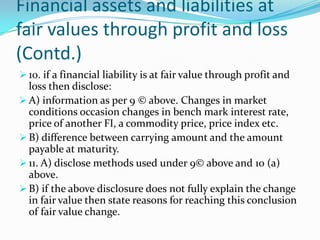

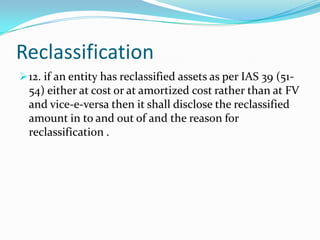

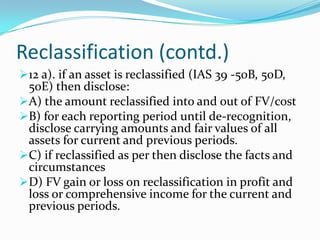

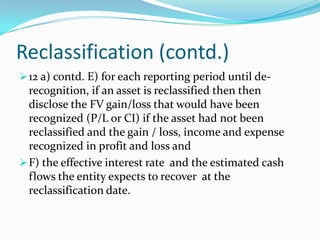

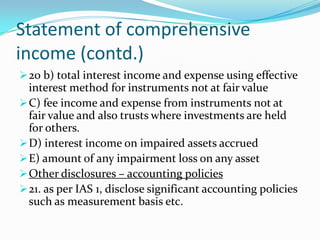

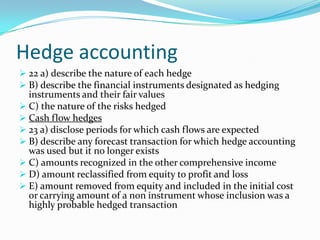

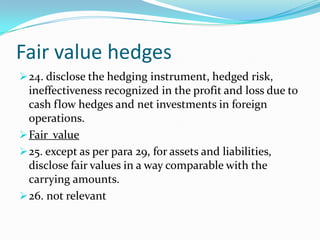

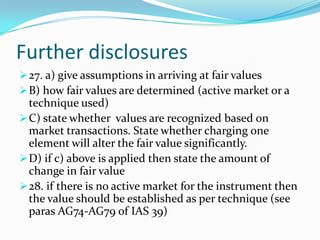

This standard provides guidance on disclosure requirements for financial instruments. It aims to enable users to understand the significance of financial instruments for an entity's financial position and performance, as well as the nature and extent of risks arising from financial instruments. Key disclosure requirements include information on classes of financial assets and liabilities, fair value measurements, credit risk, liquidity risk, market risk, and hedge accounting. The standard requires both qualitative and quantitative disclosures to provide a comprehensive picture of an entity's exposure to various risks from its use of financial instruments.