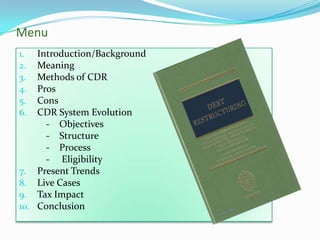

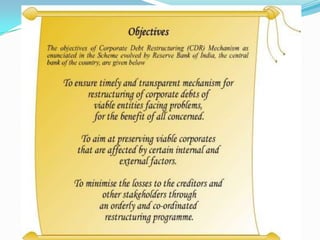

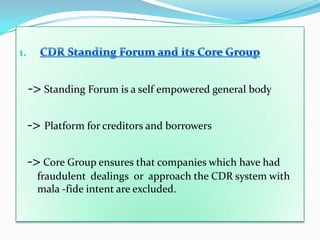

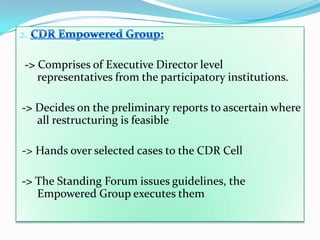

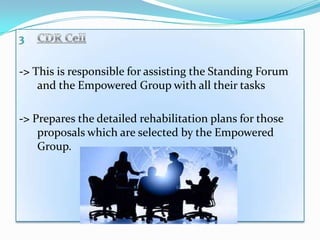

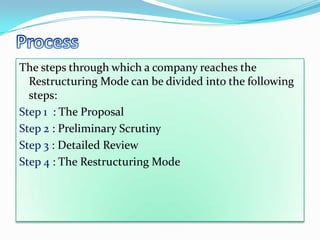

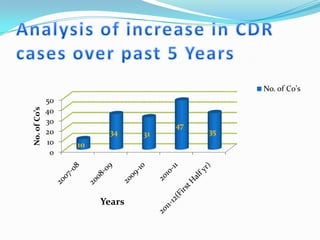

CDR is a method used by companies with outstanding debt obligations to reorganize the terms of debt agreements in order to achieve advantages like waiving interest, concessions in payments, and converting debt to equity. It allows a business to gain control of its finances and improve its credit rating with help from creditors. However, it can also place holds on new credit and negatively impact a company's public image. The CDR process in India involves a standing forum, empowered group, and CDR cell that work to restructure eligible corporate debts.

![Banks / FIs should also disclose in their published annual

Balance Sheets, under "Notes on Accounts", the following

information in respect of corporate debt restructuring

undertaken during the year:

a. Total number of accounts ,total amount of loan assets

and the amount of sacrifice in the restructuring cases

under CDR. [(a) = (b) +(c) + (d)]

b. The number, amount and sacrifice in standard assets

subjected to CDR.

c. The number, amount and sacrifice in sub-standard assets

subjected to CDR.

d. The number, amount and sacrifice in doubtful assets

subjected to CDR.](https://image.slidesharecdn.com/corporatedebtrestructuring-120221043922-phpapp02/85/Corporate-debt-restructuring-25-320.jpg)