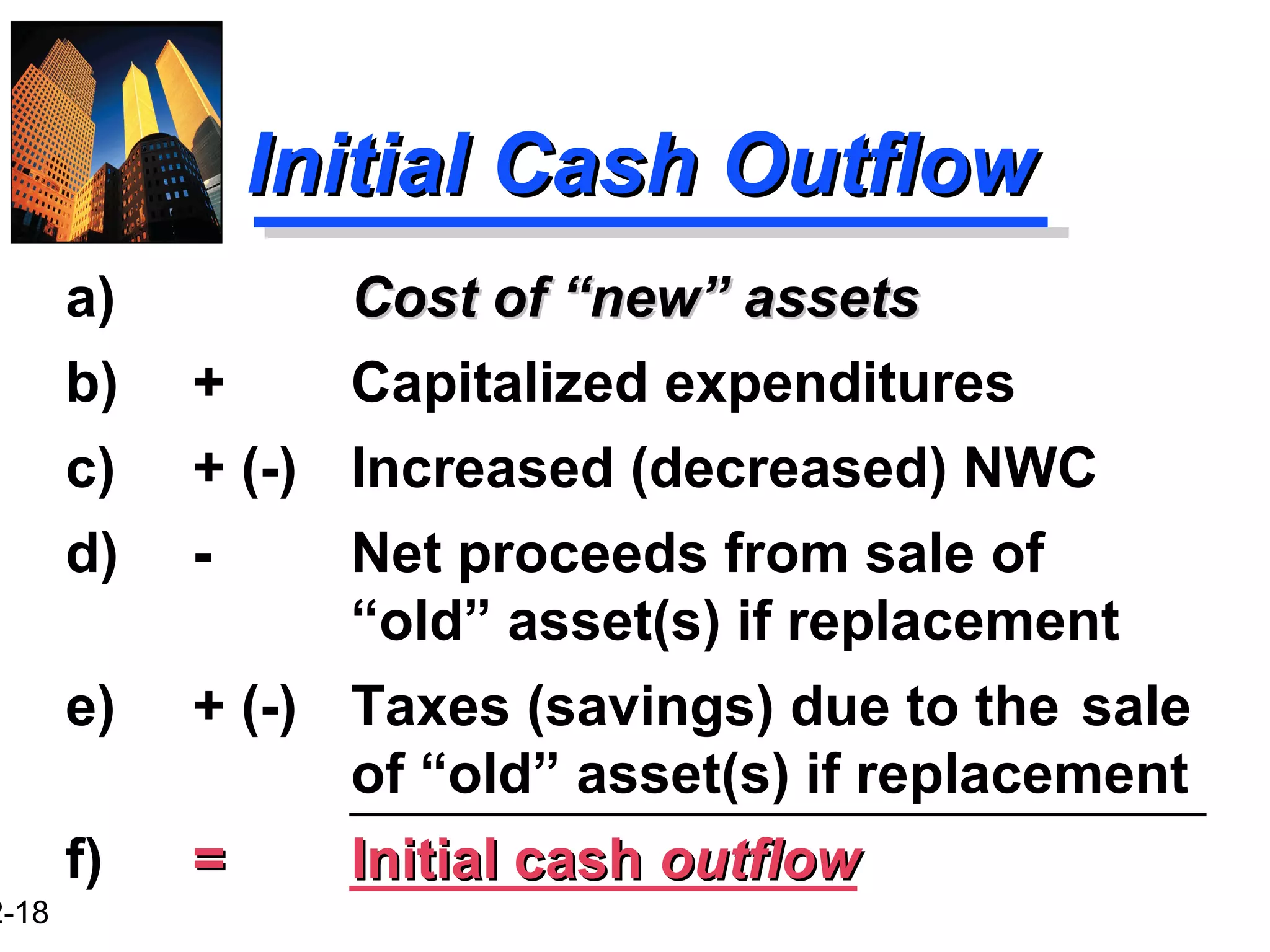

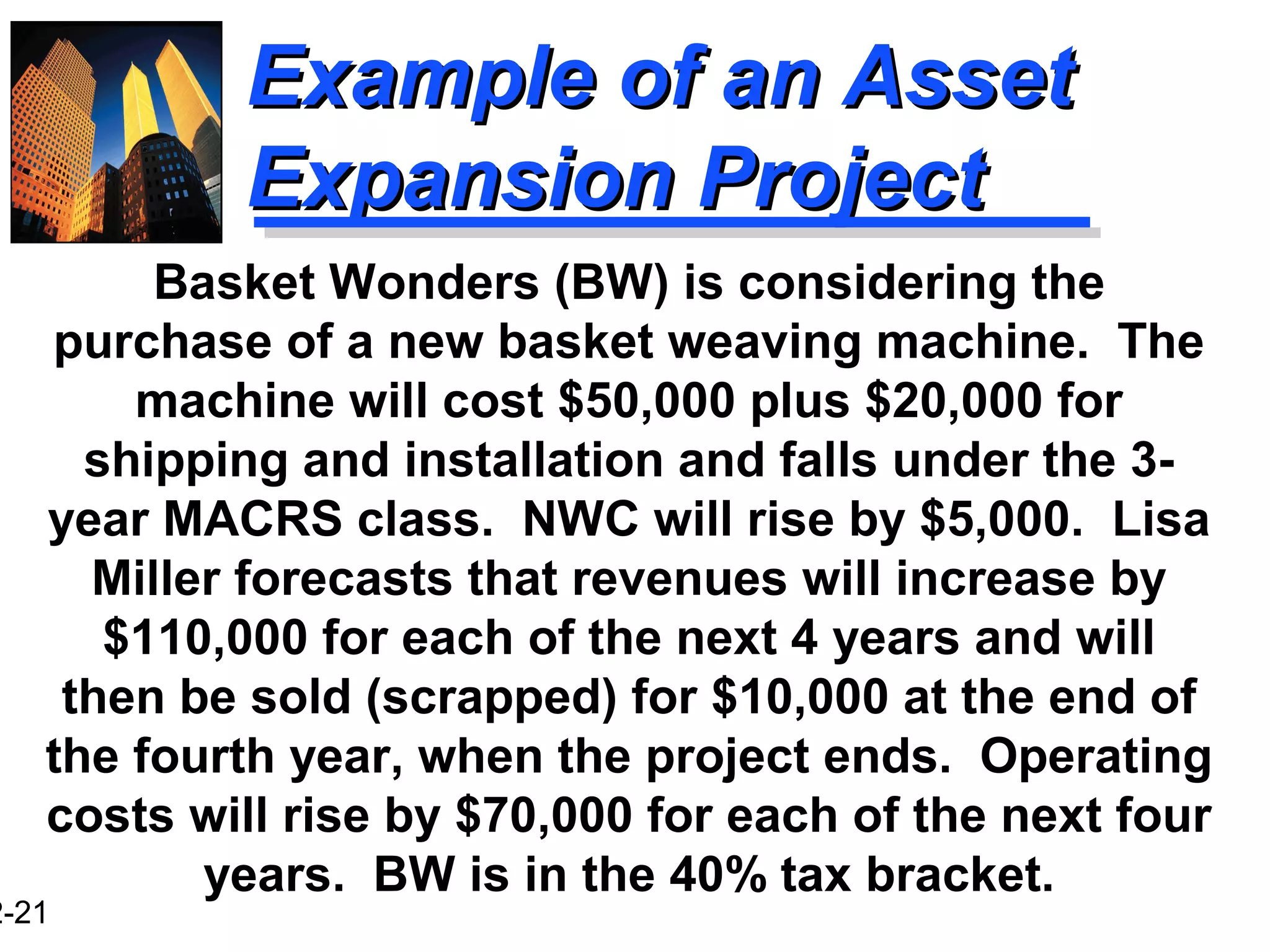

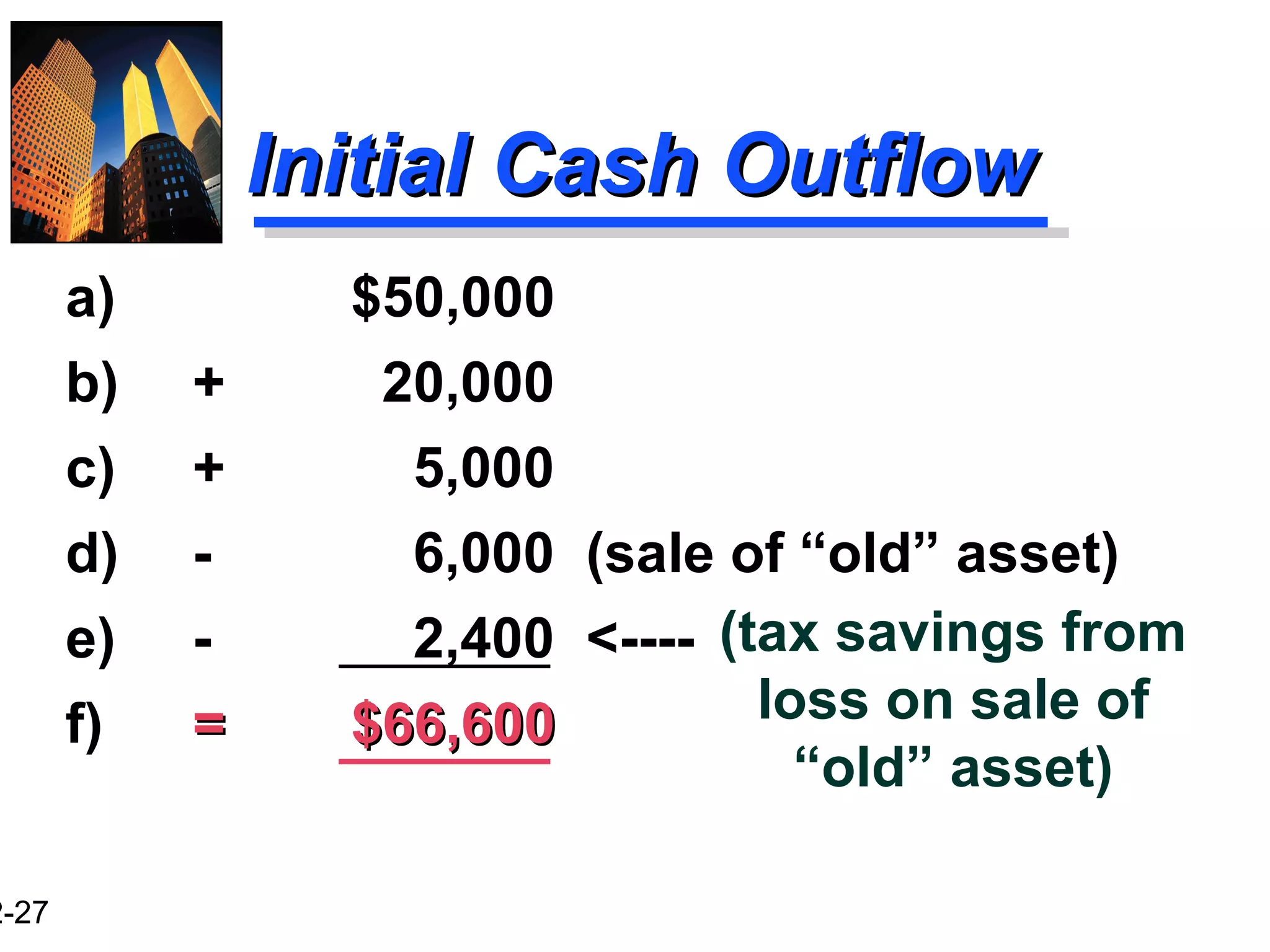

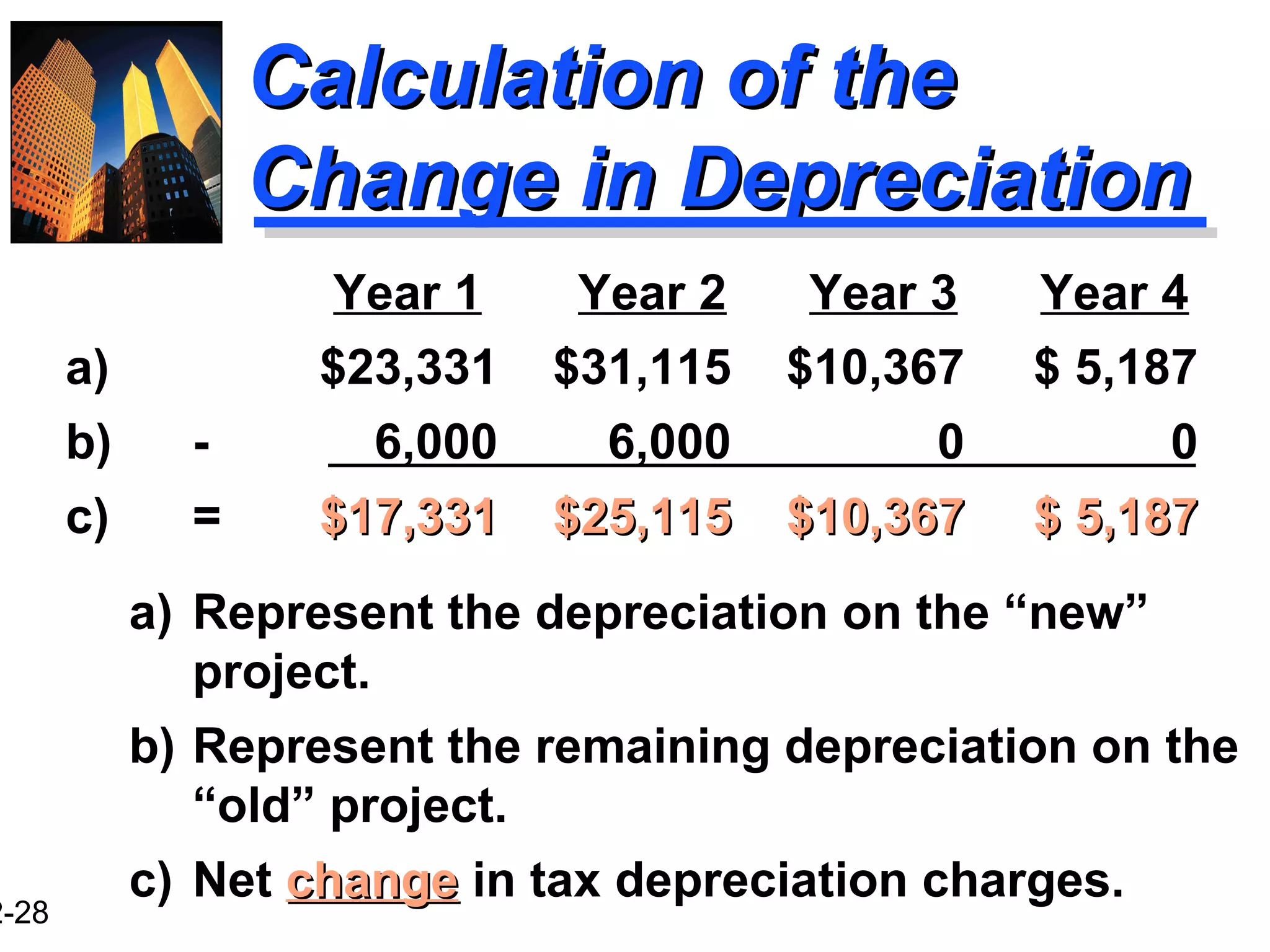

The document discusses capital budgeting and estimating cash flows. It defines capital budgeting as identifying, analyzing, and selecting investment projects with returns extending beyond one year. The capital budgeting process involves generating proposals, estimating after-tax cash flows, evaluating projects, selecting projects, and reevaluating implemented projects. It provides examples of estimating initial cash outflows, incremental cash flows, and terminal cash flows for new asset and replacement projects.