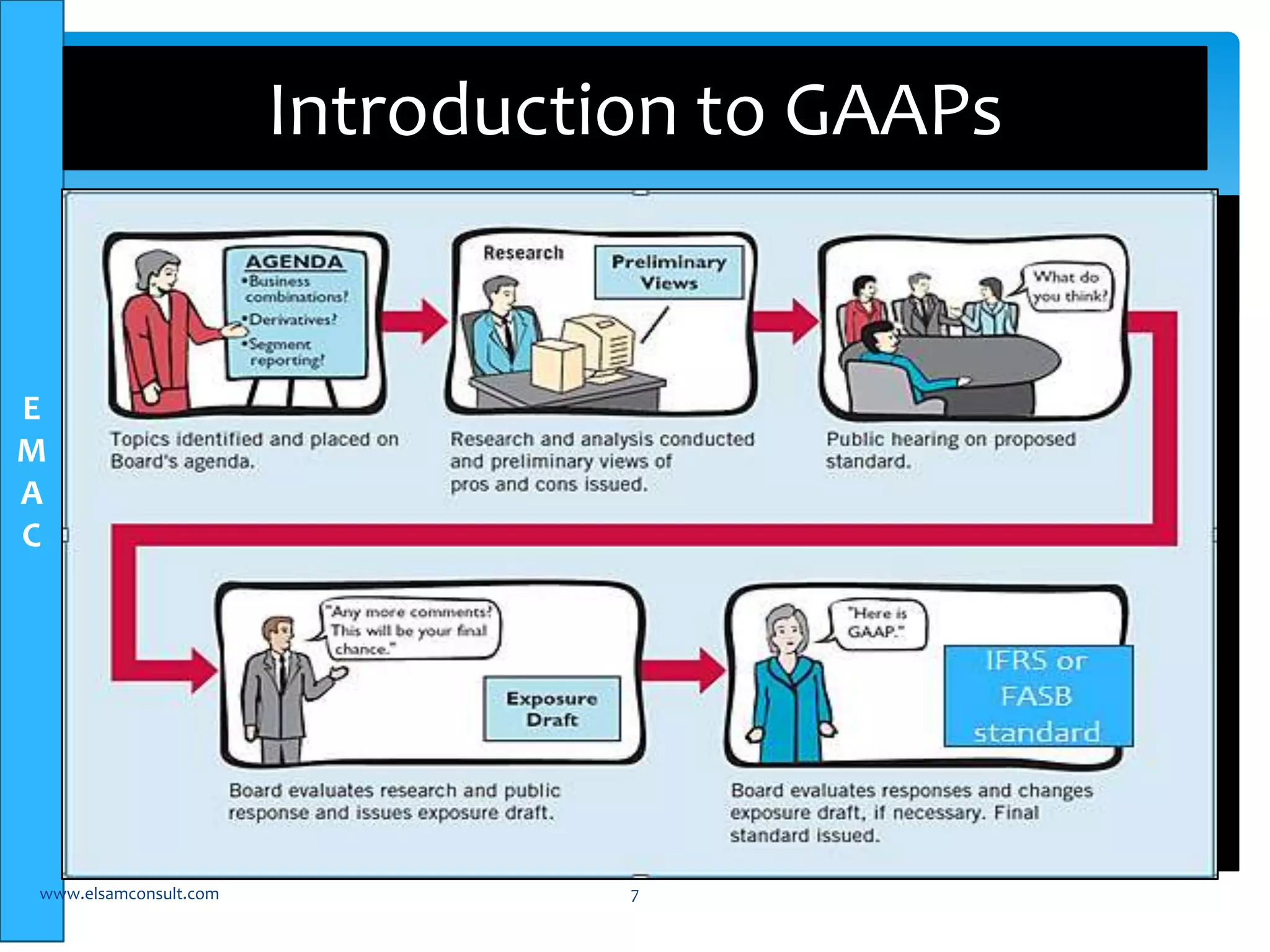

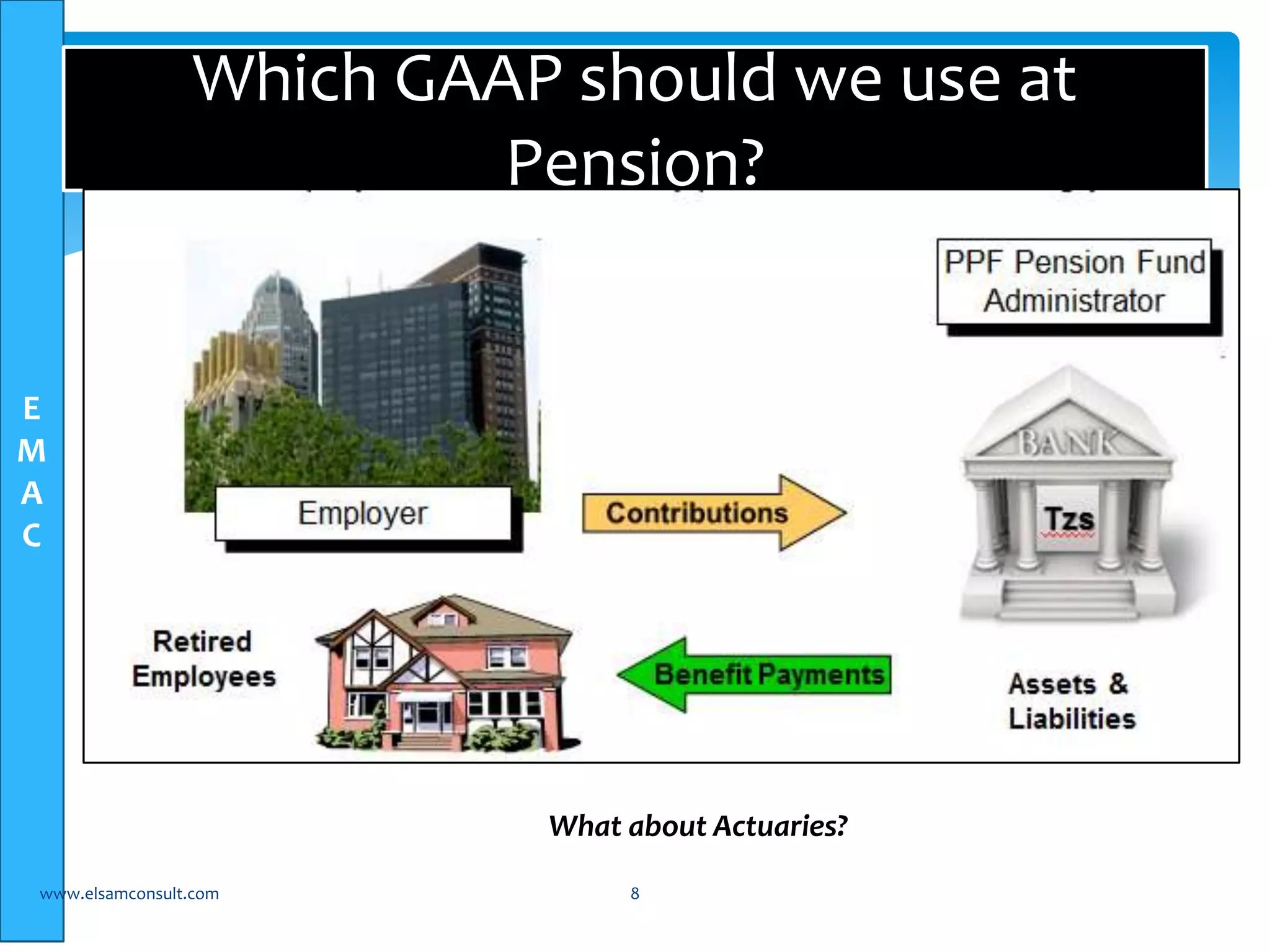

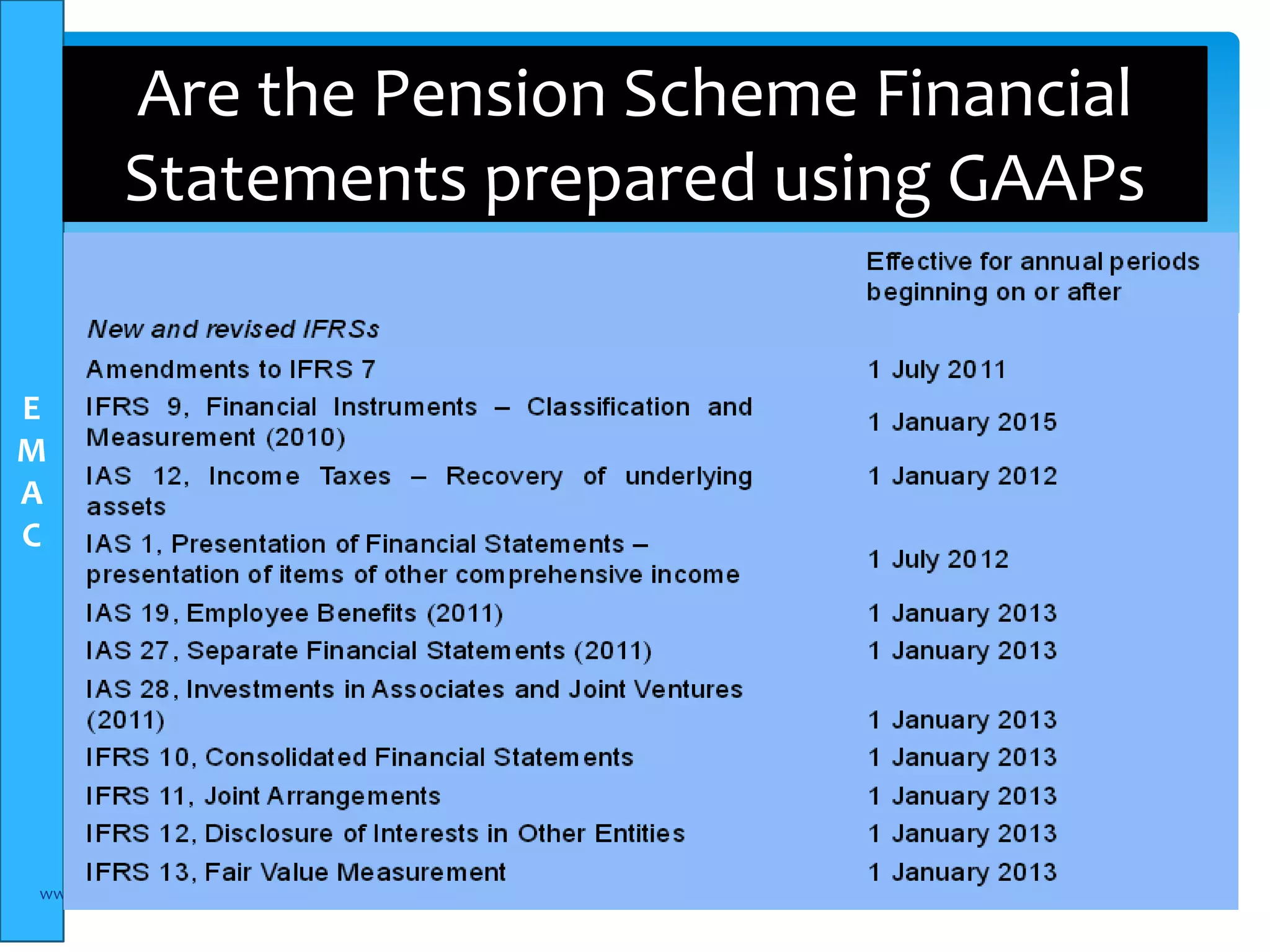

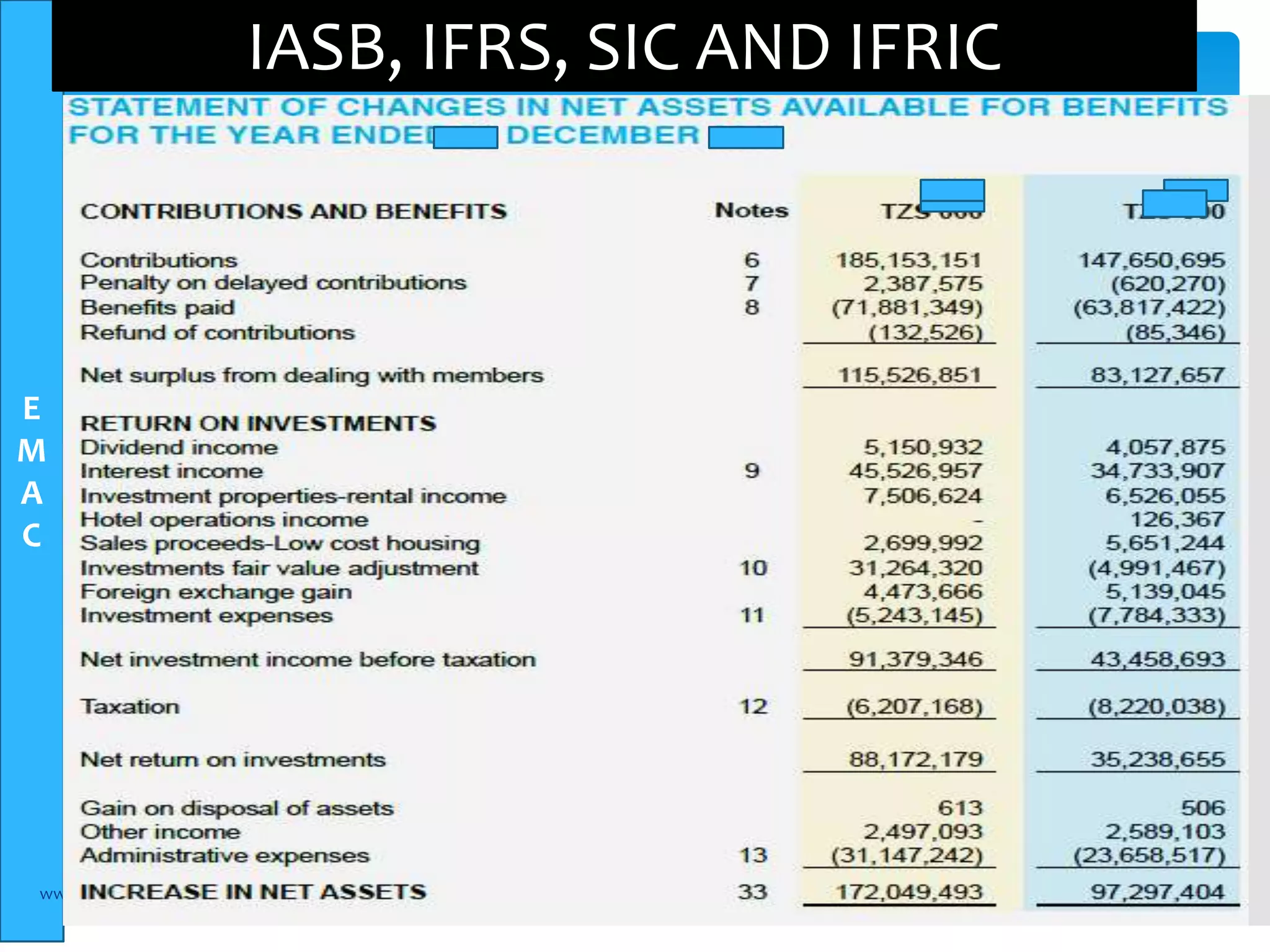

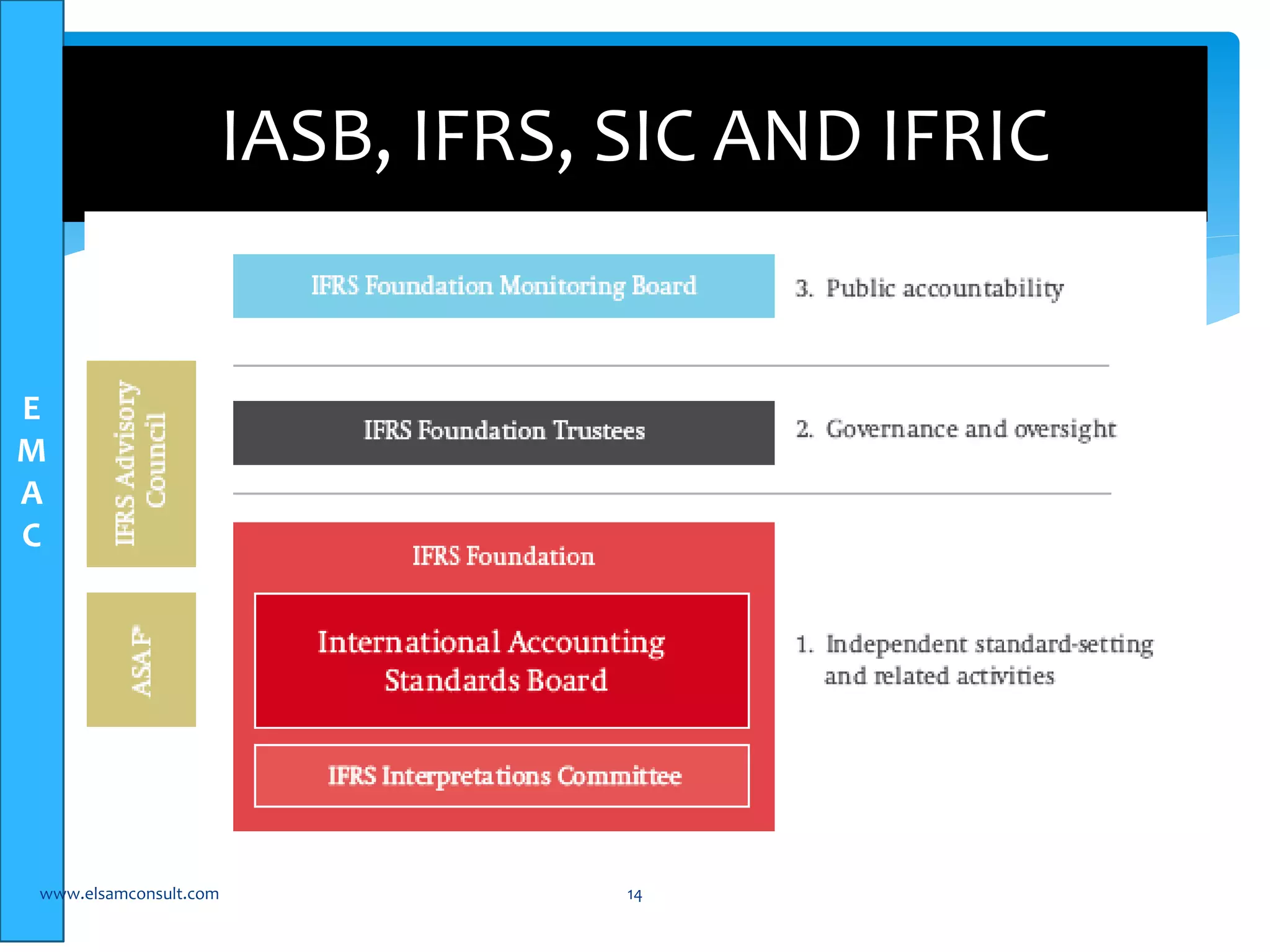

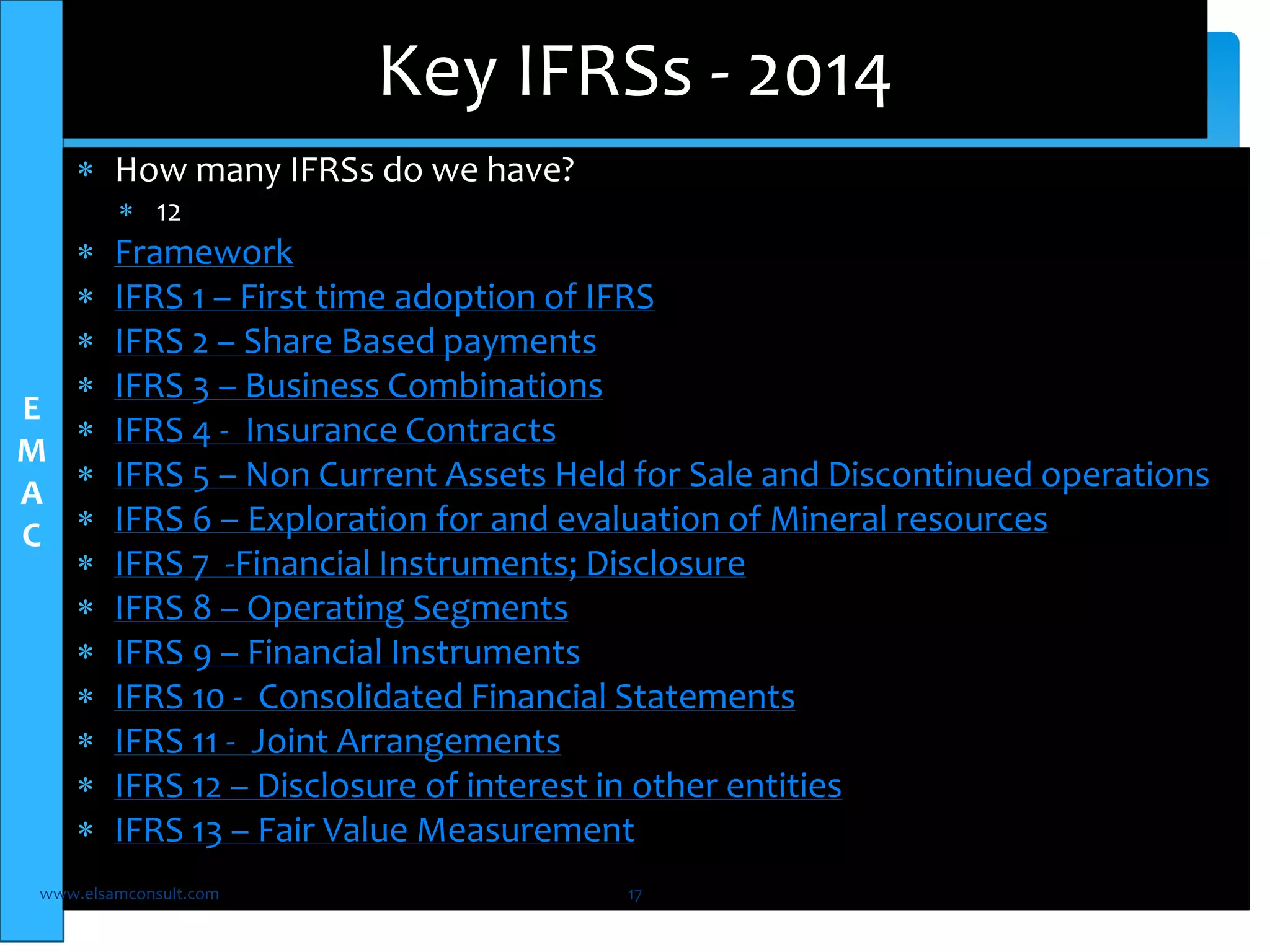

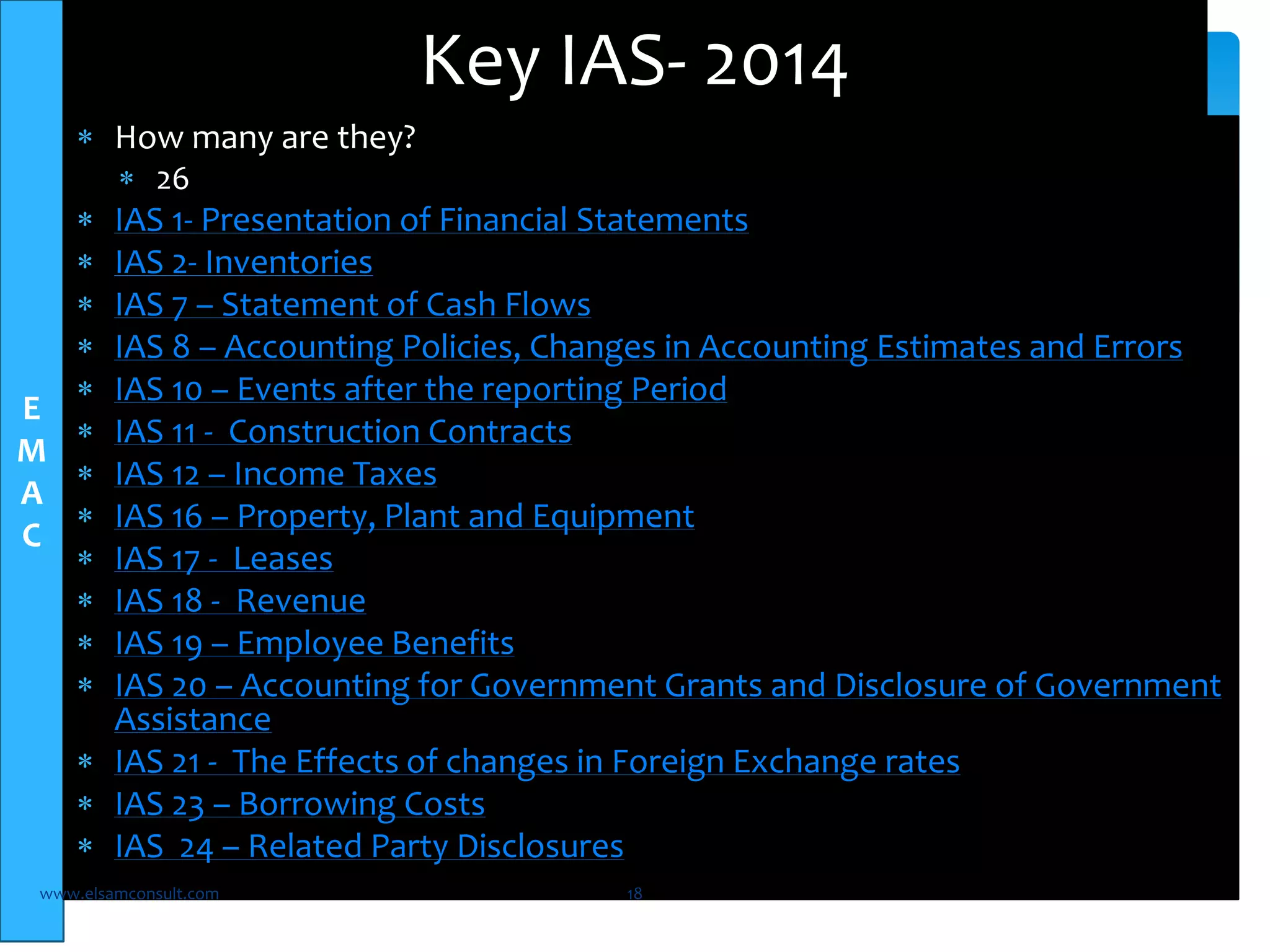

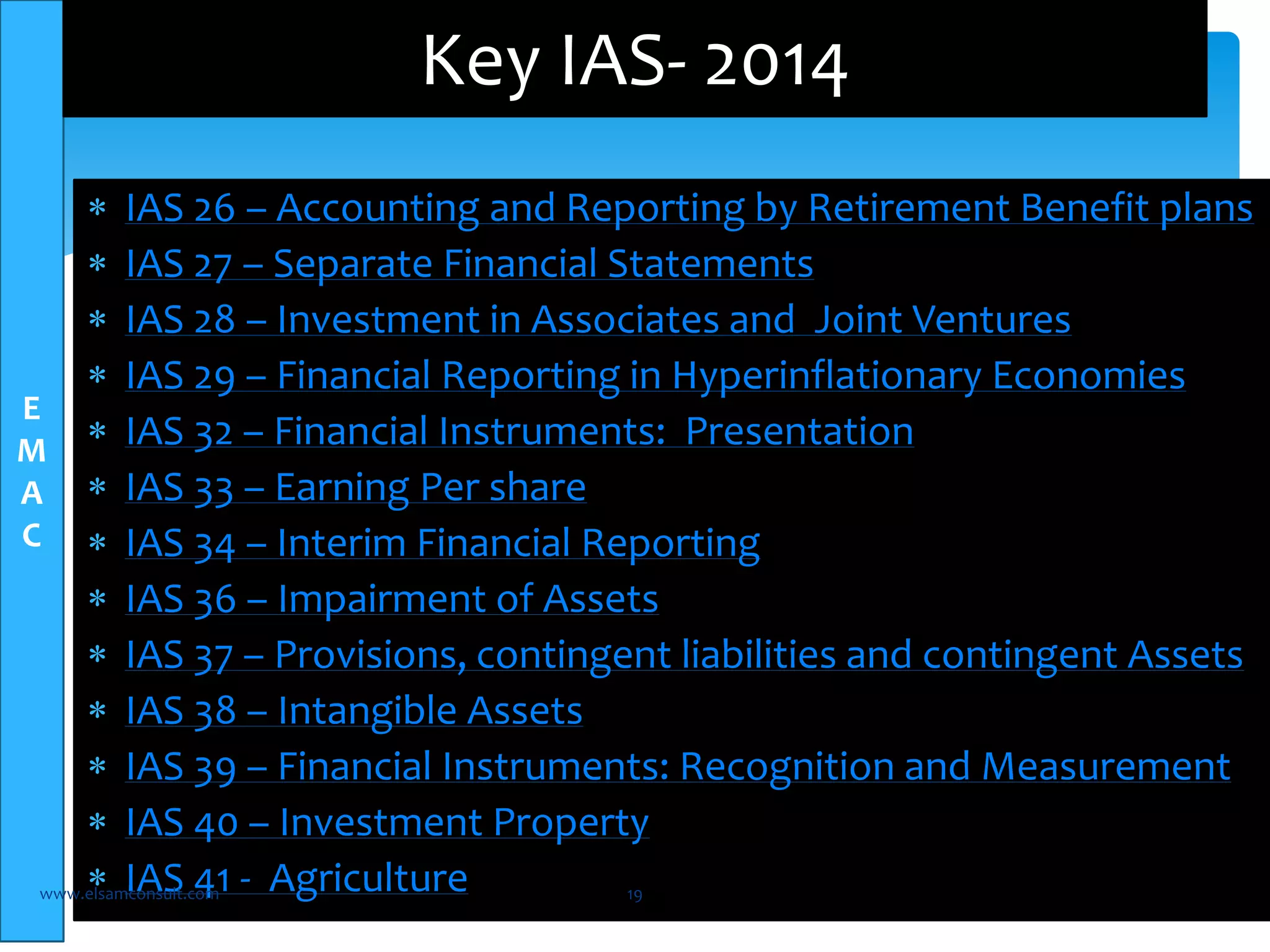

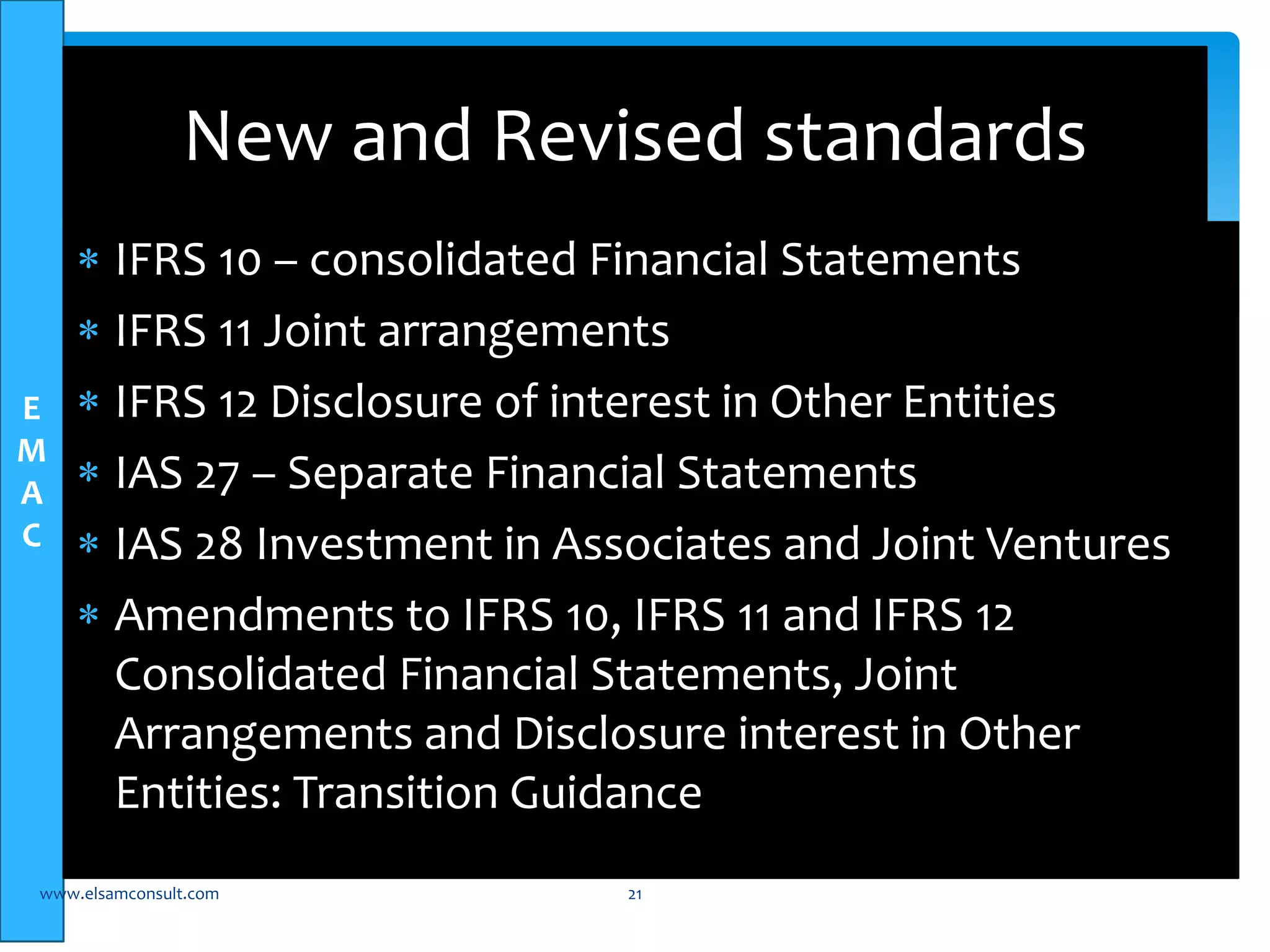

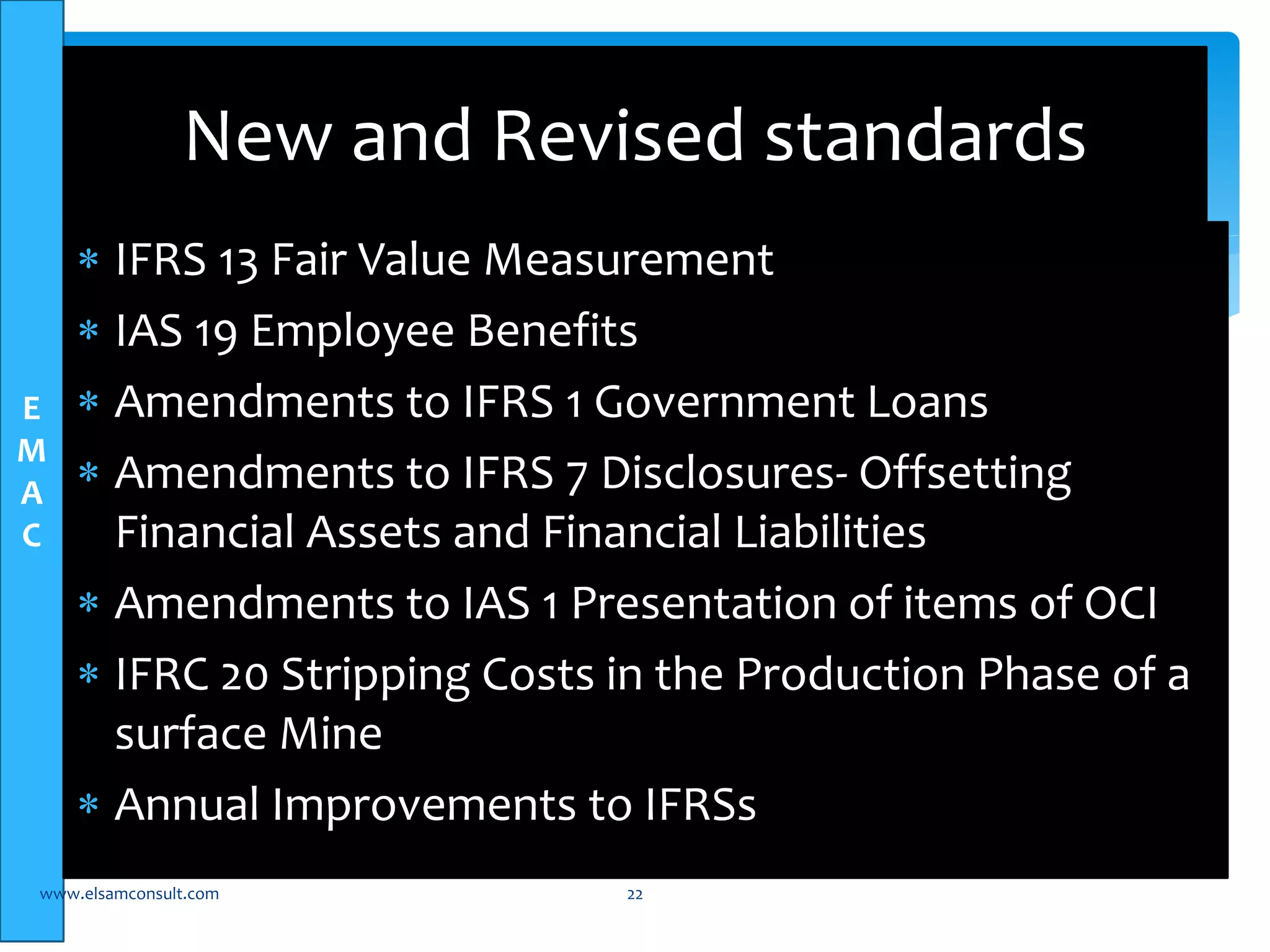

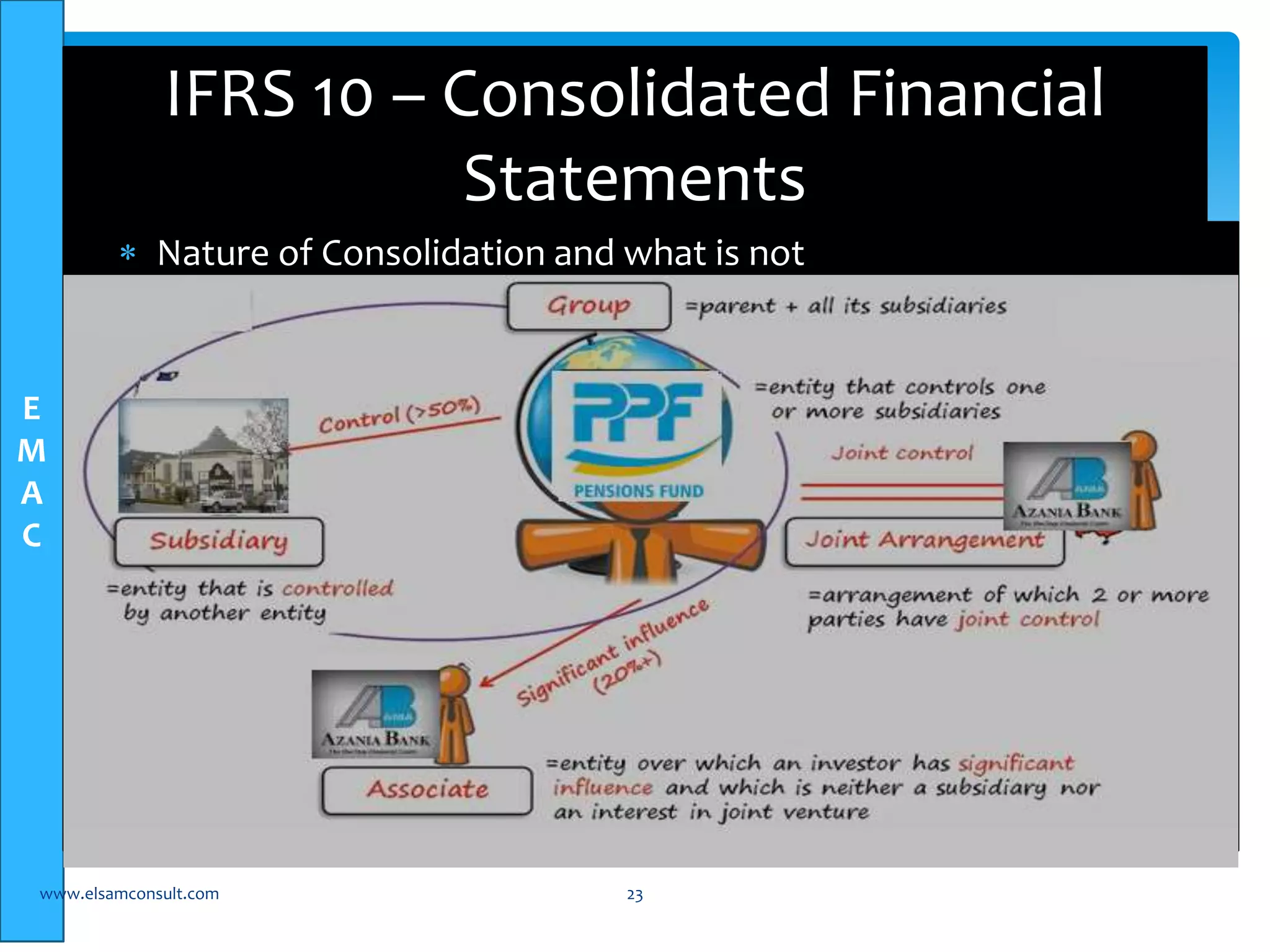

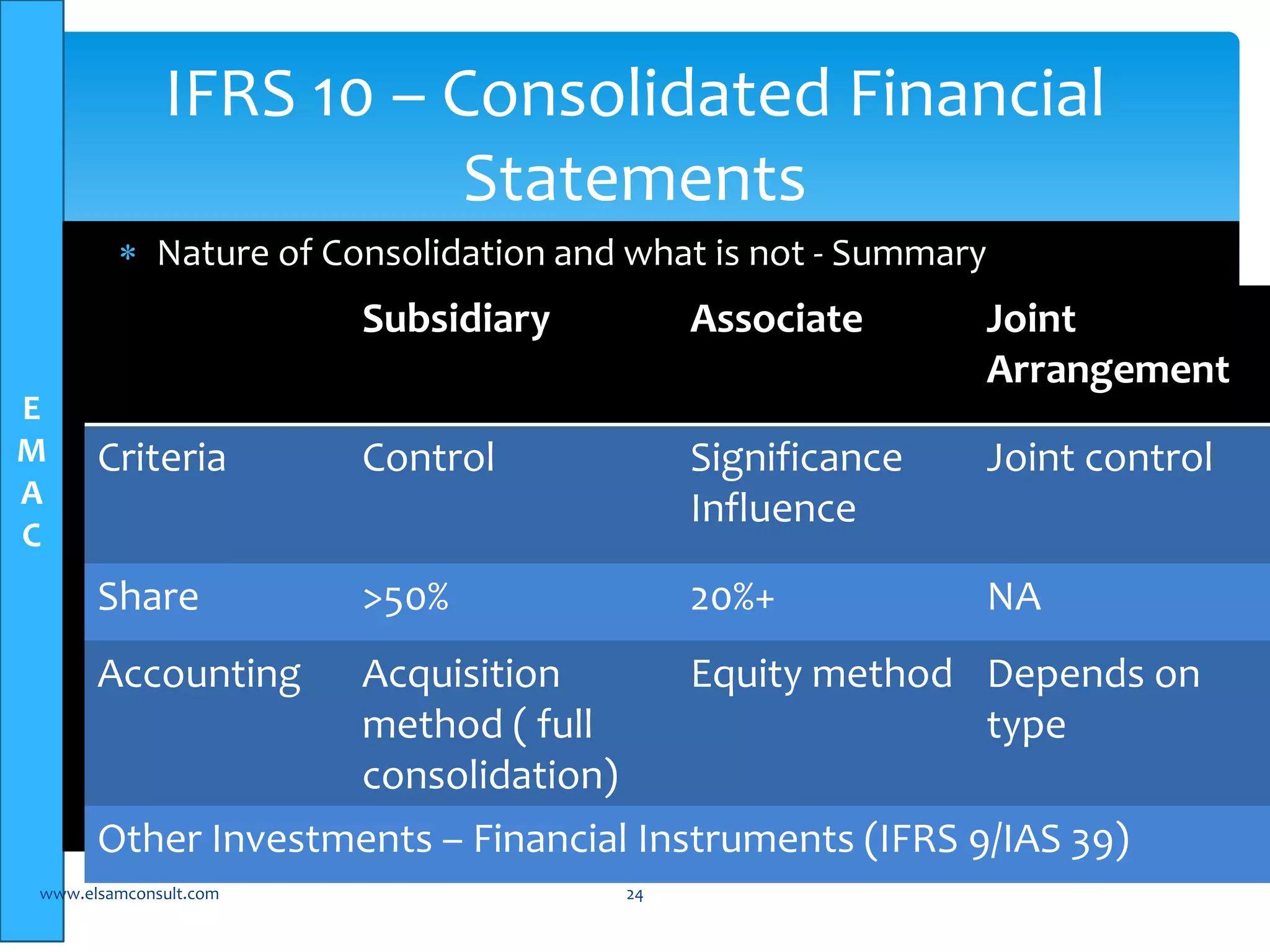

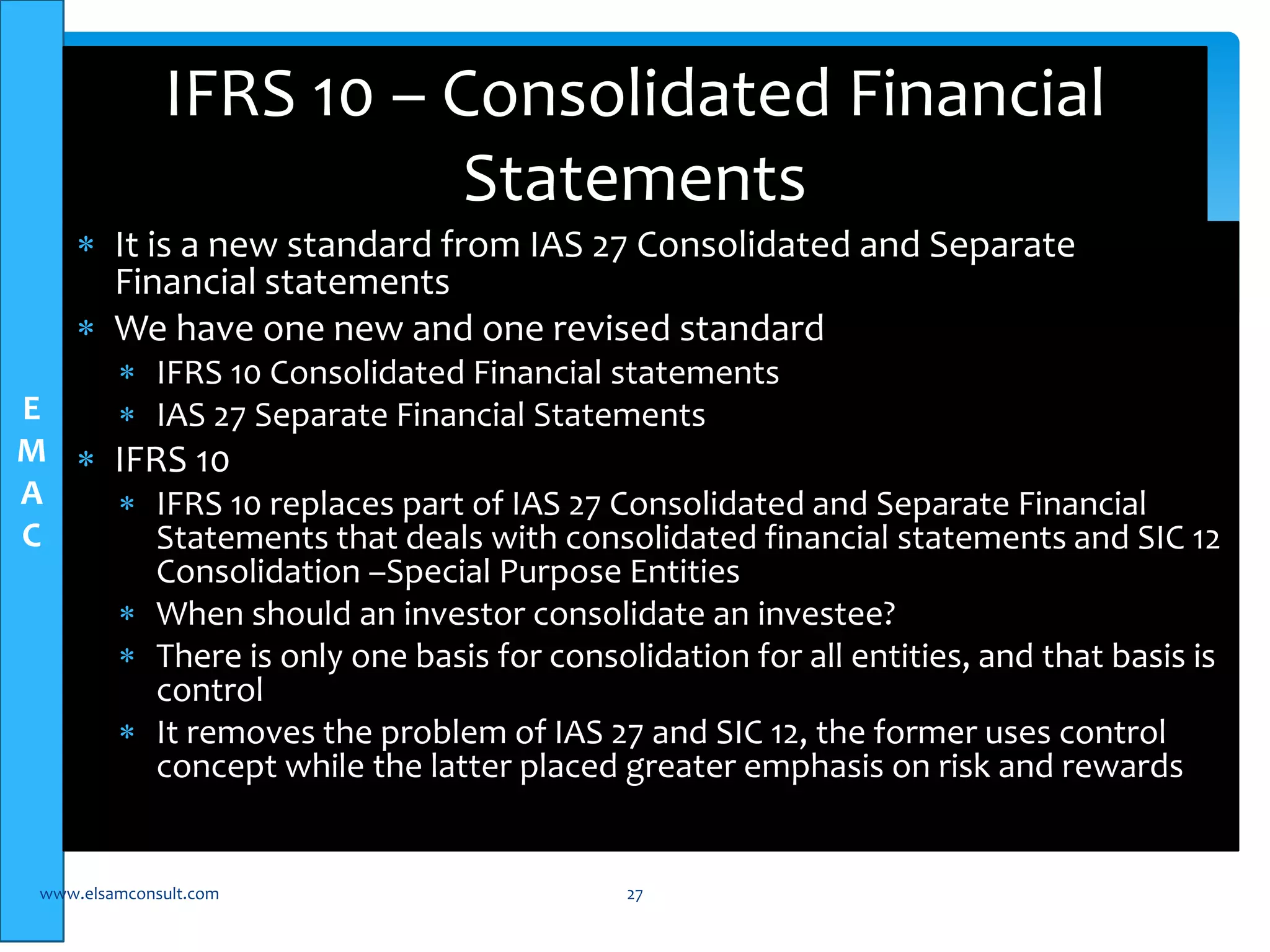

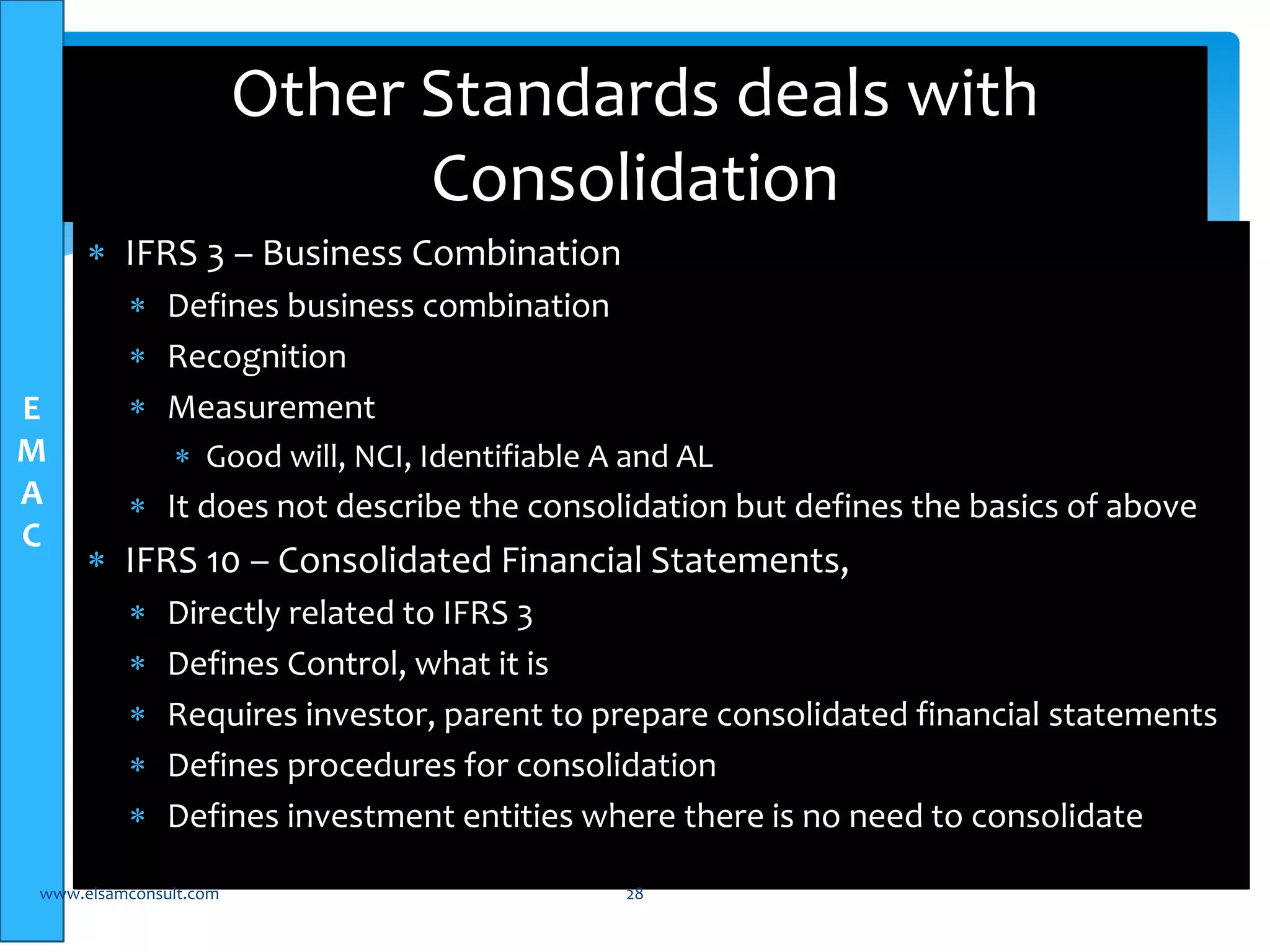

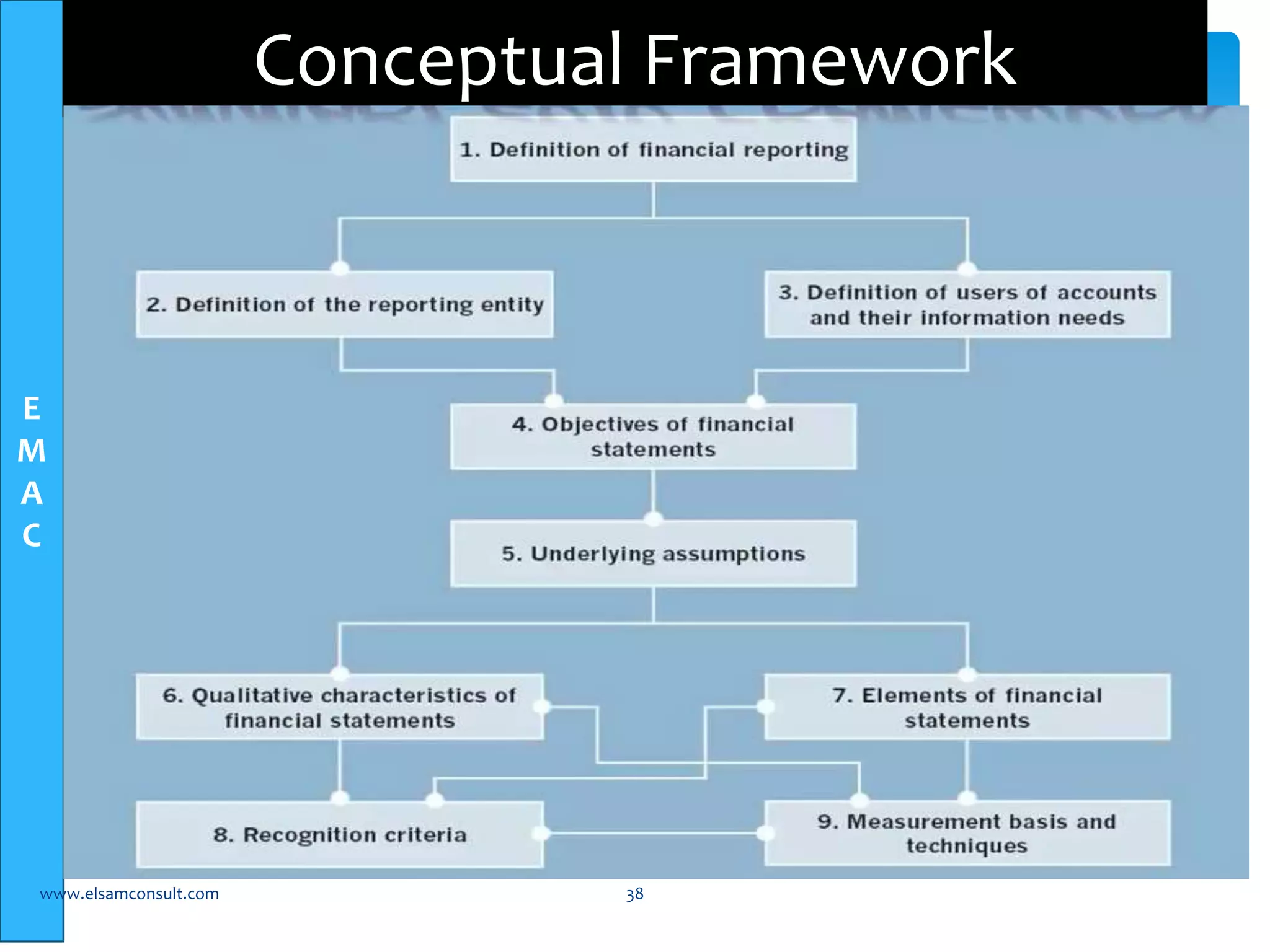

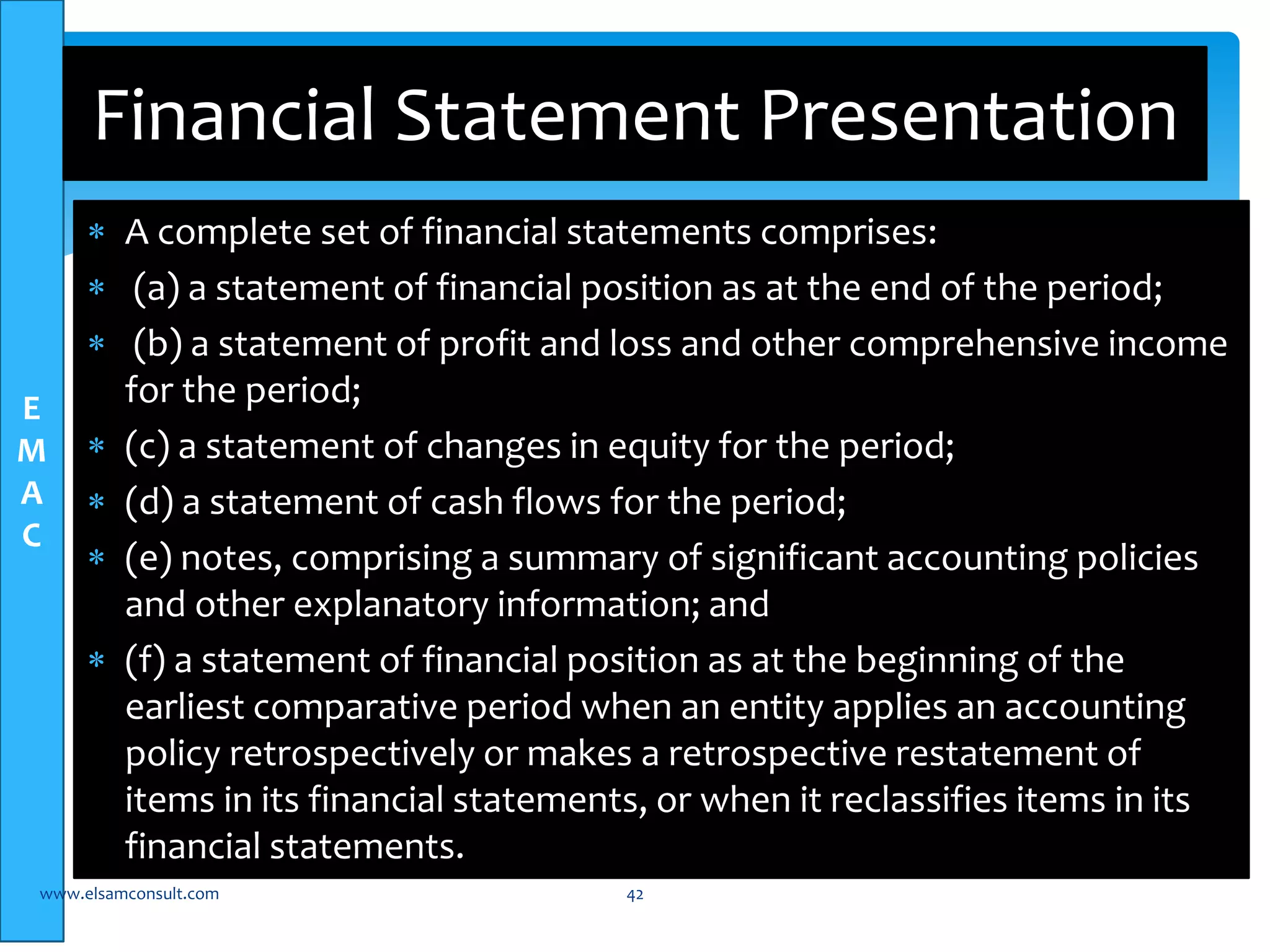

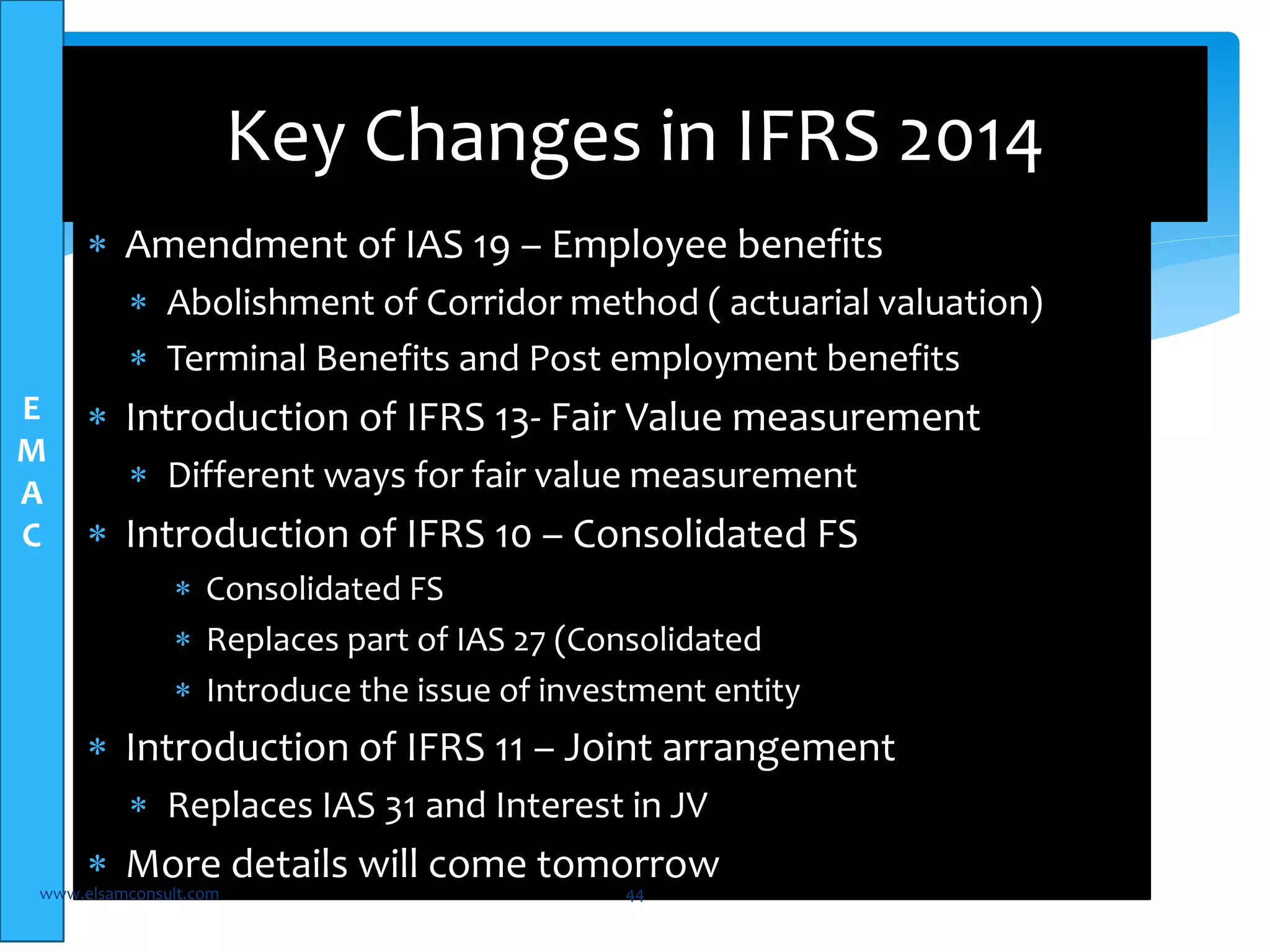

The document outlines the structure and objectives of a training program on International Financial Reporting Standards (IFRS) conducted by Elsam Management Consultants (EMAC). It includes a detailed schedule of topics to be covered over five days, ranging from an overview of IFRS to specific standards and principles related to financial statements. EMAC emphasizes the importance of a global framework for financial reporting and the convergence of different Generally Accepted Accounting Principles (GAAPs).