The document discusses asset-backed securitization, including:

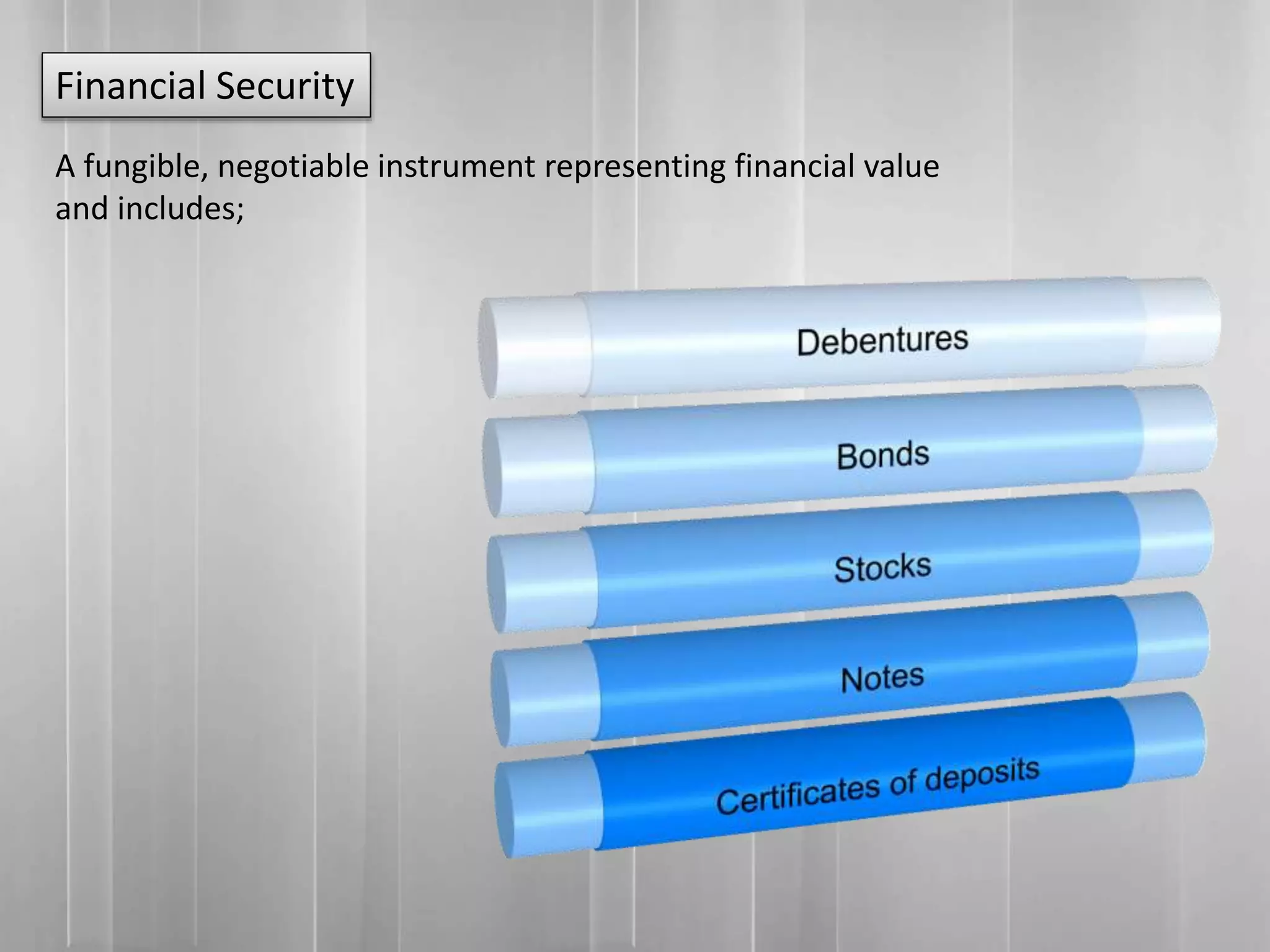

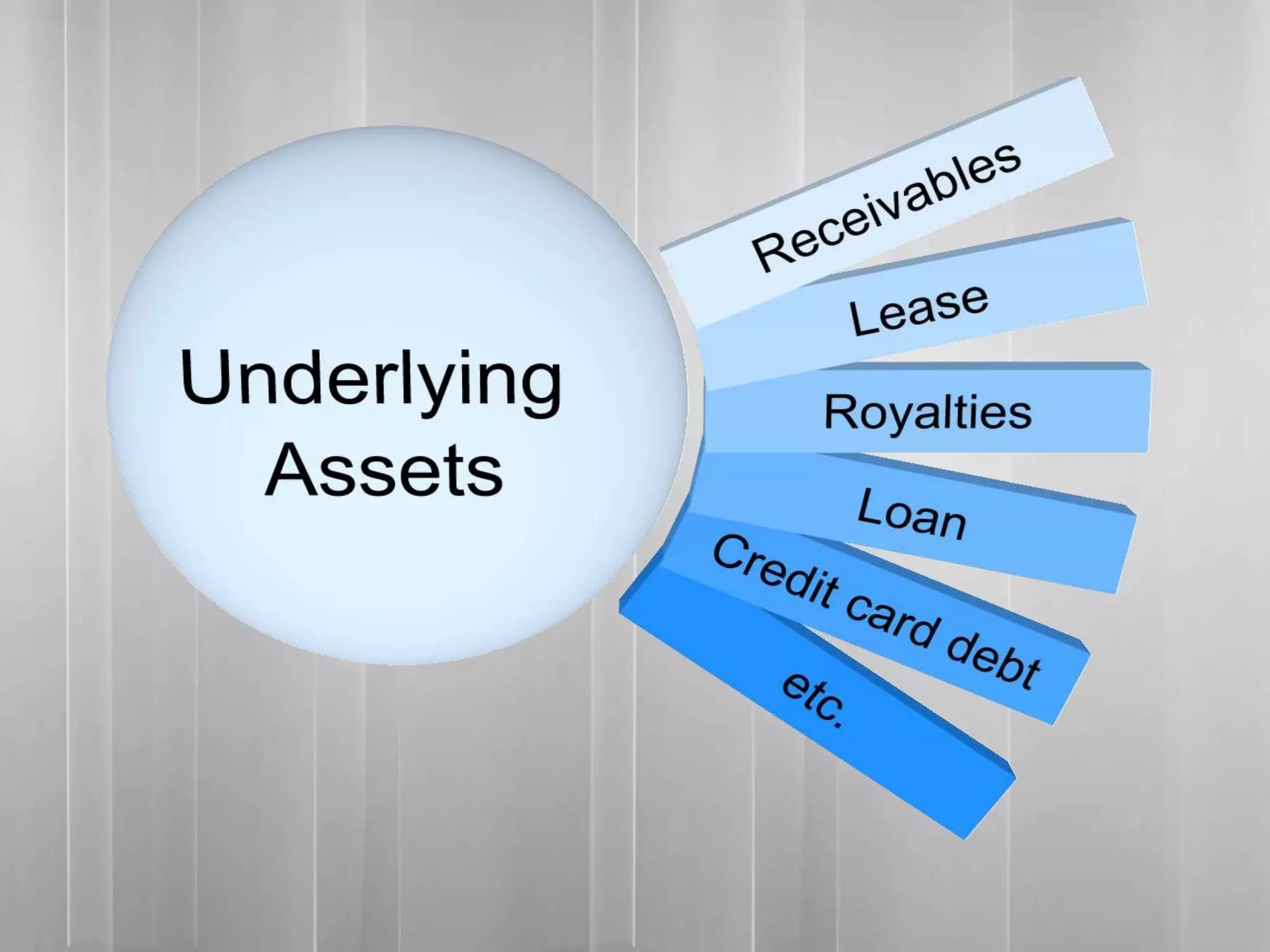

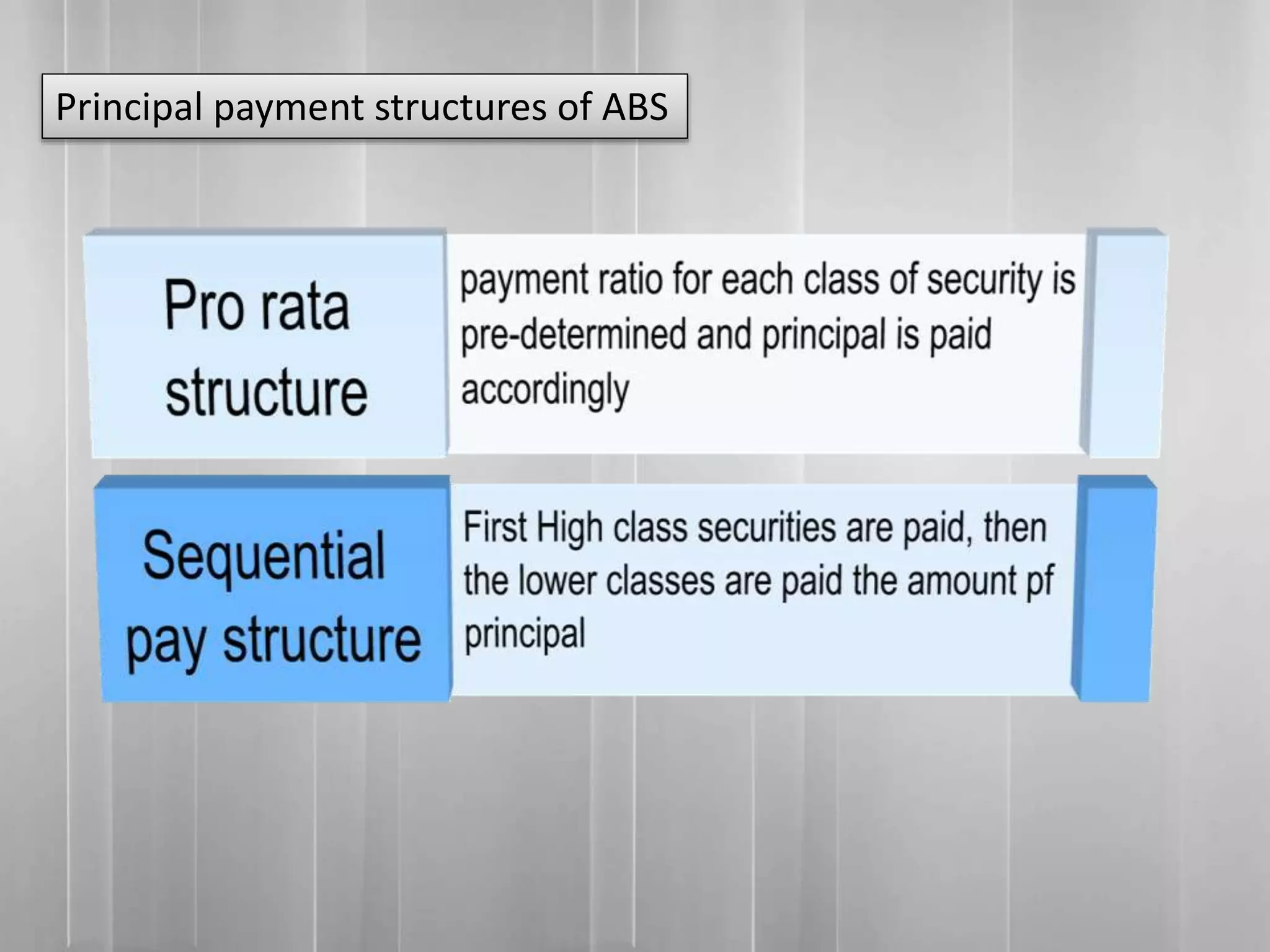

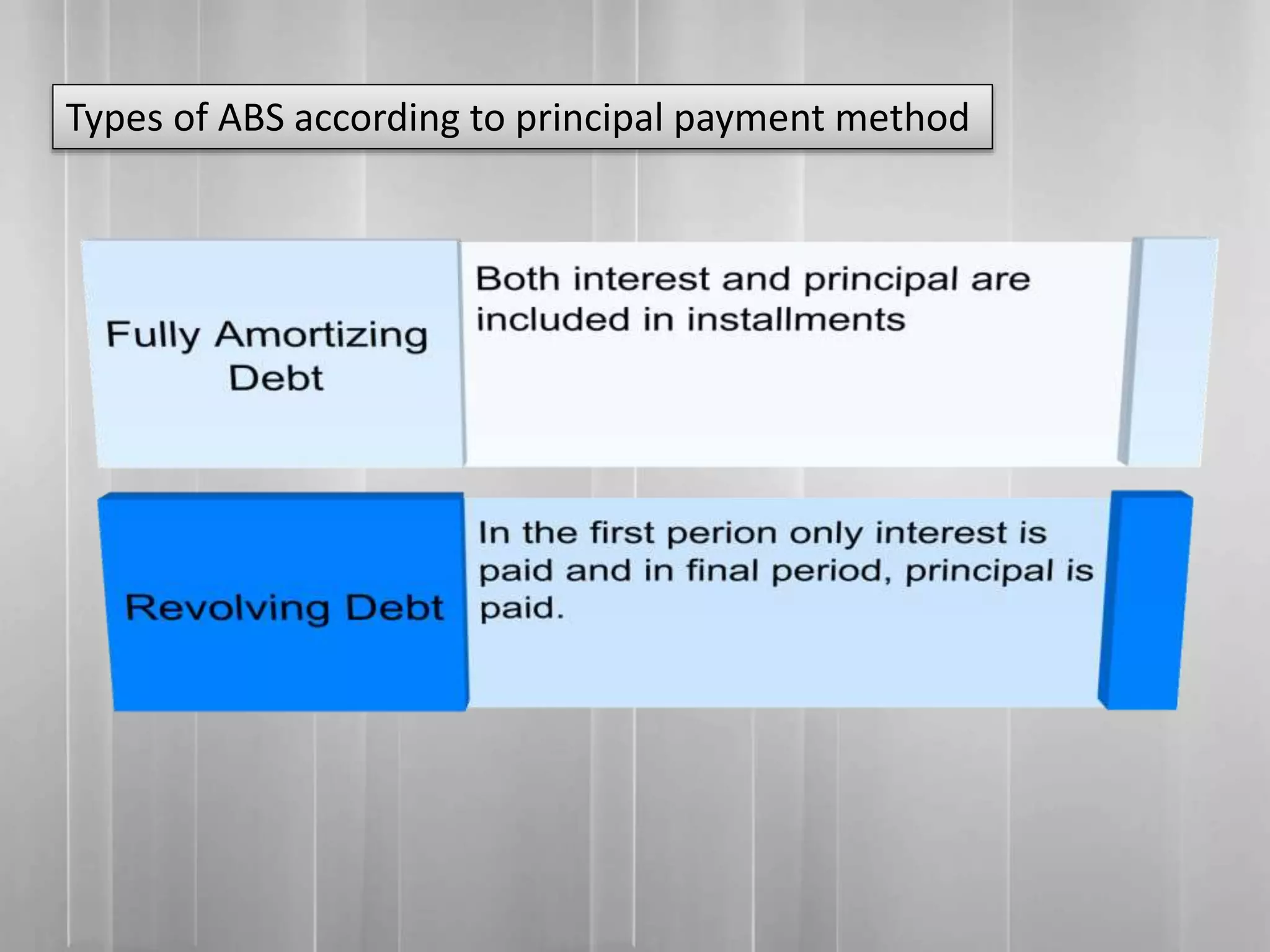

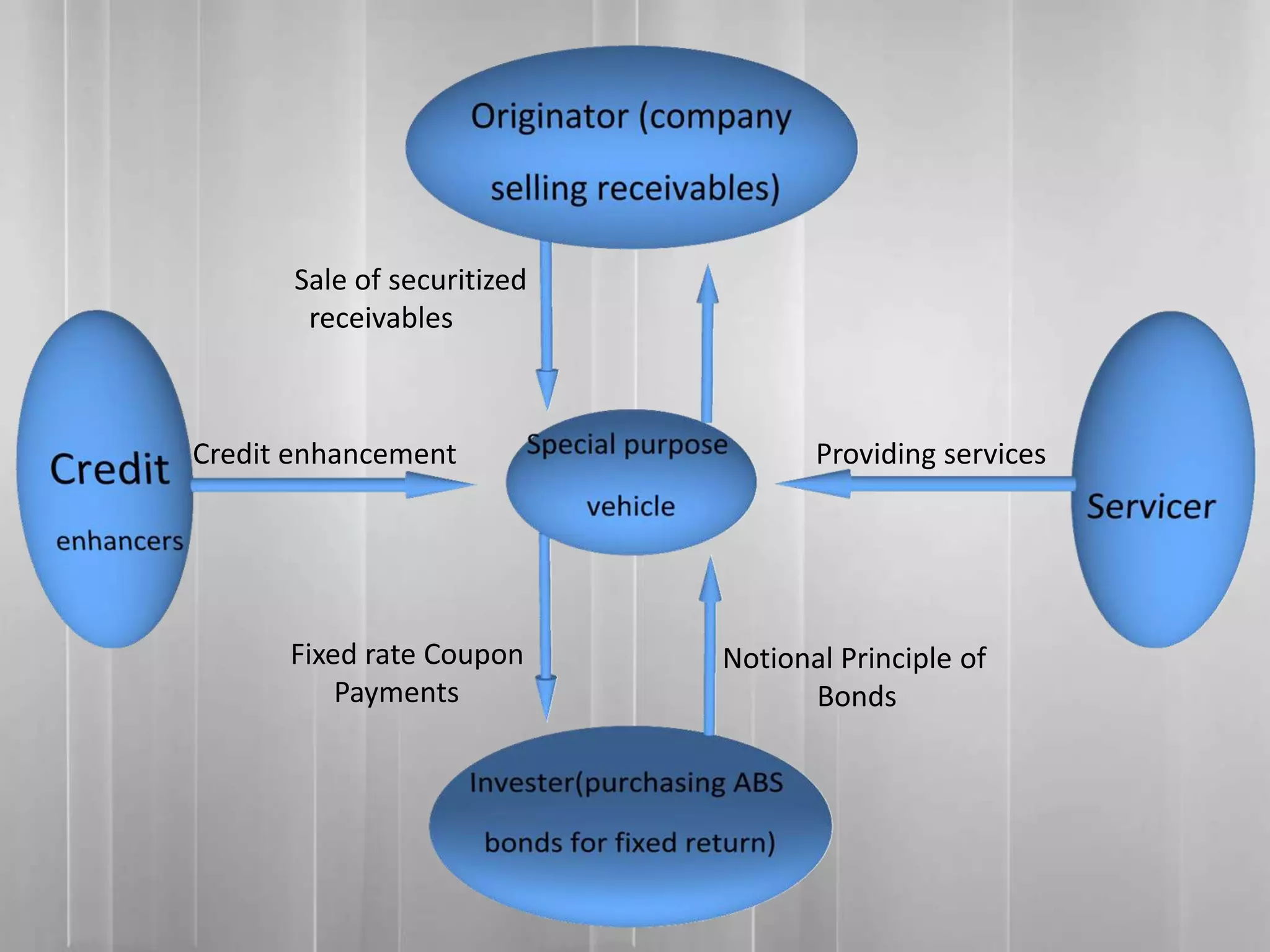

1) Asset-backed securities derive their value from pools of underlying assets like loans or receivables, and are issued by special purpose vehicles (SPVs).

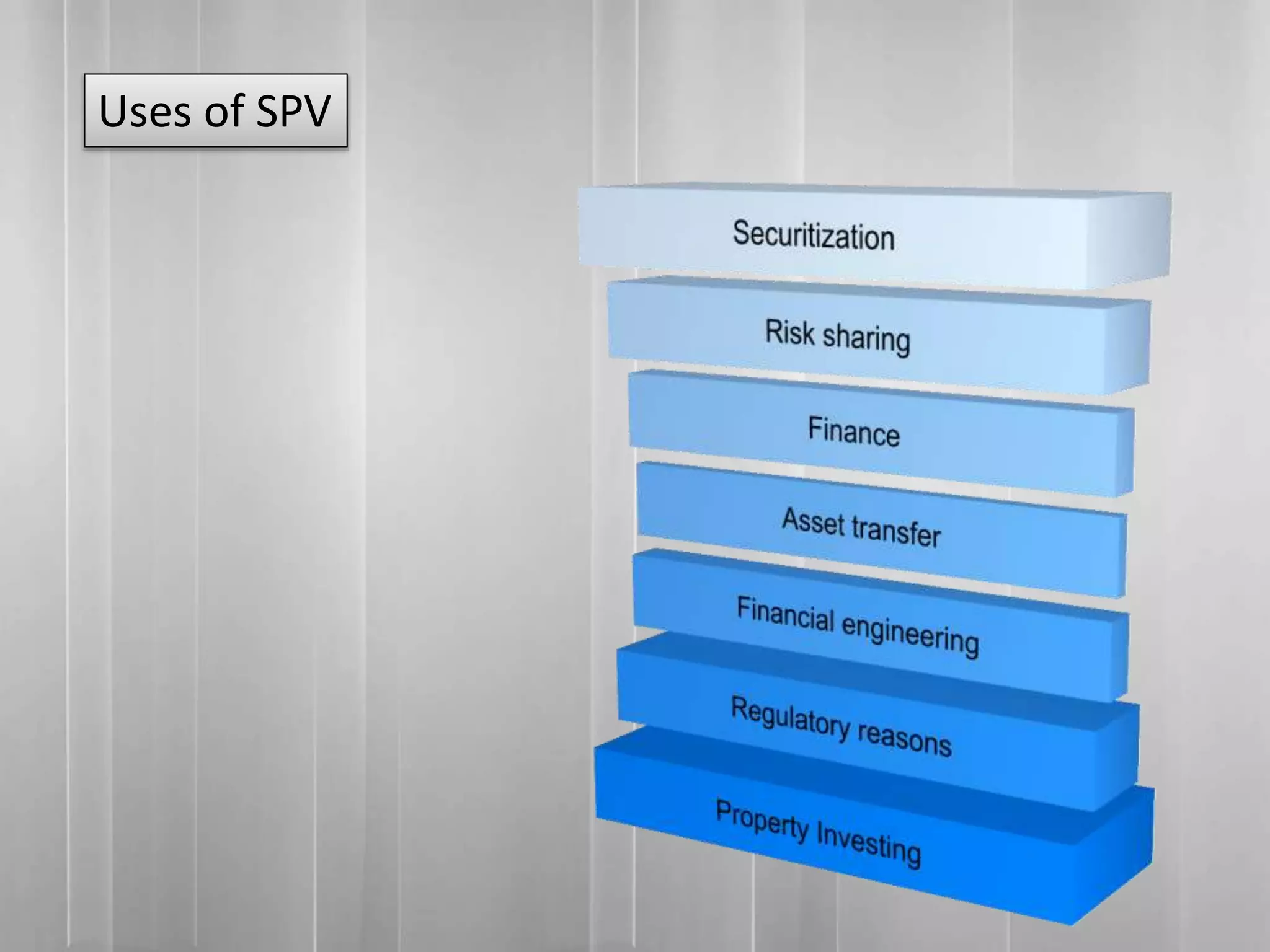

2) SPVs are entities created specifically for securitization and have strict characteristics like bankruptcy remoteness.

3) The US mortgage market is highly developed, with originators like banks securitizing mortgages through government-sponsored entities like Fannie Mae and Freddie Mac or private conduits.

4) Pakistani law establishes an regulatory framework for securitization, including registration of SPVs, eligibility criteria for promoters/directors, and obligations of SPVs in operating asset-backed programs.