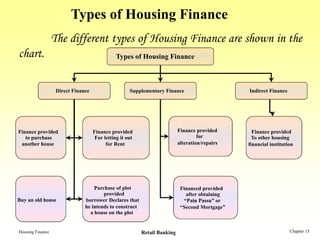

The document discusses housing finance. It describes the different types of housing finance like direct finance, supplementary finance, and indirect finance. It discusses the purpose, quantum, eligibility, and terms of housing loans. Housing loans are typically provided for purchasing or building a house. The loan amount usually ranges from Rs. 100,000 to Rs. 2 crores. Individuals over 18 with sufficient income are eligible, and loans are typically repaid over 15-25 years. Housing loans have a margin of 80-85% of the property cost and are secured by a mortgage on the property. Interest rates can be fixed or floating.