This document provides an overview of securitization, including:

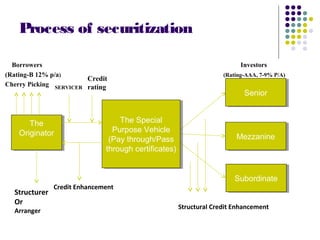

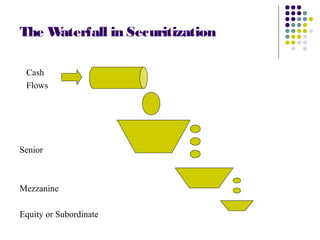

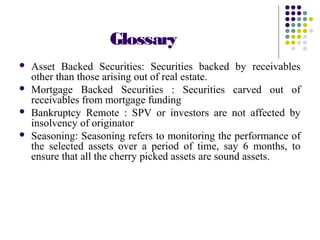

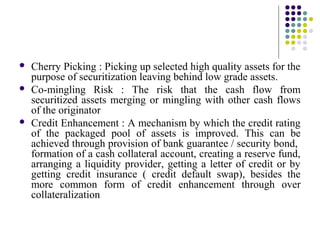

- Securitization is the process of converting illiquid assets into liquid assets by pooling them and selling securities backed by the pooled assets.

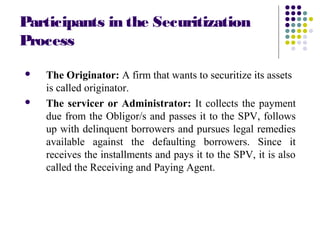

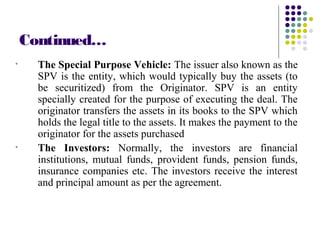

- The key participants are originators, special purpose vehicles, investors, and servicers. Assets like mortgages, credit cards, auto loans can be securitized.

- Benefits include off-balance sheet financing for originators and returns for investors. Risks include collateral, structural, legal, and third party risks.

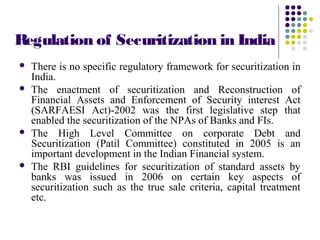

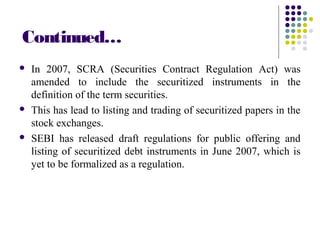

- India has taken steps to regulate securitization but lacks a comprehensive framework and standardization.