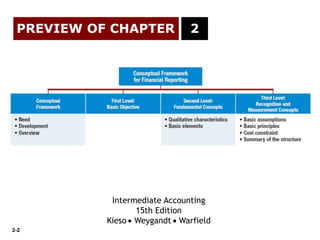

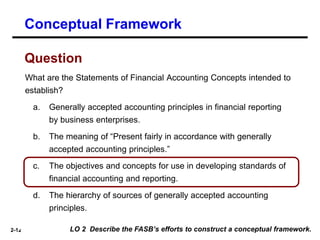

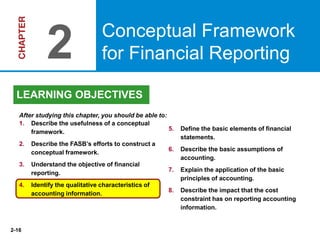

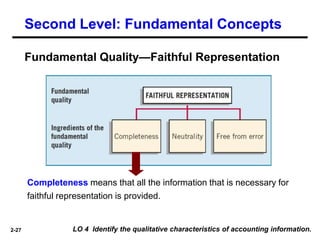

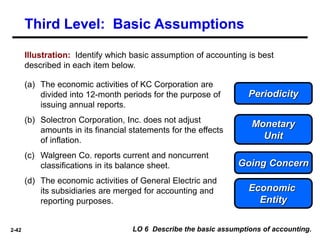

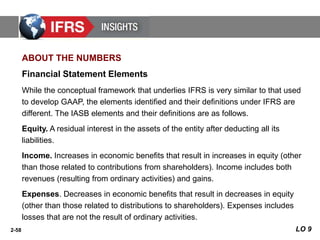

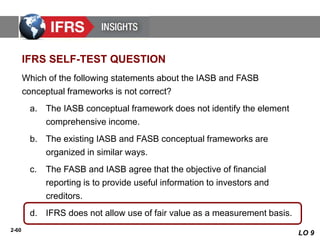

The document discusses the importance of a conceptual framework for financial reporting, emphasizing its role in establishing consistent standards and addressing emerging accounting issues. It outlines the Financial Accounting Standards Board's (FASB) efforts to develop this framework, detailing the objectives of financial reporting and the qualitative characteristics of accounting information. The text also covers basic accounting principles, assumptions, and the elements of financial statements, providing learning objectives for understanding these concepts.