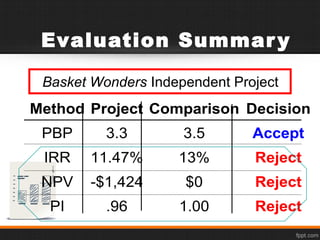

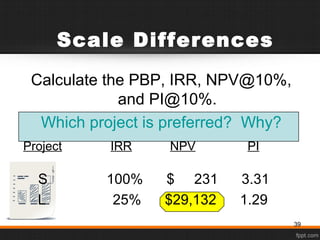

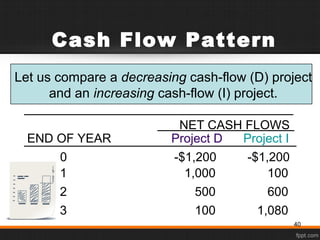

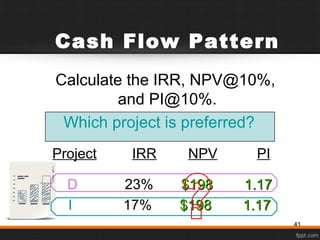

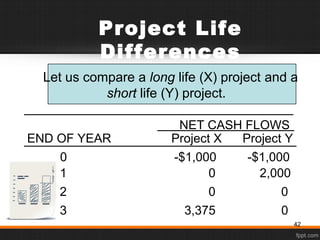

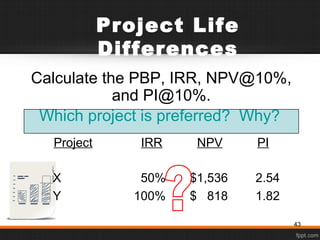

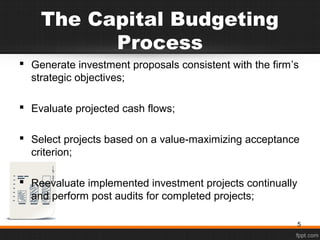

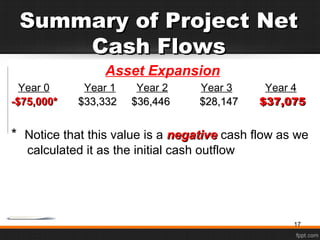

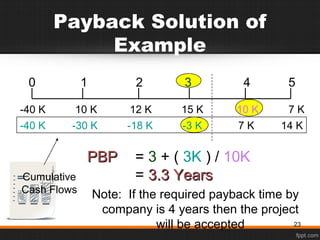

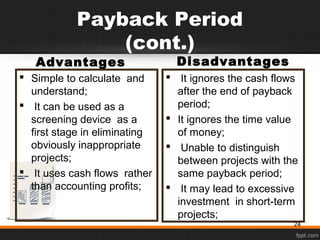

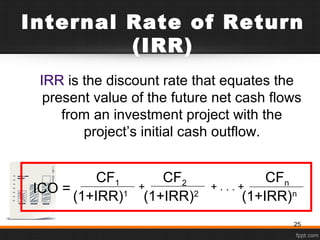

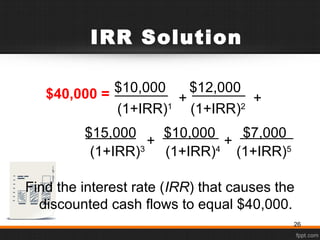

This document discusses various capital budgeting techniques used to evaluate investment projects. It defines capital budgeting as the process of identifying, analyzing and selecting long-term investment projects. The key techniques covered are payback period, internal rate of return (IRR), net present value (NPV) and profitability index (PI). For an example project with $10,000-$15,000 cash flows over 5 years and $40,000 initial cost, the document calculates the metrics and determines that the project should be rejected based on IRR, NPV and PI, though accepted by payback period. It also discusses how the techniques can provide contradictory results for mutually exclusive projects.

![IRR Acceptance

Criterion

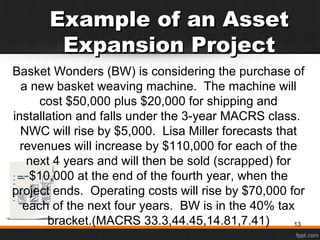

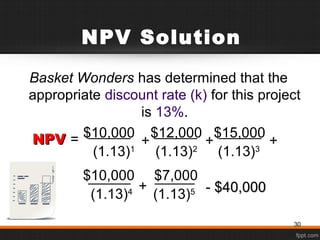

The management of Basket Wonders

has determined that the hurdle rate

is 13% for projects of this type.

Should the project be accepted?

No! The firm will receive 11.57% for

each dollar invested in this project at a

cost of 13%. [ IRR < Hurdle Rate ]

27](https://image.slidesharecdn.com/chapter8-160510103816/85/Chapter-8-Capital-Budgeting-Techniques-27-320.jpg)

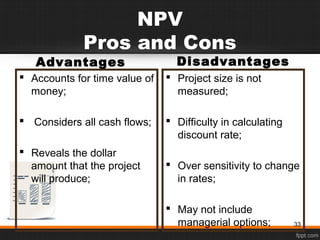

![NPV Acceptance

Criterion

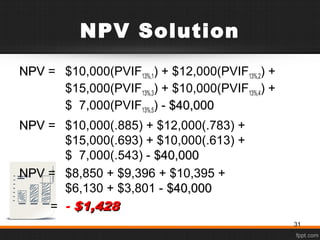

The management of Basket Wonders has

determined that the required rate is 13%

for projects of this type.

Should this project be accepted?

No! The NPV is negative. This means

that the project is reducing shareholder

wealth. [RejectReject as NPVNPV < 00 ]

32](https://image.slidesharecdn.com/chapter8-160510103816/85/Chapter-8-Capital-Budgeting-Techniques-32-320.jpg)

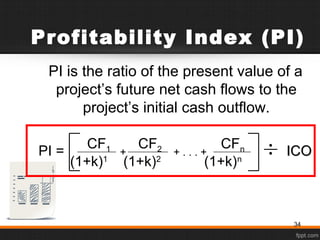

![PI Acceptance

Criterion

PIPI = $38,572 / $40,000

= .9643 (Method #1, 13-34)

Should this project be accepted?

No! The PIPI is less than 1.00. This

means that the project is not profitable.

[RejectReject as PIPI < 1.001.00 ]

35](https://image.slidesharecdn.com/chapter8-160510103816/85/Chapter-8-Capital-Budgeting-Techniques-35-320.jpg)