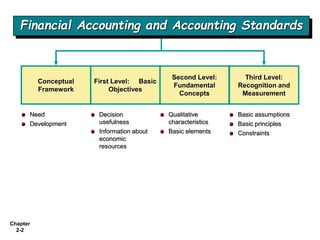

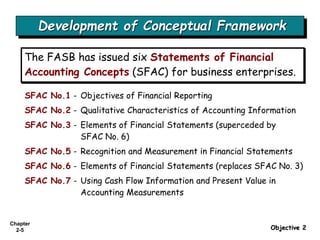

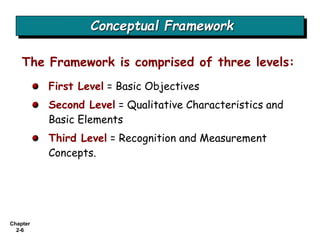

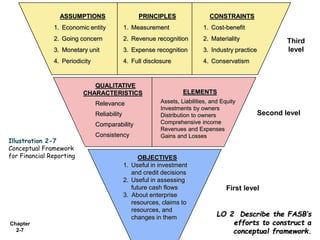

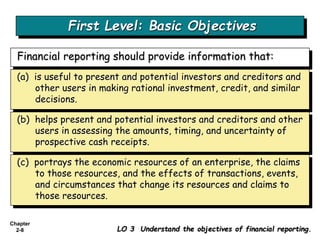

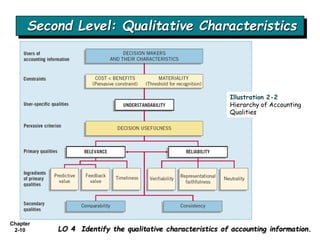

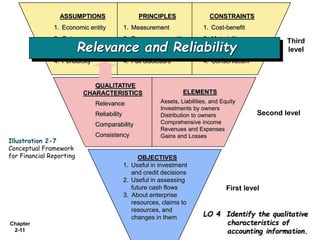

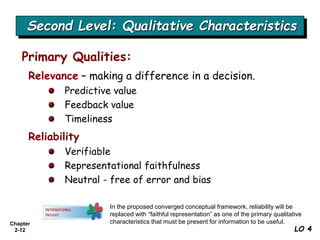

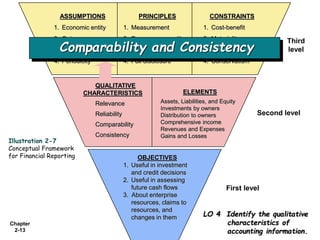

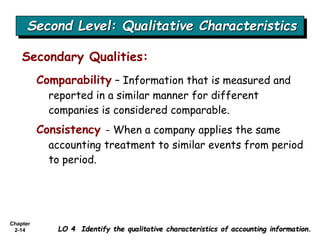

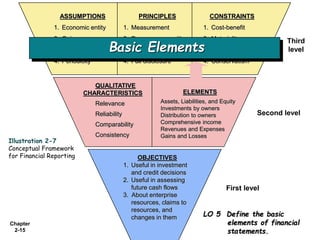

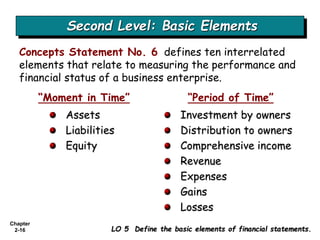

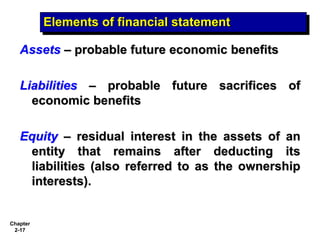

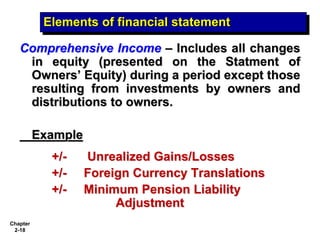

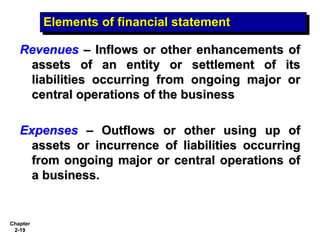

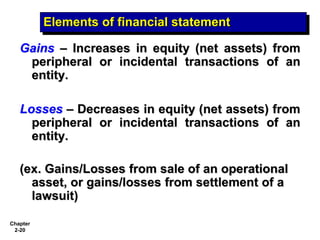

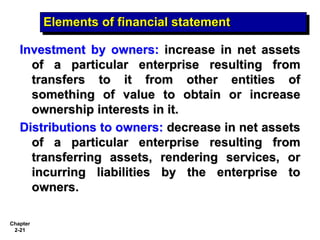

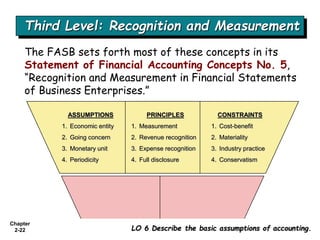

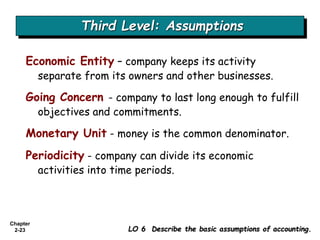

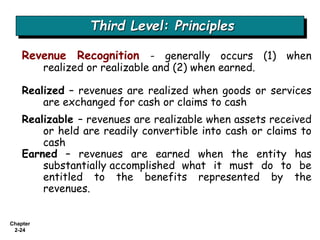

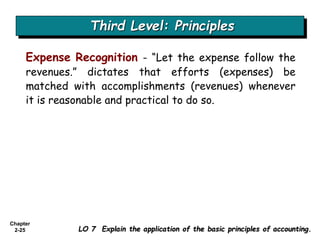

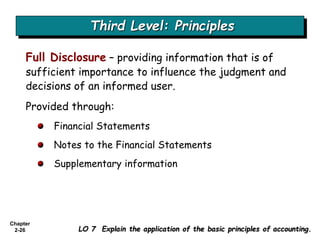

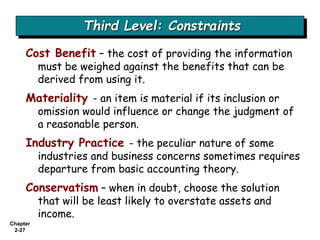

The conceptual framework provides a coherent system of objectives and fundamentals that can lead to consistent accounting standards. It establishes the nature, function and limits of financial accounting. The FASB has issued six statements of financial accounting concepts to develop the conceptual framework. The framework consists of three levels - objectives of financial reporting, qualitative characteristics of accounting information, and recognition and measurement concepts. It also identifies basic elements, assumptions, principles and constraints of financial reporting.