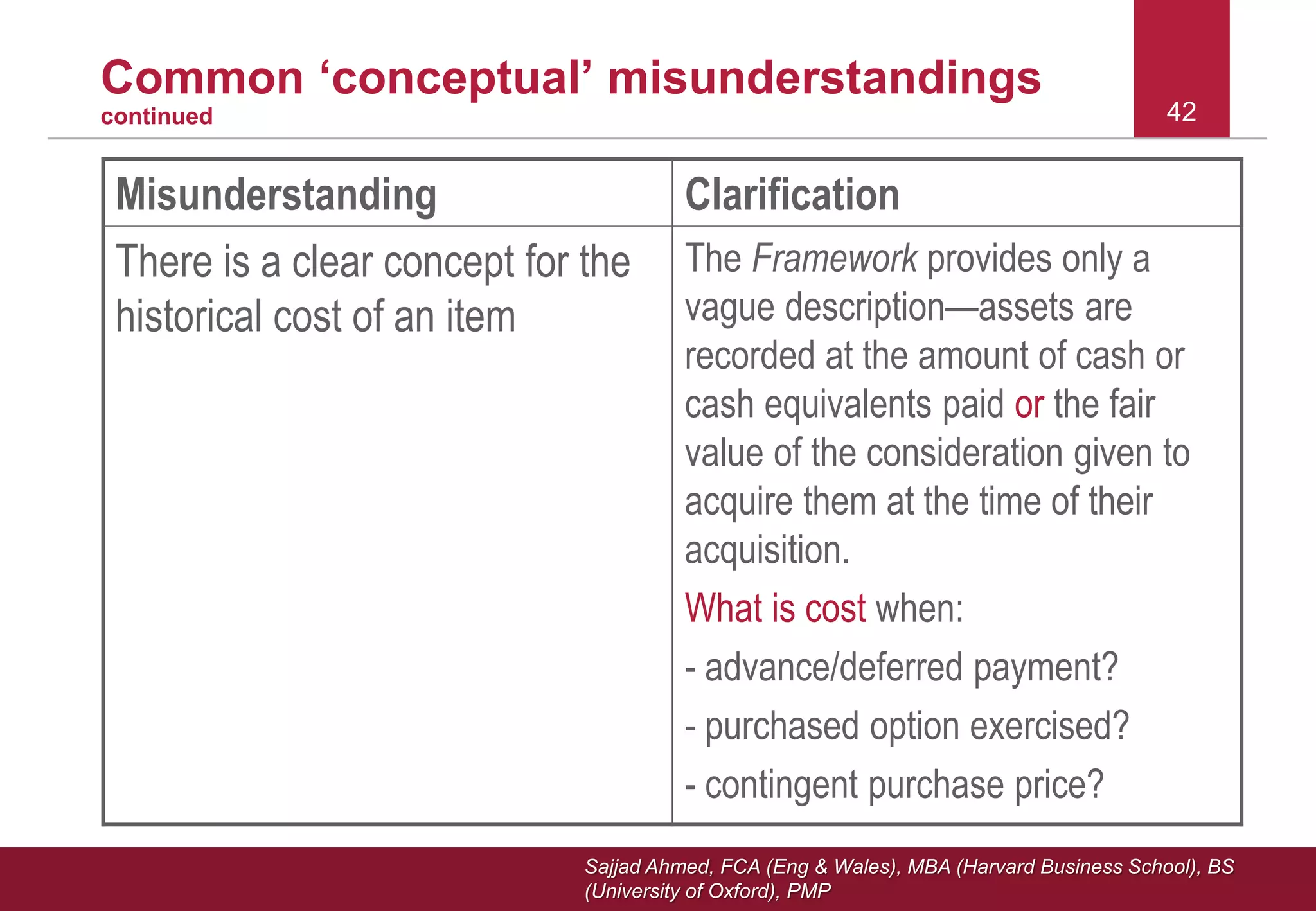

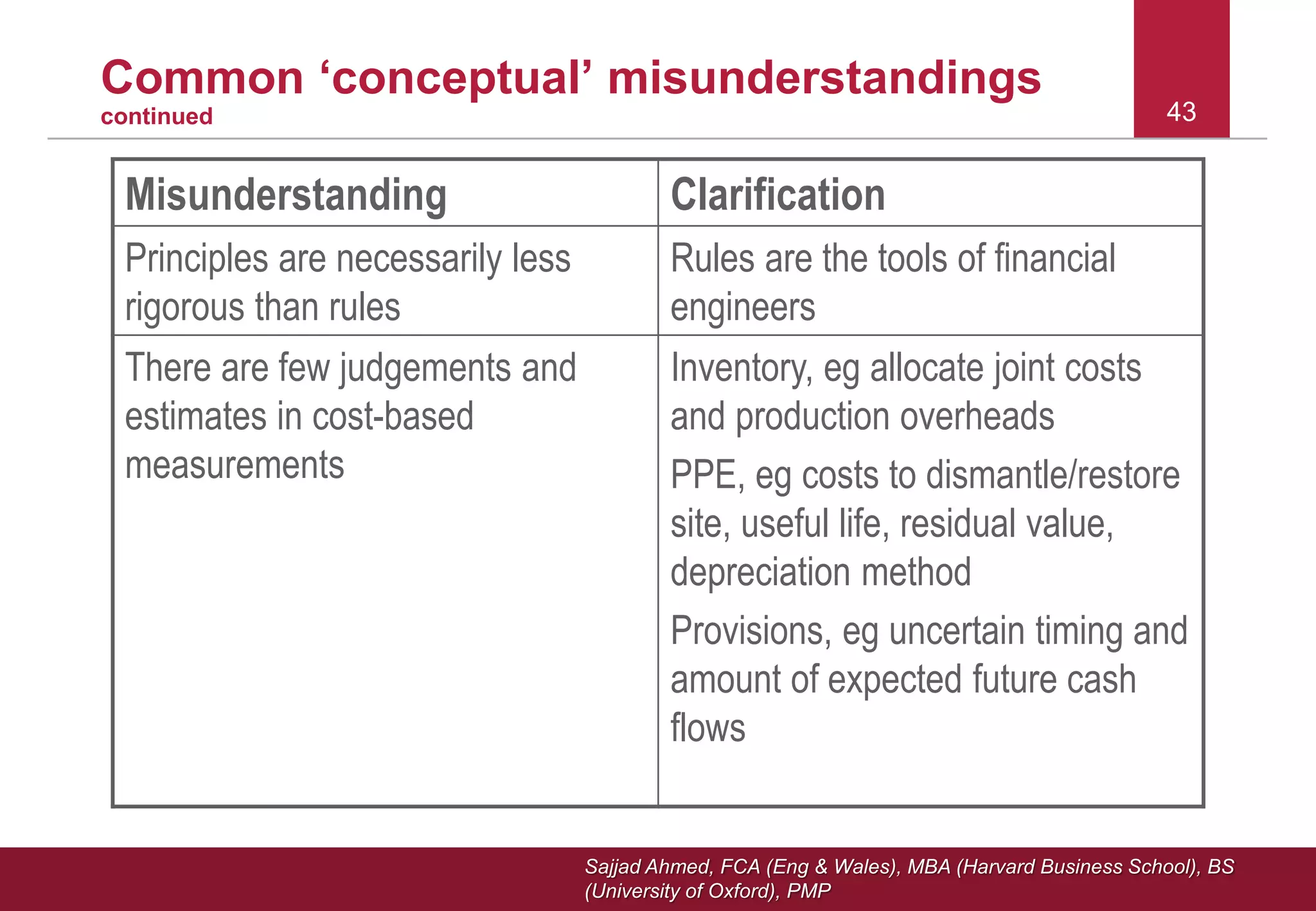

This document summarizes a presentation on the International Financial Reporting Standards Conceptual Framework. It discusses key concepts such as the objective of financial reporting which is to provide useful information to investors, lenders and other creditors. It also discusses the qualitative characteristics of relevant and faithfully represented financial information, and fundamental elements such as assets, liabilities and equity. The presentation provides examples and discusses concepts such as recognition and measurement in financial reporting.