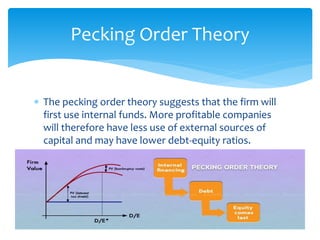

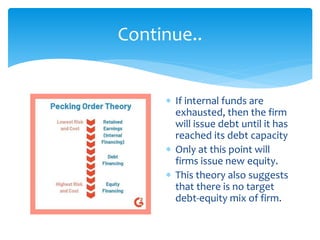

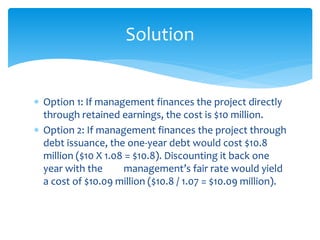

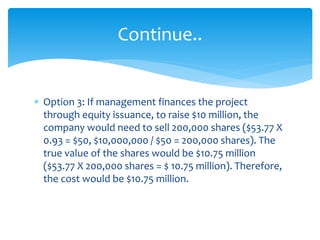

The pecking order theory suggests that firms prefer internal financing over external financing and debt over equity. Under this theory, firms will first use retained earnings to finance projects and needs before considering external funds. If additional funds are needed, firms will take on debt before issuing new equity. The pecking order theory is based on the ideas that internal funds are cheapest, debt is cheaper than equity, and managers have more information about their firm than outside investors.