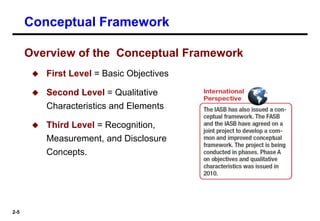

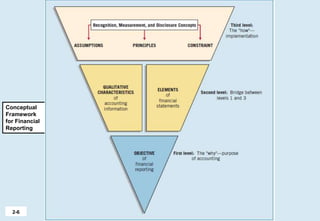

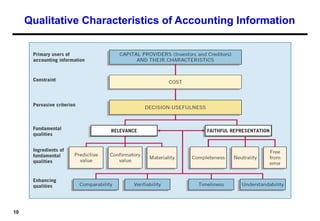

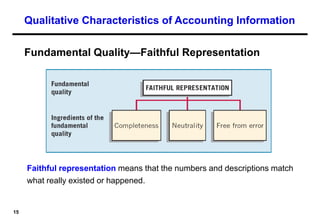

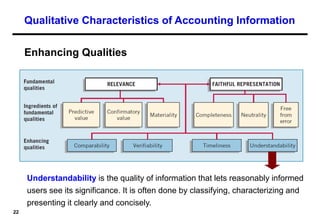

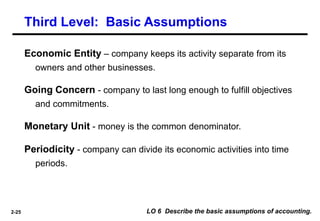

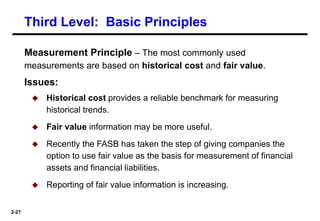

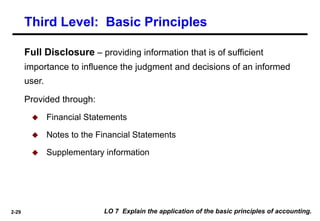

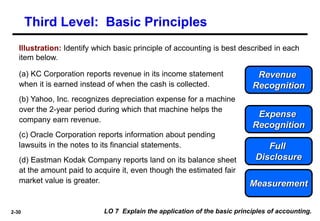

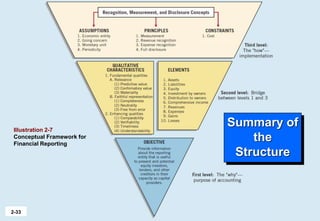

The conceptual framework provides the theoretical foundation for financial reporting standards. It establishes key concepts such as qualitative characteristics of useful financial information, elements of the financial statements, and basic assumptions and principles of accounting. The framework is structured in three levels: objectives and qualitative characteristics, basic elements, and underlying assumptions and principles. It aims to provide coherence and guidance in setting accounting standards and solving emerging financial reporting issues.