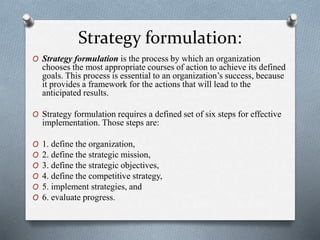

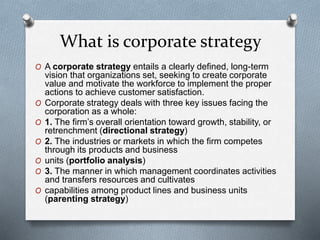

The document discusses various aspects of corporate strategy formulation. It defines corporate strategy as dealing with a company's overall growth orientation, portfolio of industries/markets, and coordination across business units. The key elements discussed include:

1. The 6 steps to effective strategy formulation: defining the organization, mission, objectives, competitive strategy, implementation, and evaluation.

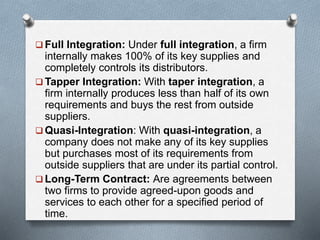

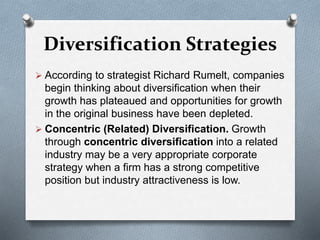

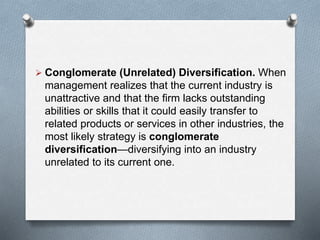

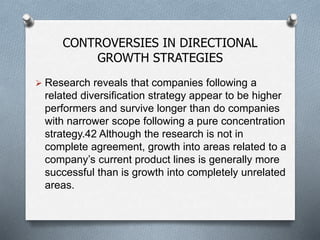

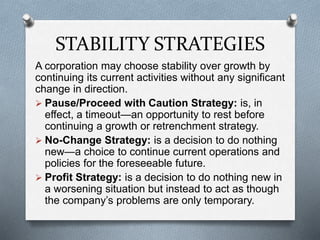

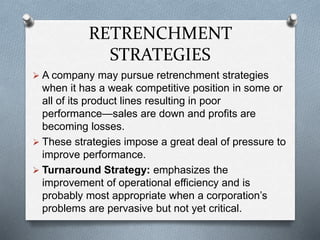

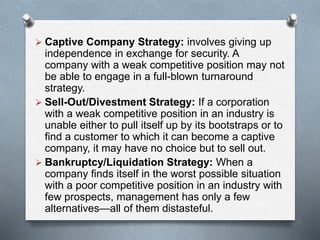

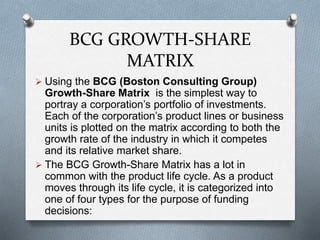

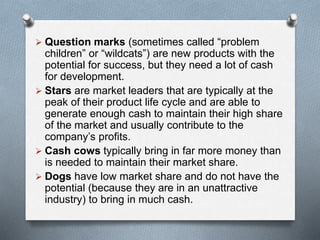

2. Types of directional strategies like growth, stability, and retrenchment and the concentrations, diversifications, and portfolio analysis used within them.

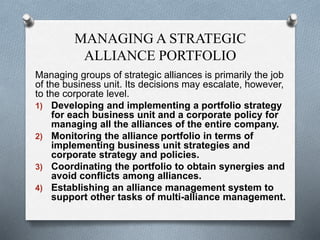

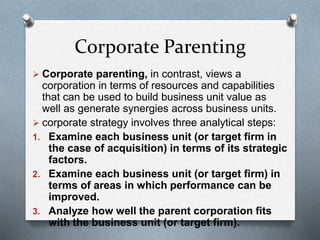

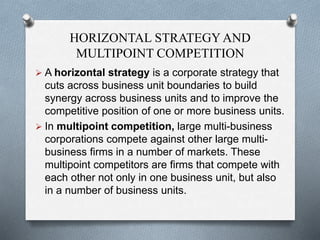

3. Methods for managing strategic alliances, business units, resources, and capabilities across a corporation.