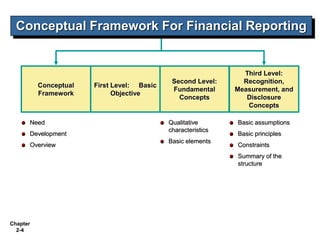

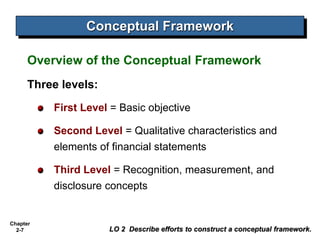

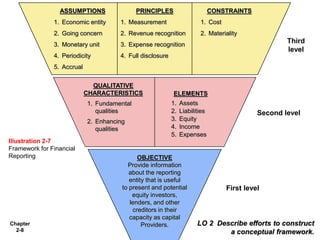

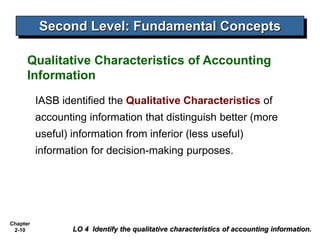

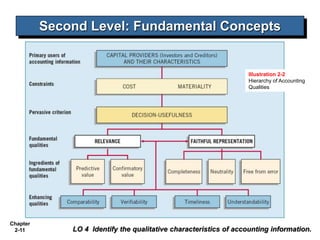

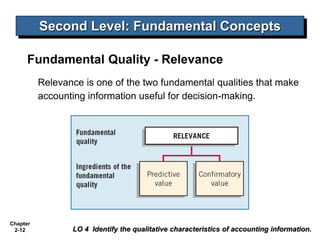

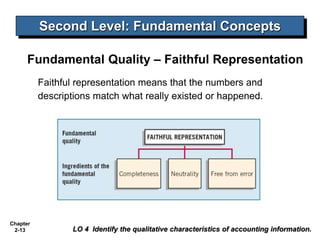

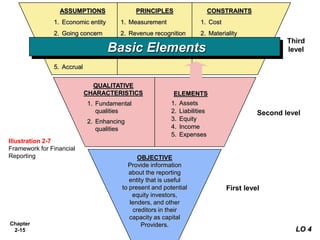

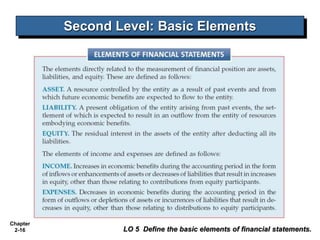

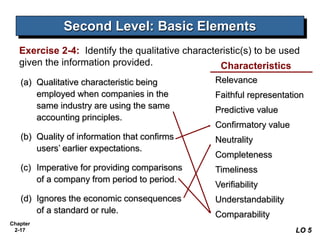

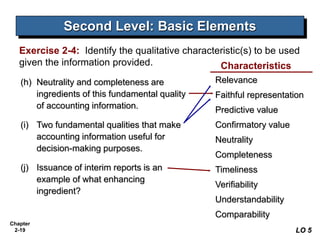

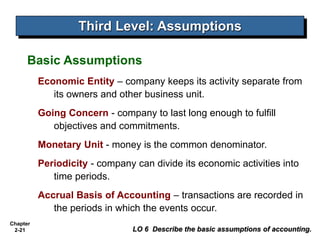

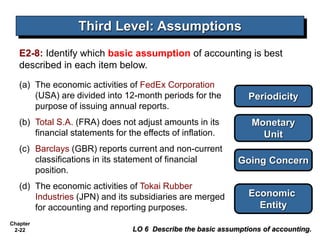

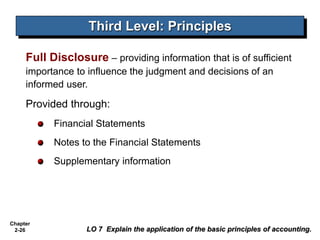

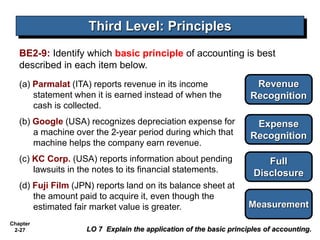

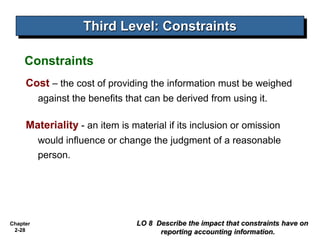

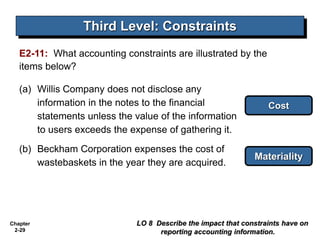

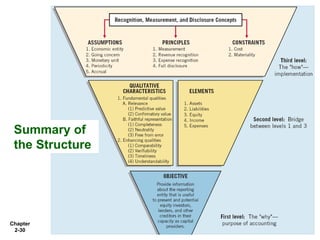

The conceptual framework establishes fundamental concepts that guide standard-setting and financial reporting more broadly. It is being jointly developed by the IASB and FASB and consists of three levels: the objective of financial reporting, qualitative characteristics, and specific concepts. The objective is to provide useful information to capital providers. Key qualitative characteristics include relevance and faithful representation. The framework also outlines basic elements, assumptions, principles, and constraints that guide accounting practices. It aims to create consistency and coherence in financial reporting standards over time.