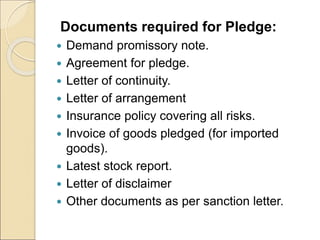

The document discusses various modes of charging security, including lien, pledge, hypothecation, and mortgage, outlining their characteristics and requirements. It explains that a lien allows retention of goods until debts are repaid, while a pledge involves delivery of goods as security for debt, and hypothecation allows an equitable charge without possession. Furthermore, it describes the essentials of a pledge, necessary documents, and details about liquid assets and their liquidity in financial contexts.