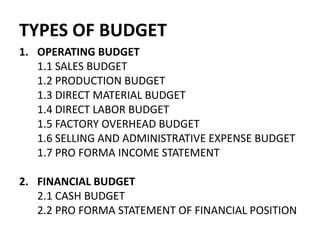

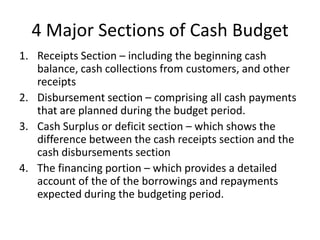

This document discusses various aspects of financial forecasting and budgeting for a business enterprise. It defines internal and external financing and outlines the steps to project financing needs. The percent-of-sales method is described as the most widely used for projecting financing needs by estimating expenses, assets, and liabilities as a percent of sales. Types of budgets are defined, including operating, financial, sales, production, materials, labor, overhead, and cash budgets. Formulas for calculating various budget items are provided.