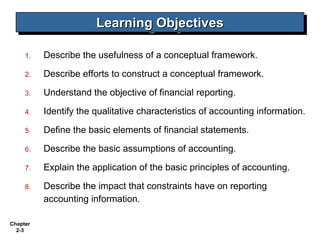

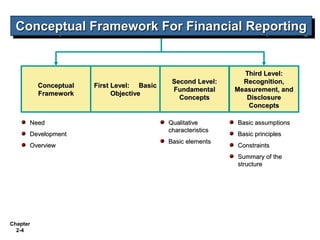

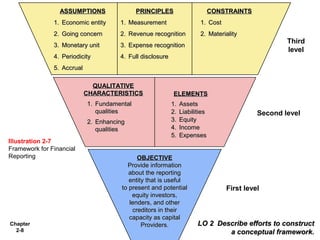

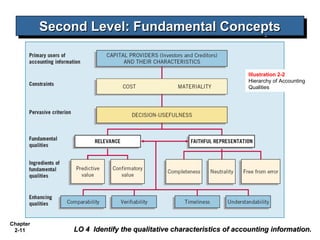

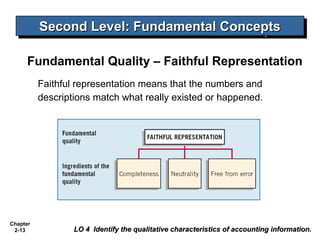

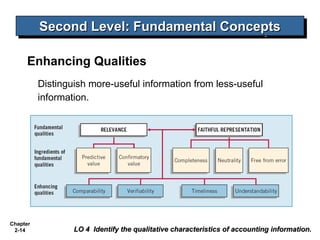

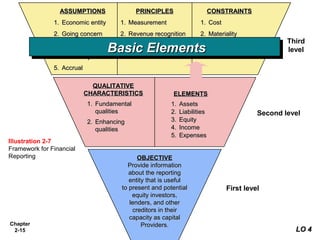

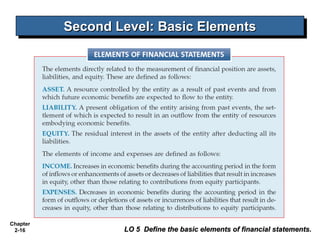

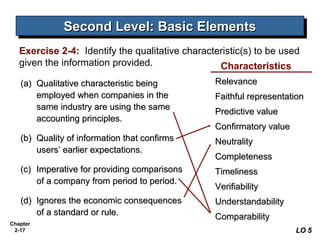

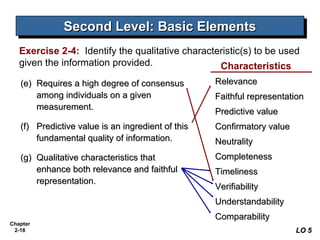

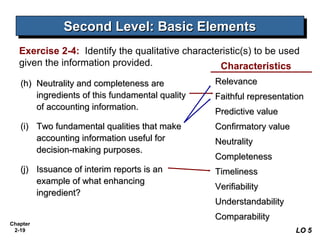

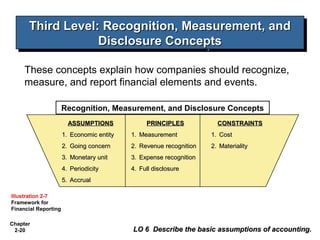

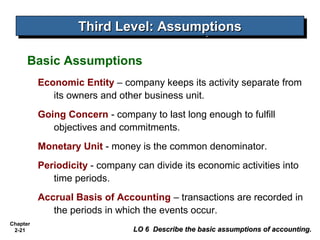

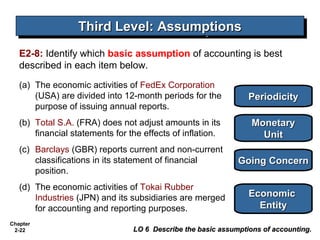

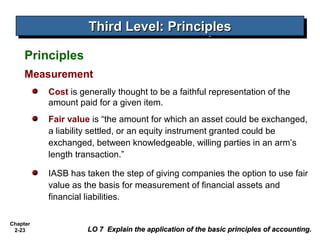

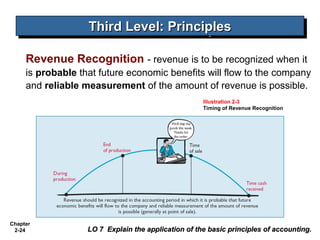

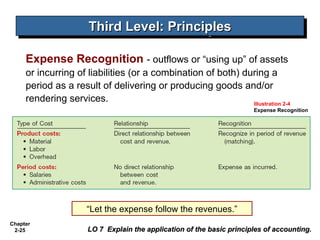

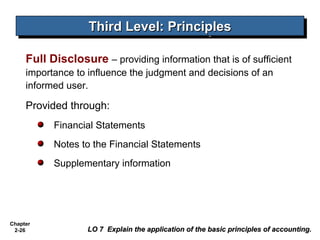

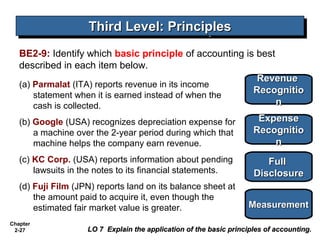

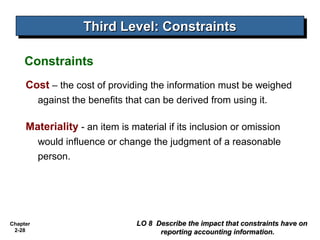

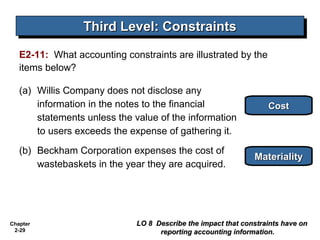

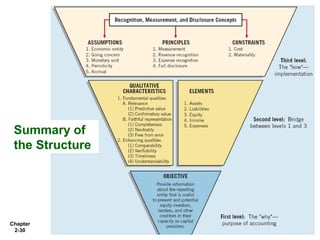

The document provides an overview of the conceptual framework for financial reporting. It describes the three levels of the conceptual framework: the basic objective of financial reporting, the fundamental concepts including qualitative characteristics and basic elements, and the recognition, measurement, and disclosure concepts including assumptions, principles, and constraints. It also discusses the need for a conceptual framework, efforts to develop a joint conceptual framework between the IASB and FASB, and key aspects of the conceptual framework such as the objective of financial reporting, qualitative characteristics, basic elements, assumptions, principles, and constraints.