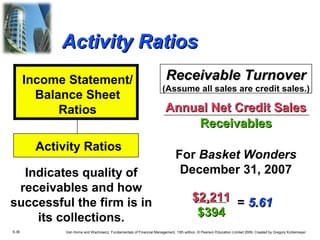

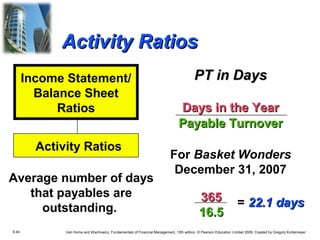

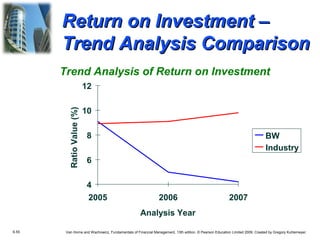

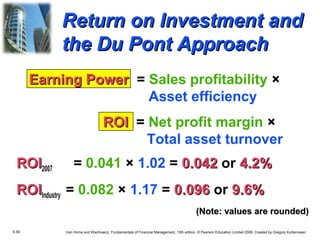

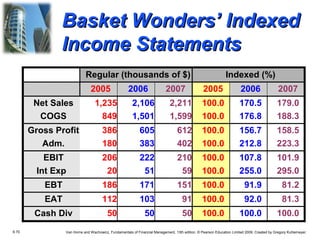

This document provides an overview of financial statement analysis and ratios. It begins with learning objectives for Chapter 6, which cover understanding basic financial statements, convergence in accounting standards, importance of analysis, calculating and interpreting key ratios, operating and cash cycles, using ratios to assess firm health, DuPont analysis, limitations of ratios, and trend/common-size/index analysis. The document then presents frameworks for analyzing a firm's funding needs, financial condition/profitability, and business risk to determine financing needs. It provides examples of key ratios to evaluate liquidity, financial leverage, and compares the firm's ratios to industry averages.