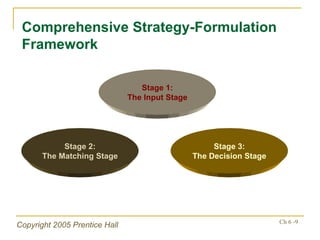

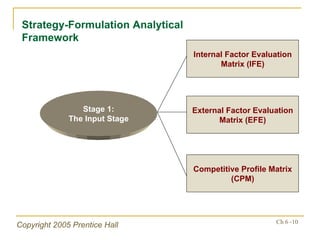

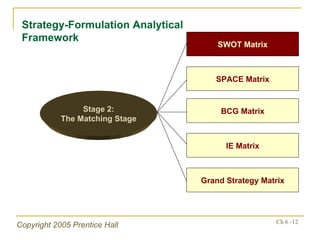

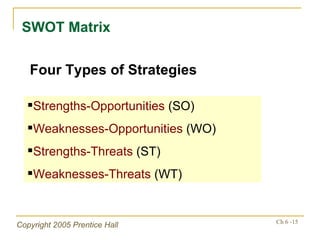

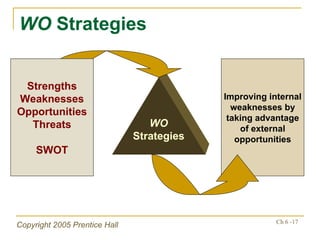

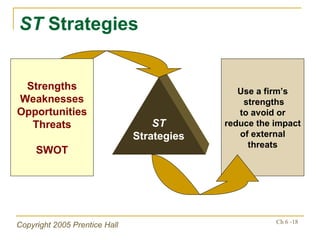

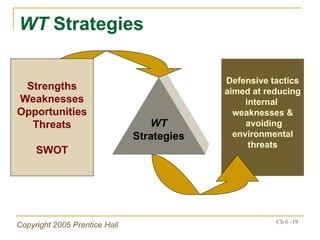

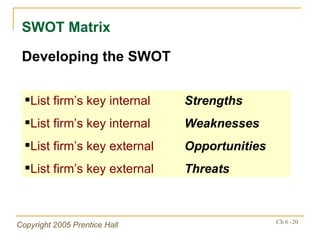

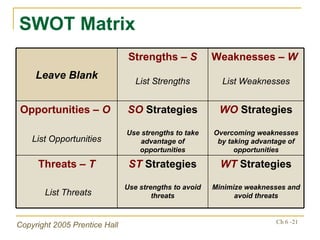

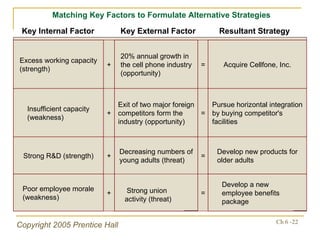

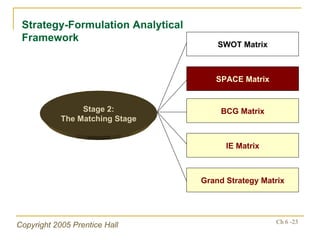

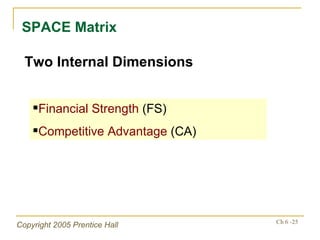

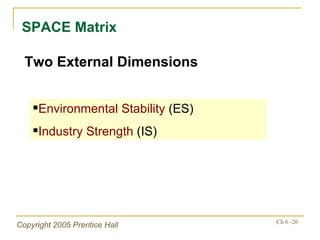

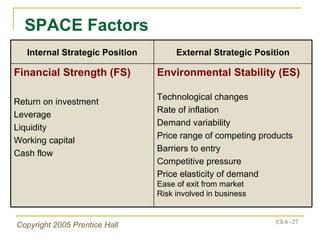

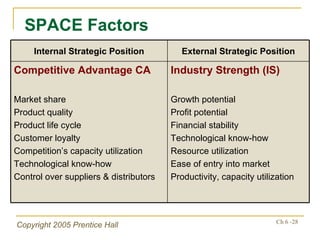

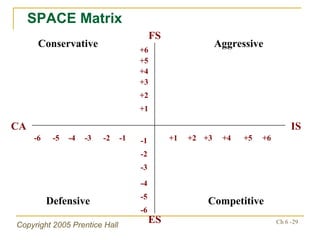

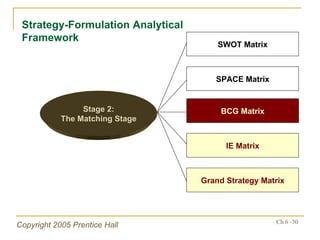

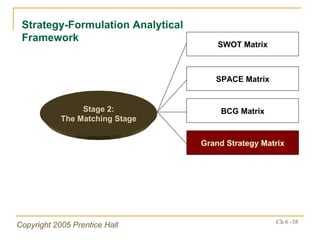

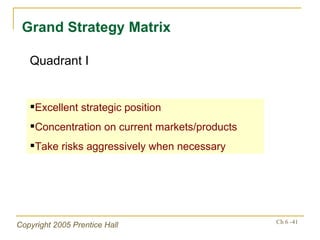

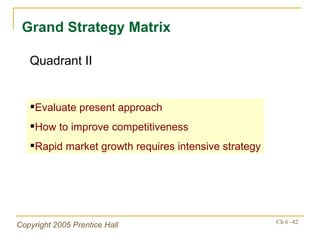

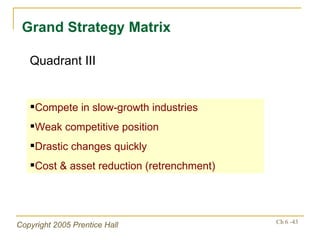

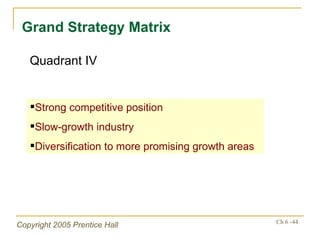

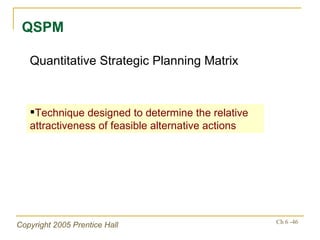

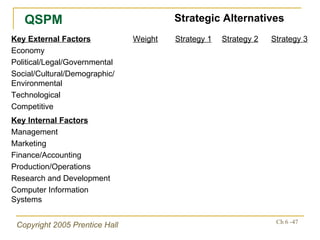

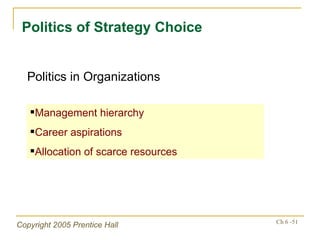

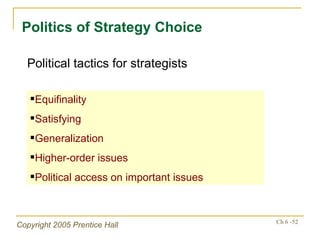

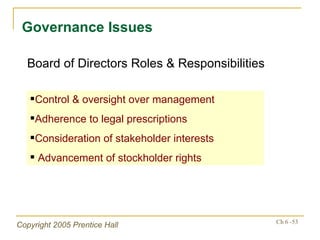

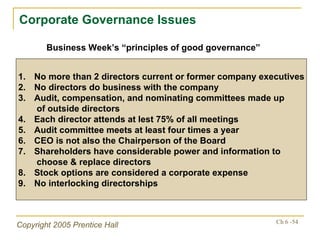

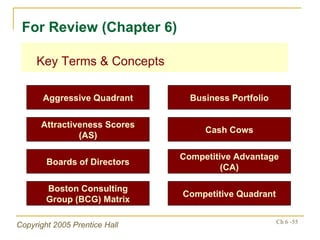

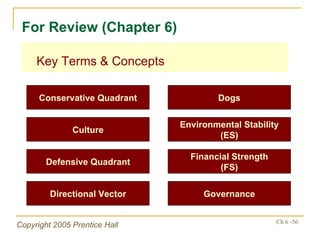

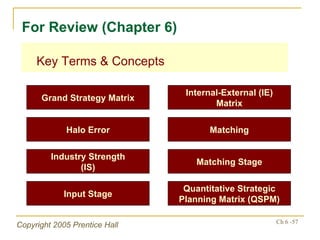

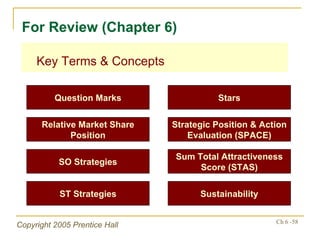

This document outlines the strategy formulation framework presented in Chapter 6 of the textbook. It discusses the 3 main stages of the framework: 1) The Input Stage which involves gathering internal/external data, 2) The Matching Stage which matches internal strengths/weaknesses to external opportunities/threats using tools like SWOT and SPACE matrices, and 3) The Decision Stage which uses tools like QSPM to evaluate alternative strategies. It also covers how organizational culture and politics can influence strategy choice.