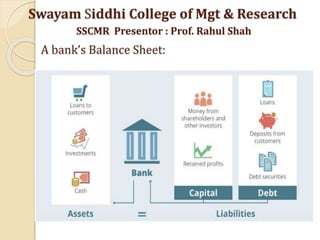

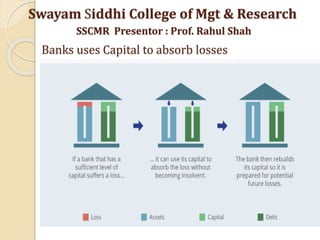

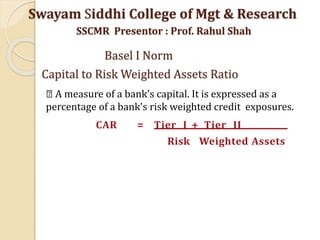

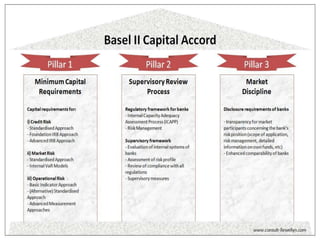

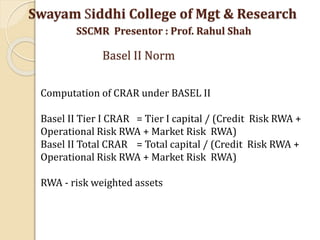

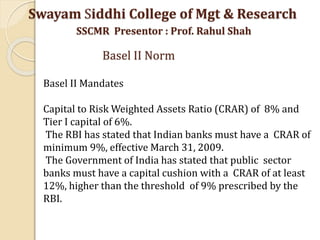

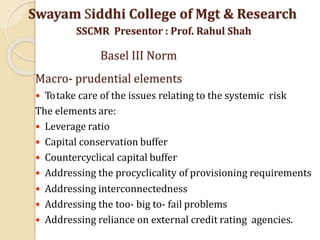

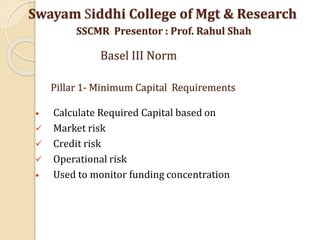

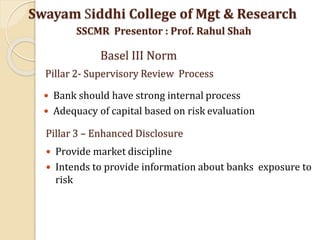

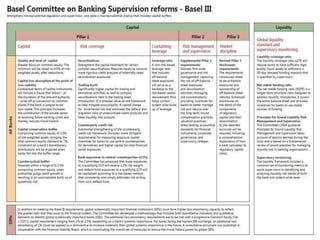

The document discusses capital adequacy norms for banks. It explains that capital acts as a cushion for banks against losses from risks like credit, market, and liquidity risks. The amount of capital a bank needs depends on the risks it takes and is assessed by regulators. There are two tiers of capital - Tier 1 includes equity and reserves, while Tier 2 includes provisions, revaluation reserves, and subordinated debt. The Basel Committee on Banking Supervision issues guidelines on capital adequacy requirements to help banks manage risks.