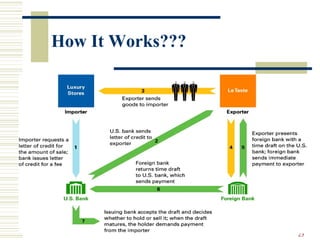

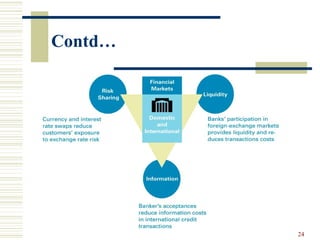

International banking involves banks conducting financial transactions that cross national borders. It provides services like trade financing, foreign exchange, and investment banking to clients engaged in international business. There are various types of international banking offices including correspondent banks, foreign branches, and offshore banking centers. Major reasons for international banking include gaining access to new markets for growth, taking advantage of regulatory differences between countries, and following multinational clients abroad. The largest risks international banks face come from currency fluctuations, issues in foreign economies, and credit risks from international loans.