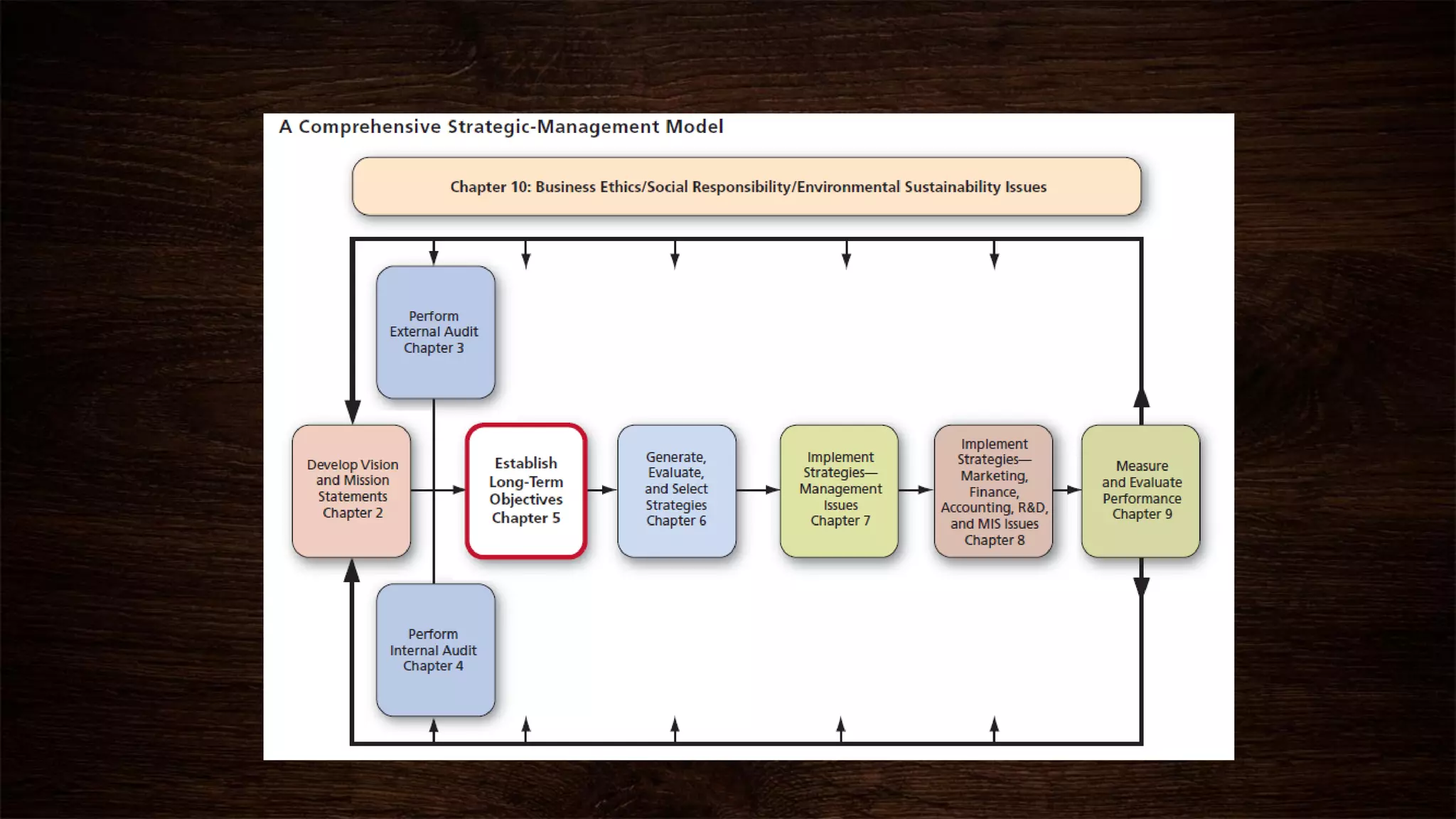

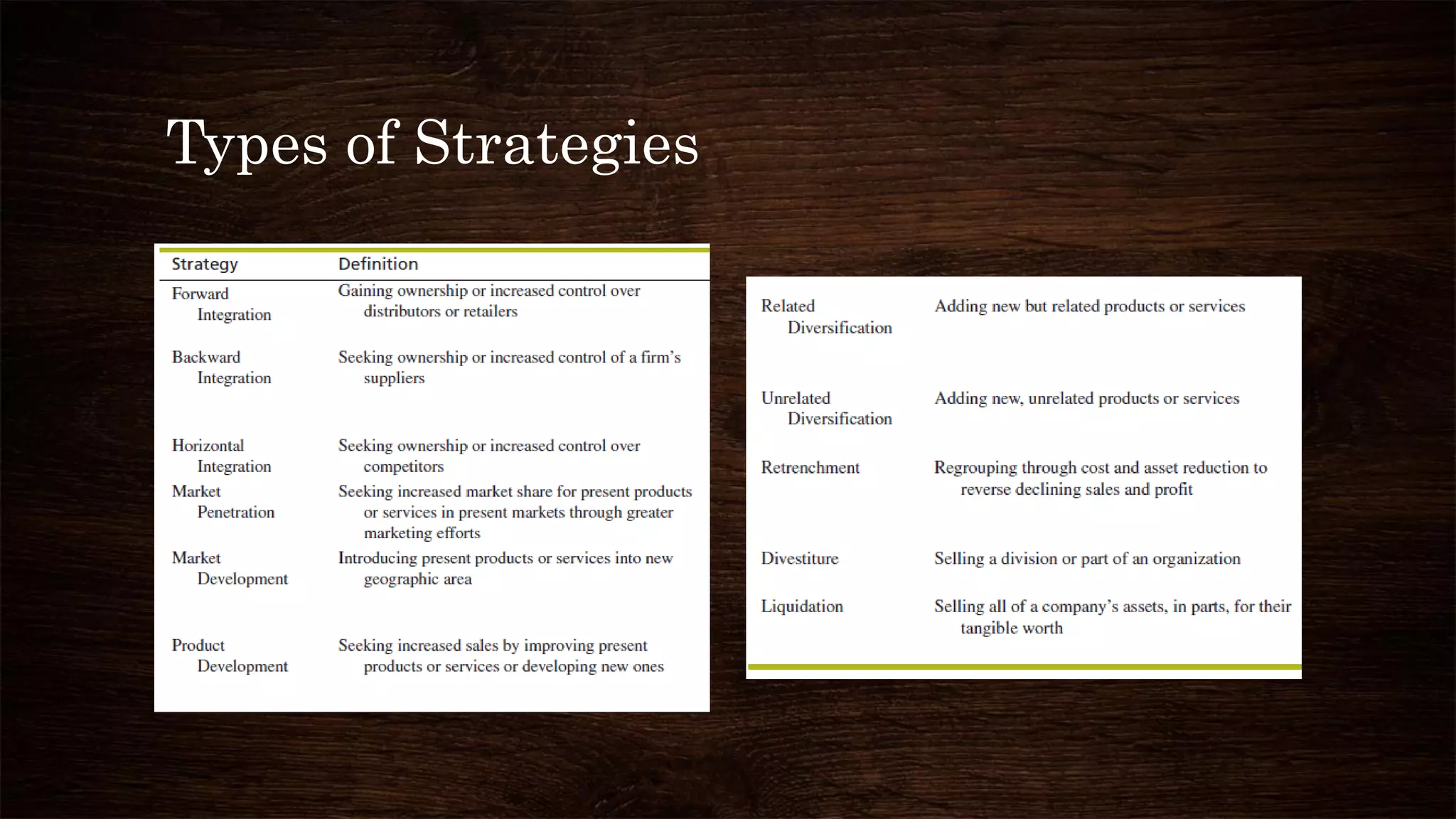

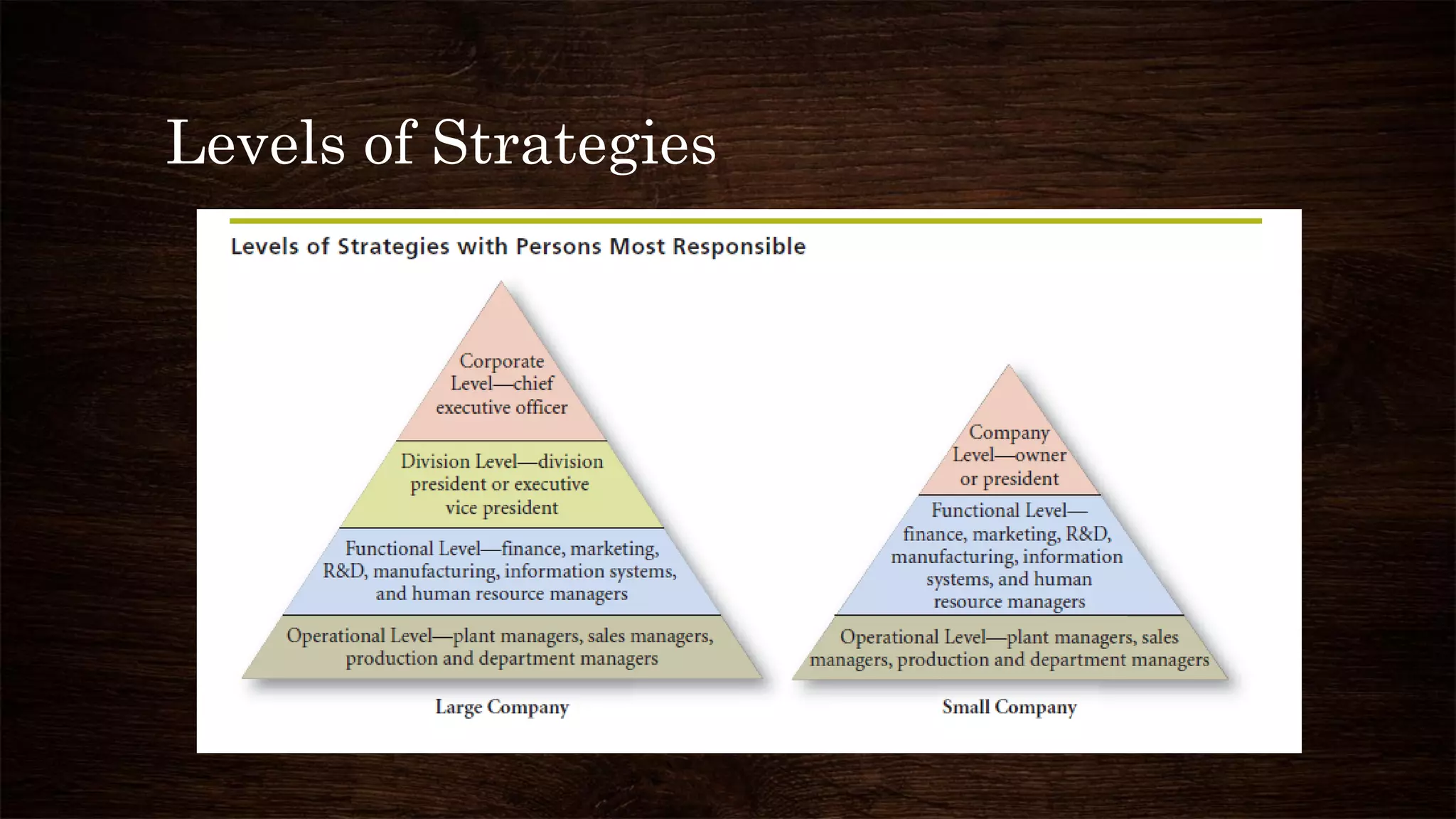

Long-term objectives and strategies provide direction for organizations over 2-5 years. Objectives should be measurable, realistic, and obtainable. They provide benefits like consistent decision making, performance evaluation, and resource allocation. Objectives exist at the corporate, divisional, functional, and operational levels. Financial objectives focus on growth and profits while strategic objectives compare performance to competitors. Effective strategies include market penetration, product development, and vertical integration through controlling suppliers or distributors.